Nvidia has once again climbed to the top of the global corporate ladder, reclaiming its title as the world’s most valuable company, surpassing tech titan Microsoft, which also happens to be one of its major clients. The chipmaker's shares surged 4% to close at $154.31 apiece on June 25. This rally was driven by investor confidence that China’s export restrictions would not derail Nvidia’s dominant position in the artificial intelligence (AI) space.

Nvidia Reclaims Top Spot as World's Most Valuable Company; Surges Past Microsoft

This marks the second time this month that Nvidia has overtaken Microsoft in market cap. The chipmaker's shares surged 4% to close at $154.31 apiece on June 25

This marks the second time this month that Nvidia has overtaken Microsoft in market cap. With the latest rally, Nvidia's market value has soared to a staggering $3.77tn, overtaking Microsoft's $3.66tn. Apple trails behind in third place, with a market capitalisation hovering around $3tn.

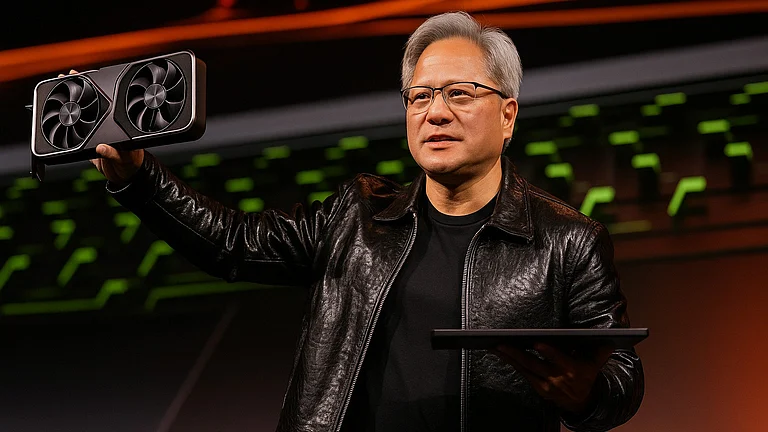

The rally came on the back of an upbeat commentary from the company’s CEO Jensen Huang at the company's annual shareholder meeting. Huang assured investors that AI-related demand remains strong, and emphasised that the computer industry is still in the early innings of a sweeping AI infrastructure transformation. He also added that other than AI, robotics is the company’s biggest growth opportunity.

According to a report by Reuters, Loop Capital has raised target price on Nvidia shares to $250 from $175 apiece while maintaining its ‘buy’ call on the stock. The brokerage attributed the bullish stance to the company’s positioning of benefitting from a “Golden Wave” of AI adoption.

In the February–April quarter, Nvidia reported earnings of $18.8bn, or 76 cents per share, up 26% from a year ago. Revenue soared 69% year-on-year to $44.1bn. If not for a $4.5bn charge related to US restrictions on sales to China, adjusted earnings would have been 96 cents per share, blowing past analyst expectations of 73 cents.

Looking ahead, the chipmaker is expecting for another stellar quarter, estimating revenue of around $45bn for the May–July period.