The IT sector’s Q4 earnings played out just as D-Street had anticipated—soft and subdued. Trump's tariff play and macro uncertainty dominated earnings calls, as companies reported weak revenue figures. India's tech heavyweights, TCS and Infosys, posted net profit declines of 1.3% and 3.3% on a YoY basis, respectively, setting the tone for a cautious outlook.

IT Sector Needs More Than Deal Wins to Lift Investor Interest

The IT sector’s Q4 earnings offered only one source of optimism: strong deal wins. However, analysts believe that new deals alone won’t be enough to improve the sector’s investor outlook

Even better-than-expected results from HCL Tech and Wipro failed to lift the overall mood as guidance for the coming quarters slipped further into red. For instance, Wipro expects a revenue dip of 1.5%–3.5% in Q1FY26, while Infosys has also slashed its growth forecast to a modest 0–3%, a far cry from earlier hopes. Even HCL Tech, which had one of the more optimistic outlooks for FY26, has ended up lowering its forecast.

Delayed salary hikes, global uncertainty and cautious client spending are creating a near-perfect storm for the sector. Yet, amid the gloom, management pointed to one source of optimism: strong deal wins. However, even this lone bright spot comes with its own catch.

Deals amid Doubt

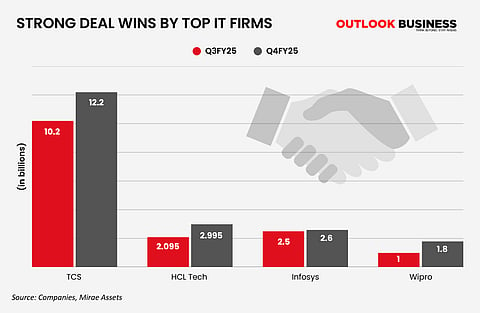

India's top IT firms reported an uptick in the total contract value (TCV) of deal wins. For instance, TCS won deals worth $12.2bn during the quarter ending March, higher than the $10.2bn recorded in the corresponding quarter of the previous fiscal.

While Tier-I IT companies reported strong TCV wins in Q4FY25, with an average YoY increase of 11%, led by HCLTech and Tech Mahindra, this alone may not be sufficient to uplift investor sentiment, say analysts.

"The key concern lies in the ability to convert these wins into sustained revenue growth. Ongoing global economic volatility continues to delay decision-making cycles and has led to increased scrutiny of discretionary IT spending as clients remain cautious, reassessing their budgets and priorities, which could hinder near- to mid-term growth for Indian IT companies," a brokerage firm Choice Broking told Outlook Business.

Wipro, during its earnings call, pointed out that certain large-scale transformation projects have been paused due to macro uncertainty. The recent imposition of tariffs by US President Donald Trump has dampened demand in sectors such as consumer goods and manufacturing. Meanwhile, TCS has warned that clients in the retail and automobile spaces are also exposed to the effects of tariffs.

This means that even if the deal pipeline remains strong, an overall blurry outlook might give rise to doubts. Plus, new wins are often cost-focused, far from growth-driven transformational projects where commitment is required. Narinder Wadhwa, managing director and chief executive of financial services provider SKI Capital Services, points out that even after deals are signed, revenue realisation is often delayed due to slow ramp-ups. This signals that clients are phasing out spending gradually. But for India's IT companies, the trouble doesn't end here.

Margin Play

The top four IT firms by market capitalisation have reported either flat or decline in sequential margins. The decline was sharpest for HCL Tech, where the earnings before interests and taxes (EBIT) margin contracted by around 150 basis points QoQ to 18%. This is despite a rise in operational efficiencies. A lot of this can be blamed on the new buzzword haunting the bottom line of IT firms: AI.

As automation and GenAI gained pace, IT firms enjoyed the perks that came disguised as cost reductions and efficiency gains. However, some clients are now asking for a part of those perks, demanding the pricing leverage that comes with AI integration.

"Clients expect AI-led productivity to translate into immediate cost reductions for them. On top of this, there is a shift towards fixed-price and result-oriented contracts, which exposes IT firms to delivery risks without proportionate rewards. While operating efficiencies improve, gross and EBIT margins may stagnate or decline slightly due to pricing resets," says Wadhwa.

This might also intensify bidding wars and drive down contract price levels, further making sustainable margin expansion unlikely in the near term. However, for smaller mid-tier IT firms, the story might turn out differently.

These companies have achieved cost synergies via reinvestment in R&D and should be able to hold on to their margin profile or slightly improve it in FY26 in this competitive pricing environment, according to Aamar Deo Singh, senior vice-president, research at Angel One, a stock broking company.

While most IT firms have maintained their margin guidance largely in line with the previous fiscal year, uncertainty remains high as was evident in the earnings commentary.

BFSI Rings in Hope

For now, D-Street analysts are divided on what FY26 might bring. While delays in decision-making could weigh on clients' discretionary spending, the silver lining is that there haven’t been any major project ramp-downs or cancellations, something that is a major relief for IT firms.

While verticals such as retail, consumer and manufacturing might experience delayed or deferred spending in the coming quarter as clients absorb the uncertainty, the banking, financial services and insurance (BFSI) sector might offer some hope.

"So far, however, it looks like the BFSI sector is still a good hiding place and may well offer some shelter to India's IT services," financial services company Motilal Oswal said in a report citing strong earnings by major US banks, including JP Morgan, Goldman Sachs, Citibank and Morgan Stanley.

But, again, risks from macro turbulence still loom large. Nearly all banks have flagged concerns around recessionary pressures and tariff policies, even as tech spending continues to be a strategic priority across the board.

For now, matters remain out of focus. The Nifty IT index plunged over 25% this year before recovering some of its losses. In contrast, the Nifty50 has remained in positive territory during the same period. Analysts expect FY26 to perform comparatively better as clouds of uncertainty begin to lift amid easing macroeconomic tensions.

"Big companies can see margins remaining stable but dependence on spending revival and execution is the key," says Angel One’s Singh.