Trump's higher-than-expected tariff move triggered a sharp downtrend in investor sentiment globally. From Wall Street to Asian markets, bears took charge as concerns around prospective trade wars heightened. In just 2 trading sessions, the S&P 500 index plummeted below the key 5,100 level mark, declining by around 500 points. Tech-heavy index, Nasdaq followed the cue and dropped by over 1,100 points or more than 7% during the same period.

Trump's Tariff Move Tanks Wall Street by $5 Trillion, Will D-Street Catch a Cold?

Trump tariff: The US stock market continued its downward streak, wiping out more than $5 trillion in market value on Wall Street. Will D-street follow the cue?

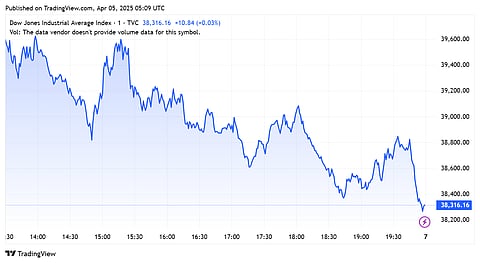

The Dow Jones Industrial Average crashed by over 2,000 points on April 4 as investors feared a recession ahead. The Asian markets also went on a downward spiral. Japan's Nikkei index declined by over 500 points. Hang Seng and Kospi mirrored the trend.

"The likelihood of retaliatory measures against the US has further heightened uncertainty. U.S. bond yields and oil prices are trending downward, reflecting concerns over potential economic slowdown and increased recessionary risks," said Vinod Nair, Head of Research, Geojit Investments Limited.

India's benchmark indices, Sensex and Nifty, attempted to shrug off the bearish sentiment and remained range-bound for most of the session, but eventually gave in to the downtrend. However, analysts believe that India's positioning is still better compared to that of its peer markets, albeit more substantial than initially projected.

Will D-street catch a cold?

With relatively strong macros, D-street players are now pinning their hopes on the upcoming Q4 results. While the impact of external factors will persist, any positive surprises in the upcoming Q4 results might counteract the negatives. A favourable interest rate decision in the upcoming MPC meet could also offer support. Experts are expecting another rate cut, as inflation has eased below the RBI’s target band.

"With rate cuts and government boost on consumption, they (India Inc.) will be able to improve their top-line as well. I am expecting markets to be volatile on both sides. This market will give good opportunities to build a long-term portfolio during dips. At the same time, it will also give opportunities to sell on the rise," said Manish Jain, chief strategy officer & director of Mirae Asset Capital Markets.

What's the outlook ahead?

In the near term, analysts remain cautious, as the risk of further earnings downgrades could weigh on the overall outlook. This is particularly true for the IT sector, which has remained under stress owing to elevated inflation levels in the US, hampering discretionary spending. Meanwhile, markets may not have fully priced in the impact of Trump’s tariff stance, despite the recent correction. This could keep uncertainty levels elevated.

"Tariffs and retaliation might keep the markets on edge. So, it's tough to expect a positive start. I don’t think it’s all factored in. To factor in something you need to be able to quantify – that’s the biggest challenge. So, “Uncertainty” is the key factor here. We don’t know when and where it will settle," Jain said.

Technical outlook and key levels

Technically, the Nifty index has broken down from its consolidation range on the daily chart, signalling a bearish trend. As per analysts, the index found support at the crucial 22,900 level, initially. However, the overall sentiment remains subdued and a slide below current levels might accelerate the ongoing correction.

"On the lower end, if Nifty falls below 22,900, it may move toward 22,676. On the higher end, resistance is seen at 23,100. A move above 23,100 would provide a clear signal for a strong uptrend," said Rupak De, senior technical analyst at LKP Securities.