Debt-stressed telecom giant Vodafone Idea has been thrown another lifeline. This time, it is the government’s move to convert Rs 36,950 crore of the company’s spectrum dues into equity that is expected to alleviate some of its mounting liabilities and intense competition from Reliance Jio and Bharti Airtel. But the debt-laden company’s real battle for survival may just be beginning.

Why the Government’s Quick-Fix Equity Move Won’t Solve Vi’s Debt Crisis

The latest development of the Vodafone Idea saga gives the beleaguered company some breathing space, but concerns over its long-term viability are not going away any time soon

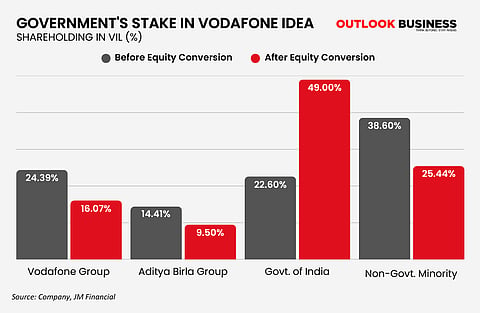

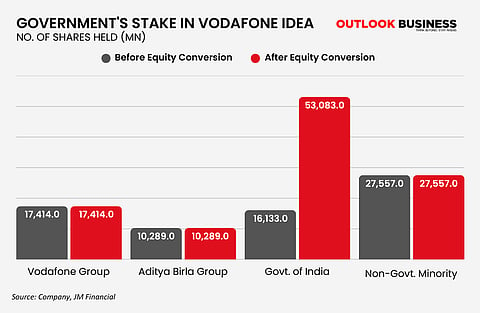

In an order dated March 29, the government approved converting outstanding spectrum auction dues into equity shares, in line with telecom reforms approved by the Union Cabinet in 2021—raising its stake in the business from 22.6% to 48.99%. The move—the second such relief for the telecom firm, comes six months ahead of the end of the moratorium on its dues from adjusted gross revenue (AGR) payments and spectrum charges. The company’s existing promoters, Vodafone Plc and the Aditya Birla Group, will continue to have operational control, albeit with reduced stakes of 16.07% and 9.5%, respectively.

Industry observers largely welcomed the move, however, many noted that this may only be a "bandage" solution. The company still faces several challenges in paying off pending dues and funding investment plans to compete with the Mukesh Ambani-led Reliance Jio and Sunil Mittal’s Bharti Airtel.

“The government’s decision to convert Vodafone Idea’s debt into equity is a smart move and makes sense both for the company as well as the exchequer,” Mahesh Uppal, head of advisory firm Com First India, told Outlook Business. However, he added that risks remain, and “the company is not out of the woods.”

This waiver from the government is part of a 2021 reform package aimed at maintaining healthy competition in a sector burdened by mounting AGR dues, spectrum usage charges and licence fees. The reform provided telecom services providers the option to opt for a four-year moratorium to pay their dues. This was set to end in September 2025. Additionally, the government also gave telcos a one-time opportunity to exercise the option of paying interest for the four years on deferred spectrum installments and AGR dues by way of converting into equity the Net Present Value (NPV) of the interest amount.

Almost a month after the reforms were announced, Vodafone Idea opted for a four-year moratorium to defer spectrum-payment obligations related to spectrum auctions until 2016 and AGR dues until financial year 2019.

With its cash reserves at just Rs 12,100 crore as of December 2024, Vi was in no position to pay off its total dues of Rs 2.27 lakh crore, which included Rs 1.57 lakh crore in deferred spectrum-payment obligations and Rs 70,300 crore in AGR dues.

In its Q3 FY25 earnings report, Vi’s management said the company is mandated to pay around Rs 28,000 crore to the Indian government in FY26. From FY27 to FY31, it would have to pay about Rs 43,000 crore annually to clear its total spectrum and AGR dues.

With the latest equity conversion, Motilal Oswal Financial Services estimates that the government's move would help Vi reduce its spectrum payment dues by approximately Rs 42,000 crore between FY26 and FY28. However, Vi would still need to repay around Rs 8,000 crore in spectrum dues between H2 FY26 and H1 FY28, along with Rs 2,200 crore annually for spectrum payments related to the 2021-24 auctions.

Motilal Oswal also noted that Vi’s current cash earnings before interest, taxes, depreciation and amortisation (Ebitda) of about Rs 9,000 crore should be sufficient to cover spectrum payment dues until H1 FY28. However, apart from spectrum dues, Vi would have to repay approximately Rs 16,500 crore annually for AGR dues starting in March 2026, which are not covered under the government’s equity conversion plan.

In 2023, Vi availed itself of the government’s reform package, converting Rs 16,133 crore in deferred spectrum payments and AGR dues into a 33.44% equity stake. Then, in April 2024, a Rs 18,000 crore follow-on public offering (FPO) diluted the government’s stake to 22.6%.

No Other Option

An industry analyst, who chose to remain anonymous, said that the government had no choice but to convert Vodafone Idea’s dues into equity.

“Given the size of the Indian market, it is absolutely critical to have three major players. This ensures competition and provides consumers with choices,” the analyst said.

Vodafone Idea is the third-largest telecom network in India after Bharti Airtel and Reliance Jio, with a wide 4G coverage.

“Vi had proposed two other alternatives—it sought to surrender some of its spectrum or requested that interest and penalties on the AGR amount be waived. However, if the government accepted these requests, it would have to extend similar relief to all telecom players. Converting dues into equity was the only viable option,” the analyst explained.

The analyst further noted that the collapse of Vi would have impacted the entire telecom ecosystem, including enterprise and mobile users, as well as vendors. For example, Vi signed a Rs 30,000 crore deal with Nokia, Ericsson and Samsung for network equipment supply over three years, typically under long-term payment plans. The domino effect of Vi’s collapse would have been severe.

In a note, integrated financial services group JM Financial said that given the legal and logistical challenges involved in waving Vi’s AGR and spectrum dues, the only alternative was to extend the 2021 moratorium.

Conflict of Interest

Meanwhile, the government’s increased stake in Vi might create a conflict of interest, given its ongoing efforts to revive state-owned BSNL, says Uppal. However, he argues that Vi is a very different case from BSNL.

“Vi has a superior network, it is fairly competitive, its performance on various network parameters is comparable to its private competitors and its ARPU [average revenue per user] is improving. With BSNL, that is not the case,” he said.

While the state-owned telecom firm has gained some users after tariff hikes by Jio, Airtel and Vi, the delayed rollout of 5G remains a significant issue.

To revive BSNL, the government has over the past three years injected nearly Rs 3.22 lakh crore in relief packages. The public sector company reported a net profit of Rs 262 crore in Q3 FY25, marking its first profitability since 2007.

Vi ‘Not a Victim’

Com First India’s Uppal also noted that Vi’s financial crisis is partly self-inflicted.

“One of the biggest blunders that Vodafone Idea made was not provisioning for possible liabilities in case the AGR verdict went against them,” he said.

Uppal was referring to an over-a-decade-long court battle between the telcos and the government over the definition of AGR—a percentage of which telcos are to share with the government. The Supreme Court, in 2019, ruled in favour of the Department of Telecom, making telecom operators, including Bharti Airtel, Vodafone Idea and Reliance Jio, liable for Rs 1.47 lakh crore in dues. The operators did get a breather in 2020, with the Supreme Court granting a 10-year period to repay AGR dues, with payments starting in March 2021 and concluding in 2031.

Not Out of the Woods Yet

In Q3 FY25, Vodafone Idea reported a 4.2% year-on-year revenue growth to Rs 11,117 crore and reduced net loss to Rs 6,609 crore. However, its subscriber base shrank by 7.2% to 199.8mn, despite an increase in ARPU to Rs 173.

By contrast, Airtel and Jio demonstrated stronger financial stability, with ARPUs of Rs 245 and Rs 203.3, respectively.

According to JM Financial, Vi would require multiple significant tariff hikes—raising its ARPU to over Rs 380 by FY28—to meet its annual obligations to the government in FY28-31.

Ambit Capital echoed this view, stating, “Vi needs tariff hikes the most, as it must reinvest in 4G coverage expansion and roll out 5G services to retain users.”

The brokerage added that since 2019, Vi has implemented three major tariff hikes, 30% in December 2019, 20% in December 2021 and about 17% in July 2024.

Ambit Capital expects a 15% tariff hike in December 2025, followed by annual hikes from 2026-33, enabling a 10% tariff compound annual growth rate (CAGR) to stabilise Vi’s financial position. Questions sent to Vi regarding its plan to pay AGR dues went unanswered.

Investing in Quality

While some industry watchers have criticised handing another line to the beleaguered telecom player, reasoning that government policies should aim at protecting competition in the sector, and not a single company, Uppal noted that the government has enhanced its chances of recovery of dues it is owed with no increased exposure of public funds.

“Vodafone Idea is the third-largest telecom services provider in India with a nationwide network. Though it is yet to offer 5G services, its 4G network coverage and quality is comparable to that of its competitors—Bharti Airtel and Reliance Jio. The government is wise to recognise that it is an investment in high-quality network and try to save it,” he said, adding that along with the company, the dues it owed to the government were also at risk.

“This support, therefore improves chances for both sides…it is shrewd of the government to do what it did. Taking a bet on Vodafone Idea’s survival is a good move,” he said.

Another industry watcher that Outlook Business spoke to added that converting dues into equity was the only viable option at present. The government has just gotten shares in a company and going forward, these shares can also be sold. “This is just an investment which can be divested,” the expert said, adding that the collapse of Vodafone Idea would have impacted the entire ecosystem, including customers—both enterprise users and mobile users, as well as the vendor ecosystem.

For instance, the company signed a $3.6bn (around Rs 300bn) deal with Nokia, Ericsson and Samsung, for supplying network equipment over a period of three years. Typically these deals have a long-term payment plan, meaning that the domino effect of Vodafone Idea’s collapse would have been massive. Hence, the move was needed to protect the entire ecosystem.