Kumar Mangalam Birla, chairperson of the over 160-year-old Aditya Birla Group, made the vision for his businesses clear. Speaking at an event in November, the 57-year-old industrialist minced no words and announced, “We want to be No. 1 or 2 in every business that we are in or get into. So, like they say, scale isn’t everything, but it’s the only thing.”

Kumar Mangalam Gets Ready to Fight for Birla’s Future

As Kumar Mangalam Birla completes 30 years at the helm of the Aditya Birla Group, he has a battle to defend his businesses and conquer new ones

When Birla took over in 1995 after his father’s untimely death, there were doubts whether the young scion—he was only 28 then—had it in him to be aggressive and capture new markets. From just a $2bn turnover in 1995, the textile-to-telecom conglomerate’s listed firms crossed $100bn market capitalisation in May 2024.

However, there are signs of competitive headwinds in the horizon.

Birla’s companies are mainly up against Gautam Adani-led Adani group and Mukesh Ambani’s Reliance Industries (RIL). Though comparatively new in India Inc, these two business honchos are known to cripple competitors in their respective sectors which include telecom, ports, media, green energy and airports among others. The capital-heavy groups, with market cap of over Rs 12 lakh crore (Adani) and Rs 18 lakh crore (RIL), are opening their purse strings to venture into newer areas.

Push Forward

With the Union government planning to spend Rs 11.1 lakh crore on infrastructure this fiscal, there has been a renewed interest from various business groups.

“Cement, metals and financial have been areas where the conglomerate [Birlas] has a significant presence. As the competition is intensifying, the group will have to respond to protect its market share,” says Suresh Srinivasan, professor of strategy and accounting at Great Lakes Institute of Management.

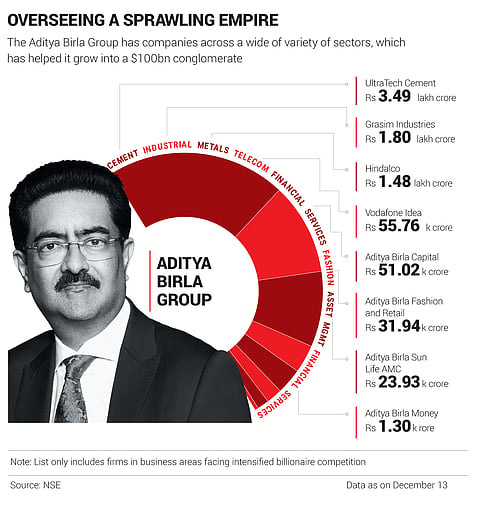

The Birla Group is present in a wide variety of sectors including cement, textile, metals, financial services, telecom, paints, chemicals and renewable energy. The group’s listed companies with a market cap of Rs 8 lakh crore plus, posted total revenue of Rs 5.6 lakh crore in the last financial year.

S&P Global Ratings, an American credit rating agency, said in a report released in October that investments worth $800bn will be made by conglomerates in the next 10 years. This amount will be three times the investments made in the last decade.

According to the S&P note, groups such as Adani, RIL, Tata and JSW will focus beyond current business areas. Meanwhile, the Birla Group is expected to pump in its investments in its existing businesses, sticking with its conservative image.

The Birla Group is present in a wide variety of sectors including cement, textile, metals, financial services, telecom, paints, chemicals and renewable energy

Birla’s face off with the Adani group has given a glimpse of how the battles could play out. “Their [Adanis’] ambition is to build a fully integrated infra business. In the past five years, Adani has increased its play in a lot of sectors,” says Aditya Kondawar, partner and vice-president at Complete Circle Capital, a wealth management company.

A case in point is the cement sector. Adani entered the cement sector with the $10.5bn acquisition of Ambuja Cements and ACC in 2022. Notably, the Gujarat-based industrialist’s move is similar to that of the Aditya Birla Group which acquired Ultratech Cement in 2004 in the biggest deal in the sector at that time.

Today, Ultratech is the leading Birla Group firm in terms of market capitalisation. Moreover, it also contributed Rs 71,547 crore to the total revenue of the conglomerate. With 152.7mn tonnes per annum capacity, Ultratech is also the leading player in India’s cement market.

With Birla’s leading crown jewel in the cement sector under pressure from Adani, the Gujarati industrialist is now making his move in the metals segment, challenging Hindalco, the flagship metals company of the Aditya Birla Group.

In March 2024, Adani announced the first phase of its $1.2bn copper plant in Mundra, Gujarat. The play is about to get even bigger as a Mint report suggested that Adani has plans to invest $5bn to establish a presence in aluminium and steel along with boosting its presence in copper.

Hindalco has a leading presence in aluminium and copper manufacturing. With Rs 2.1 lakh crore revenue in the last financial year, the highest among other Birla firms, it is the group’s crown jewel.

Kumar Mangalam Birla seems to have chosen a strategy of doubling down on his existing businesses. A big move from the conglomerate came in early 2024 when it announced its entry into the paints market with ‘Birla Opus’. In November, it announced the opening of its fourth manufacturing unit, which took its capacity to 866mn litres per annum.

It is already the second-largest paints manufacturer by capacity and has started chipping away at Asian Paints. “The paints business aligns well with the cement segment. Good synergy with the two can unlock value for the company and will give them an advantage against Adani,” says an industry executive tracking the competition closely.

Birla has also gone on an acquisition spree. In July, the conglomerate announced the acquisition of India Cements, a significant move to consolidate the southern market.

While it is defending its share in the cement sector, the metals business is going on an investment spree. During the annual general meeting in August, Birla announced that its metals company will make investments worth $10bn in Indian operations and its US-based subsidiary Novelis.

The Other A

With the Adani group challenging Birla in the cement and metals sectors, there is another competitor moving in on a separate Birla turf. Mukesh Ambani’s Jio Financial Services is looking to be a financial behemoth. From asset management, where it has collaborated with BlackRock, the world’s largest asset manager, to insurance, which may see a partnership with another global behemoth Allianz, the Reliance firm is set to up the stakes.

Till now the Birla Group has maintained a robust presence in the financial sector. Aditya Birla Capital contributed Rs 34,348 crore to the group’s total revenue in the last fiscal. But with Jio Financial still in its infancy, Birlas have some breathing space for now.

“Being a conglomerate with a multi-decadal legacy, the Birlas will respond to competition within each business segment as per the industry dynamics. It is quite natural that it will be forced to be more proactive and innovative in a particular business segment when it faces competition from other well-capitalised business groups,” says Sougata Ray, Thomas Schmidheiny chair and professor at the Indian School of Business.

On one hand, the conglomerate is shoring up its legacy segments, while on the other it is trying to increase its presence in consumer businesses. Aditya Birla Capital invested Rs 100 crore in its digital subsidiary.

It also unveiled a direct-to-consumer platform in April this year, aiming to add 30mn users in the next three years.

It has also gone on an offensive with a Rs 5,000-crore investment in consumer-facing jewellery business where it will take on Reliance Jewels and Tata-backed Tanishq. In the telecom segment, where it is also taking on Reliance’s Jio, Birla-backed Vodafone Idea raised Rs 18,000 crore.

“It is part of the transition from the old economy to more dynamic consumer-facing new age segments. Given the fact that India’s consumption base has continued to grow over the past decades and is expected to grow even further, the traditional conglomerates will try to tap the potential growth,” says Nilaya Varma, co-founder and chief executive at Primus Partners, a consultancy.

The target Birla has set for himself is ambitious. In the next five years, the group wants its consumer operations to clock $25bn in revenue which is close to what Hindalco is bringing in for the group now.

Keeping the Funds Flowing

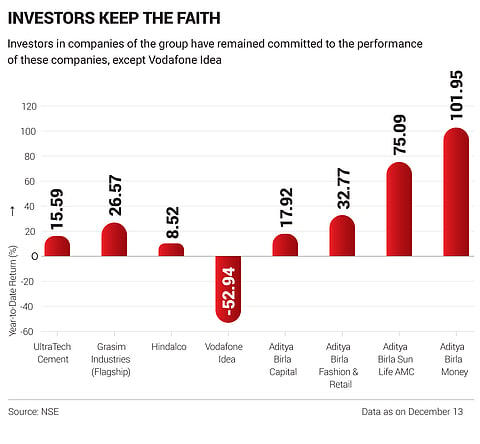

As the contours of battle become clearer, the biggest weapon will be capital. To the Birla Group’s advantage, the cement, metals and financial services segments turned in healthy profits in the last financial year. Except for Vodafone Idea, all the other group stocks have gained in value this year.

Adani group’s recent trouble in the United States could could have an effect. The credit ratings of several Adani firms have already been downgraded by global ratings agencies which is bound to increase the cost of capital. RIL is also on the hunt for more funds as it reportedly seeks $2.9bn loan to refinance debt.

The Birlas also have fundraising plans—Grasim Industries approved the issuance of Rs 2,000 crore worth of non-convertible debentures in December.

While the firm has said that the US-based metal subsidiary Novelis is unlikely to hit the markets soon, but the initial public offering plans remain. The company may likely get a leg-up if Donald Trump rolls out his America-first policy.

The group is also preparing the next-generation Birlas. Aryaman and Ananya, Kumar Mangalam Birla’s children, were inducted as directors on the Hindalco board in August 2024. This follows their induction onto the boards of Aditya Birla Fashion and Retail in 2023.

Winning the trust of investors to ward off the expansion spree of other conglomerates is something Birla appears to be chasing. For the Birlas, the battle is well and truly on.