It was only a matter of time before the Indian business mammoth called Reliance strode into the glistening and blooming corridors of the beauty segment. Stride it did, with elan. Reliance Retail, a subsidiary of Mukesh Ambani-led Reliance Industries and helmed by his daughter Isha Ambani as the executive director, launched its beauty portal, Tira Beauty, last month.

Tira was launched with an app, a website and a 4,300 square feet flagship store at Mumbai’s upscale Jio World Drive mall. For a deep-pocketed conglomerate like Reliance, which has its footprints spread across all major markets from oil to telecom and data, neither its foray nor the grand entry into the beauty and personal care (BPC) segment can be a surprise to anyone. It already has a strong presence in retail sectors like fashion, grocery and electronics.

Dressed to Kill

Will Tira, with the might of Reliance Retail behind it, put a wrinkle in the well-contoured plans of established brands?

According to Govind Shrikhande, retail expert and former CEO and managing director of Shoppers Stop retail chain, it is essential to understand the makeup of the retail trade before jumping to oversimplified conclusions, especially since the beauty sector has changed drastically in the past decade. BPC’s categories—skin care, makeup and fragrances—have distinct buyer behaviour, with the first two having a high customer loyalty level, he explains.

Retail chains like Shoppers Stop, MAC Cosmetics and Sephora concentrate on the premium end of the market through curated offerings. At the same time, brands like Nykaa, Purplle, Plum, MyGlamm and Sugar Cosmetics offer a wider assortment across varied price points through their digital-first platforms. This has further opened the gateway for other direct-to-customer brands to enter the market. While e-commerce platforms like Amazon, Myntra and Flipkart also tried to capture the online clientele, they were not as successful since their horizontal marketplace approach did not help in the curation of the BPC product range.

“Reliance, like for all its other retail ventures, is planning a big splash in this category through an omnichannel play. Considering the market size, it should be able to gain market share, especially from smaller beauty stores across India,” Shrikhande says. “Moreover, with no distinct big leader, other than Nykaa, in the online space, there is sufficient room for a new player with deep pockets to create a strong position for itself,” he adds.

The early days might present some challenges for Tira, even if it does not take too long to settle in. Karan Taurani, senior vice president of Elara Capital, feels that Nykaa is a better platform than Tira since it has a wider product variety, lower lead time in delivery and a better app user experience. However, he admits, things could change in favour of Tira in the near to medium term, given its large-scale operations on the retail side. This, in turn, can help Reliance Retail garner a sizeable market share in the online BPC segment and have a negative impact on Nykaa’s growth in online BPC, he says.

“We have seen many new entrants in the online BPC space due to reasons like lower discounting, increased penetration opportunities, demand for premium products and better profitability for platforms. However, Tira may increase the quantum of discounts in the near term only to drive increased traffic and customer base,” he surmises.

Beauty Is Not Skin Deep

While introducing Tira, Isha Ambani had said that the brand aimed to democratise beauty for consumers across segments. “Our vision is to be the leading beauty destination for accessible yet aspirational beauty, one that is inclusive and one that harbours the mission of becoming the most loved beauty retailer in India,” she added.

Shopping behaviour has evolved within this segment as contemporary consumers are more experimentative, with growing awareness about distinct product attributes and an eagerness to opt for clean, sustainable merchandise. Also, they want an unfettered shopping experience—anywhere, anytime in physical outlets and on online platforms. Therefore, any beauty brand’s success depends on its omnichannel presence.

Prateek Ruhail, co-founder and CEO of beauty marketplace Vanity Wagon, feels that Reliance Retail is playing its cards right by adopting an omnichannel approach.

“Post-pandemic, digital-first companies are finding it difficult to cope with the ever-increasing marketing and allied costs. Having a foot in the retail space allows a brand to balance out its bottom line,” says Ruhail. “Reliance Retail will definitely have the advantage of brand value, which customers will see in their stores. Omnichannel strategy is likely to build trust early on,” he adds.

Business of Beauty

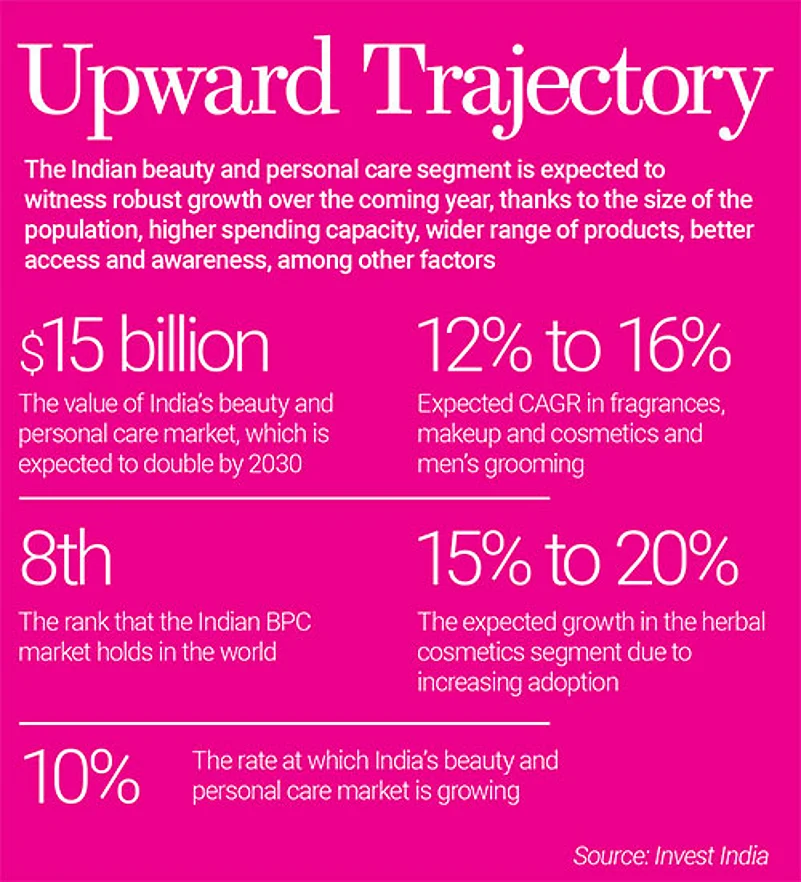

The outlook for the beauty and personal care market in India is quite bright, riding on strong drivers like a large population, better spending capacity and increasing awareness about skin health and beauty products among others. Higher internet penetration has further improved the prospects of the market, with ecommerce increasing the access of consumers to a wide range of products with diverse pricing.

The BPC market in India, currently the eighth largest in the world, stands at $15 billion. It is growing at 10% and is expected to double by 2030, with skin care and cosmetics driving this growth, according to national investment promotion agency Invest India.

The demand for products that are natural and free from toxins and animal cruelty has increased, with consumers willing to pay more for higher value.

A report by Expert Market Research states that growing disposable income has helped the growth of India’s beauty and personal care industry in recent years. With the disposable income, demand for improved products and a growing expectation to look good among Indian consumers, the beauty and personal care market in India has a golden opportunity to expand exponentially, it notes.

While the female segment holds the maximum share of the BPC market, the male segment is expected to get stronger, with an Allied Market Research report on skin care product market in India expecting it to grow at a CAGR of 10.2% between 2021 and 2027.

According to Elara Securities, the BPC market was valued at $15 billion in CY21 and is estimated to grow at a 10% compound annual growth rate [CAGR] until CY30. The IMARC group pegged the value at $26.3 billion in 2022, expecting it to reach $38 billion by 2028 at a CAGR of 6.45%.

An Avendus Capital report states that online beauty and personal care shoppers in India are likely to quadruple from 25 million in FY20 to 110 million in FY25. This virtual space is exactly where brands like Nykaa, Sugar Cosmetics and Plum Goodness originated and earned their success from before adopting a well-rounded omnichannel avatar.

That digital-native brands have focused primarily on digital platforms to build their presence is evident since it is part of the ecosystem’s DNA. Many brands forayed into physical outlets for multiple reasons—to tap more customers, retain existing ones or create better brand awareness.

Ultimately, beauty is an omnichannel business that requires significant investment to build a seamless and consistent brand experience across multiple touchpoints. Pakhi Saxena, practice head of retail and CPG [consumer packaged goods] at Wazir Advisors, notes that the online channel of the BPC segment contributes around 15% to the business, which will double in the coming two years, while the dominant offline channel will account for around two-thirds of the segment.

“An engaging ecosystem of social media, deep penetration of retail points, expertise across assortment, warehouse and logistics management, order fulfilment, and service grid, gifting and personalisation—these are all imperative for building an omnichannel platform. And this expertise is something that the Reliance Group has built over the years,” she avers.

This does not mean that the other players in the beauty business have let the omnichannel opportunity pass them by. In 2022, Nykaa opened 45 new stores, taking its total store count to 141. It plans to add 50 more outlets by this year-end. This is despite offline retail accounting for less than 10% of the company’s revenue, as shared by Nykaa’s executive chairperson, MD and CEO Falguni Nayar during a post-earnings call in March 2023.

Sugar Cosmetics has over 150 physical outlets and plans to augment this number. Most D2C brands opt for a shop-in-shop format, a kiosk in a mall or departmental store or an exclusive business outlet for their offline foray. However, this long-term and capital-intensive investment is not for the faint-hearted. This is where Reliance Retail can bring its A-game.

Prashant Narang, co-founder of Agility Ventures, points to the fact that Reliance Retail has shown its ability to invest in and scale up diverse businesses, such as telecom, retail and e-commerce with a long-term perspective. By integrating Tira into its existing retail and digital infrastructure, the conglomerate can optimise costs and resources while maximising customer value, he says.

“Moreover, Reliance Retail can leverage its partnerships and collaborations with global beauty brands and suppliers to source and curate the best products and services for Tira. In short, while there are challenges in the omnichannel beauty business, Reliance Retail’s track record and resources can give it a fighting chance to fare better than its peers,” he adds.

Saxena, too, agrees that private labels tend to be successful after consumers enjoy the variants across brands and products on digital platforms. Hence, it is quite probable that Tira may explore private label accessible pricing over a few years to find a place in a consumer’s shopping basket.

However, it would be overreaching to presume that a second player could define the future of the beauty sector, even one as strongly placed as Reliance Retail. What is more probable is a collective push of multiple entities that meet the varied needs of different consumer groups with a broader assortment of products across different price points. There is also a possibility that start-ups could partner with Reliance Retail to offer niche or premium products, build loyalty programmes or tap into new distribution channels. Ultimately, the vast beauty sector is evolving quickly and there is room for multiple players to coexist and thrive if they offer value, quality and relevance to their customers.