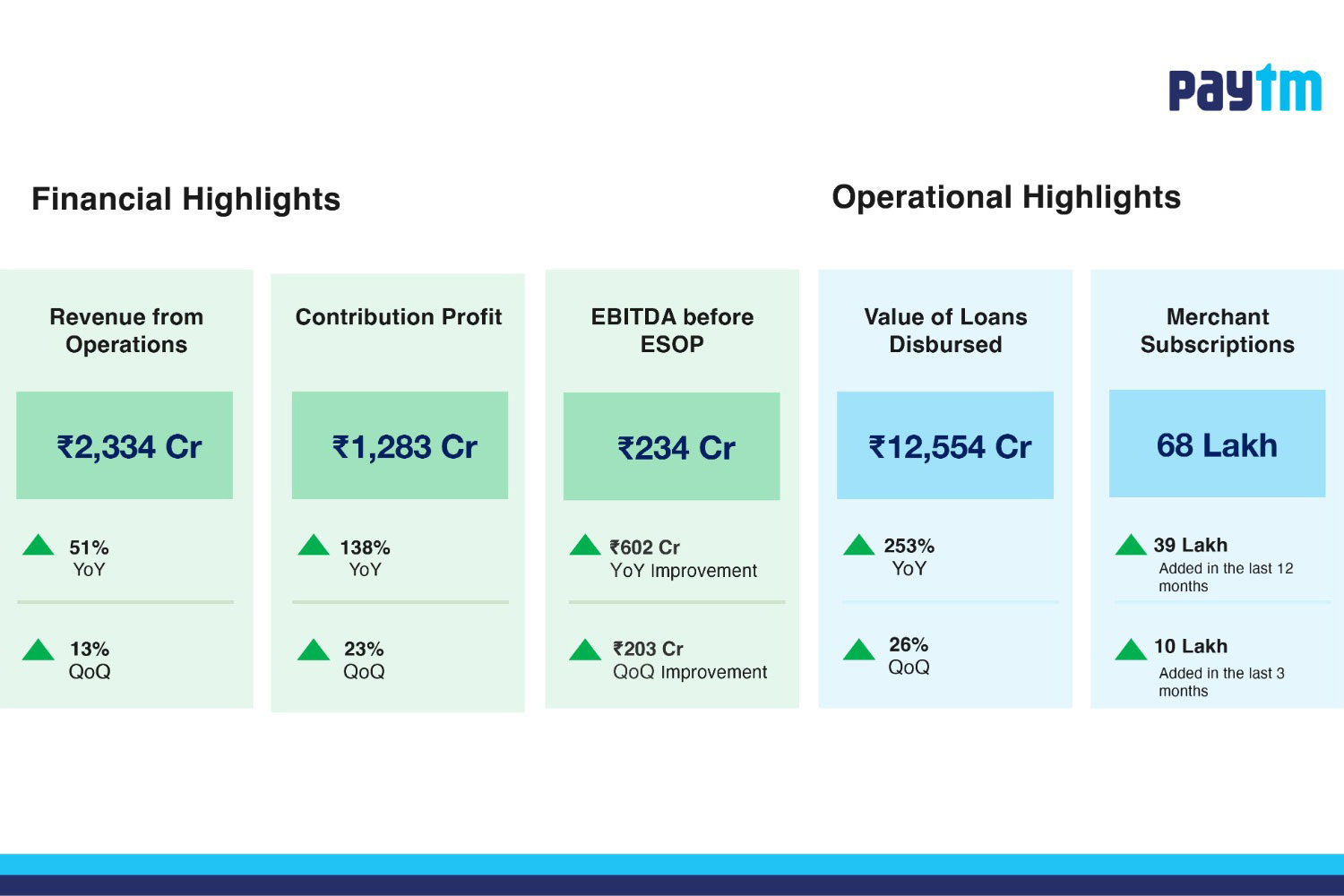

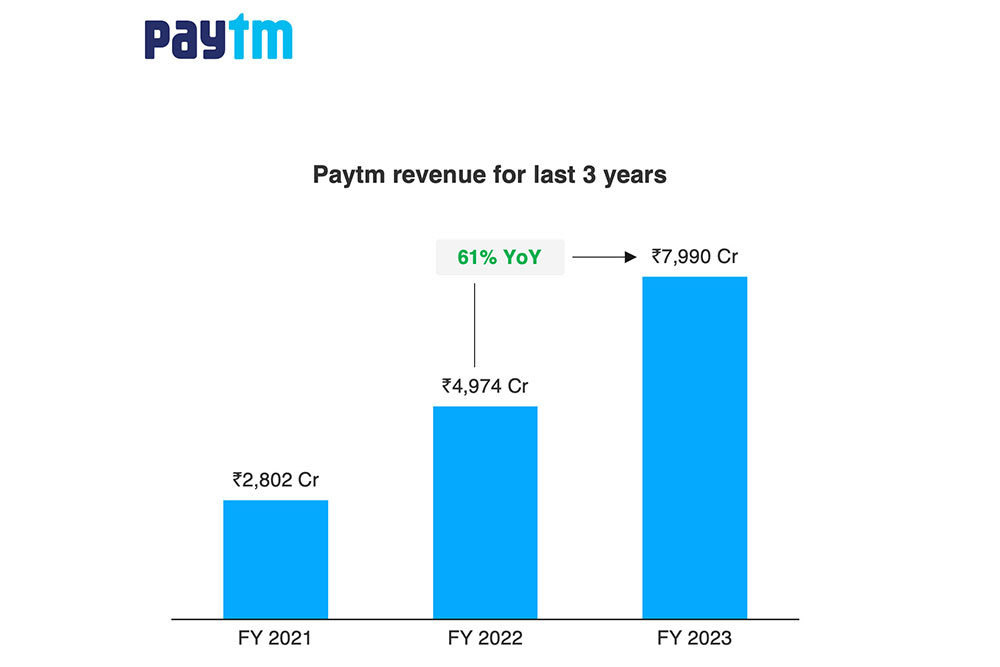

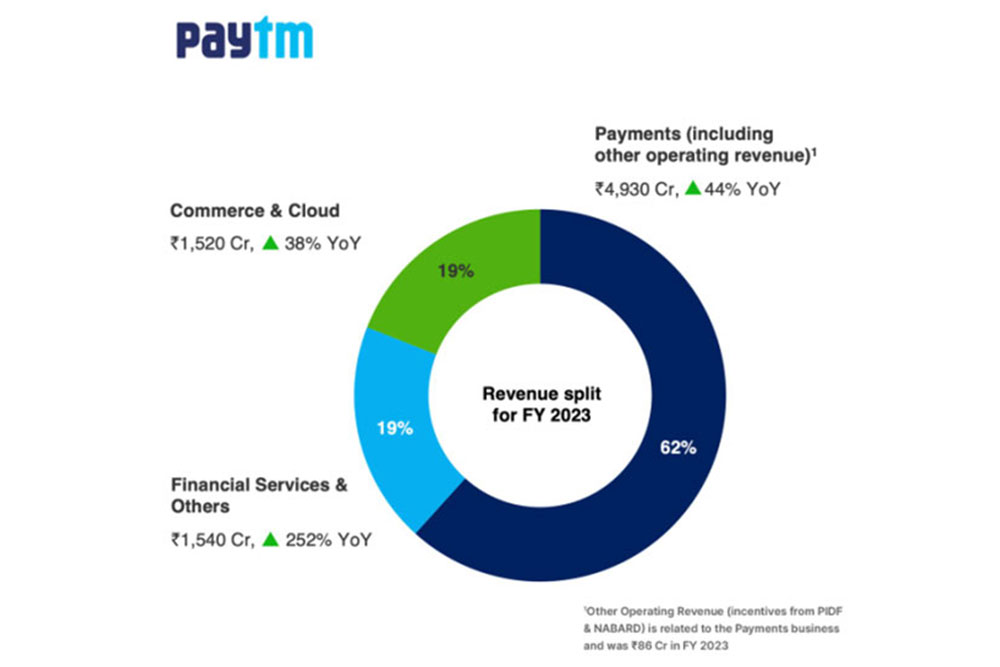

One97 Communications Limited (OCL) that owns the brand Paytm, India’s leading payments and financial services company and the pioneer of QR and mobile payments, has announced Q4FY23 as well as the FY23 results. The company’s revenue from operations increased 51% YoY to ₹2,334 Cr in Q4FY23 and 61% YoY to ₹7,990 Cr in FY23.

The company has further expanded its EBITDA before ESOP costs, including UPI incentive applicable for this quarter only, to ₹101 Cr, a three times jump from Rs 31 Cr in the previous quarter. For FY23, EBITDA before ESOP cost stood ₹(176) Cr, a significant improvement of ₹1,342 Cr. This was achieved by the increased pace of monetization, better cost management, and higher operating leverage.

For the full year, its contribution profit grew to ₹3,900 crore, a growth of 160%; while its net loss too reduced by 26% to ₹(1,776) Cr. For the quarter, its net loss narrowed by almost 80% to ₹(168) Cr.

Paytm’s loan distribution business, in partnership with marquee lenders, continues to scale. In Q4FY23, total number of loans grew to 1.2 Cr (up 82% YoY) while the total value of loans amounted to ₹12,554 Cr, growth of 253% YoY, were disbursed through Paytm across its three product offerings — Paytm Postpaid, Personal Loans, and Merchant Loans.

Driven by continued improvement in payments profitability and increasing mix of high margin businesses like credit distribution, Paytm’s contribution margin stood at 55%. The fintech giant continues to capitalise on growth of UPI and other mobile payment methods opportunities by bringing innovative products to its customers. Since the launch of Paytm UPI Lite platform February 2023, it has already onboarded 55 lakh customers.