Indian Defence stocks are not just rising, they are rallying, and that too without a pause. The recent conflict between India and Pakistan triggered a social debate over the military arsenal strength of both nations. And, while the conflict might have started to calm on social channels, the stock markets are signalling a clear win beyond the battlefield.

Indian Defence Stocks Fire Up After Indo-Pak Conflict Fell Silent, China's Lag Behind - Tale of Two Markets

Indian Defence stocks are not only witnessing a robust rally on D-street but also signalling who 'really' had an upper hand in the recent border conflict

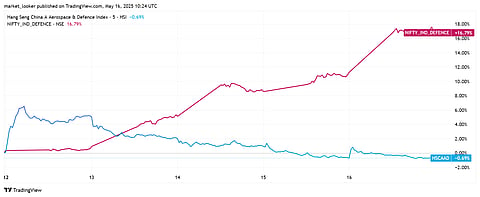

In the last 5 trading sessions, the Nifty India Defence Index has surged over 16%. In comparison, the Hang Seng China A Aerospace and Defence Index has struggled to remain in the green territory. Undeniably, China's military equipment was quite extensively used by Pakistan during the recent border conflict with India.

With that, the weak performance of Pakistan's equipment infront of India's armed defence systems dented sentiment for Chinese defence majors. In addition, the escalating conflict between India and Pakistan had also sparked hopes of an uptick in defence export orders to Chinese defence companies. To that effect, the news of the ceasefire rattled such expectations, eventually dampening sentiment for China's defence sector.

The recent movement in defence stocks across both markets signals contrasting investor sentiment. It’s a tale of two markets and two very different reactions.

At home, defence stocks are flying high. Shares of major defence firms, including Cochin Shipyard and Garden Reach Shipbuilders, witnessed a double-digit uptick of 11% on Friday. Mazagon Dock even surpassed its 52-week high on the National Stock Exchange after surging by nearly 9%. Brokerages are already expecting a robust order book and a strong push for 'Made in India' military equipment.

"We continue to be positive on the Indian defence shipyards sector given strong order outlook, a robust policy framework favoring indigenisation, and substantial government investment," Antique Stock Broking stated in a report released earlier this week.

Even Bharat Dynamics and Hindustan Aeronautics Ltd (HAL) followed suit and experienced a rise of 2.08% and 5.15%, respectively, on Friday. Despite a bearish undertone in broader markets, defence stocks surged on Dalal Street.

"The Defence Acquisition Council (DAC) has approved orders worth Rs 8.45 trillion over FY22–25, which is almost 3.3x the same number for the preceding three years. We expect this to translate into significant order inflows in FY26–27 for defence shipyards," the brokerage firm said.

While D-street confidence remains high, some investors have also raised banners of caution over the valuation part.

Defence Stocks Recap

Last year, defence stocks witnessed a similar rally, with some even delivering multibagger returns on Dalal Street. However, investor over-optimism pushed valuations to stretched levels, eventually putting a pause on the rally.

However, some analysts now believe that valuations across the sector have become more reasonable, following the recent correction period in the broader markets.

"The recent rally in the defence sector reflects a mix of short-term sentiment and growing long-term conviction. The operation Sindoor highlighted India’s strength and brought focus to domestic defence companies. It’s a strong reminder of how a geopolitical event can fast-track investor interest in a sector that already had solid fundamentals and structural tailwinds," said Mayank Mundhra, FRM (financial risk management)-VP risk and head research at Abans Financial Services.

Meanwhile, India has set an ambitious target to boost defence exports to Rs 50,000 crore by FY29, up from Rs 23,622 crore at present. This, coupled with a higher defence budget and strong policy support, has improved the sector's overall outlook.

Analysts also pointed out that previously, only a few large PSUs used to gain the majority of investor interest. However, this trend is now shifting, which in-turn indicates improving fundamentals and the overall strength of the sector.

"Now, even mid- and small-cap companies with niche technologies or manufacturing strengths are seeing investor interest. Such broad-based participation indicates a more sustainable rally and points to the sector’s strengthening fundamentals," said Mundhra.