Twenty-three-year-old Aryan works with one of Bengaluru’s leading technology companies. First time out of his hometown, he is soaking in the big city thrills thanks to his first job. With ride-share and co-living spaces, he isn’t looking to buy a car or a house. That was his dad’s dream. Instead, he wants to retire by 40!

His friend just started investing in mutual funds (MFs) and asked him to check out Scripbox. What he saw caught his interest: The online investment platform starts by telling you what Rs.5,000 can get you — a few days at a resort with friends, an expensive date with someone special and, with a regular monthly investment for 17 years, a multimillionaire networth. The last one had him hooked and he started with the click of a button.

Bengaluru-based Scripbox is a fully automated advisory firm looking to onboard first-time investors, and provide them with advisory services. Scripbox is powered by algorithms that make investment recommendations based on the customer’s income details, risk profile and financial goals. This data is fed into an AI engine, which matches these parameters with investment products and delivers an optimal portfolio in real time. The robo advisor then rolls up its sleeves and begins to manage the portfolio, rebalancing it and ensuring tax-efficient return.

Robo advisory is the buzzword in India’s investment industry today. But like most things tech, the concept took birth in the US more than a decade ago. Back in 2008, after the crash, when investors were thoroughly disgruntled with the conventional ways of investing, with bankers and investment advisors playing foul with customers, a young American entrepreneur, Jonathan Stein launched an independent online advisory start-up called Betterment.

Most people invest based on recommendations from friends and family, or a friendly investment advisor/broker, whose intent you can never gauge quite correctly. But you still follow their advice because you know nothing, nor do you have the inclination to do detailed research on where to invest. Even if the broker sold you an abysmal fund because he earned a better commission on it, you wouldn’t know you have made a bad choice for quite some time.

New-age investing

Robo advisors promise to take human intentions out of the equation as well as the possibility of bad judgement. Instead, they give you automated, objective advice. Ironically though, almost all of them offer the option of talking to a human advisor, with or without an extra fee. There is another plus. While conventional financial advisors often charge a minimum of 1% as management fee and take only portfolios of a certain size, these new firms charge lower fees and are open to smaller portfolios. For instance, Betterment has no minimum account balance and charges 0.25% for accounts valued up to $2 million. At Wealthfront, another robo advisory founded in 2008, the service is free for accounts valued at $5,000 or less. Most of these bots manage exchange-traded funds with low expense ratio.

Today, leading financial institutions such as Vanguard, Charles Schwab, Merrill Lynch and Fidelity have robo advisory arms. According to Statista, a German online statistics portal, assets under robo advisory amounted to $980 billion at the beginning of 2019 and are expected to touch a little over $2.5 trillion by 2023. Vanguard’s robo platform, the largest in the US had around $115 billion in assets under management (AUM). In India, robo advisories, around 60 in all, manage around 2% of the total AUM. That’s minuscule, even in an industry that is not exactly big.

But the chatter around robo advisors is getting louder. In India, MFs as an investment option have gained traction since 2008. The industry’s AUM has increased 4x from Rs.5.96 trillion in April 2009. However the industry is still nascent. It manages around Rs.25.8 trillion — only 4% of the total investments in financial assets. That said, the demographics of this country is changing. Millennials are warming up to the idea of MF investments, despite the rap-paced cautionary aired with every fund house ad. They are more aware about financial savings and investments, and appreciate ease of digital transactions. The share of inflows through digital modes has increased to more than 10% from almost nothing two years ago. “The share of millennials in our workforce is only increasing and I want to be ready for them. Being digital natives, they are comfortable with technology and will drive the adoption of digital transactions,” says Girirajan Murugan, CEO, FundsIndia.

There is a slow climb in interest but independent financial distributors are too few to cater to it — according to Sebi there are only 120,000 distributors in a population of 1.3 billion people. Out of this, only 1,136 are registered investment advisors. Technology, or bots, can solve the scale problem. “The internet gives easy access to financial products. Tech platforms now provide low-cost data-led advice that is transparent and consistent to everyone,” says Ashok Kumar ER, co-founder and CEO, Scripbox.

On a grand scale

There are new-age advisories, such as Fisdom, who still rely on traditional distribution channels. The Bengaluru-based firm which has around 170,000 users on its platform works with banks and financial institutions such as Lakshmi Vilas Bank and Oriental Bank of Commerce to grow its customer base. “We believe this is a more effective way to scale up the business rather than burning capital to acquire customers,” says Subramanya SV, co-founder, Fisdom. The firm offers both a marketplace — for direct and regular plans, term insurance, pension funds and digital gold — and active rebalancing of a portfolio. Here, asset allocation mismatches and alerts to redeem funds based on performance are triggered by the algorithm.

Singapore-based WeInvest also prefers to work with institutions rather than individuals. “We felt that we could scale the business faster if we partner with banks, and help them serve the underserved mass and mass affluent customers better,” says Bhaskar Prabhakara, co-founder and CEO, WeInvest, that works with large retail banks across Singapore, Thailand, UAE and Malaysia.

WeInvest relies on technology to generate a continuous curve of portfolios, called the efficient frontier, where any portfolio below the efficient frontier is sub-optimal. “In wealth management, typically, investors are bucketed into five major risk profiles. If you fall into one of these risk profiles then you are given a portfolio selected for that particular category,” says Prabhakara. But according to him, while risk and return appetite can be similar, it can never be the same for two different individuals and having an automated platform means you can offer a more granular portfolio that is more suited for the individual’s risk profile.

The core of any robo advisory platform is to take the fuzzy elements of a customer profile, investment goals and risk profile and map those objectives to a set of products and create a portfolio. FundsIndia, one of the largest players in the online investment space, uses an algorithm that assigns a score for parameters such as customer’s risk profile, investment goal horizon and age. It then looks at the cash flow required to reach that investment goal and assigns an asset allocation plan. Finally, the algorithm matches the asset allocation to the product mix that comes closest to the customer’s risk profile.

They currently have AUM of Rs.65 billion and so far, the results have been encouraging. Over the past five years, the firm’s select funds under equity-moderate risk generated 17.30% against the S&P bse-200’s return of 15.20% and select funds under equity-high generated a return of 22.20% compared to 19.70% generated by the Nifty Mid-cap Total Return Index.

The fringe players

There are various advantages in sight but, for now, fintech firms are focusing on improving the ease of transactions and helping more customers get online. For instance, Paytm Money, MobiKwik and ETMONEY offer direct plans for MFs as investment options. Direct plans were introduced in 2013. Unlike regular plans, direct plans are do-it-yourself products with no assistance or advice from the distributors. These firms do not earn from such plans as the distributor’s commission is not involved. But that does not worry them yet.

Paytm Money’s whole time director, Pravin Jadhav, says, right now the focus is only on growing the market as it is underpenetrated. Almost 65% of their two million customers are first-time investors from Tier-III and Tier-IV towns. This is in stark contrast with India’s regular mutual funds investments, of which 85% comes from top 30 cities, according to AMFI. “We will look at monetisation when we reach 10-15 million subscribers. Once we reach that scale, there will be multiple avenues to offer value-added services for which customers will be willing to pay,” says Jadhav.

After introducing MFs distribution in 2018, Paytm will launch equity broking this year. The idea is to use MFs to reel people onto the platform, and then cross-sell a host of financial products. Similarly, ETMONEY, which also offers direct plans, has about Rs.20 billion invested in MFs through its platform and aims to double its user base to 10 million by the year end.

Balancing act

If so many millions are heading to these platforms for objective advice, can they be assured of it? In the end, humans are building these algorithms. Additionally, since there is no regulation that governs these robo advisories, there is actually nothing that stops a firm from assigning the highest weight to a fund offering them the highest commission.

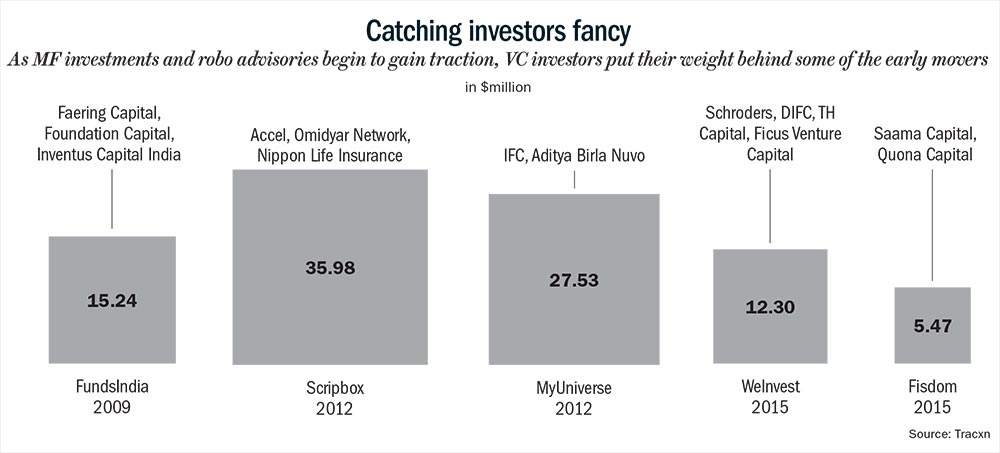

While most firms agree that there are no checks in place to identify or remove bias, there are some who are operating with an eye on the long term. “The proof is in the pudding and the only thing that matters in the end is the ability of our funds to outperform the broader market. This is the best indicator that our algorithm is bias-free,” says Sanjiv Singhal, co-founder, Scripbox. The start-up that currently manages assets worth Rs.11 billion, recently raised Rs.1.5 billion from its existing investors. It takes into account several parameters to build its hypothesis for outperformance (See: Catching investors fancy). While the outcomes aren’t set in stone when it comes to market-related products, Singhal says having a robust process in place ensures consistent outcomes.

Apart from making the choice easier, Scripbox also educates the customer a fair bit. One of the first things that the firm advises investors to do is set up an emergency fund to meet sudden unexpected expenses. “This helps in two ways. One, the constant worry on how you will meet any unforeseen expenses is gone. Second, you are not tempted to withdraw your funds during any period of short-term volatility in the market,” says Kumar.

While other players are gung-ho, Nitin Vyakaranam, founder of Hyderabad-based ArthaYantra, says, customers may take a while to warm up to the idea of robo advisors. “The best option therefore would be to have a hybrid model where the advice is generated by the algorithms, but the investment rationale is explained by a person,” he adds. His online-advisory firm, with around 20,000 paid subscribers, helps with all aspects of personal finance rather than investments alone. “Our offering looks at both streamlining expenses as well as optimising the sources of income,” he says.

When a person goes to an advisory, it is perhaps the first time they trust someone with financial information, outside of family and friends. ArthaYantra addresses the anxiety with human advisors who explain the rationale behind their investment plan or the products chosen therein. These advisors cannot change the suggestion made by the platform, just like on FundsIndia and Scripbox. All the three firms offer regular plans of MFs, so they earn commissions and do not charge the customers for their advisory services.

Dhirendra Kumar, CEO, Value Research believes that establishing credibility and winning the trust of customers is going to be a long drawn process for robo advisors. “While portfolio creation and ongoing rebalancing can be done by algorithms, it cannot handle the nuances involved in goal planning and understanding human behavior during market cycles,” he says. Robo advisory firms agree that a balanced approach works best and most of them are working on a hybrid model.

FundsIndia’s Murugan believes while some of their customers may still prefer relationship managers to handle their large portfolios, tech-enabled platforms such as FundsIndia are ideal for the salaried class with increasing income levels but little time on their hands. “In India, technology adoption has been much faster than developed countries. We have leapfrogged many cycles thanks to smart phone penetration. It is only a matter of time before the adoption of digital transactions become more prevalent,” he says. FundsIndia is betting on technology and social media to improve its reach in Tier-II and Tier-III towns.

The next step for robo advisors is to understand customer behaviour and pre-empt bad decisions, rather than doing a post-mortem analysis during periodic reviews. For instance, counseling a customer who repeatedly exits investments when the equity market gets volatile. With human intervention, firms can help the customer understand the investment rationale. Success will come to those robo advisory firms who can seamlessly integrate both – machine logic and rational reassurance.