Defence stocks witnessed a robust surge on domestic bourses after India's powerful retaliatory play against Pakistan. Major defence shares, including Paras Defence and Space Technologies, Hindustan Aeronautics (HAL) and Bharat Dynamics (BDL), soared as much as 5.93% on the National Exchange.

India Pakistan Conflict: Shares of Paras Defence, HAL, Bharat Dynamics Rise Up to 6%

As tensions escalate between India and Pakistan, major defence stocks, including HAL and Paras Defence, witnessed a robust rise on Friday

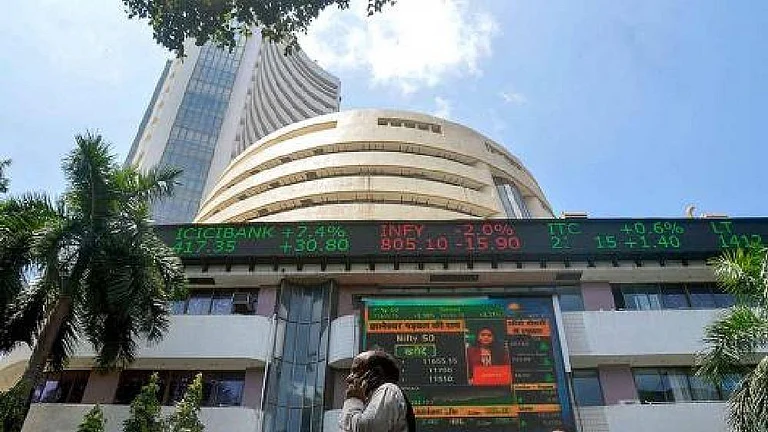

The Nifty India Defence index surged by nearly 2.4% or 164 points on Friday despite broader markets witnessing a downturn. Benchmark domestic indices— Sensex and Nifty— declined by over 1% as border tensions continued to remain high

At 11:15 am, BSE Sensex was trading at 79,521 level mark, down by over 813 points. Whereas, the NSE Nifty 50 index declined over 250 points and was trading around the psychological level of 24,000.

Shares of BDL were trading at Rs 1,537 price level, up by more than 5.7% on the National Stock Exchange. Shares of Paras Defence and Space Technologies followed suit, and increased over 5.58%, trading at Rs 1,436.50 price level on NSE. HAL was trading at Rs 4,511 price level, up by nearly 2%.

"Under normal circumstances, on a day like this, the market would have suffered deep cuts. But this is unlikely due to two reasons. One, the conflict, so far, has demonstrated India’s clear superiority in conventional war fare, and therefore, further escalation of the conflict will inflict huge damage to Pakistan. Two, the market is inherently resilient supported by global and domestic macros," said VK Vijayakumar, chief investment strategist, Geojit Investments.

FII Flow Remains Resilient

Foreign institutional investors continued their buying spree despite escalating border tensions between India and Pakistan. This signals broader confidence across D-street.

On Thursday evening, India delivered a powerful retaliatory action against Pakistan's attempted air strikes.

On the global front, an appreciating rupee value coupled with signs of a weakening US economy is also prompting FIIs to flock to Indian markets.

"Weak dollar and potentially weakening US and Chinese economies are good for the Indian market. The domestic macros construct is further rendered stronger by the high GDP growth expected this year and the declining interest rate environment. These are the reasons why FIIs have been on a buying spree in the Indian market during the last sixteen trading sessions," said Vijayakumar.

Investors should not panic and exit from the market now. Remain invested, monitor the developments and wait for the dust to settle, he added.