Nvidia and AMD have reportedly struck a deal with the White House to resume chip exports to China.

In exchange, they will provide 15% of their China revenues to the US government.

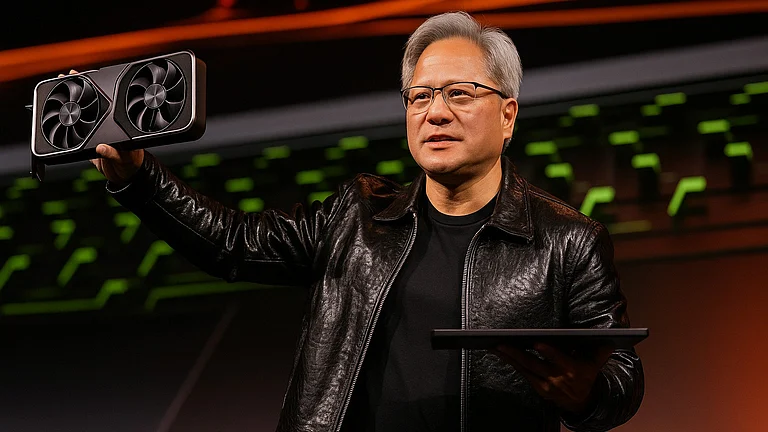

Among the chips allowed for sale are Nvidia’s H20 and AMD’s MI308, both developed to meet US export control rules.

Paying the Chip Toll: Why Nvidia, AMD Are Ready to Pay Heavy Price for Chinese Market

The chips in question are Nvidia's H20 and AMD's MI308. Both are advanced graphics processing units (GPUs) specifically developed to comply with export controls put in place by successive US governments, especially the Biden Administration

US chipmakers Nvidia and AMD have agreed to an unusual deal with the White House to allow their chip exports to China. The Trump Administration, as per media reports, will allow chipmakers to sell their advanced chips to Chinese customers in exchange for sharing 15% of their revenues.

The deal was first reported by the Financial Times, and later Reuters also confirmed it, citing sources.

“While we haven’t shipped H20 to China for months, we hope export control rules will let America compete in China and worldwide. America cannot repeat 5G and lose telecommunication leadership. America’s AI tech stack can be the world’s standard if we race,” Nvidia told FT.

The chips in question are Nvidia's H20 and AMD's MI308. Both are advanced graphics processing units (GPUs) specifically developed to comply with export controls put in place by successive US governments, especially the Biden Administration. They required companies like Nvidia to reduce the capabilities of their advanced GPUs if they wanted to sell them to China and also required authorisation from the Bureau of Industry & Security (BIS), under the Department of Commerce.

When US President Donald Trump came to power, he further extended these restrictions. On May 15, the US Department of Commerce (DOC) required all chipmakers to have BIS licence before for selling advanced computing chips to China. This reportedly included H20 and MI308 chips.

Trump Admin Lifts Export Control

However, in July, some of these export control norms were lifted gradually. First, the Commerce Department lifted a short-lived licensing requirement on chip design software (EDA) used by companies such as Synopsys, Cadence, and Siemens. Later, on July 15, the Trump administration reversed the ban on Nvidia’s H20 AI chip exports to China, allowing shipments to resume as part of trade negotiations that included Chinese concessions on rare-earth materials.

Later, Commerce Secretary Howard Lutnick justified the export allowance in a CNBC interview, where he said Nvidia wants to sell China its “fourth best” chip, which is slower than the fastest chips that US companies use.

“We don’t sell them our best stuff, not our second best stuff, not even our third best. The fourth one down, we want to keep China using it. We want to keep having the Chinese use the American technology stack, because they still rely upon it,” he said.

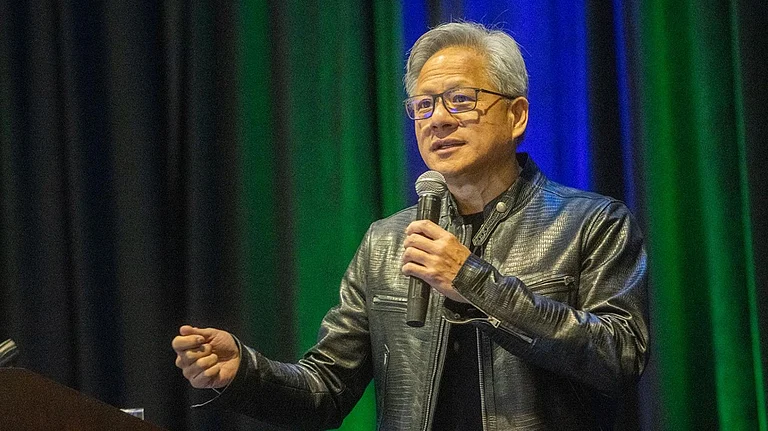

But reports claimed the move came after Nvidia CEO Jensen Huang lobbied Donald Trump at the White House on July 10 to ease export rules.

Experts are now saying that the White House move pushes US companies into "a new and dangerous world.”

“What we are seeing is, in effect, the monetisation of US trade policy in which US companies must pay the US government for permission to export," Stephen Olson, a former US trade negotiator, told Bloomberg.

Deborah Elms, head of trade policy at the Hinrich Foundation in Singapore, told the news agency that with this deal "the sky is the limit" as the White House might target other industries.

Why China is Critical for Nvidia, AMD

According to data compiled by Bloomberg, out of a total of $130 billion sales Nvidia made in FY25 (January to February) worldwide, about 13% ($17 billion) came from China. For AMD, 24% of 2025's sales came from China, accounting for $6.2 billion out of $26 billion total sales.

Further, demand for Nvidia's H20 GPUs is so high that Chinese companies, including ByteDance, Alibaba Group, and Tencent Holdings, have placed at least $16 billion in orders for Nvidia's H20 server chips in the first three months of the year, though none have been shipped in the last few months.

In the first quarter, the company revealed that it expected to incur $4.5 billion in charges related to excess inventory for the H20 chip as DoC blocked the exports.

"The demand for GPUs like NVIDIA is high everywhere and restrictions of their sale to China heavily impacted sales and revenue to NVIDIA, AMD, and Intel. This also comes during trade negotiations with China, so this can be seen as a bargaining chip or concession," Alvin Nguyen, Senior Analyst, Forrester told Outlook Business.

On July 15, when the White House allowed Nvidia to restart exports to China, US brokerage Wedbush said in a note that "now Nvidia gets the key China market back, which is roughly 15% of total revenues but could go up significantly over the coming years."

"This is all a game of high-stakes poker between Nvidia and the Trump Administration. Jensen & Co. have been huge supporters of job creation and onshoring efforts and leading the AI Revolution around the world, as we saw on Trump's recent Middle East AI-focused trip with Jensen front and centre in Saudi Arabia and the UAE. On the other hand, Nvidia is not going to hand Huawei its business on a silver platter, and Jensen knows well that if the US government does not let it sell its H20 chips, this gives China an advantage in the AI arms race," wrote analysts led by Daniel Ives.

"For the Trump Administration, it’s well known that one of the biggest chips on this poker table with China is Nvidia GPU chips, and allowing the company to sell its chips back into the country should help trade negotiations between the two countries. There is only one chip in the world fuelling the AI Revolution, and it’s Nvidia that is clearly understood both in the Beltway and Beijing," they added.

Why US Banned Chip Exports to China

The US policy directives on China have differed from time to time since the ban on advanced electronics and artificial intelligence technology first started in 2020. One reason has been at the centre of it all, "National Security".

It began in May 2020, when the first Trump administration blocked semiconductor shipments to Huawei, crippling its HiSilicon chip unit. Later that year, the US Commerce Department designated Chinese government-owned chipmaker SMIC as a military end-user and placed it on the Entity List, blocking most US exports to the company.

In 2022, the Biden administration introduced sweeping export controls covering advanced computing chips (such as FinFET/GAAFET logic chips ≤14 nm, DRAM ≤18 nm, and NAND flash ≥128 layers), semiconductor manufacturing equipment, and foreign-produced items for supercomputing or chip development. Under these rules, Chinese facilities faced a “presumption of denial” for licences. In December 2022, more Chinese firms, including memory-chip maker YMTC, were added to the Entity List, cutting them off from US-origin technologies. April 2023 saw restrictions expand to AI chips, cloud access, and model weights under the “AI Diffusion” policy, followed by further tightening in March 2024 on US AI chips and chipmaking tools.

In October, 2023, the Bureau of Industry and Security issued three new rules targeting advanced computing chips, semiconductor manufacturing equipment, and an expanded Entity List with 13 additional Chinese entities. In its final weeks, in 2025, the Biden administration further required licensing for exports, re-exports, and in-country transfers of chips, including those via third countries, to prevent circumvention.

However, experts later claimed many of these measures failed to stop the flow of advanced chips to China. A primary example was seen in Huawei’s Ascend 910B AI processor, which came out in 2023. Analysts found these processors allegedly used a die made by Taiwan's TSMC. This triggered US Commerce Department scrutiny.

A subsequent probe found that one of its Chinese customers, Sophgo, had provided the chip to Huawei, though the company publicly denied having any business relationship with the smartphone maker. In 2024, Sophgo was placed on the US restricted trade list alongside Huawei. Later that year, reports found that nearly 3 million TSMC-made chips ended up with Huawei due to export control loopholes.

"Progress by Chinese semiconductor companies in their AI chip efforts have been impressive and would likely decrease demand for non-Chinese GPUs long-term, creating more competition and weakening the positions of current western chip manufacturers over time," Nguyen said adding that Chinese AI and AI GPU manufacturers focus on efficiency versus ultimate performance aligns better with the global enterprise AI inferencing market expected to grow beyond the AI training market.

After the Trump administration allowed exports of H20 chips in July, a group of 20 US experts wrote to Secretary Lutnick.

"The H20 is a potent accelerator of China’s frontier AI capabilities, not an outdated AI chip. Designed specifically to work around export control thresholds, the H20 is optimised for inference, the process responsible for the dramatic capabilities gains made by the latest generation of frontier AI reasoning models," the experts wrote. Among them were former General Counsel for the National Security Agency Stewart Baker and former Deputy Assistant Secretary of Defence Diana Banks Thompson. The latter added that the H20 is a cutting-edge AI chip central to China’s AI ambitions and outperforms even Nvidia’s restricted H100 in this area.

They noted that following DeepSeek’s breakthrough model earlier this year, Chinese AI labs began bulk-ordering H20s to advance next-generation models. The global AI chip supply is already constrained, with US data centre demand projected to require up to 90% of worldwide production through 2030. Nvidia’s new “Blackwell” chips are sold out until late 2025, meaning greater Chinese access to H20s could divert scarce resources from US developers.

They even cited reports claiming Chinese tech firms have collectively placed orders worth $16 billion for Nvidia’s H20 GPUs, and said these chips "contain many of the same advanced components and use many of the same semiconductor production and packaging facilities that are necessary for producing the Blackwell chips that US companies are desperate to buy."

"Every H20 chip shipped to China requires scarce resources that could have been allocated to producing AI chips for US developers. At a time when chips are in critically short supply, we should be prioritising American innovation, not allowing a strategic competitor to drive up costs," they said.

The letter went on to claim that the biggest buyers of Nvidia’s H20 chip are nominally civilian companies in China, but they fully expect the H20 and the AI models it supports to be deployed by China’s People's Liberation Army.

"Under Beijing’s ‘Military-Civil Fusion’ strategy, cutting-edge tools developed for commercial use, like Nvidia’s H20 chips, are swiftly adapted for military purposes," the letter said.

After the publication of this article, Donald Trump confirmed the deal from the White House press room. "The H20 is obsolete," Trump said. "So I said, 'Listen, I want 20% if I'm going to approve this for you, for the country.'"

Trump also said that Nvidia CEO Jensen Huang will present a new Blackwell chip to him, which, according to Trump, will have "30% to 50% taken off of it" from the original version.

AMD has also said that the US approved its applications to export some AI processors to China, but did not directly address the revenue-sharing agreement.