Trump Tariffs: The end of the financial year usually provides D-Street investors a clear view of the road ahead. But not this time, as Trump's tariff stance has only made the outlook far more uncertain and tough to gauge. While the April 2 deadline is all set, exactly how these ‘reciprocal’ tariffs will play out still remains unclear.

As Trump’s April 2 Tariff Call Nears, These Indian Sectors Could be in Trouble

Trump's April 2 deadline is now just around the corner, keeping investors around the world on the edge of their seats as they try to gauge the impact of reciprocal tariffs

A report by Emkay Global already pointed out the complexity of Trump’s tariff plan, which aims to impose reciprocal duties on every single commodity from nearly 200 countries. This could result in over 2.6 million individual tariff rates, making broad-based tariffs more likely. However, analysts caution that the real concern might come from the ripple effects on corporate confidence, capex and global trade flows.

"US reciprocal tariffs may consider not only partner countries' tariffs but also factors like VAT, exchange rate deviations from market value and non-tariff barriers. Also, non-tariff barriers are challenging to quantify. So, determining the overall impact at this stage is difficult," said Sumit Bhatnagar, fund manager- equity, LIC Mutual Fund AMC.

As of FY24, the US accounts for about 18% of India’s total exports, contributing roughly 2.2% to India's GDP. It remains India’s top export destination, with a trade surplus of nearly $35.3 billion. Most D-street players believe that the auto sector might bear the brunt, owing to Trump's recent call for the imposition of a straight 25% tariff rate on both finished products and auto ancillary.

This was quite visible in investor sentiment as well. Last week, the benchmark index, Nifty50 remained largely rangebound, albeit in green. Whereas, the Nifty auto index plummeted over 2.26% during the same period.

Hidden edge?

Sectorally, the auto industry is the most exposed to tariffs in Asia, followed by semiconductors and steel. But India faces a relatively lesser risk when compared to peer nations like Taiwan, Thailand, South Korea and Japan, Nomura stated in a March report.

Plus, tariffs on other nations can potentially give India's exports a cost advantage. In FY24, India exported $2.1 billion worth of auto parts and accessories to the US but its share in US auto imports remained limited to only 2%, far behind that of Mexico (39%), Canada (13%) and China (12%). So even if reciprocal tariffs are imposed, which we are currently sure of, India's positioning might become competitive.

However, there is another sector that might witness a higher risk: Pharma.

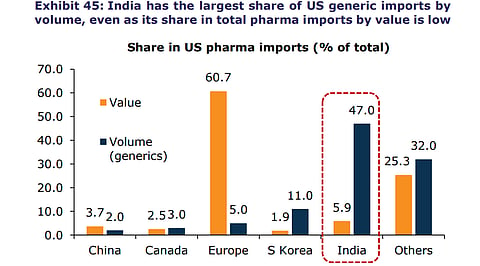

In CY24, the US imported around $212 billion worth of pharma products, making it the fifth-largest import category. While India’s share stood at only 6% ($12.5 billion), it still dominates in generic drug category, supplying 47% of the US’s total generic imports. But, at the same time, the US is also a major market for India, accounting for 37% of its pharma exports. Any kind of tariff imposition can hurt the bottom-lines of domestic pharma companies. So far this year, the Nifty Pharma index has plummeted by around 10%.

Interestingly, India has a cost advantage here as well. The US might be the second-largest producer of generics globally, but its products are much more expensive than Indian generics. And, as of now, the US lacks the capacity to replace Indian generics.

Even if Indian firms shift their production units, which Trump apparently wants, it would erase their cost advantage and make drugs more expensive for US consumers. Emkay Global's Chief Economist Madhavi Arora noted that the imposition of tariffs would likely be passed on to consumers, making medicines even more expensive. This comes at a time when lowering healthcare costs is one of the few issues both US parties agree on.

Other sectors at loss

Major sectors like electronics, auto and pharma might have made more headlines amid concerns over Trump tariffs, but these sectors are still less vulnerable. In contrast, sectors like gems, jewellery and textiles face a bigger risk as India has less negotiating power here.

According to the Gem and Jewellery Export Promotion Council (GJEPC), nearly 50% of exports might be wiped out, leading to job losses of around 1 lakh to 1.5 lakh workers. As for the textile industry, other south-east nations have much better positioning. "Tariff hikes could hit price-sensitive segments like garments, making them less competitive against rivals like Vietnam and Bangladesh," said Devarsh Vakil, Head of Prime Research at HDFC Securities.

What should investors watch out for?

Last week, trade negotiations between India and the US continued to find a base point. However, Trump's comments provide a flip-flopping stance. While he did praise the Indian Prime Minister, calling him a “very smart man” and a “great friend,” he didn't hesitate to criticise India as one of the world’s highest tariffing nations, again.

While export-driven sectors like technology, electrical and industrial machinery continue to face higher levels of uncertainty, the real shocker might come from the retaliatory tariff play, something that investors are currently not counting-in.

"Tariff announcements often cause stock market volatility, presenting both risks and opportunities for short-term investors. Retaliatory tariffs from other nations could disrupt supply chains, impacting companies with global operations. However, there is a potential upside—such tariffs might boost the competitiveness of certain Indian-manufactured products in international markets as well," said Bhatnagar.

The end of the current fiscal year is set to be quite a dynamic play for D-Street players, who just started witnessing a market recovery after a sharp correction. A lot will depend on how India bargains in sectors where it holds strength.