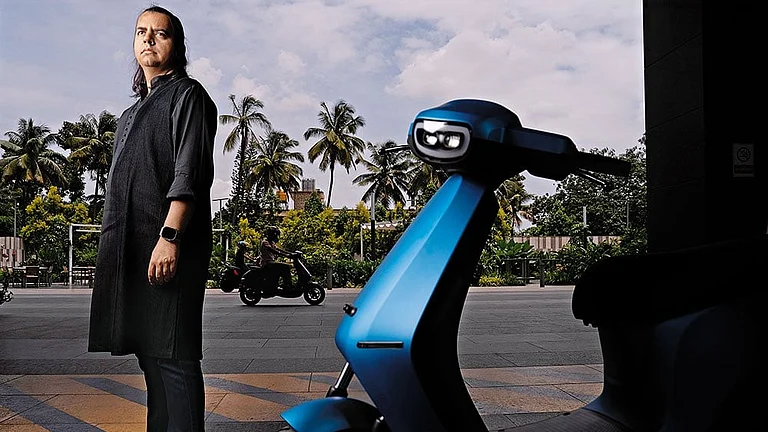

Bhavish Aggarwal-led Ola Electric has received board approval for fresh funding round, just nine months after the of IPO (initial public offering) launch. The EV maker will now raise up to Rs 1,700 crore through the issuance of non-convertible debentures (NCDs) and other eligible debt securities, Ola said in an exchange filing on Thursday.

Ola Electric's IPO Shine Fades In Just 9 Months, Now It Needs New Capital - Here's Why

Ola Electric, led by Bhavish Aggarwal, has secured board approval to raise up to Rs 1,700 crore through debt instruments like non-convertible debentures. This comes less than a year after its IPO, aiming to bolster the company’s finances amid ongoing pressures such as declining market valuation and competitive challenges

These funds will be raised in one or more tranches. However, other details regarding the fundraising round like intended use of proceeds have not been disclosed by the company --- facing heightened scrutiny from regulators, government, and users.

“… the board of directors… has inter-alia, considered and approved the proposal of fund raising by borrowing funds within the borrowing limits approved by the shareholders of the company, by way of: (i) term loans, working capital facilities; or (ii) issuance of NCDs or any other eligible debt securities, in one or more tranches, on a private placement basis or such other methods,” the filing read.

The new fundraising is a part of EV maker’s broader efforts to strengthen its financial position and support operations along with the growth amid rising challenges such as sliding market cap, stock value, market share, etc.

Is It For Expansion Plans?

The new-age EV company has successfully raised $1 billion across 14 funding rounds from 2017 to 2024. Besides this, it has also received approximately $734 million funds through its IPO in August 2024. But since then, it has been facing ups and downs, including regulatory challenges, product quality issues, falling stock price, and more. Amid all these uncertainties, Ola has once again turned to capital markets and investors for fresh funds.

The company has notified the markets regulator, Securities and Exchange Board of India (Sebi), about the board’s approval to issue NCDs and other securities. Speaking about the same, Kranthi Bathini, Director of Equity Strategy at WealthMills Securities said the dalal street is surprised with the fundraising round.

However, considering the turbulence in the electric two-wheeler space, and the company’s plans for capacity expansion and battery manufacturing, Ola may need additional capital to support its operational needs, Bathini told Outlook Business.

“Competition in the electric two-wheeler segment is intensifying and Ola has been going through a rough patch lately. So, raising capital is a way to cushion against these uncertainties. Also, to maintain market leadership, Ola needs to keep introducing new models, which requires extra capital. So this fresh fundraising is aimed at supporting those new launches,” he added.

Himanshu Arya, founder and CEO of Luxury Cart said that with IPO funds falling short of addressing these evolving demands, the need for additional capital has become more urgent, especially for those looking to stay agile, competitive and prepared for long-term growth.

Besides expansion plans, Ola is also facing some ongoing challenges, which may require the injection of fresh capital.

Or Ongoing Challenges?

Adding to the pressure, recent evaluations by rating agency ICRA and key investor Vanguard have raised concerns. Vanguard has reportedly slashed Ola’s valuation to $1.25 billion, down more than 80% from its peak of $7.3 billion in 2021. And ICRA has also downgraded the debt ratings of Ola Electric from ‘A’ to ‘BBB+’ with a negative outlook.

Ola has also lost its market leadership in the electric two-wheeler segment in April to TVS Motor, according to the data from the government-run Vahan portal. Ola has registered 19,709 vehicles last month, down 42% year-on-year, capturing 21.46% of the market.

"The market share of Ola Electric has reduced. And going forward, if losses will increase, they will need money to run the firm. They can also use these funds to complete their battery side of business," said VG Ramakrishnan, Managing Partner at Avanteum Advisors LLP.

Additionally, the company’s net loss widened 50% year-on-year to Rs 564 crore, while its operating revenue declined 19% in the October-December 2024 quarter. The company is yet to announce its earnings for the fourth quarter of 2024-25.

And the most notable challenge is regulatory scrutiny. The company has faced increased scrutiny due to alleged inconsistencies in sales reporting, concerns over vehicle quality, and the lack of trade certificates at multiple retail locations.

In February, regulators raised questions about discrepancies in the company’s sales figures. While official Vahan records indicated 8,652 vehicle registrations for that month, the company’s filings reported sales of 25,000 units. Ola attributed this difference to a temporary backlog resulting from ongoing contract renegotiations with registration service providers Rosmerta and Shimnit India.

Despite this explanation, the mismatch prompted investigations by the ministries of heavy industries as well as road transport and highways.