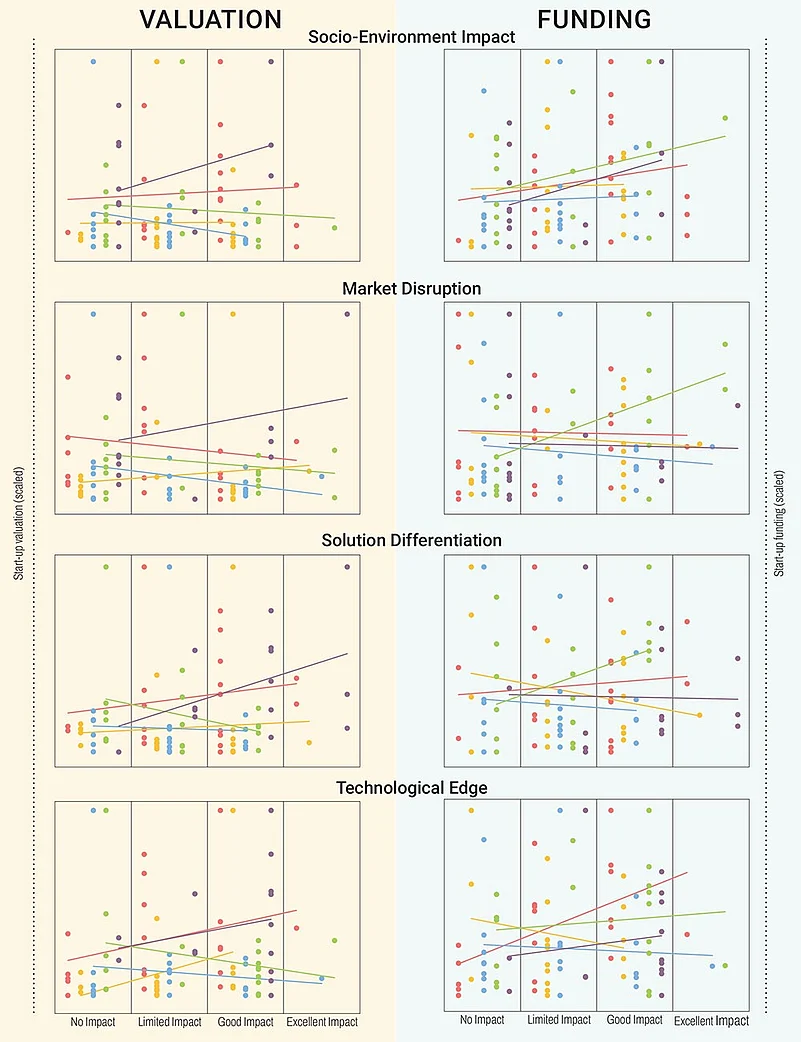

What Drives Valuation and Funding for Growth-Stage Start-Ups: Evaluation parameters include market disruption potential, socio-environmental impact, solution differentiation and technological edge from the operation strength category

D2C: Going by the analysis of all growth-stage start-ups, as depicted in the trend lines, a D2C company stands to gain the most from having a superior technological edge. Both for valuation and attracting funding, the technological edge parameter gives it the best results among the four selected parameters as shown in slanted trend lines

Ecommerce: Among the four parameters, an ecommerce start-up should focus the most on having a better technological edge for securing a higher valuation. Such a correlation does not exist significantly in case of funding for these start-ups. In fact, none of these parameters have a large impact on funding of these companies

Edtech: An edtech start-up should focus the most on creating socio-environmental impact to have a better chances at higher funding. However, a similar positive correlation does not exist as the driver of valuation

Fintech: None of the selected parameters has a positive correlation to valuation for a fintech start-up, but, interestingly, all of them have a good positive correlation with funding. The correlation is more robust when the start-up has a higher solution differentiation and superior market disruption potential

Healthtech: All parameters have a positive correlation to the valuation of a healthtech start-up. However, the major focus for them must be on becoming better solution differentiators, followed by creating greater socio-environmental impact. In fact, the latter is highly likely to drive their funding up

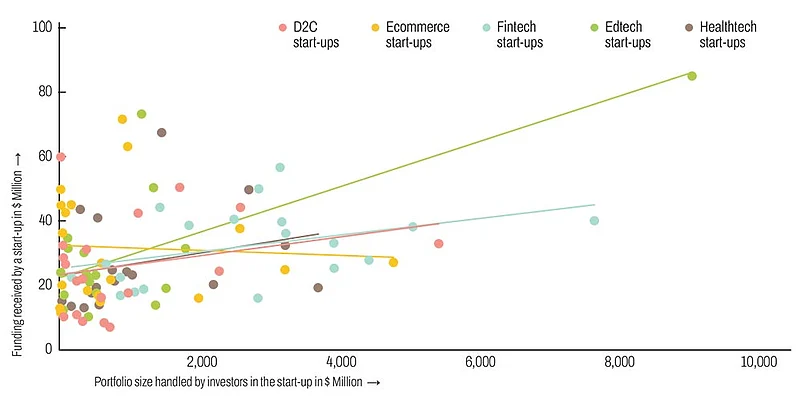

Correlation Between Funding a Start-Up Receives and Portfolio of its Investors

Some correlation exists between total funding of a start-up and total portfolio of all its investors taken together. This correlation is highest among edtech companies and lowest in the ecommerce sector. A slanted trend line at an angle of almost 45 degrees shows a robust correlation. Dots represent individual start-ups, whose proximity to trend lines suggests a healthier correlation. The above trend lines, thus, show that edtech companies funded by larger investors had greater chance of securing higher funding. However, this argument does not hold for ecommerce companies.