For Dr Reddy's Laboratories, the recent quarter's performance signals a mixed play, but the slide is slightly tilted to the rougher edge. While new product launches coupled with higher growth, aided by the in-licensed vaccine segment, might have saved the day for the domestic pharma firm, margins remained a pain-point. Perhaps, this is why the shares of the pharma firm witnessed only a marginal rise despite a double-digit surge of 22% in profit figure to Rs 1,594.

New Product Launches Save the Day for Dr Reddy’s in Q4, But Margins Remain a Sour Pill

The pharmaceutical firm displayed a mixed picture in the latest quarterly earnings, but margin play remains a key watch

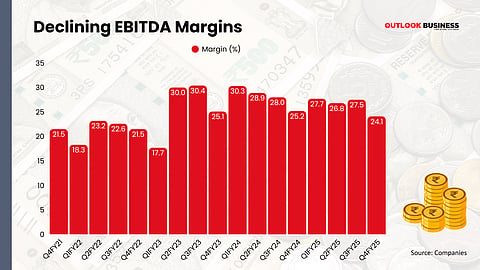

Gross margin dropped by 300 basis points from last year to 55.6%, mainly because of weaker profitability in the global generics business. The subdued investor sentiment has also been visible in the stock price. So far this year, shares of Dr Reddy's Laboratories have struggled to remain in the green territory, declining by over 11.7%.

The pharma major posted a 24% EBITDA margin this quarter, which was a bit of a letdown compared to what D-Street analysts were expecting. Even though weaker gross margins led to this dip, the impact was partly cushioned by tighter cost controls in R&D and Selling, General and Administrative (SG&A) segments. However, managing the margin levels might not be an easy task in the quarters ahead as D-street is expecting a drop in Revlimid sales.

Revlimid Weakness Drags Outlook

In the past quarters, a good part of the company's growth has come from Revlimid. The cancer drug has contributed significantly to the pharma firm's overall bottom line. However, analysts are expecting the growth driver to lose its shine moving forward as the off-patent date (January 2026) nears.

Once the patent expires, generic versions may flood the market, eventually leading to price erosion since Revlimid is a high-margin drug.

"Dr Reddy's has posted a decent Q4 with double-digit growth in India and Emerging markets followed by 9% growth YoY in the US. We expect earnings to decline which is pretty much a foregone conclusion as Revlimid sales recede from the US business," said Bhavesh Gandhi, lead pharma analyst, institutional equities research, Yes Securities.

While the drug's faltering sales figures will have a major impact on the drug and on the overall margins, the company is strategically using the cash to invest in future pipelines like peptides, biosimilars and GLP products. But again, the gains might take some time to reflect in the bottom line.

"The extent of Revlimid run-off in FY26 would determine the earnings trajectory in the near term though offsetting factors like NRT purchase, biosimilar and peptide launches would cushion the decline," Gandhi said.

Outlook Ahead

While margins did display a faltering image, the management pointed out that the one-off expenses, like severance and accounting provisions, further weighed down the overall figure. Meanwhile, the pharma major is expecting double-digit revenue growth and flat margins for FY26. The management also reiterated their confidence in achieving a 25% Ebitda margin once Revlimid exclusivity ends.

"Currently, our FY26F revenue factors in 6.1% revenue growth for FY26F. Our FY26F Ebitda margin is at 26.3%, slightly higher than management guidance. This might be on account of lower contribution from higher-margin product, Revlimid," Nomura said in a report. The brokerage firm has maintained its 'Buy' rating on the stock with the target price set at Rs 1,575.

According to Motilal Oswal analysts, the company is implementing a plan to expand product offerings across markets and add/ build capacity to cater to the respective markets. "Having said this, the intensified competitive pressures in the base portfolio would keep earnings growth in check," the brokerage firm said and reiterated its 'Neutral' stance on the stock.

However, PL Capital maintains a cautious outlook on the stock. "We maintain our ‘Reduce’ rating with target price of Rs1,225/share, valued at 24x FY27E EPS. Any big-ticket Abbreviated New Drug Application (ANDA) approvals and sharp recovery in base business margins are key risks to our call," PL Capital stated in a report.