On an April morning that President Donald Trump termed ‘liberation day’ for the US but left world markets to grapple with the tariff shocks from Washington, DC, a quieter but more consequential drama was unfolding in Beijing. China, on the brink of a trade war with the US, retaliated against the US’ reciprocal tariffs by announcing a slew of export restrictions on rare earth elements, essential inputs in the defence, energy and automotive sectors.

Why India Still Assembles Batteries, Instead of Manufacturing Them

Electric battery-manufacturing dreams face a reality check as India struggles with raw materials, high costs and R&D

What began as a power play between the two largest economies in the world had ripple effects across the globe. In India, where the electric-vehicle (EV) revolution is just picking up pace, the move struck at the heart of an emerging industry. Automakers across the country suddenly found themselves struggling to secure raw materials needed for the production of EVs.

In hindsight, the move was not unexpected. In 2010, China banned the export of rare earths to Japan over a fishing-boat dispute. More recently, between 2023 and 2025, China imposed export restrictions on strategic materials to the US.

But India’s troubles aren’t just about rare earths. The country’s EV ambitions face a more fundamental hurdle: the lack of homegrown capacity to produce key components for electric batteries, such as cathodes, anodes and electrolytes.

“All the restrictions that were put on rare earths in the past 18 months are quite similar to the restrictions by the Chinese government on anode and cathode in the past 18 months,” says Vikram Handa, founder and managing director, Epsilon Advanced Materials, a battery-manufacturing company.

Chained to Imports

In recent years, India’s push to become a serious player in battery manufacturing has gathered momentum. Battery-manufacturing companies like Amara Raja Energy and Mobility, and Exide are racing ahead with giga-scale battery-cell manufacturing facilities, fuelled by the government’s Production-Linked Incentive (PLI) scheme.

But beneath the optimism, a critical link is missing: the building blocks of battery cells—cathodes, anodes, electrolytes—are still imported. India, for now, remains a battery assembler, not a manufacturer.

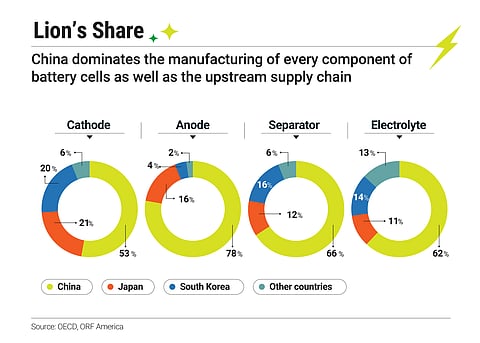

The essential components in a typical lithium-ion battery include an anode, a cathode, electrolytes and separators. While the country has just started off making cells and battery packs, cathode materials, anode-grade graphite, battery-grade electrolytes, separators and refined lithium, cobalt, nickel and manganese come primarily from China, followed by South Korea and Japan.

In Telangana, Amara Raja Energy and Mobility is investing ₹9,500 crore in its Giga Corridor—a sprawling complex for lithium-ion cell and battery-pack manufacturing. While the facility promises to catalyse cell production locally, its component supply chain is still heavily reliant on imported components.

A similar narrative repeats with Exide Industries, which is partnering with China’s Svolt, a company that develops energy-storage solutions, to manufacture cells in Karnataka. More than 80% of the lithium-ion value chain lies outside India, predominantly in China.

“In terms of production of battery components, the country is witnessing the solar story again,” says Debmalya Sen, president at India Energy Storage Alliance (IESA), an industry body. “We can make cells, but not profitable enough when compared to China. So, like the early strategy in solar, where we imported cells from China and assembled them here—the same pattern is playing out with batteries,” he adds.

But the appetite for energy-storage systems is on the rise. A 2023 study projects an estimated demand of 327 gigawatt hour (GWh) for stationary storage and 576GWh for EVs by 2030.

“The biggest roadblock is China’s tight grip over the technology, followed by our sluggish R&D investment and blind imitation,” says IESA’s Sen. “We are copying the technology that they have today, forgetting that China is continuously innovating. By the time we manufacture a cell here, China has already moved on to the next version,” he adds.

Battery Bill

And yet, scaling up from assembling battery packs to a manufacturing ecosystem is a capital-intensive affair. Studies estimate an investment of $4.5bn would be required to develop 5GWh of lithium-ion cell and battery manufacturing capacity under the PLI scheme.

A 2023 study by the Council on Energy, Environment and Water (CEEW), a think tank, puts the cost of a 5GWh battery-manufacturing facility—including land, factory infrastructure, warehousing and utilities—at $325–450mn. But that’s just the first step. The figures do not include upstream infrastructure for cathode powders, synthetic graphite or battery-grade electrolytes—inputs that are still largely imported.

To picture the scale of investment: the new Navi Mumbai airport, pegged at ₹16,000 crore, could fund only four to five such plants, without factoring in the cost of component manufacturing.

Additionally, these factories will be energy intensive. A 5GWh battery-production facility would consume around 250 GWh of electricity annually, while India is projected to need between 1,000 and 1,450 kilotonnes of cathode materials, graphite and electrolytes for battery production by 2030.

Without deep investment in the full value chain, giga-factories risk becoming assembly units dependent on China. But while the battery-component part of the supply chain is capital- and tech-intensive, China’s dominance is the work of nearly a decade. The country either acquired the tech or built plants.

If resources were missing, they invested abroad—in Congo and Indonesia. The mines may be local, but the money behind them is Chinese. Even if minerals are extracted in India, they would end up in China, which controls 90% of global processing.

In India, where battery-cell assembly is gaining traction, component manufacturing is still a challenge. One of the exceptions is Epsilon Advanced Materials, which is developing graphite anodes for lithium-ion batteries. In the last six years, the company has spent close to ₹1,000 crore on this business. EV manufacturer Ola Electric is also investing in battery innovation, including early-stage research in cell chemistries.

But the playing field is uneven. “Our cost of production is 5–7% more than a Chinese company’s cost of production. A big challenge here is that the capex is far higher than in China. There, local governments build the infrastructure—plants, power, roads—cutting capex by up to 40%. That makes their project returns better and prices more competitive. Even with PLIs, we just can’t match that advantage,” says Epsilon’s Handa.

So what’s the way forward? “The government must signal that battery materials matter, just like it has done for rare earths. I tell my customers: sure, import if it’s cheaper, but source at least 20–25% locally. Keep us in your supply chain so when global taps shut off, we are ready to step in.”

Hope Beyond Lithium

The challenges surrounding lithium-ion batteries—raw material constraints and component manufacturing—have prompted researchers to explore alternatives such as sodium-ion and zinc-air batteries.

Sodium-ion cells are gaining popularity for their sustainability potential as well as the use of sodium—an abundant and inexpensive element. While they don’t match lithium-ion in energy density, they are a strong contender for stationary energy-storage systems.

Zinc-air is another promising option. “Zinc is abundant, cheap and safe, thereby making it a strong alternative to lithium,” says Ranjit Bauri, professor, department of metallurgical and materials engineering at IIT Madras. He points out that its simple electrochemistry allows easy integration into batteries and unlike lithium, it does not pose fire risks. “With solid reserves in India, it [presents] a promising direction for non-lithium battery development,” he adds.

Zinc also offers a higher theoretical energy density than lithium-ion, that is, the maximum possible energy that a battery or energy storage system can store. This means longer range per charge, if technical barriers, such as rechargeability and scalability can be overcome. However, the challenge lies in making them rechargeable. “If we crack the chemistry, zinc batteries could power both stationary energy storage and mobility,” says Bauri.

Globally, companies in countries like Canada are already developing zinc-air batteries for home back-up and grid storage. India, Bauri says, needs focused R&D before the market is ready for such new technologies. “If we invest in the right research now, zinc-ion could emerge as a credible alternative to lithium-ion,” he adds.

Are We Doing Enough?

Launched in 2021, the PLI scheme for Advanced Chemistry Cell battery storage offers incentives to achieve a battery-manufacturing capacity of 50GWh. But experts argue that the scheme, while necessary, doesn’t go nearly far enough. More support is needed to boost R&D and scale up indigenous cathode and anode manufacturing.

What is needed is investing in national labs focused on cell chemistry and materials science, as well as nurturing global innovation partnerships

“The current PLI is geared only towards main component manufacturing—like module, cell, wafer, polysilicon in solar and battery cells in energy storage,” says Rishabh Jain, senior programme lead at CEEW.

Critical components don’t qualify for PLI support, even though capex is high, he says, and adds, “The logic could have been PLI winners would procure from domestic manufacturers, which would develop the ecosystem. However, delays in some PLI projects have also reduced the financial viability of the component manufacturers.”

The solution is taking India’s battery ambitions upstream. This means investing in cathode and anode factories, mineral refining and crucially, R&D for next-generation batteries.

But cost remains the central challenge. “Technology know-how may exist in parts of the world, but without price parity and without government support, Indian manufacturers can’t compete—no matter how good the product is,” Jain says. To counter China’s low prices, which are supported by state subsidies, India needs subsidy matching, low-interest financing and domestic demand assurance.

An important lesson can be drawn from China’s tightly integrated battery-supply chain. India, by contrast, presents a fragmented industry where anodes, cathodes and processing tools are all imported.

To truly power its energy transition and meet its 2030 EV targets, India needs to build its battery backbone, not just buy it. If not, the country could see another replay of the rare earth saga, vulnerable to geopolitical calculations and external supply shocks.