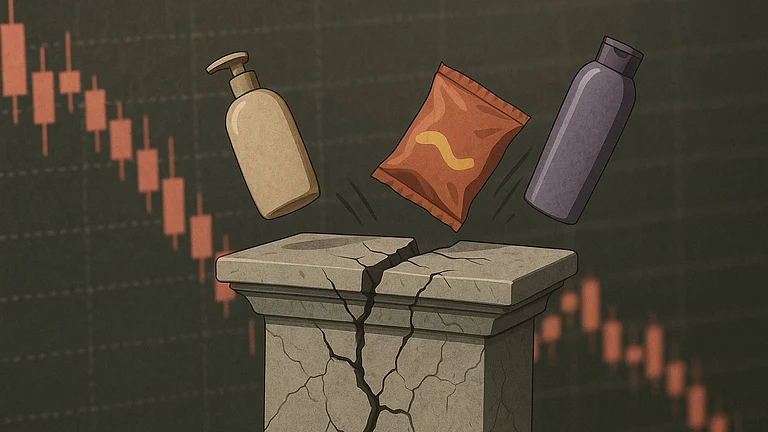

India's fast-moving consumer goods (FMCG) sector witnessed a sequential recovery in demand in the first quarter of financial year 2025-26, with an uptick in volume growth, particularly in urban markets, according to key players. However, companies are still expected to report single-digit revenue growth for the June quarter.

Monsoon Blues: How Unseasonal Rainfall Is Delaying FMCG Demand Recovery

Companies like Dabur India, Marico, and Godrej Consumer Products said they are seeing signs of demand recovery, especially in urban markets, with Marico also noting improvements in rural areas

Companies like Dabur India, Marico, and Godrej Consumer Products said they are seeing signs of demand recovery, especially in urban markets, with Marico also noting improvements in rural areas. However, Dabur pointed out that its consolidated revenue growth is expected to remain in the low single digits, impacted by weak beverage sales due to unseasonal rains.

“The beverage portfolio was impacted during the quarter due to unseasonal rains and a short summer,” Dabur India said on Friday, adding that the company plans to focus on the Activ portfolio going forward to align with consumer trends and reduce the seasonality of its juices business.

Unseasonal Rain

India experienced its wettest May since 1901, with nationwide rainfall more than 106% above normal, according to the India Meteorological Department (IMD). The unseasonal rain was driven by an early southwest monsoon, frequent western disturbances, and cyclonic circulations. States like Delhi, Marathwada, and parts of Karnataka recorded unprecedented rainfall.

This unusual weather disrupted typical summer patterns, affecting agriculture and dampening demand for summer-linked consumer products.

“Although this quarter typically benefits from the summer portfolio, the early onset of the monsoon and unseasonal rains from the last week of May hit sales of summer-led categories. Beverages, glucose, cooling oils, and talcum powders were among the most affected,” said Elara Securities in a note on July 3.

The brokerage added that categories like biscuits saw improved consumption, driven by rural recovery—benefiting Britannia more than Bectors.

“A normal monsoon is expected to support demand in categories such as tea, household insecticides, OTC products, and ethical medicines. Detergent players continue to run aggressive promotions, especially in the liquid detergent segment, to gain market share,” the firm said.

Godrej said its Home Care business is witnessing strong and widespread growth and is likely to deliver double-digit growth in value and volume this quarter.

Dabur’s Home and Personal Care (HPC) division is also expected to perform well, driven by its oral, home, and skincare categories. The company said key brands such as Dabur Red Toothpaste, Odonil, Odomos, and Gulabari are expected to post strong growth along with market share gains.

“Within healthcare, our brands such as Dabur Honey, Hajmola, Dabur Honitus, and Dabur Health Juices are expected to post robust double-digit growth. Dabur Honitus is expected to perform exceedingly well, with over 40% growth,” Dabur added.

Raw Material Costs Still a Concern

All three companies noted the impact of raw material costs on their bottom lines. Marico reported a slight dip in Parachute volumes due to high input costs but said strong brand equity helped absorb price hikes with minimal disruption. Value-Added Hair Oils grew in the low double digits, driven by premium segments.

“Among key inputs, copra prices continued to see sequential inflation, exacerbated by unseasonal rainfall patterns. Vegetable oil prices eased following an import duty cut, while crude oil derivatives remained rangebound. As a result, gross margins are expected to face incremental pressure, partly due to the high base effect and pricing-led high denominator,” Marico stated, adding that it expects margin pressures to ease in the second half of the fiscal year.

Despite cost pressures, Marico said it maintained brand-building investments in line with its strategy to strengthen long-term equity and diversify its portfolio. Saffola Oils delivered strong revenue growth in the high twenties, supported by mid-single-digit volume growth, and the company passed on import duty benefits to consumers. Its Foods and Premium Personal Care segments continued to scale up while maintaining profitability.

Godrej noted that its Personal Care segment is under pressure “mainly due to weaker performance in soaps.” However, excluding soaps—which are undergoing price and volume adjustments due to raw material cost fluctuations—the rest of the standalone business is expected to show strong performance, with double-digit volume growth.

In a good news for consumers, the company said palm oil prices began to moderate toward the end of June.

“...benefits of this moderation will only be realised in H2FY26,” it noted.

Winners and Losers of Q1

In Q1FY26E, the FMCG sector is expected to report 5.8% year-on-year revenue growth and 3% volume growth, with companies like Marico, Tata Consumer, Britannia, and Mrs. Bectors likely to benefit from pricing-led growth in categories such as coconut oil, tea, salt, and biscuits, according to Elara Securities.

Marico and Britannia may also post above-average volume growth, while Colgate, Emami, Dabur, and Varun Beverages could see flat or declining volumes due to a weak summer portfolio and increased competition, especially in oral care, it added.

However, rising input costs, particularly for copra, tea, and coffee, are expected to weigh on margins. Gross margins are projected to contract by 195 basis points and EBITDA margins by 120 basis points year-on-year. Overall EBITDA growth for the sector is estimated at just 1%.