Janakiraman Rengaraju knew right from his school days that he was destined to be in the stock market. While the sizes of the portfolios he manages have increased many times over since he first started off as a fund manager, his investment philosophy has remained the same — invest in quality mid-caps that generate a good return on capital and free cash flows. After managing a corporate investment portfolio, he now manages Franklin India Prima Fund and Franklin India Smaller Companies Fund. He is also the co-portfolio manager of the Franklin India Prima Plus Fund. Just like his predecessor KN Siva Subramanian, he too has a zen-like personality, which helps him stay grounded during volatile times and is also self-effacing to a fault, attributing all his success to timing and luck. It is his repeated refusal to beat his own drum that makes Franklin Templeton one of the most respected fund houses in the country.

Market Calling

Rengaraju’s first brush with the market came when he was in high school. His neighbour, a professor as well as Rengaraju’s good friend introduced him to the stock market. Right from 1988, he began investing in IPOs, which were extremely popular then, and it was his mother, who gave him the initial capital. “That’s how my interest started and it continued throughout my college days. I was able to pay for my college fees and manage expenses, too,” he says. They must have been good investments you tell him, but he is quick to retort, “Rather than good investments, those were good times. There was money in the market and you didn’t really need very sharp or differentiated thinking like you do now.”

Rengaraju completed his engineering in 1992, and then went on to pursue his management studies at IIM Bangalore. It was clear to him by then that the financial market was his calling. Right out of IIM, he joined Indbank Merchant Banking in 1995 and worked in the investment banking division for a year. Later, he went on to join UTI Securities in Mumbai and was part of its research team for four years. “While Mumbai is a great place for networking and establishing contacts, I was fairly certain that it will not be the place where I will be building my professional career.” As if on cue, he bagged an opportunity in Chennai, when one of his clients in UTI Securities sold his business to Bayer and was looking for an efficient hand to build an investment portfolio. “It was equivalent to what people call a family office these days. We were the only two involved in investment decisions. Our strategy was simple — to identify quality mid-caps and buy a material stake in them. Our timing was good as the tech bubble had just burst and assets were low. We had three years to build the portfolio, but it did not do well in the set time-frame. It was after the market recovered that the portfolio performed.” Some of the bets they took back then — Bayer, Pidilite and Karur Vysya Bank — paid off well.

After spending seven years managing the portfolio at Indian Syntans, Rengaraju felt that the time was right to move to a more organised environment. Luckily for him, Franklin Templeton was hiring and he joined them in 2007. “If I had stayed any longer, it would have been difficult for me to get into an organised environment. In Indian Syntans, the approach was more intuitive whereas in Franklin Templeton, there is much more rigour in the process. We follow a more disciplined and well-thought-out approach in order to convince the team about our decision as well.” While being at Franklin Templeton meant taking fewer concentrated bets, his personal investment philosophy wasn’t vastly different from that of the fund. “I would not have fit in otherwise,” he states.

Simple yet effective

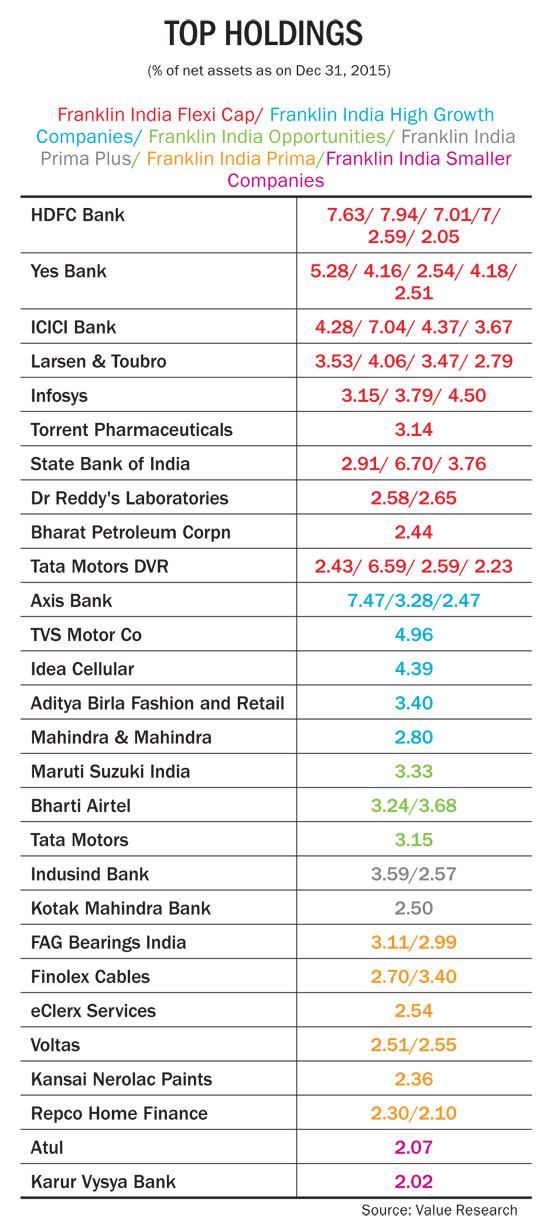

Ask him about his investment philosophy and he says, “It is very simple and nothing really very exciting. I look for businesses that generate a good return on capital and has the ability to generate free cash flows through a business cycle. They tend to be less capital intensive, not highly leveraged and more often tend to have consumer-facing characteristics. It need not be a direct consumer-facing business but could be in manufacturing with a large after-sales market.” Some of his most successful investments such as Amara Raja Batteries and FAG Bearings came through this thought process and he calls them business compounders. “They don’t grow in a flashy manner but every few years, they manage to grow their earnings steadily and double their business over a period of time and we ride on that growth.” For instance, for Amara Raja Batteries that the fund bought in 2007-08, Rengaraju liked the fact that the company was keen on its brand building initiatives, which strengthened its position in both the auto and telecom segments, although it supressed margins initially. By 2009, the company was firing on all cylinders with a strong aftermarket in auto, a bounce back in the telecom business and with margins improving as they scaled up the business. “What I liked about the company is that it is not too fixated on quarterly margins and is realistic about sustainable margin levels. It improved its processes continuously and has dealt with dealers in a better way than its competitors.” Besides, Rengaraju looks for companies that are good in their day-to-day execution and can spot tactical and strategic opportunities. Take the case of Repco Home Finance, which is into lending to people without a regular income — a segment with not much competition. “It is a large business with multi-year growth opportunities. But it is a tough business to execute and these people are doing it reasonably well since the focus is on discipline.”

Rengaraju also pays attention to boards that are alert in preventing the misuse of access and that understand related party transactions. “Pass the companies through these filters and only a few will clear the list. So, you will end up having a buy-and-hold strategy and stay invested in them through business cycles, unless there is a big change in their business characteristics.” But a simple buy-and-hold strategy in reality is tougher to execute when the market tend to test your patience and you are constantly compared with your peers. “I have realised that patience and time are my biggest competitive advantages. The filters are not all that complicated and many can identify these companies, but it is the ability to hold on to the stock through its idiosyncratic down phase that creates the difference. If your initial framework is robust, you must have the maturity to hold on to the business.”

Case in point is Finolex Cables where the company’s business fundamentals were sound, but it bore the brunt of the financial crisis as some of its forex options led to huge losses. “They had an active treasury that went in for some options and incurred losses. The company was paying nearly #60 crore as mark-to-market losses but the good part is that they wrote it off for each year completely without carrying it forward or renegotiating with the banks. After the payouts, they were still making profits. But this was for a definite period and once it ended in 2011-12, the company emerged as a much stronger brand-oriented business with efficient operations.

FAG Bearings was another stock that Franklin Prima Fund had a substantial holding in around FY05, which was subsequently pruned down. In 2009, it caught Rengaraju’s attention given its larger share of revenues coming from the after- sales market and the demand from the automobile segment picking up. “The bearings business has a fantastic operating leverage and when the demand goes up both volumes and prices increase, so it’s a double bonanza as far as margins are concerned.”

Making the right choice

According to Rengaraju, if investors are willing to look beyond one or two quarters, there are a lot more investment opportunities and the risk comes down sharply if a calmer approach is adopted. “You will feel some pressure due to competitive positions but you just have to live it. If investors are in search of portfolios that outperform all the time and through all cycles, it will be like a physics quest of the grand unified theory, it simply doesn’t exist!”

He points out that the tenets of investing haven’t changed much since the 1990s. “At that point in time, you had limited set of information to process. The challenge today is to sift through all the data and figure out what is relevant and what is not,” he says.

Every investor has his own toolkit. Rengaraju prefers to do his own research relying on primary data which is mostly annual reports and meeting the company management. “Once you get the model right and the valuation at reasonable levels, the maintenance job is much easier. I will be much relieved if we go back to semi-annual reporting. There is too much focus on quarterly numbers and a lot of energy is spent predicting the accuracy of the numbers. So if the company fails to achieve the estimated growth, the analyst is quick to say that it has disappointed even though the base reference are his numbers.” In fact in the past five years, his levels of engagements in his most successful investments have been restricted to meeting the managements probably twice a year and reading up their annual reports. According to him, the only bright side to all the volatility created by the noise surrounding the market, is that, it gives long-term investors like him good entry points.

While his buy-and-hold strategy has helped him ride out the market’s ups and downs, the challenge of managing a large fund investing in mid and small caps is the higher impact costs. Buying large quantities in this space automatically pushes the price up and the buy-and-hold strategy provides the solution to this problem. “In a larger portfolio with a buy-and-hold approach, you are removing the single largest obstacle to scale which is why my portfolio turns are low, so the impact costs are not material in terms of portfolio returns.” For instance, Franklin Prima which has 55 stocks has a portfolio turnover of around 20%, while Franklin Smaller Companies Fund with 70 stocks is lower at 15%. “Managing a higher number of stocks has not been too much of a challenge. Handling these 70 stocks has not kept me beyond 6.30 pm in the office,” he quips.

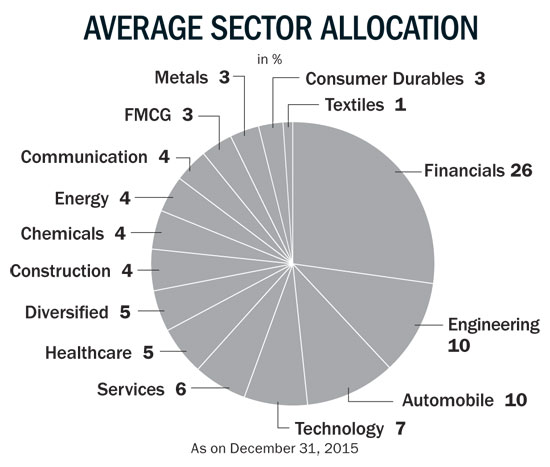

For managing a fund that invests in mid and small caps, a simpler framework is adequate. “The mispricing in stocks is much more in mid and small-caps.So, the probability to generate a higher alpha is also much higher. The large-caps are widely researched and calls for differentiated and sharper thinking for you to generate a higher alpha. It is much tougher to generate a higher alpha in large-cap stocks,” he adds.

While his investment framework has held him in good stead over the years, he is the first to admit that whenever they have deviated from the framework, the outcome hasn’t always been great. “The charm of the business is that it allows us to make some mistakes and still be in business. In certain cases, where the business visibility has not been that clear, the returns haven’t been great. He cites the example of Coromandel International, in which they invested and a positive return is yet to be seen. “It is a company with a high quality management in an average industry. Given the structure of the industry, there is so much volatility that it requires risk management at several levels. But given the quality of management the hope is that they will manage it all and outperform in the long term.” Rengaraju admits to going wrong in interpreting the contract terms in the airport businesses of GMR and GVK. “These were viewed as sunrise industries and the market was willing to overlook some contractual terms which came to haunt us. When there is a sector re-rating, your thought process does get influenced and the risk you are willing to assume within the sector goes up. When that happens, you relax the quality requirements assuming the sector tailwind will take care of those things and it hardly turns out to be true.”

Through ups and downs

Like every other fund manager, Rengaraju too has seen his share of businesses that have not scaled up the way he had hoped. He also has his list of lost opportunities. “I haven’t been all that great in spotting businesses where two or three things fall in place and the business takes off. Classic examples would be Aurobindo Pharma, Motherson Sumi and Eicher Motors. We were one of the earliest investors in Eicher Motors, but I did not build a material position because I didn’t expect the company’s super normal growth to continue for such a long time. Similarly in Motherson Sumi, I was generally a bit wary about its acquisition spree, but the company’s ability to not only scale up the business of its acquired assets but also improve on its margins was truly impressive. Such investment decisions call for some imagination as these drivers are difficult to predict and we must improve on this.” While he counts Warren Buffett, Charlie Munger and John Maynard Keynes as people who have influenced his thought process, some of his favourite writers include Peter Bernstein and Adam Smith, author of The Money Game, which he has read five times. He also loves to read up on investment history, especially the works of Charles Kindleberger and John Kenneth Galbraith.

Quoting either Yogi Berra or Niels Bohr (there is a debate on who said it first) “It is tough to make predications, especially about the future”. Rengaraju points out that in economies that have long periods of high growth, demographics has been a powerful driver of that growth. “If you get the demographics right, you have reasonably good tailwind. Without the tailwind, your stock picking ability has to be very sharp and the odds of success are considerably lower when it comes to equity investing.” According to him, India has the demographics advantage till the late 2040s that gives the country over two decades of good economic growth. “This advantage gives us reason to be optimistic when you have a short-term crisis. It is in those times of crisis that we get good prices,” he says. Predicting a trend line of economic growth of about 6% and adding inflation of 5%, he expects earnings growth of about 13-14% over the next couple of years to lead to better stock returns.

While he believes the demographic advantage will ensure stock returns will remain positive in the long term, he says any short-term volatility should provide investors good entry points. “There has a sharp correction in some stocks post the quarterly results. While the fall has been significant in stocks of average businesses, I would still stay away from them,” he says. For instance, he believes PSU banks can still be a landmine. But he is using the current volatility to add some quality stocks that have fallen to reasonable valuations in the consumer discretionary space, technology, domestic industrials and regional banks. This time around, he believes that the return will be measured and gradual and will not come through in a hurry.