US Commerce Secretary Howard Lutnick has announced that foreign nationals with "$5mn to spare" will soon be able to register for the most-awaited "gold card" visa. Interestingly, while registrations are expected to open shortly, the full details of the scheme will only be released later.

“I expect there will be a website up called ‘Trump card dot gov’ in about a week,” Lutnick said at Axios’ “Building the Future” event in Washington, DC, on Wednesday. “The details of that will come soon after, but people can start to register,” he stated.

Detailed information about the visa program will come in the next few weeks. Lutnick made no effort to downplay the exclusivity of the scheme, stating, “Everyone I meet who is not American is going to want to buy this card if they have the fiscal capacity.”

Story We Know So Far

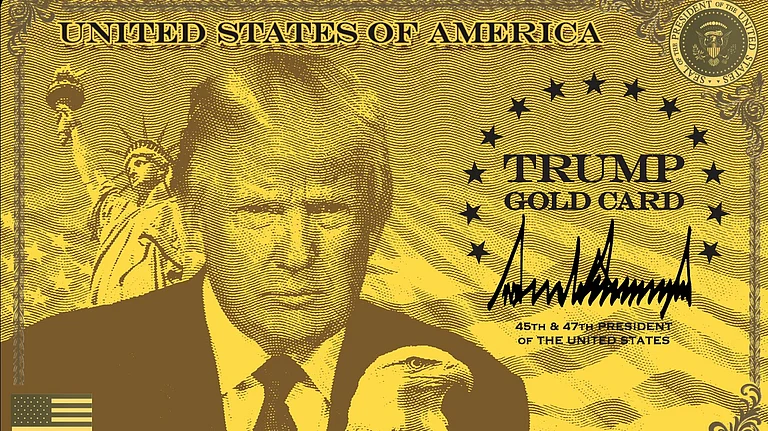

In February, US President Donald Trump announced plans to replace the employment-based EB-5 immigrant investor visa with a new gold card citizenship initiative by paying $5mn. The rationale: attract wealthy individuals who could bring business, investment and economic opportunity to American shores.

Lutnick went a step further. Talking about the audacious objective of the “gold card” program, he suggested that the programme could also be used to address the US’ ballooning national debt, which currently exceeds $36trn. "If there are 200,000 people who pay, that’s a trillion dollars. That pays for everything,” he projected.

For comparison, the EB-5 programme grants permanent residency (green card) to foreigners who invest at least $1.05mn in American businesses and create at least 10 jobs for Americans. The gold card, on the other hand, could just be a purchase of a Green Card by paying a sum of $5mn to the US government.

However, many experts have flagged that creating a new visa would require approval from Congress as well. The Immigration and Nationality Act (INA), in its current form, does not allow for the implementation of a Gold Card program.

Wealth Paradox in the US

Even as the targets set by the Trump administration seem way ambitious, they rest on a plausible foundation of the US' overwhelming dominance in private wealth. According to a recent report from Henley & Partners (H&P) titled 'The Great US Wealth Paradox', the country accounts for a staggering 34% of global liquid wealth. America is also home to 37% of the world’s millionaires, with over 6mn high-net-worth individuals each holding more than $1mn in liquid wealth.

"The USA presents a fascinating paradox. As the world’s wealthiest nation and home to the largest concentration of millionaires, America simultaneously serves as both the primary source market for outbound investment migration and a powerful magnet attracting wealthy individuals from around the globe," says Basil Mohr-Elzeki, managing partner at H&P North America.

Between 2014 and 2024, the number of millionaires in the US grew by over 78%, the highest among the world’s top 10 wealth markets. It also hosts over 10,800 of the world’s 30,450 centi-millionaires (those with $100mn+) and over 860 of the world’s 2,650 billionaires.

Despite this wealth, the world's largest economy is witnessing unprecedented interest from American citizens in obtaining alternative residence and citizenship options abroad. So far in 2025, US citizens account for over 30% of all investment migration applications submitted through H&P— nearly double the combined total of the next five investor nationalities, which include Turkish, Indian and British applicants.

H&P noted that this shift reflects evolving perspectives among high-net-worth Americans. Most of them view investment migration as sophisticated risk management, creating a ‘Plan B’ that provides optionality for themselves and their families to relocate if they need or want to, it said.

"We view the Gold Card as a complement to the EB-5 program, creating a multi-tiered system addressing different investor segments while maintaining the job creation focus that has made EB-5 so successful," Mohr-Elzeki noted, adding that this will help America's evolution as the world’s premier wealth hub, maintaining a strong global appeal to investors and entrepreneurs despite a the paradox.

Recently, it came to notice that New Zealand has experienced a significant increase in applications for its "golden visa" program after implementing some changes, aiming to attract foreign investment. It has received 65 new applications within six weeks, with as many as 55 of them originating from the United States

Stuart Nash, a former immigration minister and co-founder of the relocation consultancy Nash Kelly Global, told the Financial Times that Trump has been a key factor motivating many affluent Americans to pursue residency overseas. He said that Trump has pushed uncertainty into the global market and now applicants are looking for just safe havens, unlike in the past when they only had appetite for tax havens.

Against this backdrop, it remains to be seen whether Trump’s Gold Card vision will bear fruit. But one thing is clear that in an era defined by global volatility and wealth mobility, the race for economic citizenship is intensifying and Trump intends to stay in the lead.

What's for Indians?

Indian nationals make up one of the largest demographics awaiting US Green Cards, with backlogs stretching beyond 50 years in some employment-based categories. The introduction of the Gold Card could offer a significantly faster route to US residency for wealthy Indians.

It may also simplify the hiring of top Indian graduates—whether already in the US or abroad—by allowing American employers to bypass traditional visa hurdles through the $5mn route.

However, there are downsides to it, too. Though it is not clear, but the move could potentially exclude middle-tier investors who previously used EB-5 as an alternative to employment-based green cards. With a shift of focus from job creation to wealth, highly qualified yet less wealthy Indian applicants could be overlooked in favour of richer counterparts.