"We approach this Budget with minimal expectations but hope to see measures that support ease of doing business, which is currently impacting growth. "Tax clarity is essential to ensure a stable and predictable business environment, especially as global competitors, like the US, implement tax cuts, which could impact India's competitiveness. Simplifying GST compliance would further ease the burden on businesses, promote efficiency and reduce operational hurdles. Together, these measures can enhance India's appeal as a business destination and support economic growth," said Arpit Jain, Joint MD at Arihant Capital.

Union Budget 2025 Expectations: FMCG Companies Watch For Demand Push

Union Budget Expectations: Tax clarity, simplifying GST compliance remains top wish of industry players ahead of Budget

Trump’s Return Stirs Global Uncertainty, Businesses Call for Tax Clarity

We anticipate this to be a rural-focused, agriculture-supportive Budget, considering key elections in the next two years. Higher allocations for government policies, such as water and infrastructure development, are expected, he further added.

Tax-Relief for Middle-Class Among Key Demands

Budget 2025 is expected to bring much-needed tax relief for the middle class, who have seen their tax contributions double in just three years. Raising the basic exemption limit to Rs 5 lakh and introducing fairer slabs, like 10% for Rs 5–10 lakh and 20% for Rs 10–20 lakh, could make a real difference in people’s lives, said Chakrivardhan Kuppala, cofounder and Executive Director of Prime Wealth Finserv.

Increasing 80C limits to Rs 2.5 lakh and 80D to Rs 50,000 would better reflect today’s rising costs. These changes wouldn’t just reduce financial stress—they could also boost spending and investments, helping both individuals and the economy, he further added.

Targeted Incentives for High-Value Manufacturing Sectors

The Union Budget 2025 holds immense significance for India’s manufacturing sector as the country strives to achieve its $2 trillion export target by 2030. To enhance global competitiveness, we expect measures such as tariff rationalization, duty exemptions, and expanded remission schemes to lower production costs and boost exports," said Sunil Kalra, Partner, Forvis Mazars.

Simplifying compliance procedures is also crucial to streamline operations and attract greater foreign investments. Targeted incentives for high-value manufacturing sectors like electronics and precision machinery, alongside support for labour-intensive industries such as textiles, footwear, and food processing, can drive rural development and create widespread employment, he added.

Budget 2025 Expectations LIVE: Aditya Birla's Naresh Tyagi Calls for Tax Incentives to Boost Green Housing

Dr Naresh Tyagi, chief sustainability officer at Aditya Birla Fashion and Retail Limited says that builders and developers have a substantial role to play in the construction of green housing projects. Budget 2025 is likely to introduce incentives specifically tailored to encourage their involvement in such projects. Possible measures could include tax credits for appropriate use of renewable energy sources, rebates for integrating sustainable building practices, as well as fast-track approval of green building projects.

“The availability of green financing is crucial for driving sustainable development. While the government's initiative to develop a "taxonomy for climate finance" is commendable, its success hinges on the introduction of accessible financial products in the upcoming Budget. Measures such as lower interest rates for green projects, tax incentives, and subsidies for adopting sustainable building materials and energy-efficient systems can significantly encourage developers to invest in green technologies,” he added.

Budget 2025 Expectations LIVE: Mehta Equities' Rakeshh Mehta on Outlook and Market Resilience Amidst Uncertainty

Rakeshh Mehta, chairman of Mehta Equities Ltd says the markets are now eagerly awaiting key developments such as the upcoming budget and Donald Trump's trade and tariff decisions now that he has now assumed power. If the budget takes a negative turn, there is potential for the markets to experience a downturn.

However, Mehta remains optimistic, highlighting that the underlying strength of the economy, driven by factors like the Maha Kumbh Mela and the wedding season, will support growth.

"Despite the potential volatility, we are positive about the long-term market outlook. The economic fundamentals remain robust, and the resilience of sectors driven by cultural and social events suggests that the markets could rebound even if short-term challenges arise, underscoring the belief that the economy will continue to expand regardless of temporary setbacks," he added.

Budget 2025 Expectations LIVE: Digi Yatra Calls for Incentives, Frameworks to Boost Tech Adoption in Tourism

"We are looking forward to policymakers introducing incentives and frameworks that support tech adoption in the tourism sector, ensuring a sustainable and competitive ecosystem for businesses while delivering unmatched experiences for travelers," said Suresh Khadakbhavi, CEO, Digi Yatra Foundation.

"Furthermore, in the industry at large, granting infrastructure status to smaller projects, simplifying the licensing process, and rationalising GST structures are some of the critical reforms that can help reduce operational hurdles for travel and hospitality businesses. These measures would encourage more investments, support budding entrepreneurs, and strengthen India’s position as a global leader in tourism," he added.

Budget 2025 Expectations LIVE: Simplified Taxation on Fixed Income Investments Expected, Says Suresh Darak

Suresh Darak, founder of Bondbazaar says over the past few budgets, tax rates for various investment instruments and income streams have been gradually streamlined, reducing exceptions and differential treatments. This has brought several options, such as Fixed Deposits, Debt Mutual Funds and Bonds, onto a level playing field by taxing them similarly. This alignment eliminates arbitrage opportunities between instruments and fosters a more balanced investment landscape.

“Looking ahead to Budget 2025, we anticipate further progress in this direction, and possibly a complete revision in the structure of personal income tax. We may see a much simpler unified approach to taxation, spanning all asset classes in the coming years," he said.

Budget 2025 Expectations LIVE: Amway India on Prioritising Preventive Healthcare to Reduce Long-Term Costs

“India's increasing focus on health and wellbeing aligns with the Government's vision for a healthier nation. The upcoming Union Budget 2025 should also help prioritize preventive healthcare, especially as lifestyle diseases rise, to reduce long-term costs and improve overall health outcomes," said Rajneesh Chopra, Managing Director of Amway India.

"A key step in this direction would be rationalizing the GST from the current 18% on health and wellness products, including dietary supplements. Furthermore, expanding GST exemptions and input tax credits on dietary health and wellness products will help promote holistic wellness across the country," he added.

Budget 2025 Expectations LIVE: Govt Should Support Insuretech Innovation: Grant Thornton Bharat's Narendra Ganpule

"Digital natives are beacons of innovation. Insuretechs are no different. So it's imperative that the union budget / regulations allow the amount spent by insurers on experimentation / R&D / innovative operating models and keep it out of the 'expense of management' limitations. Boards of the respective companies can provide requisite governance to ensure integrity of the spend," says Narendra Ganpule, partner at Grant Thornton Bharat

Union Budget 2025: Health Insurance Industry Pushes for Public Infra, Tax Reforms Amid Rising Costs

"GST on health insurance premiums needs to be lowered across the board to 5% to foster greater insurance penetration. Mandatory health insurance coverage could be implemented for companies that employ over 20 employees," said Suneeta Reddy, Managing Director, Apollo Hospitals

"The Budget must also prioritise initiatives to boost telehealth and digital medicine to expand healthcare access and dedicate resources to preventive care, which would reduce the strain on hospitals. These measures will help pave the way for a robust and equitable healthcare system, ensuring better health for all," she added.

Budget 2025 Expectations LIVE: FMCG Stocks in Focus

Getting demand levels back on track is a top priority for industry leaders to spark growth in the consumption sector. For D-Street analysts, this remains important, as subdued macros and a complicated geopolitical picture are already weighing down FMCG stocks. While tax rebates for middle-class tops the budget wishlist, it alone might not be enough to spur consumption levels.

Budget 2025 Expectations LIVE: Integrating Flex Spaces into Urban Development Projects, Like Smart Cities, to Boost Growth

"The future of India’s flex space industry lies in a synergistic partnership between the government and the private sector. The government can play a pivotal role by introducing policy frameworks that encourage innovation -such as tax incentives, streamlined regulatory approvals, and interest subvention schemes to ease capital access for operators. Integrating flex spaces into urban development projects, like smart cities, IT parks and transport hubs, will further bolster growth and establish them as a vital component of India’s economic infrastructure," said Anshu Sarin, CEO, 91Springboard.

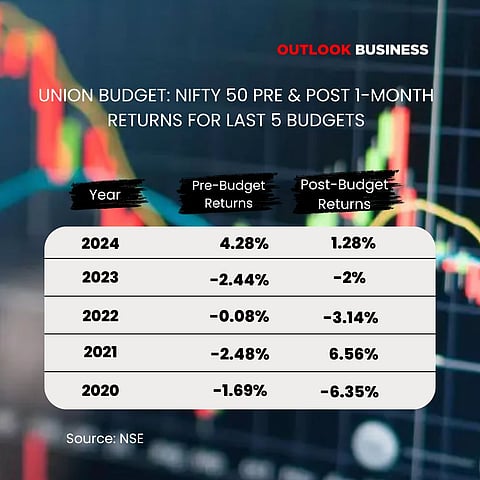

Budget 2025 Expectations LIVE: Nifty 50: Pre- and Post-Budget Performance in Last 5 Years

In January 2025 so far, the benchmark NSE Nifty 50 index has tanked over 2.7%; keeping in trend with the one-month performance of the stock market before the budget in the last five years. Benchmark Nifty 50 fell four times in a month ahead of the Union Budget, out of the last five years. Except in 2024, when the index jumped over 4% in a month in the run-up to the event, the index fell up to 2.5% in the other four years. The trend indicates a cautious market ahead of the fiscal announcements, where investors are wary about the potential policy impacts.

On the other hand, the market's response to the budget announcement itself has been a mixed bag in recent years. In 2024, the index gained nearly 1.3% in the month following the budget announcement. However, in 2023, it witnessed a decline of about 2%. In 2022, the index fell by more than 3%, while in 2021, it gained over 6.5%. In 2020, Nifty dropped over 6.35% post-budget.

Budget 2025 Expectations LIVE: Tata Consulting Engineers Calls for Infra, Energy Push

Amit Sharma, Managing Director & CEO, Tata Consulting Engineers, says the FY26 Budget is a key opportunity to advance India's infrastructure, energy transition, and technological innovation. "We expect continued capital investment in water supply, metro systems, and climate-resilient infrastructure, along with support for Smart Cities, Transit-Oriented Development, and affordable housing," he said.

"A stronger push for renewable energy, including offshore wind, green hydrogen, and small modular reactors (SMRs), coupled with grid expansion, viability gap funding, and single-window approvals, will accelerate the energy transition. Strengthening nuclear energy through Bharat Small Reactors (BSR) and a contingency reserve for disaster management will bolster long-term energy security," Sharma added.

Budget 2025 Expectations LIVE: Push for Infrastructure Spending

"We anticipate that the upcoming Union Budget will prioritise infrastructure spending, which will significantly benefit our lending segments, particularly small businesses, contractors, and transporters. This focus on infrastructure is expected to lead to a surge in demand for steel, cement, and other materials, further driving demand in vehicle finance and other sectors reliant on bulk materials," said Umesh Revankar, Executive Vice Chairman, Shriram Finance.

"This will not only boost economic activity but also create substantial employment opportunities, especially in semi-urban and rural areas. We foresee new vehicle sales growth in Q4 to be in double digits year-on-year, as we expect government spending on infrastructure to be much higher than previous quarters," he said.

Budget 2025 Expectations LIVE: Increased Allocation for Upskilling Programs in Emerging Technologies

"Tax incentives for startups and MSMEs should include introducing tax breaks or deferments for startups during their initial years. Simplifying tax compliance, especially for smaller businesses, and expanding exemptions under schemes like Startup India would encourage innovation and growth. Enhanced funding access can be achieved by establishing government-backed venture capital funds, low-interest loans, and credit guarantees for startups," said Tabrez Alam, Chief Strategy Officer, Bobble AI.

Skill development and innovation hubs need increased allocations for upskilling programs in emerging technologies such as AI, blockchain, and green tech, he added.

Budget 2025 Expectations LIVE: Prudent to Continue Walking the Path of Fiscal Consolidation, Says Padiyar from Tata Asset Management

"With new President in the US promising further protectionism, every economy in the world needs to focus on its strong points and look more internal. Fiscal discipline along with other macro parameters would be critical in these times. India has done very well over the past few years on improving fiscal health and the government has articulated its target to achieve below 4.5% deficit for FY26E," said Chandraprakash Padiyar, Senior Fund Manager at Tata Asset Management.

"Additionally, Finance Minister articulated the target to reduce debt to GDP sharply beyond FY27. It would be prudent to continue to walk the path of fiscal consolidation and reduce debt to GDP ratios for the country which will go a long way in sustaining growth in the long term," he added.

Budget 2025 Expectations LIVE: Strengthening IT Sector with the Apt Digital Infrastructure

With the rise in technological advancement, our expectations from budget 2025 are to strengthen the IT sector with the apt digital infrastructure and focus on cyber security & skill advancement to continue leading globally in the technology space, said Abhishek Narayan, Co-Founder & Director, Growing Pro Technologies.

"For SMEs and MSMEs it is significant to introduce streamlined regulatory frameworks and incentives to continue to serve as pivotal drivers of economic growth," he further added.