The much-debated Carbon Border Adjustment Mechanism (CBAM) of the European Commission, which proposes to penalise heavy emissions during manufacturing of products being traded in the European Union, entered its transitional phase in October last year. While this takes the EU closer to its ambition of net-zero emissions by 2050, for countries that export to the region, it highlights the urgency of a reality check on how well-prepared they are to meet the stringent regulatory demands.

The CBAM currently covers the most carbon-intensive sectors like iron and steel, aluminium, cement, fertiliser and electricity. However, it is expected to soon encompass others as well. And, polymers, including textiles, are next. According to a 2022 paper by the International Labour Organization, the textile and garment sector accounts for an estimated 6% to 8% of the global carbon emissions, which puts it in the high-risk category for climate action.

India is the third-largest exporter of textiles and apparels, with EU being among its top importers. As per the data from the Ministry of Textiles, the 27-member bloc was the second-largest destination of India’s textile and apparel exports after the US in 2022–23. Worth $7,670 million, the exports accounted for 21% of India’s total textile exports.

CBAM mandates that partner countries follow environmentally sustainable practices to manufacture products being exported to the EU. Failing this, they will be required to pay a carbon tax. As a country that has already been struggling to meet the environmental, social and governance (ESG) compliance requirements, is India prepared for the burden of CBAM?

The Cost Concerns

The concern over regulations largely relates to additional costs that the manufacturers will have to bear for meeting the requirements of compliances and documentations. The manufacturing process will need close monitoring, calculation, verification and documentation as per the standards set by the EU. While this may not be a problem for the big players, it is the smaller ones who stand to lose for lack of resources.

In the 1970s, India’s prominence in global textile exports was predominantly fuelled by small and medium enterprises. Not much has changed since, with only a select few large-scale companies achieving significant scale. Industry estimates suggest that approximately 1,400 large textile companies operate in the country, while a staggering 1.5 million companies function within the small industry sector. In the absence of resources, both financial and technological, these small-scale manufacturers often fail to meet the ever-increasing demands of compliance.

Chandrima Chatterjee, secretary general of the Confederation of Indian Textile Industry, underscores the concerns over emerging requirements for climate-related regulations, like traceability and its impact on trade and market access opportunities for the Indian textile value chain. “Traceability of an exported cotton shirt requires that it can be traced back to the cotton farm from where the cotton was procured for making it. While the intent is to ensure social and environmental sustainability across the value chain, which is very important, it has several intended and unintended impacts on the level-playing between suppliers of the shirt from different countries,” she explains.

The concerns arise firstly from the limited capacity of smallholders or units to meet traceability requirements, given the highly technology-driven nature of the process. Secondly, India faces a substantial challenge due to the fragmented nature of its value chains. In contrast, the cotton value chain in the US is more integrated, with the farmer also serving as the ginner. In India, a bottleneck emerges as a single ginner may source from 50 to 100 farmers, resulting in higher traceability costs compared to integrated units, Chatterjee explains further.

Losing Out to Rivals

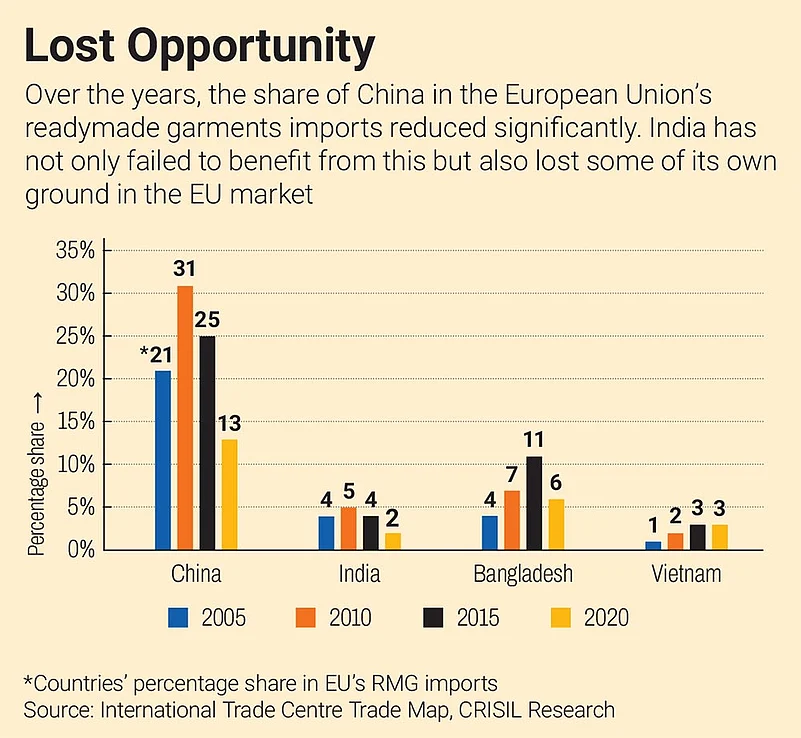

India has consistently ceded its share of the global textiles export market to countries like Bangladesh, Vietnam and other smaller nations over the years. Bangladesh is at the second position in ready-made garment (RMG) exports, while India is fourth.

“Despite the EU and the US being the largest RMG export destinations for India with approximately 32% and approximately 27% share in fiscal 2020, respectively, India was unable to increase its presence there. While Bangladesh was able to improve its share in EU exports due to low cost of labour after abolition of quota system for developing nations, Vietnam increased its share in US exports as it acquired most favoured nation (MFN) status in 2001,” states a report by CRISIL, which provides research and analytics services.

The Bangladeshi government has made targeted investments and comprehensive reforms in the RMG sector. The country is home to around 50% of the world’s top 100 LEED-certified green industrial units, which are in the apparel sector. On the other hand, in India, government policies have predominantly targeted reforms in IT services and large-scale manufacturing in the automobile and electronics sectors, overlooking the potential in textiles.

Biswajit Dhar, distinguished professor at the Council for Social Development, notes that Bangladesh’s garment industry has done much better than India’s. “One argument can be that since 80% of its exports are garments, Bangladesh could focus better on one subset of textile and clothing to become competitive, which we have not been able to,” Dhar says.

To promote textile manufacturing in India, the government has approved the establishment of seven PM Mega Integrated Textile Region and Apparel (PM MITRA) Parks in the Union budget of 2021–22 with a budget outlay of Rs 4,445 crore for a period of 2021–22 to 2027–28. But it was only in January this year that textiles secretary Rachna Shah said that the Centre and the states were in the process of forming special purpose vehicles for setting up these parks. There is no information on how much money was spent and where in the first two years.

Miles to Go

In Tiruppur, approximately 300 textile processing units have seamlessly integrated with common effluent treatment plants, ensuring zero liquid discharge. In Panipat, Haryana, open-end spinners are embracing sustainable practices by utilising recycled fibres, repurposing nearly 90% of used PET bottles into fibre.

There are concerns that such ongoing efforts may be insufficient to help India prepare for CBAM, unless the government secures flexibility from the EU during free trade negotiations. A news report last year stated that one of the options India is exploring is to seek repatriation of the amount collected as carbon tax into its climate mitigation fund. This is in line with concerns raised in an article by the World Economic Forum that CBAM may not be consistent with fundamental rules of the World Trade Organization. The article, CBAM: What you need to know about the new EU decarbonization incentive, summarises major concerns of countries outside the EU. Noting that such a mechanism places a carbon tax on countries that were not primarily responsible for the climate crisis, it points to calls for ringfencing of revenue collected from sale of CBAM certificates to less developed countries. However, the final CBAM agreement does not address this concern.

D.K. Nair, former secretary general of the Confederation of Indian Textile Industry, says, “Western countries have historically employed various tactics to undermine the competitiveness of poorer nations in accessing their markets, using non-tariff measures in the process. The recent initiative by the EU on CBAM should be viewed in this context. Although textiles are currently not explicitly covered, there is a likelihood that they will be included,” he adds.

Time to Shape Up

India believes it will be able to talk EU into making concessions, but that might be unfounded optimism at best, considering that the latter went ahead with the transition phase without doing much to assuage concerns of non-EU nations.

Dhar expresses dissatisfaction with the sluggish response of Indian authorities in tackling the sustainability challenges facing the industry. “It is not that the government was unaware of the impending challenges. We had sufficient time to prepare for this situation, since the EU had hinted at introducing CBAM well over a decade back, but no steps were taken to prepare our industries in the interregnum,” he remarks.

He sees another problem too. “Even if we attempt to negotiate CBAM through a bilateral deal, access to the necessary technologies could be challenging, as it is owned by private companies rather than the government and protected by intellectual property rights,” he says.

India cannot ignore the severe imbalance in demands of its development goals and those of climate action. But it can also not afford to close its eyes to the dynamic trade ecosystem that increasingly seeks to align its ambitions with sustainability goals. Fair or unfair, protectionist or not, regulations like CBAM and ESG norms come wrapped in the narrative of environmental well-being and it may not be possible to skirt around them forever. The sooner India accepts it and weaves it into its plans, the better for its growth and leadership ambitions.