HDFC Q3: Not a great picture but definitely in-line with what the D-street analysts had expected. Profit growth was modest at 2.2% YoY, while net interest income (NII) impressed with a 7.7% surge, reaching Rs 30,653 crore. However, net interest margin (NIM) took a slight dip to 3.43%, down by 3 bps QoQ, but still managed to eke out a 3 bps improvement on YoY basis.

HDFC’s Q3 Holds Ground: Will the Shares of Banking Giant Bounce Back?

HDFC shares: Last month, the shares of the banking giant impressed the D-street with its trajectory, signalling that the worst might be over. But the recent Q3 results indicate that recovery might take a bit longer

Post Q3 results, the shares of HDFC Bank surged by over 2.5% on the bourses before erasing some of the gains. This was a major movement in the stock trajectory, as the bank has struggled to remain in the green territory since the advent of this month, dropping by nearly 7% (year-to-date). For the D-street, the quarterly results did bring-in some hope.

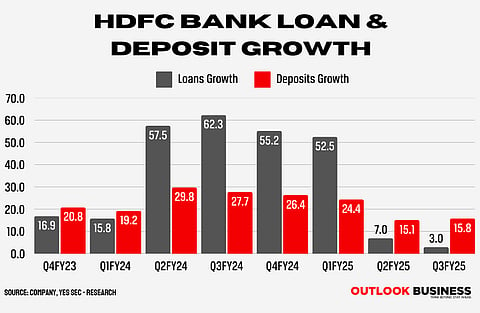

On the deposit side, there was plenty to cheer about. HDFC reported a 16% YoY growth in overall deposits, thanks to a robust rise in term deposits. However, as the bank shifted its focus to the latter source of funds, the CASA ratio took a hard hit and declined to 34% in the quarter ending December.

During the earnings call, the management mentioned that the CASA ratio is expected to improve in a couple of years as term deposit rates take a declining road.

Loan growth, on the other hand, remained tepid at just 3% YoY. That too, was largely driven by gold loans, which grew by 27.5% YoY. While this imbalance between advances and deposits might cast a shadow on the outlook picture of the banking giant, it's aligned with HDFC's strategy to reduce the loan-deposit ratio. In fact, the management had already stated that it would lag system loan growth in FY25.

"The bank had previously said that it would lag system loan growth in FY25, match it in FY26 and exceed in FY27. Hence, the current growth is in line with what the bank had said, averred management," Yes Securities stated in a report.

While HDFC's past troubles are mostly behind, the recovery road might still be a bit bumpy in the short run.

Mixed game of margins

One of the key takeaways of Q3 earnings was the mixed play of margins. HDFC Bank's NIM have remained relatively stable but at the same time, there has hardly been an improvement. On the positive side, the reduction in high-cost borrowings inherited from HDFC Ltd. has helped lower overall funding costs, providing a tailwind to margins. But there's a hidden caveat in the bottom-line.

The decline in CASA deposits has already pushed the bank to rely on other not-so-cheap sources of borrowing, eventually squeezing into margins. On top of this, the bank had to reverse Rs 1-1.5 billion worth of interest income, which impacted the margins by a few bps.

"The borrowings book, particularly that inherited from HDFC Limited, is having a cost of about 8%, including the hedges. As part of the ongoing process, the bank extinguished some of this. However, the tailwind from reduced borrowing cost has been offset by reduced CASA," Yes Securities stated in a report.

During the quarter ending December, the gross NPA (Non-Performing Asset) additions reached Rs 88 billion, resulting in a slippage ratio of 1.4% for the quarter. Excluding agricultural slippage, the bank’s slippage stayed flat QoQ, which is pretty solid given the current macro environment. It is also worth noting that HDFC Bank has the lowest slippage ratio among its private sector peers. If we include agri loans, slippage went up 13% QoQ, but that’s still lower than earlier expectations of 15%-20%, Nuvama said in its report.

But again, even as the overall asset quality remains strong, the outlook ahead depends heavily on a robust margin play, which might take some time to arrive.

Is the worst over for HDFC stock?

While most of the brokerage houses have maintained their 'BUY' rating on the stock with no changes in the target price, D-street analysts are still cautious about the loan growth which can act as a potential mood dampener for investors.

"We are closer to the point where the risk of further cuts to NII/NIM appears to be lower. We may still have a few quarters of disappointment on the quantum of deposits mobilised, as it is harder to forecast..." Kotak Institutional Equities stated in a report.

The brokerage house has maintained its BUY rating but lowered earnings by 5% to account for the slower-than-expected improvement in NIM expansion.

Last year went quite well for HDFC Bank, as the shares witnessed a sharp double-digit surge after nearly 3-years of range-bound movement. The third-most-valued firm on the D-street was able to touch a new all-time-high of Rs 1,880.

However, in the last 3 months, the stock has struggled to remain in the green territory. Motilal Oswal has cut its earnings estimate for FY26 and FY27 by 3% each, citing lower loan growth and CASA moderation. "We estimate HDFC Bank to deliver FY26E RoA/RoE of 1.8%/13.9%. Reiterate BUY with a target price of Rs 2,050," the brokerage firm added. As for now, loan growth in the current macro sphere does create a potential headwind for the banking firm, but a gradual decline in high-cost borrowings will likely offset the impact of the former.