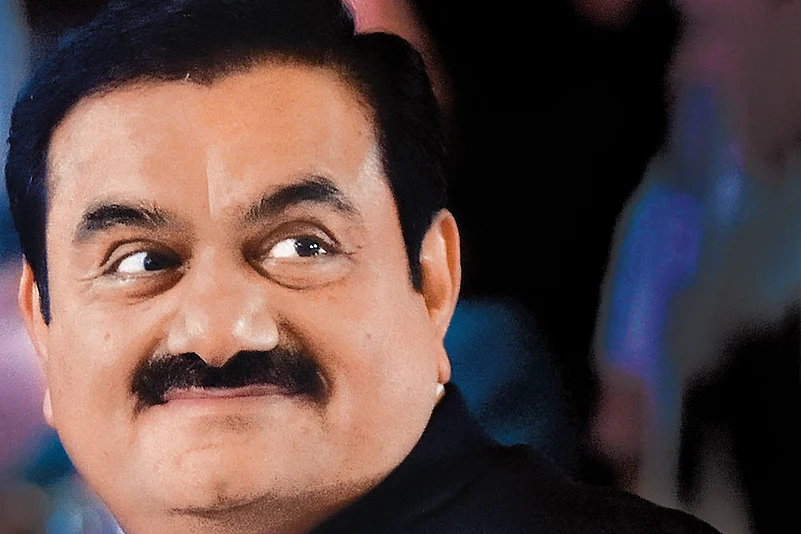

With a net worth crossing $115.7 billion, Gautam Adani, the 60-year-old Ahmedabad-based infrastructure-to-energy business tycoon, recently displaced Bill Gates to become the fourth richest person in the world.

In addition to the bourses being in his favour, the mogul has been on an acquisition spree. In May this year, the Adani Group became the second largest cement maker in the country after it took over the $10.5 billion cement capacity of Swiss giant Holcim in India. He has also announced detailed plans worth $70 billion to harness green energy and produce the cheapest green hydrogen. In July end, the Adani Group had a market cap of over $199.91 billion—or Rs 15,79,289 crore at 79 rupees to a US dollar—and has seven publicly traded companies.

During his over three-decade-long journey, Adani, a first-generation entrepreneur, has amassed a huge fortune and become an entity that is too big to fail for India’s economy in power and infrastructure. With a foray into spaces like new energy, green hydrogen and, recently, even telecom, Adani is looking to cover more ground.

AEL or Nothing

Adani built his empire from scratch after spanning a distance between being a small-time trader and establishing his flagship Adani Enterprises Limited (AEL) in 1988. He turned AEL into an incubator of sorts with Adani Transmission, Adani Power, Adani Ports and Special Economic Zone (SEZ), Adani Green Energy and Adani Total Gas under its wing.

From building India’s largest private cargo handling capacity at ports, largest power generation and transmission facilities, top gas distributor and so on, Adani has created larger-than-life capacities under AEL.

To fund his dreams, he had largely relied on primary issuance and bank funds. It was only in the late 1990s that AEL hit Dalal Street with its primary offer. At the time of public issue, it was an incubator for the port, special economic zone and power businesses. It remained as a majority shareholder even when Mundra Port (now Adani Port and SEZ) and Adani Power accessed the primary market in 2007 and 2009, raising Rs 1,771 crore and Rs 3,016 crore respectively.

In 2015, the holding company was demerged—first the transmission and subsequently the gas and green energy businesses. Independent entities were created and directly held by the promoters Gautam Adani and his family. In February 2022, with an offer for sale, Adani Wilmar, a joint venture of AEL and Singapore’s Wilmar International in the FMCG space, was also listed as a separate entity.

Amid all the recent activities, AEL continues to remain an incubator for most of Adani’s new initiatives. Even his future businesses announced so far—green hydrogen, data center, copper mining, polyvinyl chloride, defence, digital super app and telecom—are planned under AEL.

Of Debt and Dalal Street

As Adani expands his business areas, the group’s debt seems to be rising as well—doubling in just one year. At the end of 2020–21, the group’s total debt was Rs 1,55,463 crore, which shot up to Rs 2,20,584 crore at the end of March 2022.

The funding pattern has also been changing with on-time project execution capacities, wider resource and business reach. Jefferies, a leading global equity research firm, noted that the group has accessed bond markets on a big scale. The sourcing of funds from bonds has more than doubled to 31% in 2022 from just 14% in 2016. Of the total debt in March 2022, banks had a share of 51% from 86% five years ago.

“There is scepticism around capital management. However, in the last decade, the group has mostly relied on debt but has successfully brought down net debt to EBITDA levels over the years, even after expanding. We believe that this decade will be no different and the [Adani] group will keep relying on debt capital to expand till its return on equity is greater than the cost of debt,” says Vinit Bolinjkar, head of research, Ventura Securities.

In October 2021, the Sensex peaked at 62,245, its all-time high. Since then, the market dynamics have changed due to the ongoing Russia-Ukraine war, soaring inflation and rising interest rates, and the benchmark Sensex is down by almost 10%. However, all the Adani Group shares have witnessed increased buying interest. As of July 22, 2022, the share prices have gone up with the exception of Adani Ports and SEZ.

What is behind this sustained interest in the Adani Group? “The investors are taking cognisance of the fact that the group is making large investments in new-age businesses which have a tremendous growth outlook. Unlike other groups, the Adani Group has been known for large project execution capabilities and, hence, the market is not too worried about its large financial commitments,” explains Bolinjkar.

The interest also translates to Adani’s wealth, which grew from $9 billion to $115.7 billion in less than two years, and share prices of all his listed entities scaling to near record highs. Despite the rising debt, long gestation period for project execution and profitability, it is clear that shareholders are not worried.

Looking at the shareholding pattern, it seems like lower floating stocks, or the number of shares available to trade in the short term, are one of the reasons why the Adani Group shares are scaling new highs. In most companies, the Adani family, or foreign partner combined, hold between 72% and 74% shares. Foreign portfolio investors, mostly long-term investors, hold between 12% and 20% shares. The floating stocks that change every day on the bourses are not more than 10% in any of its listed entities.

“In other words, trading volume will give wild swings in either direction to Adani shares. At the moment, the share prices are in a rising trend, so it is going up,” says a veteran trader, who tracks market behaviour, on condition of anonymity.

Two Gujarati Titans

Whatever the underlying reasons may be, rising stock prices have helped Adani climb up on the list of global billionaires every day. In this process, he has also dislodged his counterpart Mukesh Ambani, chairman and managing director of Reliance Industries Limited (RIL), as the richest Indian this year. With a net worth of $88.7 billion, as per the Bloomberg Billionaires Index, Ambani had held this position for almost a decade.

While the fortunes have historically been in favour of the chairman of the oil-to-mobile business with a slew of fundraising initiatives and deleveraging the balance sheet, the astonishing share price performance of stocks have helped Adani pip Ambani.

For decades, the two Gujarati businessmen cautiously did not cross each other’s path. That, however, seems to be changing with Adani’s ambitious plans to venture into green energy, healthcare, green hydrogen, petrochemicals, super app, drone manufacturing and now—even telecom, currently Ambani’s bastion.

Reliance Jio Infocomm, the telecom arm of RIL, is emerging as a major source of revenue and profit for Ambani. Adani’s plans to enter the telecom business, albeit only as a private network operator for captive consumption, might hinder that source.

In his bid to expand and build one of the largest business houses in the country, Adani recently threw his hat in the 5G spectrum auction ring, announcing his eventual entry into the telecom space. Even though the company has clarified on record that the spectrum it is bidding on is only going to be used for its private network, big app and data centre businesses, analysts are looking at it almost like a déjà vu moment.

Jefferies feels that Adani’s plan to bid for the spectrum is possibly a larger telecommunications play. The financial group sees that the bid has “uncanny similarities” with fellow billionaire Mukesh Ambani’s telecom bid of 2010 that eventually created India’s biggest mobile operator.

Industry observers believe that Adani is certainly looking at a consumer business that could extend beyond the FMCG offerings of Adani Wilmar. The management had stated that the high-speed 5G data will also be used for consumer-centric offerings like its own digital platform, including super apps, edge data centres, and industrial command and control centres, which indicates that there will be some rollover of its 5G services to consumers. It could also mean the possibility of an expanded telecom foray over the next few years.

At the same time, the Adani Group bidding only for one circle—Gujarat, as per the Department of Telecom document—will not serve the purpose of an expanded telecom foray. “The group will need a passive network, intercompany roaming pact and infrastructure that will require an additional investment of Rs 2,50,00 crore,” a Motilal Oswal Financial Services research note read.

“The estimated investment is higher than the total debt the Adani Group has on its books at the moment. It seems unlikely that, with a major acquisition spree recently and new energy and business already lined up, Adani will become a full-fledged telecom player in near future,” says a telecom veteran on the condition of anonymity.

But, as Adani goes beyond his infrastructure and energy moat and focuses on casting a wider net across sectors, some say his journey has just begun.