Profits of most Indian listed companies remained subdued in the third quarter of the 2025 financial year, a trend that has persisted for the past four quarters. A mix of financial strain and geopolitical uncertainties has had a negative impact on the bottom lines of India Inc. overall. The results of the earnings season, though disappointing, were not entirely unexpected.

India Inc's Q3 Remains Muted, But the Worst May be Over

A mix of financial strain and geopolitical uncertainties has had a negative impact on the bottom lines of India Inc. overall. But there is cautious optimism in the air

“Rise in oil and gold imports, supply chain disruptions and restrictive trade regulations are all on the horizon, hence we were not expecting magic from earnings calls,” said Kush Gupta, director at SKG Investment & Advisory.

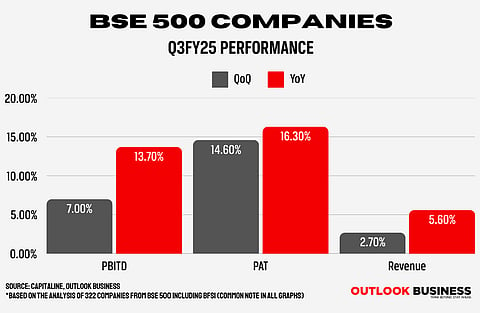

An Outlook Business analysis of 322 out of the top 500 companies on the BSE shows aggregate profit after tax (PAT) in the December quarter has increased 16.39%, and total revenue has grown 5.6% year-on-year. Profit before interest, taxes and depreciation (PBITD) has gone up 13.7% year-on-year.

These companies make up 60–70% of results in broad weight terms. On a sequential basis, aggregate PAT surged 14.66%, PBITD grew 6.99% and aggregate revenue by 2.7%.

The same universe of Nifty 500 companies witnessed a 0.2% decline in PAT year-on-year in the September quarter, a 2.9% rise in the June quarter and an 18% rise in March.

Tech a Bright Spot

Information technology (IT) is one of the sectors that has shown resilience this quarter. IT companies are seeing an improvement in earnings and outlook driven by a positive outlook for economies such as the US. A few quarters ago, there were concerns about a slowdown in the US and Europe.

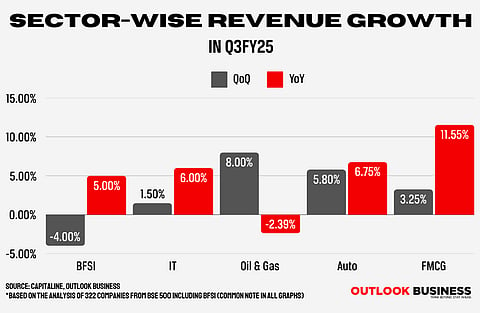

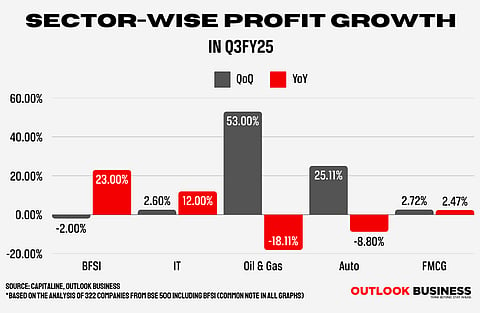

But those fears have now been alleviated. Most IT companies are now optimistic about their prospects, which is reflected in their earnings guidance. On a quarter-on-quarter basis, combined revenue has gone up 1.5% and PAT has risen by 2.6%.

Banking Hope

The banking, financial services and insurance (BFSI) sector has benefitted from the strong performance of private banks, including HDFC Bank, ICICI Bank and Kotak Mahindra Bank. BFSI companies clocked a year-on-year growth of 5.07% in aggregate revenue. Aggregate PAT has surged 22.9% and PBITD 17.4%.

Aamar Singh Deo, senior vice president at broking firm Angel One, says HDFC Bank, ICICI Bank and Bajaj Finance have successfully navigated the economic slowdown and have kept investor optimism intact.

But on a quarter-on-quarter basis, 65 BFSI companies posted a 4.88% decline in the December quarter and operating profit rose 1.9%. PAT slipped 1.55%. Deo says Axis Bank and insurance companies have left room for concern in pockets of the sector.

Overall asset quality has seen an improvement for both private and public banks. Public banks have seen gross non-performing assets fall from 14% in 2018 to 3% in 2024 while public banks have seen a decline from 4.5% to less than 2% during the same period.

“Though the strong growth posted in the unsecured [loans] portion was and still is a concern,” says Deo. He adds, however, that the recent steps taken in the Budget and the Reserve Bank of India (RBI) in enhancing liquidity into the system should go a long way in reducing the burden of unsecured loans.

Declining deposit growth, though, remains a challenge, which banks will continue grappling with considering the strong performance of the equity markets. Around 11% of total household assets in India are currently held in listed equities, says Deo.

Fast-Movers’ Pains

In spite of the festive season boost in demand, fast-moving consumer goods (FMCG) companies continued to feel the pinch in the third quarter of this fiscal year. High raw material inflation and increased cost of agricultural commodities have taken a toll on margins.

Even the premium FMCG segment, that has been more resilient the past few years, has failed to provide the necessary boost.

In the October–December quarter, the combined revenue of 17 FMCG companies, including Hindustan Unilever, Dabur India, ITC and Britannia Industries, rose 11.5%. The combined PAT saw a growth of only 2.47%. On a quarter-on-quarter basis, combined revenue grew 3.2% and PAT 2.7%.

“Staples companies had a muted quarter due to sluggish urban demand, weak winter portfolio uptake, high food inflation and steep inflation in palm oil. Companies are implementing price hikes to offset the inflation,” write experts at Motilal Oswal Financial Services in their interim review report.

Mehul Desai, vice-president and consumer analyst at investment banking firm JM Financial, says two things can help drive growth in the FMCG sector going forward: first, the recent changes in tax structure, which could put more disposable income into the hands of consumers, and second, the upcoming monsoon. “How the crop output plays out will directly impact raw material inflation,” he says.

Uncertain Auto

Third quarter results of automobile companies were mixed. Revenue numbers were in line with the market’s expectations but earnings before interest, tax, depreciation and amortization (Ebitda) fell short of estimates.

Automobile and auto component companies saw revenue from operations grow 6.75% year-on-year while PAT fell sharply by 8.9% year-on-year. Compared with the September quarter, revenue from operations rose 5.85% and profits were up 24.11%.

Seasonal festivities did boost automotive demand with the support of discounts. Demand for two-wheelers, passenger vehicles (PVs) and tractors rose by 8–12% from the festive season last year. Much of this demand surge was in rural markets.

In urban markets, automotives saw muted PAT growth for two-wheeler original equipment manufacturers (OEMs). PV growth was mixed but tractors performed well.

Management commentary on demand for the 2026 fiscal year is uncertain. The commentary appears more optimistic about rural demand outpacing urban demand, according to the Motilal Oswal report.

Jinesh Gandhi, the lead analyst for automobiles at financial advisory firm Ambit Capital, says, “Before the Budget, we were expecting growth momentum to moderate for two-wheelers and PVs and improve for tractors and light commercial vehicles (LCVs). With a pro-consumption Budget, we see an upside risk in our volume growth for two-wheelers.”

Fuel in Trouble, Chemicals in a Pickle

Oil, gas and consumable fuels companies, excluding Reliance Industries, reported a 2.4% decline in year-on-year combined revenue from operations. PAT fell 18.11%.

On a sequential basis, combined revenue from operations rose 7.93% and profits went up by 52.7%.

In the chemicals sector, most companies posted a sharp turnaround in earnings. Analysts, however, say the positive earnings are not as impressive as they seem. They add that while a few companies have performed better than it was anticipated, the overall sector is yet to find its footing.

Kunal Shah, a senior research analyst at Carnelian Asset Management and Advisors, says the good news is that the chemical sector has done well in terms of capital expenditure and many companies have strong balance sheets. Some have built core competencies around certain chemistries.

“I believe it’s just a matter of time before demand picks up. And when it does, we should see much better performance from chemical companies. This is a space that looks promising for the future,” Shah adds.

Other key sectors, including real estate, healthcare and capital goods also contributed positively to earnings growth.

As Things Stand

With downgrades outpacing upgrades, the outlook for India Inc. heading into financial year 2026 is somewhat uncertain. There are signs that a reversal is on the horizon, especially after the measures taken in the Budget to revive consumer demand.

Gupta of SKG Investment & Advisory says he is cautiously optimistic about the future. “India’s growth story remains strong, but we cannot shield ourselves from the global outlook that looks uncertain.”

Saurabh Patwa, head of research and portfolio manager at Quest Investment Advisors, says the current phase, characterised by a cooling economy, is a natural part of the post-pandemic growth cycle.

“It is very natural to go through this period. You cannot expect year-on-year robust growth in earnings,” he says. Patwa expects demand dynamics to shift in both urban and rural areas given the government’s focus on consumption-driven growth.