Have you heard about the one where a cable maker walks into a bar? No. It’s because nothing fun is ever associated with cables (unless EL James and her shades of Grey have something to do with it). Therefore, it must be difficult to build an engaging cable brand. For example, what kind of taglines could the company have, to have people wear them on T-shirts and caps? “Wired right” or “Sparks don’t fly”? Or what kind of events could they host, to catch the interest of a spender? Maybe “a conclave on the advances in rubber insulation”? Even with an open bar, that event will be sparsely attended.

Is KEI on the cusp of transformation?

The cable manufacturer may need to get into a competitive space to change its fortunes

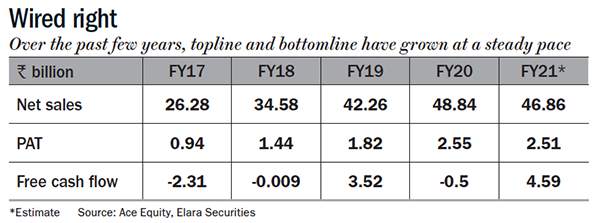

Retail sales is hard to crack in cables but those who have done it, like Polycab, the biggest cable manufacturer in India, reap big rewards. KEI has chosen the safer route, selling to other businesses (B2B) and government agencies. Its strategy has been working well (See: Wired right). Sales started picking up after 2003, with revenue doubling in certain years. It recently bagged its largest contract from Tamil Nadu Transmission Corporation for extra high voltage (EHV) cables of 400kv worth Rs.1.48 billion — putting KEI in the league of handful companies across the world to manufacture 400 kv EHV cables. But, the market is not giving it much love.

Retail sales is hard to crack in cables but those who have done it, like Polycab, the biggest cable manufacturer in India, reap big rewards. KEI has chosen the safer route, selling to other businesses (B2B) and government agencies. Its strategy has been working well (See: Wired right). Sales started picking up after 2003, with revenue doubling in certain years. It recently bagged its largest contract from Tamil Nadu Transmission Corporation for extra high voltage (EHV) cables of 400kv worth Rs.1.48 billion — putting KEI in the league of handful companies across the world to manufacture 400 kv EHV cables. But, the market is not giving it much love.

KEI is available at a lower-than-industry valuation of 11x, even when Polycab is trading at 16x. Is the reading on the gauge right?

Plug in

A family-owned company, KEI was founded in 1968 as a partnership firm. The current CMD, Anil Gupta, joined his father in 1980 when the sales turnover of the company was a humble Rs.7 million and its business was restricted to cables for small appliances and for minor telecommunication projects. In 1992, it became a public limited company and, a year later, Gupta took over the reins. From then on, the company started manufacturing cables for power transmission — from low-tension (LT) since the early days to extra-high voltage (EHV) power cables starting 2010. It exports to 45 countries. While LT cables continue to bring in the most in volume and revenue, the company’s focus has shifted to EHV cables and EPC (engineering, procurement, construction). The inflexion point was five to six years ago.

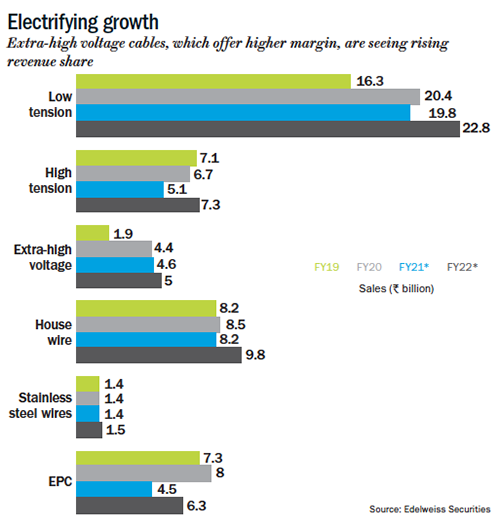

It is only with the incumbent government that KEI saw its fate turn, says Harshit Kapadia, associate vice president of Elara Capital, adding, “Until then both EPC and EHV were very small and nascent” (See: Electrifying growth). The present government’s various schemes for urban and rural electrification, and upgradation of transmission and distribution networks among other things boosted KEI’s EPC and EHV revenues. While analysts believe that government spending might take a hit for a few quarters, it will continue to invest in rural electrification and smart city programmes. Thus, these are businesses with a wide moat.

EHV cables, carrying massive volume of high voltage electricity, are used to power cities. They are also used in airports and railways, and at manufacturing facilities. In 2009, KEI partnered with a Swiss company, Brugg Kabel, to manufacture these cables. In 2011, the company got their first EHV tender from UP Transmission Corporation of Rs.1.4 billion and, in the same year, they got their second project from the Karnataka Transmission Corporation worth Rs.900 million. “It takes around eight to 10 years just to get approval to participate in tenders of EHV cables. So, it gives KEI a unique positioning,” says Kapadia. This business also offers a better margin of 14-15% than what regular cable products offer at 10%. Given the profitability, this business can attract the interest of its competitors. Amit Mahawar, associate director-institutional equities research at Edelweiss Securities says, “Eventually, Polycab and Finolex Cables could sharpen their utility cable focus (EHV) due to growing opportunities, but KEI has a clear first mover’s advantage right now. Three to five years down the line, competition for KEI could increase.”

The other rabbit KEI has pulled out of its hat is the EPC business. The average order size in this vertical is Rs.1 billion-Rs.3 billion, and the company’s clientele includes marquee names such as L&T, Siemens and ABB, besides various government bodies. In the EPC segment, KEI has a unique advantage. The company manufactures the wires and cables needed for the EPC work in-house, which is 25-30% of the overall cost of projects with LT cables and 75-80% of projects with EHV cables. In FY20, revenue from this vertical was Rs.7.64 billion (excluding cable sales for the respective projects). Recently, the company launched a QIP to expand this business but, with the pandemic striking hard, the expansion has been deferred for later and the funds have been used to clear pending payments and reduce debt. One of the investors, who participated in the QIP, says, “Over the years, they have proven their track record of timely deliveries, didn’t ever have overcapacity, didn’t go overboard in terms of growth and have been focused on expanding existing lines of businesses. After settling part of their debt this year, the balance sheet appears leaner.” The investor, who wishes to remain anonymous, believes that the company’s order book is strong and will help it survive through FY21. He expects KEI to grow at 15-20% here on, particularly with the ‘Make in India’ drive. This initiative will give KEI an edge in the EHV segment, which otherwise had products mostly imported from South Korea and China. KEI had a debt of around Rs.7 billion in September 2019 and Kapadia says that, after the QIP, they have repaid some of the long-term debt and reduced short-term debt so that KEI can borrow again once the situation improves. And post the recent QIP, analysts say that the company will not need to raise additional equity capital for the next five to six years. According to an Elara Capital report, the company has already repaid debt of Rs.4 billion. Currently, long-term debt stands at Rs.530 million and short-term debt stands at Rs.2.6 billion, with net debt to equity at 0.21x. However, even when the crisis lifts, KEI will go slow on the EPC business.

The other rabbit KEI has pulled out of its hat is the EPC business. The average order size in this vertical is Rs.1 billion-Rs.3 billion, and the company’s clientele includes marquee names such as L&T, Siemens and ABB, besides various government bodies. In the EPC segment, KEI has a unique advantage. The company manufactures the wires and cables needed for the EPC work in-house, which is 25-30% of the overall cost of projects with LT cables and 75-80% of projects with EHV cables. In FY20, revenue from this vertical was Rs.7.64 billion (excluding cable sales for the respective projects). Recently, the company launched a QIP to expand this business but, with the pandemic striking hard, the expansion has been deferred for later and the funds have been used to clear pending payments and reduce debt. One of the investors, who participated in the QIP, says, “Over the years, they have proven their track record of timely deliveries, didn’t ever have overcapacity, didn’t go overboard in terms of growth and have been focused on expanding existing lines of businesses. After settling part of their debt this year, the balance sheet appears leaner.” The investor, who wishes to remain anonymous, believes that the company’s order book is strong and will help it survive through FY21. He expects KEI to grow at 15-20% here on, particularly with the ‘Make in India’ drive. This initiative will give KEI an edge in the EHV segment, which otherwise had products mostly imported from South Korea and China. KEI had a debt of around Rs.7 billion in September 2019 and Kapadia says that, after the QIP, they have repaid some of the long-term debt and reduced short-term debt so that KEI can borrow again once the situation improves. And post the recent QIP, analysts say that the company will not need to raise additional equity capital for the next five to six years. According to an Elara Capital report, the company has already repaid debt of Rs.4 billion. Currently, long-term debt stands at Rs.530 million and short-term debt stands at Rs.2.6 billion, with net debt to equity at 0.21x. However, even when the crisis lifts, KEI will go slow on the EPC business.

Despite the wide moat this business offers and the considerable price advantage, the company has made a conscious decision to cap business from the space at Rs.10 billion. Some analysts reason this is due to the limitation of its manufacturing facility, which was already operating at 95% of its capacity pre-Covid. But Gupta says that they do not want to expand this business because they have decided to stay a cable-focused company. “We are primarily a cable manufacturing company,” he says, adding, “This (EPC) is just a diversion to support our product installations, so we take EPC contracts that are cable-related.” That is, EPC is an additional service the company offers for clients using their cables. However, there is another vertical the company will grow more enthusiastically, after a blockbuster deal.

Over the past three fiscals, its exports business has nearly doubled. Net sales in exports was Rs.4.54 billion in FY18, which grew to Rs.5.32 billion in FY19 and then rocketed to a whopping Rs.8.99 billion in FY20. But before anyone lets their jaw drop, the FY20 number comes from one project (which could be a one-off) from a Nigerian company, Dangote. While KEI won Rs.4.5 billion contract with the company, another Rs.11 billion portion of the same contract went to Polycab. Fortunately for KEI, a major chunk of the order was executed before the lockdown. Amarjeet Maurya, AVP (equity research-midcap) at Angel Broking, says the company has been expanding its exports business over the past five years. But he is skeptical about its prospects, despite the massive Dangote order: “I have my doubts about sustainability of this growth as it’s a one-time order.”

Gupta says that they want to get 17-18% of their revenue from exports, from the current 13%, and explains why this business isn’t easy. “It’s challenging in terms of logistics and the costs incurred by us. There are no specific benefits that we get. We have to face delays in shipments, while the customer demands faster delivery… in spite of these, our exports markets is increasing YoY,” he says.

Retail detail

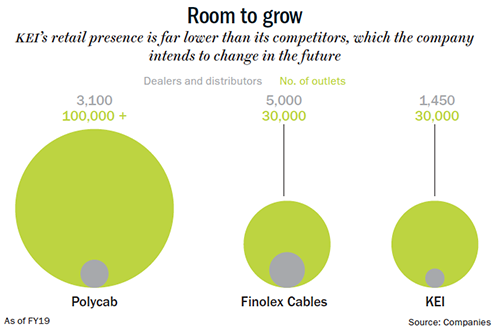

What worries the market is KEI’s weak retail presence — 33% of the company’s revenue. Meanwhile, retail sales from cables and FMEG (or fast-moving electronic goods) bring in 50% revenue for Polycab. “Within cables and wires, branded retail wires is a large and attractive business segment. For KEI, that is much lower as a percentage of sales at this stage, and much larger for leaders such as Havells, Polycab and Finolex,” says Mahawar (See: Room to grow).

What worries the market is KEI’s weak retail presence — 33% of the company’s revenue. Meanwhile, retail sales from cables and FMEG (or fast-moving electronic goods) bring in 50% revenue for Polycab. “Within cables and wires, branded retail wires is a large and attractive business segment. For KEI, that is much lower as a percentage of sales at this stage, and much larger for leaders such as Havells, Polycab and Finolex,” says Mahawar (See: Room to grow).

Analysts reckon that, despite the company’s strength in other businesses, this is what is depressing its valuation. Retail is a low-capex, high-margin business compared to KEI’s B2B-focussed business. While the former business in LT and HT cables gives a margin of 11%, the latter gives 9.5%. “One of the reasons people attribute lower value to KEI is because it is predominantly into the B2B segment,” says Kapadia. Gupta knows this too: “Today, the market gives more valuation to companies that are into retail and have a brand appeal.” Gupta wants to increase B2C’s revenue share to 42% in the next one or two years. He adds, “The difference between B2C and B2B is not so much in terms of margins but more in terms of perception and brand power. In B2C, we also have more pricing control/power with us as compared to B2B, where we have to bid for tenders.” Therefore, KEI has been trying to change its play.

Since 2014, the company has been on a mission to crack the retail market. It has doubled its spend on branding and building a distribution network. Between FY18 and FY20, the branding spend increased from Rs.148.5 million to Rs.250 million and, and for the next few years, their number of dealers is expected to grow at 8-10% annually; it currently stands at 1,650. Over the past four years, they have been sponsoring Rajasthan Royals, besides placing TV ads and doing below-the-line branding campaigns such as contractors’ meets, electricians’ get-togethers and reaching out to architects. Nidhi Doshi, AVP-research, Dolat Capital says, “The company’s product mix slowly but steadily got more skewed towards high growth potential segments.”

KEI’s lower valuation currently is also because of the macroeconomic climate, according to the investor who participated in the company’s QIP. He says, “Beyond lower retail presence, at present, KEI’s end markets are getting affected.” He is referring to infrastructure and real estate markets, and adds that infrastructure will take at least another two quarters to start normalising. Despite the current crisis, KEI is getting back on its feet with cable work picking up in Tier-II and Tier-III cities. Doshi says even though FY21 will be a washout year, FY22 will be much better, especially with KEI’s sustainable volume growth. “They have been reporting margins of 10-10.5% and the management has said that it might only get impacted by 0.5% here and there. Moreover, they have a strong EPC order book, which will sustain for at least another 18 months,” she explains.

Mahawar sees the company as a steady double-digit earnings compounder over three to five years, with a ‘medium’ risk profile on the back of higher share of cyclical revenues. “Personally, I keep a track on how their working capital and balance sheet quality is trending,” he says. This is because suppliers of the company’s raw material, such as copper, prefer upfront payment. If suppliers do extend credit, they do it only for two to three months. Therefore, KEI will be forced to approach banks, which could increase the risk on the balance sheet. That said, Mahawar has been impressed by the company’s capital efficiency and capacity-expansion management over the past five years. “Currently, they seem to be delaying capex and preserving cash, which is a logical decision for an uncertain market where the demand scenario for the next one or two years is unclear,” he adds.

With things largely going in its favour, KEI should rebound to its earlier levels once the macro sentiment improves, and businesses and governments begin to spend once more. Whether it will get a valuation closer to the industry average will only be known after its retail bet plays out. Till then, let’s finish that joke, with a disclaimer that it falls flat.

A cable maker walks into a bar, gets sloshed and walks out steady on his feet. The bartender asks how he does it, and the cable maker replies: “I am insulated”.