Remember that beige-pink powder your mother kept under the kitchen sink to polish her brass and copper ware? With just a little elbow grease, it would scrub away blackish oxidation to restore the vessel’s shine. Ravindra Prabhudesai, who founded the Pitambari Group in 1989, turned that powder into a huge business. His steadfast clientele includes people like Mumbai-based homemaker Sudha Jagannadhan, who has been buying 200 gm of the Pitambari shining powder every month for almost a decade to polish her brass lamps. “It is as regular a purchase for me as rice or atta,” she says.

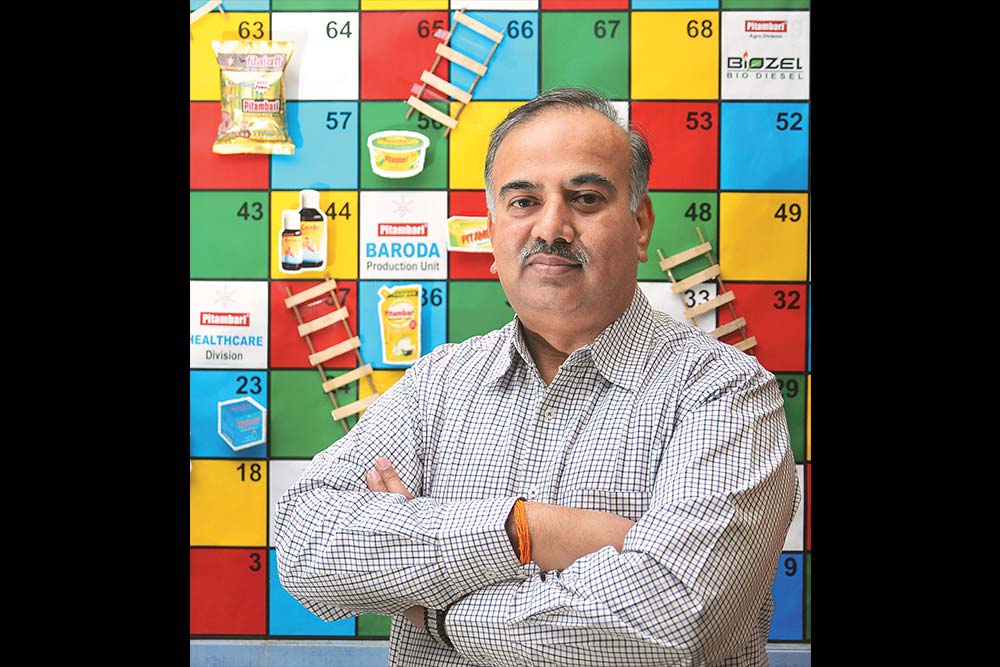

Pitambari powder, which Prabhudesai, a chemistry graduate, created in the early 1980s, has helped the group grow from an initial investment of ₹50,000 to a turnover of ₹70 crore in FY12 and a headcount of over 600 employees. The flagship product still brings in 60% of sales and is the unquestioned category leader with a 95% share of the metal-shining powder market.

It wasn’t a shining success initially. Prabhudesai started off selling the product to hotels. But the small customer base was affecting growth: “After three years, we had no big orders and had made a profit of just ₹2,000,” he recalls. During a visit to a neighbouring locality, he noticed that middle and lower middle class families had stacks of brass vessels that they polished using traditional scrubs like buttermilk and tamarind. Prabhudesai knew he had discovered a large market that could use the copper-shining product he was selling to hotels. But not everybody agreed. People said the world was moving towards stainless steel and aluminium, that a product like his would find no demand.

He persisted, tinkering with the formulation and pitching samples in neighbouring areas. “From 10 packets a day, we slowly sold more than 1,000 packets monthly and this generated the interest of shopkeepers,” he says. “Soon, we began seeing sales of 10,000 packets in a month.” The homecare segment still accounts for 80% of sales.

Trouble is, the dynamics of those markets, too, are changing rapidly. While big players like Hindustan Unilever have introduced products aimed specifically at rural, low-income consumers, competition among smaller players is only intensifying: not only are there too many me-too products, even modern retail stores have launched private labels that take Pitambari’s value-for-money proposition head-on. While small FMCG players cannot hold on to their prices, given inflating input costs, national players can either cut or hold their prices indefinitely. This has significantly blurred their prices difference vis-à-vis the numerous other local brands.

One of the options for sustainable growth could be contract manufacturing. Small FMCG manufacturers are increasingly turning contract manufacturers for private labels; they enter into agreements with retailers like Big Bazaar and D-Mart to make products that are sold under the retailer’s home brand. Pitambari does not have any such tie-ups at present, but Prabhudesai has not rejected the idea either.

Which brings Pitambari full circle to its brass-cleaning powder. That’s still its best bet for growth. But it needs a shift in strategy. Even though Prabhudesai is planning on taking his products to the larger, untapped markets of North and East India, retail analysts recommend that he invest in packaging and promotion. “Since Pitambari is casting a wider net, it has to increase its brand appeal. It has to change its communication and positioning to be more aspirational,” says Jagdeep Kapoor, CMD, Samsika Marketing Consultants. When Prabhudesai first started, he hired two youngsters to offer free samples of Pitambari in the neighbourhood. For a company its size, it was an unusual strategy, but it worked. If Pitambari is to retain its shine, he needs to come up with something equally striking now.