The final quarter of 2023 ended on a cheery note for the bottom line of India Inc. However, the stagnant growth in revenue suggests that companies are still facing demand headwinds. While automobile, energy and cement sectors were able to post robust numbers, the sluggishness in the growth of companies in the IT and FMCG sector continued.

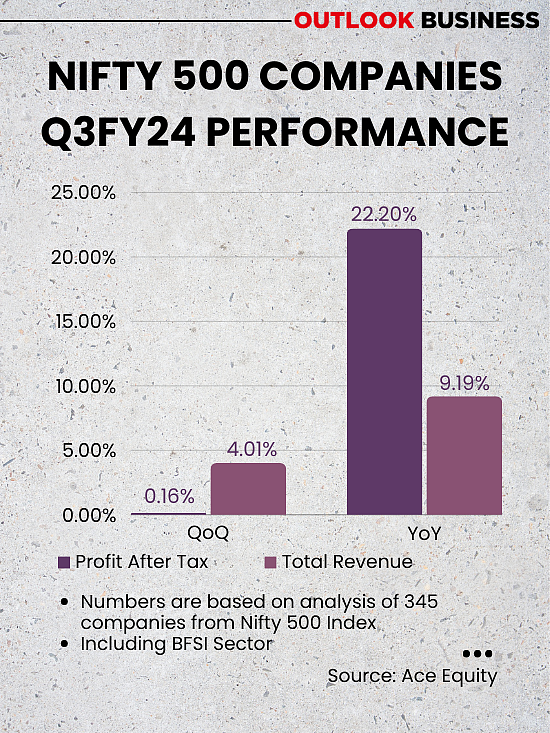

According to Outlook Business’ analysis of 345 companies from the Nifty 500 index, aggregate profit after tax (PAT) increased 22.2 per cent year-on-year (YoY) in the December quarter. Companies’ total revenue increased 9.19 per cent YoY. The companies’ EBITDA (earnings before interest, taxes, depreciation, and amortization) increased 17.7 per cent YoY in the December quarter.

On a sequential basis, aggregate revenue surged 4.01 per cent, while EBITDA fell 1.6 per cent, and aggregate PAT remained flat with a marginal increase of 0.16 per cent.

The results were mostly in line with the expectations of analysts. Despite the quarter having multiple festivals, the demand scenario did not improve, which has resulted in flattish topline growth. The sector wise performance reveals a clearer picture of how the quarter panned out for Indian companies.

BFSI And Auto Lead With Growth

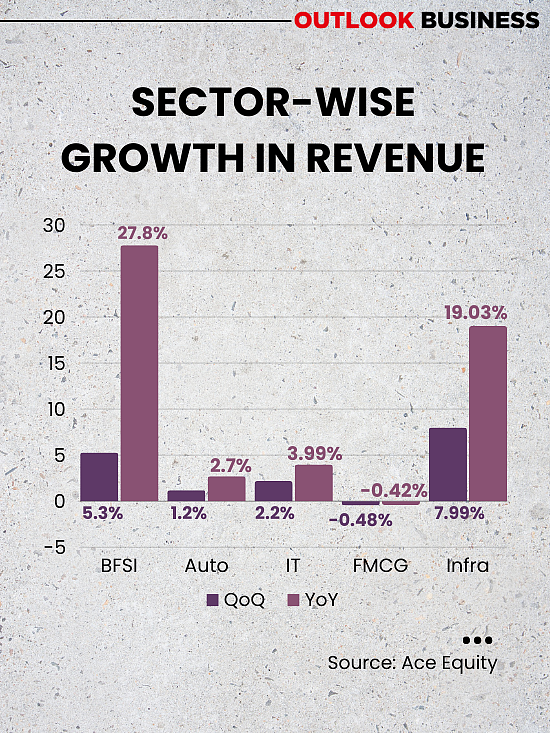

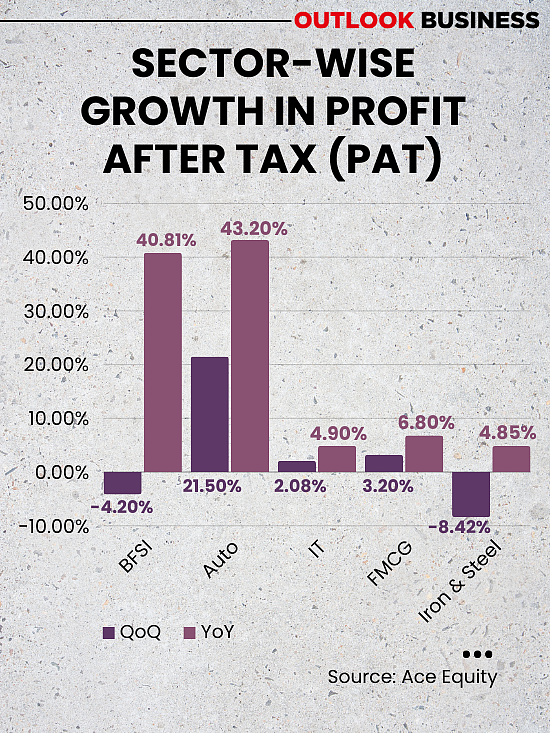

In the December quarter, 69 BFSI (banking, financial services, and insurance companies) sector reported a 27.8 percent growth in revenue while aggregate PAT increased 11.1 percent, and EBITDA grew 10.61 percent.

On a quarter-on-quarter basis, BFSI companies posted 5.32 per cent growth in the December quarter, operating profit grew 2.9 per cent while PAT fell 4.2 per cent.

According to a report by Motilal Oswal Financial Services, the banking sector exhibited a mixed performance in the October-December quarter, backed by healthy business growth, controlled provisions, persistent NIM pressure, and high operational expenses.

“Credit growth was primarily driven by retail growth. The corporate sector saw a gradual pickup, aided by MSME growth. Most of the banks witnessed stagnant or a slight dip in margins, barring select PSU banks,” the report added.

In line with the expectations, top banks have shown double-digit credit growth with small and mid-size banks performing equally well.

Anchal Kansal, Research Analyst at Green Portfolio noted that the net interest margins (NIMs) of the banks have stagnated. “NIMs peaked for banks during interest rate cycle hikes. Deposit growth has slowed down on the back of stagnant interest rates by RBI. Despite this, the BFSI sector has seen great interest from FIIs who pumped roughly Rs 32,000 crores into a few banks in the sector.”

The auto sector showed stellar results backed by demand for EVs and SUVs. Tata Motors showed remarkable growth and continued its profit trajectory to overtake Maruti Suzuki and become the most valuable auto company after the latter held the spot for almost seven years.

The Automobiles and Ancillaries space witnessed a year-on-year growth of 20.74 per cent in aggregate revenue, operating profit increased 36.8 per cent, and PAT grew 68.7 per cent. On a quarterly basis, the 20 auto companies posted a 1.24 per cent rise in total revenue, operating profit surged 4.99 per cent, and profit after tax grew 21.5 per cent.

“The concept of premiumisation is spreading widely with middle-income people desiring to buy SUV models. EV penetration in India is still below the global average and the auto companies will continue to grow as they envision higher market share in India’s growing EV market,” Kansal said.

Tata Motors posted consolidated revenue from operations of Rs 110,577.14 crore in the December quarter, up 24.96 per cent from Rs 88,488.59 crore in the year-ago period. The automobile major’s profit after tax jumped 134.80 per cent from Rs 3,043.15 crore in the December 2022 quarter to Rs 7,145.43 crore in the latest quarter.

IT Sector Continues To Disappoint

Excluding the BFSI sector, the companies reported a 4.2 per cent YoY increase in total revenue, EBITDA jumped 22.3 per cent, and profit after tax increased 30.9 per cent.

On a sequential basis, the revenue increased 3.60 per cent, PAT surged 3.3 per cent while operating profit fell 4.07 per cent compared to previous quarter.

The underwhelming results of the IT companies are no longer a surprise, and most IT firms have either lowered their revenue guidance or expect to reach the lower end of the range. Infosys has tightened its FY24 revenue growth guidance to 1.5-2 per cent in constant currency from 1-2.5 per cent it had guided earlier. For the IT sector, the combined revenue of 31 IT companies present in Nifty 500 index grew 3.9 per cent YoY, and PAT remained flat.

On a sequential basis, the total revenue surged 2.2 per cent and PAT rose 2.08 per cent.

The combined revenue of Infosys Ltd (Rs 38,821.00 crore), TCS (Rs 60,583 crore), HCL (Rs 28,446 crore), and Wipro (Rs 22,205 crore) constituted around 71.8 per cent of the total revenue of Rs 208,895.01 crore.

“Indian IT companies work as an outsourcing hub for large foreign companies and it is not a surprise that 97 per cent of the revenues of these companies come from the USA. The recessionary fear in the West has forced these companies to give feeble guidance,” Kansal said.

With continued weakness in key verticals and pressure on Q4 execution, the companies have either narrowed their revenue guidance band or expect to achieve the lower end of the range, as per Motilal Oswal's report.

FMCG And Chemicals Struggle With Growth

In addition, sectors like consumer goods and chemicals continue to struggle with growth momentum. Consumer Goods companies continued to see pressure on demand sentiment due to persistent inflation and a slower-than-expected rural recovery.

During the October-December quarter, the combined revenue of 20 FMCG companies, including the likes of Hindustan Unilever, Dabur India, ITC, and Britannia Industries, fell marginally by 0.42 per cent, and combined PAT witnessed single-digit growth of 1.46 per cent.

On a quarter-on-quarter basis, combined revenue fell 0.48 per cent and the PAT increased 3.2 per cent.

According to the MOFL report, the consumption trend and management commentary about rural recovery remained unchanged in the third quarter of FY24. Local competition, a delayed rural recovery, and price cuts continued to hurt revenue performance during the first three quarters of the ongoing fiscal.

The combined revenue of 29 chemical companies in the Nifty500 index fell 19.6 per cent year-on-year and PAT declined over 58 per cent. Sequentially, total revenue from operations fell 8 per cent and PAT was 47 per cent down.

According to a report by Nuvama Institutional Equities, non-discretionary segments like agrochemicals and pharma continued facing pressure from ongoing inventory destocking but discretionary segments such as dyes, pigments, and polymers saw higher demand.

Agrochemicals was the worst impacted segment as global destocking continued and weak pricing with year-end pressure on global players to reduce working capital continued to hit demand.

What The Future Holds

Among other sectors, aviation, capital goods, consumer durables, healthcare, infrastructure, were among the solid performers, while agriculture, media, and telecom showed muted growth.

Narendra Solanki, Head Fundamental Analyst – Investment Services, Anand Rathi Shares, and Stock Brokers, said that the broader outlook hints at an economy poised to thrive due to enduring factors like enhanced infrastructure, bolstered manufacturing, and the adoption of the China plus one strategy, which involves reducing imports while increasing exports.

“In the upcoming year, we anticipate strong performance from infrastructure sectors such as defense, railways, capital goods, and roads, alongside promising prospects for banks. Even public sector undertakings (PSUs) and defense-related enterprises are poised to actively engage in market activities,” he said.

Solanki added that the execution of diverse initiatives such as production-linked incentives (PLI) and government capex plays a crucial role in propelling overall economic expansion, nurturing a conducive atmosphere for market growth.

Performance in the upcoming quarter will be influenced by inflationary pressures, interest rates, global geopolitical events, and the evolution of government spending ahead of the 2024 general election.