Almost 250,000 Indians aspire to become MBA students every year, registering for CAT, hoping to score well and get placed in one of the top B-schools. The competition is intense despite steep tuition fees. But, by hook or by crook, one has to manage if he or she is accepted in the school of their dreams.

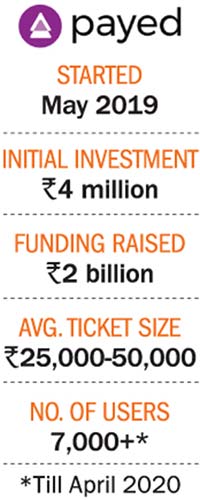

In such a cutthroat environment, Gurugram-based Nujam Technologies observed that there are millions of students, who have to settle for less just because they cannot afford a certain institution because banks don’t offer loans without collateral. That’s how Payed was founded — a fintech product that allows parents or students to borrow up to Rs.500,000 for education on a quarterly basis. Once that loan has been paid in full with interest, the customer can seek more loans. According to the company, most clients are approved for credit limit up to Rs 300,000.

NV Subramanian, founder and CEO, Payed, who observed this gap in the system says, “Education has become extremely expensive and the fees have to be paid upfront. Hence, liquidity is a bigger issue than affordability.” For instance, for a certification course requiring an upfront fee of Rs.10,000, a parent earning Rs.25,000/month would have to compromise on other needs of the household, explains the entrepreneur. Subramanian shares that he was surprised to see the income disparity of the applicants, which varied from Rs.20,000 to Rs.300,000 a month.

Powered by RBL Bank, Payed is free of hidden processing fees, deposits or collateral. However, the user has to pay an interest charge of 8.4% on a 12-month basis. This is inclusive of the bank’s interest charges and Payed’s convenience fee. The start-up acts as an intermediary between financial institutions and users, and has recently secured a line of credit of up to Rs.1 billion from RBL. The company claims that it keeps its rates reasonable since several banks have partnered with the company. And by using a unique scoring algorithm, Payed ensures it is not taking on more risk than it can manage. Its technology evaluates the probability of a customer repaying the loan amount by studying factors including their credit history.

In the span of a year, the start-up has on-boarded over 7,000 users across 45 cities and tied-up with over 100 educational institutions. It has also tied up with NBFCs for digital payouts and assures cashback rewards up to Rs.5,000/year when users shop at leading retailers like Amazon, Flipkart, Pepperfry, BigBasket, Jabong, Myntra, Adidas, 1mg, medlife etc.