President Donald Trump’s tariff on U.S. trade partners will add to the concerns for India’s Information Technology (IT) sector, which is already dealing with reduced discretionary spending and a slowdown in large deal signings, according to analysts. Although these tariffs do not directly target IT services exports—which account for over half of India’s total services exports—the "plethora of tariffs imposed across various sectors" in the U.S. could reduce client budgets.

“While India’s IT services sector is not subject to direct tariffs by the Trump administration, the resulting economic sluggishness in the U.S. could increase inflationary pressures and lead to tighter client budgets,” said Anuj Sethi, Senior Director at CRISIL Ratings, adding that this could affect the revenue growth of domestic IT firms.

The U.S. contributed about 57% of the $193 billion revenue of Indian IT services companies in FY2024. The sector—comprising major players like Infosys, TCS, HCL Technologies, and Tech Mahindra—has already been facing spending cuts in the U.S. and other markets due to inflationary pressures post-COVID-19. In Q4 of FY25, these firms were expected to report a sequential decline in revenue due to seasonal weakness, fewer billing days, and marginal deterioration in demand, according to Kotak Institutional Equities.

Heavy Dependence on U.S. Revenue

The added pressure from tariffs has triggered a broad-based selloff in IT stocks over the past two trading sessions on Indian exchanges. The Nifty IT index fell over 3.58% today. Among individual stocks, Coforge dropped 6.74%, Mphasis 5.90%, LTIMindtree 4.31%, Wipro 3.67%, Tech Mahindra 3.46%, HCL Tech 2.93%, TCS 2.89%, Infosys 2.70%, and Persistent 2.63%.

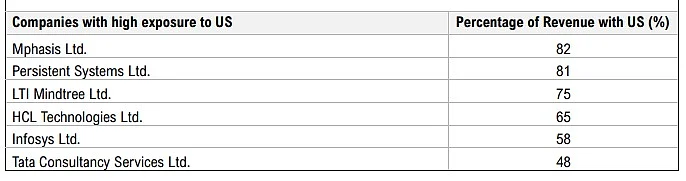

Companies most impacted appear to be those heavily reliant on U.S. revenues. According to data from Geojit Financial Services, Mphasis generates 82% of its revenue from the U.S., Persistent Systems 81%, LTIMindtree 75%, and HCL Tech 65%.

“The tariffs are pushing up operational costs and triggering a global slowdown, leading to reduced IT outsourcing spend. This could put pressure on both revenue and margins,” said Vinod Nair, Head of Research at Geojit Financial Services. He added that these challenges may compel Indian IT firms to optimize costs, explore new markets, and diversify their service offerings, especially with weak momentum in large deal wins.

“U.S. BFSI clients, which account for roughly 60% of sector revenue, are likely to face financial strain—leading to contract renegotiations, pricing pressure, and budget cuts. As a result, investments in next-gen technologies are slowing, with several projects postponed due to recession fears,” Nair added.

According to CRISIL Ratings, nearly two-thirds of the Indian IT services sector’s revenue is derived from the banking, financial services, and insurance (BFSI) vertical (around 30%), followed by retail (15%), manufacturing (10%), and healthcare (10%). The remainder comes from technology services, communications, and media. CRISIL expects revenue growth for the sector to remain modest at 6–8% in FY2026—marking the third straight year of mid-single-digit growth.

Weak Earnings Expectations in Q4

In a report released on March 31, NASSCOM said the tech sector saw stable demand in the first two months of Q4 FY25, but uncertainty increased in March due to anticipated U.S. tariff policies. According to NASSCOM, these tariffs—combined with rising investments in AI and Gen AI—may pressure pricing, leading to flat or even declining margins. Demand from the automotive sector may also weaken, particularly for engineering R&D firms. If the U.S. includes services under its tariffs, the Indian IT sector’s global competitiveness could be hit hard.

Kotak Institutional Equities expects cautious guidance from companies for FY2026. Infosys is likely to forecast 1–4% revenue growth, while HCL Tech may project 3–5%, including a 1% boost from its CTG acquisition. Wipro’s Q1FY26 guidance could range from -0.5% to +1.5% quarter-on-quarter.

Mid-sized firms like Persistent Systems, Coforge, and Mphasis are expected to show healthy growth in Q4, thanks to earlier large deal wins—with Persistent Systems likely to lead.

However, Kotak notes that some companies could face margin pressure due to wage hikes and seasonal business slowdown. Compared to last year, most large firms are expected to post better margins—except TCS. Meanwhile, mid-tier companies are set to benefit from rupee depreciation and strong revenue growth.