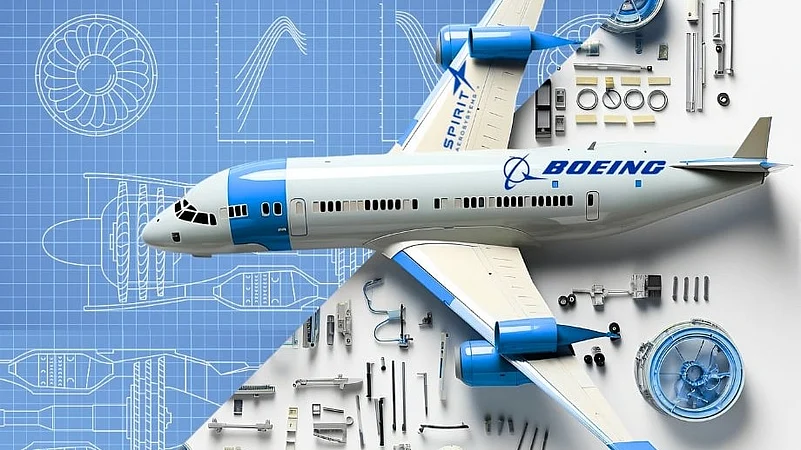

Spirit AeroSystems’s homecoming to Boeing after nearly two decades of being split up is now going through a bumpy regulatory clearance ride as the United Kingdom’s Competition and Markets Authority (CMA) investigates the merger deal. The deal holds huge significance for both, the American aircraft manufacturer and Spirit AeroSystems’ to strengthen its dominance and maintain a stronghold on the supply chain to fast-track manufacturing.

In 2005, Boeing had sold its Wichita division to an investment firm Onex Corporation for $900mn as a cost-cutting measure, according to CNN. The division was later renamed Spirit AeroSystems.

Why is Boeing-Spirit Deal Under Probe?

The merger deal worth $8.3bn, including Spirit’s debt, was announced by Boeing last year and was set to be closed by mid-2025. The UK antitrust body’s probe aims to evaluate whether the merger deal will result in a “substantial lessening of competition” in the country, Bloomberg reported.

A Spirit spokesperson, however, said the ongoing probe by the antitrust body is a standard procedure for acquisitions. The UK’s competition watchdog is expected to close the investigation by August 28 and based on its findings, it will decide whether the deal requires further probe.

Deal’s Significance for Boeing

The Kansas-headquartered company is crucial to Boeing’s supply chain as it produces critical aircraft structures like wings and fuselages for Boeing’s 737 MAX, and 787 Dreamliner lines, among others. The deal comes around a time when the global supply chain disruption, particularly in the American and European markets following the Covid-19 pandemic, has taken a toll on the aviation industry as production of aircraft has slowed down.

A report by KPMG titled “The Supply Strain” highlighted that while supply chain disruption remains a dominant theme in the international aircraft manufacturing industry, the increase in air travel demand across the globe has resulted in a surge of aircraft orders. As of May 2025, Boeing’s aircraft deliveries stood at 220 against gross orders of 552.

Ripple Effect & Its Importance for Spirit Aerospace

While Spirit is crucial for Boeing, the case of vice versa is also true. When Boeing’s workers went on strike last year demanding a wage hike, the aircraft maker had halted production for nearly seven weeks. The KPMG report stated that Boeing’s operations shutdown had a ripple effect on the Kansas-headquartered aircraft component maker. Already troubled by its poor financial health driven by mounting losses and widening debt, Boeing’s operations halt resulted in hundreds of layoffs at Spirit Aerospace.

“Spirit was impacted by the ripple effect from the strike at Boeing and furloughed hundreds of workers,” the report by the audit giant mentioned.

The production slowdown by Boeing resulted in a decrease in commercial segment revenue for Spirit AeroSystems in the first quarter of the financial year 2025. The company’s net revenues dropped 11% to $1.52bn.

“Commercial segment revenue in the first quarter of 2025 decreased from the same period of the prior year, primarily due to lower production activity on most Boeing programmes, particularly the Boeing 737 programme,” said Spirit AeroSystems in its Q1 financial year 2025 earnings.

Its net loss remained flat at $613mn in Q1 financial year 2025 compared to $617mn in Q1 of the previous fiscal.

Earlier, the aircraft component maker had flagged concerns regarding the company’s ability to continue operations unless additional liquidity is infused into it. The merger deal, apart from the $107mn non-interest-bearing line of credit offered by Airbus, is a crucial solution for the financially strained component supplier.

But since the antitrust body's probe is likely to conclude by the end of August, the mutually beneficial merger deal is months away from materialising, provided the investigation doesn't reveal any significant bearing on competition in the sector.