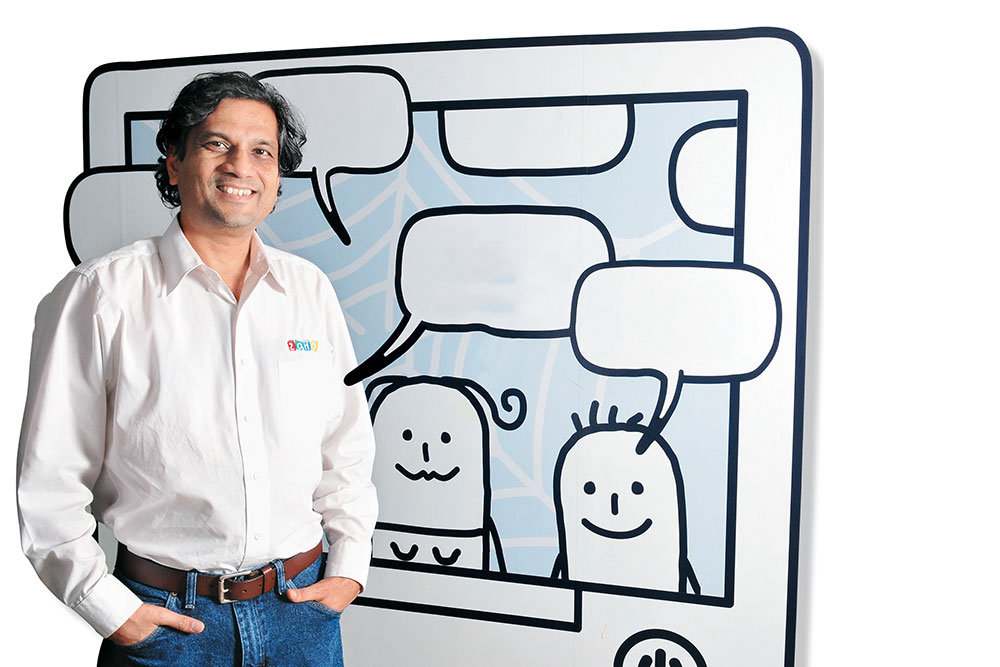

In 2007, Marc Benioff, CEO of Salesforce.com met Sridhar Vembu, founder of California-based Zoho Corp, which also has an office in Chennai, with an offer to buy him out. “He said, ‘Google is going to crush you guys with their Office suite. We can help you,’” says Vembu, recollecting the meeting. “This reminded me of the story where a bear chases two friends. One friend tells another, ‘We can’t outrun the bear’. The other one immediately says, “I don’t have to outrun the bear. I just have to outrun you’. Similarly, with Google chasing me, I thought I don’t have to outrun Google, I just have to stay ahead of Salesforce.”

That is easier said than done. But the company, known as AdventNet in its previous avatar, has managed to carve a niche in a marketplace where big boys like Microsoft, Google and Salesforce play, through products that match its global peers at reasonable prices. Launched in 1996, it initially sold network management software — now the oldest division, WebNMS. Post the dotcom recession, AdventNet revamped its portfolio in 2004 to offer enterprise IT products through ManageEngine, the largest division in the company.

A year later, online communication, business and productivity applications such as email, word processors and spreadsheets, customer resource management (CRM), project management and invoicing were introduced through its third division, Zoho.com. The company was rechristened to Zoho Corp in 2009 as the division became more popular. Today, the division contributes 25% to the company’s overall revenue of $150 million. Vembu expects its contribution to double over the next couple of years.

Road less travelled

Most of Zoho Corp’s customers are small and medium businesses. The US is its largest market, contributing 55% of revenues, followed by the UK and Japan. India brings in only 5% of business. As more and more businesses move to the cloud, online applications like Zoho’s have a huge opportunity ahead. “When Google entered this space, they validated the market,” says Raju Vegesna, chief evangelist, Zoho Corporation. “Until then people were not sure whether online apps was a sustainable business or just some new trend that would go away in time.” Google’s entry also disrupted the market, putting many smaller players out of business. “When we entered the online word processing space, there were 17 vendors. When Google came in, they managed to clear out the other 16,” says Vegesna.

How did Zoho survive? It focused on segments Google wasn’t serving, namely business applications such as CRM, project management, accounting and invoicing. While it competes against Google on five of its offerings — email, calendar, spreadsheets, documents and presentations, Zoho is the largest software provider on Google Apps Marketplace. Vegesna says Zoho’s products can easily integrate with Google apps and that’s a big advantage. For instance, not only can you import your contact list from Gmail to Zoho’s CRM, every time you receive an email, it automatically syncs with Zoho’s CRM.

Over the years, Zoho managed to scale up without external funding and Vembu is clear about not accepting VC money. “Most VCs are finance guys who can do spreadsheets well. But you cannot predict the success of a business in a spreadsheet.” He also points that once a business accepts VC money, it is committed to provide an exit through an IPO or a stake sale to a larger company within a time frame, both of which he isn’t comfortable with.

Unlike most software firms, Zoho doesn’t necessarily require employees to come with a college degree. Vembu feels most colleges are a waste of time since graduates are not always employable. You may think that’s rich coming from someone who went to Princeton for his PhD after IIT-Madras. But he says it was during his Princeton days that he realised he was wasting his time there. To prove a point that high school students can be as good, if not better, than engineering graduates, he started Zoho University in Chennai in 2005. Students, aged 17-18 years, are chosen mainly from tier I and II towns, go through a series of tests before they are admitted. They are then trained in software programming, applications building and basic communication skills for a year. This is followed by product training for six months. After two years they become permanent employees of the firm. Zoho University’s dean B Rajendran finds the students smarter than some of the engineering graduates he has taught before. “They pick up programming within a couple of months despite the fact that some have never seen a computer before in their lives,” he says. Students from the University make up 15% of its workforce, and Vembu wants to take that number to 30-35% in five years.

Smart moves

Even as the company chooses to take an unconventional stance on recruitment and financing, it’s ruthlessly focused on innovating and developing products at lower cost, explains Vegesna: “We follow the 80:20 rule. 80% of our efforts are on engineering and 20% of our efforts on marketing.” This allows the company to price its products competitively. Zoho Corp’s enterprise CRM product, for example, is priced at $25 per user per month compared to Salesforce’s offering at $125 per user per month. “Our customers do the marketing for us. We get a lot of customers through word-of-mouth references. People may come for the price but stay for the product,” says Vembu. The company also offers free trials and customers can sign up for the paid version if they are satisfied.

Pitted against heftier opponents, Vembu knows he needs to be on his toes all the time. “We have the challenge of not being taken seriously. So we need to constantly innovate and develop products that are the best in their category or at least be able to compete with the best,” he says. Next on the cards is the launch of mobile applications—Zoho already has 20-odd mobile apps and is looking to launch another 15 next year.

Vegesna says that in the products business, market conditions could be disrupted overnight, as Google and Apple have shown. Such disruptions often end monopolies — as was the case with Microsoft when Google’s online Office suite was launched — and create opportunities for smaller challengers to carve a niche. Vembu is looking to build just that kind of company.