Global macros are in no calm, thanks to Trump's 'tariff' play. The term has become both feared and something people desperately need clarity on. Following Trump’s April 2 announcement, many expected the outlook ahead to become less uncertain. However, with flip-flopping policy stances and other nations going all in for tit-for-tat tariff moves, uncertainties have only surged. In just two days, China’s double-digit tariff rate skyrocketed to 145%, with POTUS threatening further hikes if China escalates its retaliation.

Recession on cards? Analysts see US bearing the brunt of Trump Tariffs

From equities to the bond market, Trump's tariff play has rattled the dynamics of the global economy, with experts trying to gauge the impact of uncertainties arising from flip-flopping policy stance. But experts warn that the US might actually take the biggest hit for starting the tariff fight

However, amidst all this turbulence, experts are seeing the US bearing the brunt of 'reciprocal' tariffs. While the imposition of duties is largely meant to reduce the country's burgeoning trade deficit, analysts call it a self-inflicted economic harm that could have ripple effects globally.

Famous American investor Howard Marks compared the recent trade reform to an 'own goal' concept, wherein the side causing the damage ends up hurting itself the most.

"Just a couple of months ago, the US economy was performing well, the outlook was positive, the stock market was at an all-time high, and there was much talk about American exceptionalism. Now, if Trump’s tariffs are put into effect, the US economy is likely to experience a recession sooner than otherwise would have been the case, higher inflation, and extensive dislocation," Marks, Co-founder of Oaktree Capital Management, said in a memo.

The common logic behind the tariff reforms was to limit the unwanted leverage other trading partners enjoyed as the US experienced majority of the adverse impact. However, the knock-on effects— coming via global supply chains— might end up harming the US itself, as companies bearing the additional cost might pass the burden to end-buyers, eventually resulting in spiking inflation and faltering demand levels.

Not an easy play

Even as certain countries try to mitigate the impact of tariffs through trade talks and building a competitive advantage against peer economies, it might not be an easy play for the US. According to Willem Sels, CIO, HSBC Global Private Banking and Wealth, the impact of tariffs is expected to be higher in the largest economy, than in the rest of the world.

"...the US growth and earnings will be more negatively affected than in most other countries, as the broad-based tariffs make almost all imported inputs more expensive for US firms. That either puts more pressure on inflation or on corporate margins," he said.

Meanwhile, the adverse expectations were also visible in the US markets that crashed earlier this month. The CBOE Vix, Wall Street's fear gauge, witnessed its highest surge since April 2020, last week. In just two trading sessions, the Dow Jones Industrial Average plummeted around 10%, before easing some pain. Global stock markets followed suit with the Hang Seng index and Japan's Nikkei seeing some of the steepest drops.

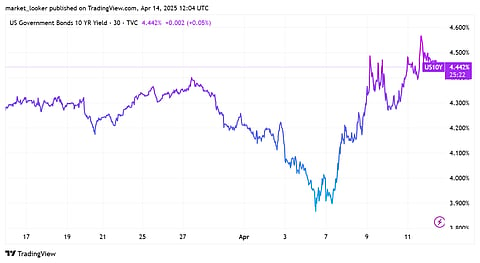

Meanwhile, the bond market went into chaos last week after a sharp sell-off in US Treasuries— usually seen as a safe haven asset—which eventually pushed 10-year yields higher than 4.5%. A Deutsche Bank analyst also said in a note that, "the market has lost faith in US assets."

Quite evidently, it's not going to be a smooth sail for the US economy which triggered a massive panic on the macro level.

All eyes on Fed

With concerns around a prospective recession lingering, investors are now eagerly waiting for the Federal Reserve's next move. The growing uncertainty caused by the ripple effects of Trump’s tariff play might have derailed the Fed’s path to reach its target this year.

If fears around an economic downtrend loom, the Fed might cut interest rates faster to boost the economy. But again, if inflation stays high, the Fed might keep rates high longer and delay any cuts. However, tariff-driven inflation is different from usual demand-driven inflation, as per analysts. And interest rate hikes are less effective at fighting this kind of inflation.

"Inflation-fighting measures such as higher rates are probably less likely to succeed against inflation caused by the addition of tariffs to selling prices than they would be against the more typical demand-driven inflation," the memo read.

For now, uncertainty is the word sailing through macro turbulence owing to Trump's tariff play, but the US might just be equally vulnerable.