In the early hours of April 2, RK Jalan, founder of industrial safety shoes company AFPL Global, was at his home in Kanpur, keenly following US President Donald Trump’s announcement on reciprocal tariffs. Until the end, Jalan says, there was a faint hope that friendly diplomatic ties between the two countries would spare India the worst of the new tariffs.

In a Global Economy Upended by Trump’s Tariffs, are India’s Trade Pact Plans Enough to Offset Market Turmoil?

The US president’s U-turn on tariffs offers short-term relief and just about enough time for India to figure out its best course of action

What followed stunned not only Jalan, but other leather exporters who had pinned their hopes on the speech.

“We were expecting a tariff of around 15%. But 26% is very high,” says Jalan.

Indeed, exporters across a spectrum of industries that are heavily reliant on the US market share Jalan’s sentiment. Narendra Kumar Goenka, founder and managing director of Texport Industries, an apparel manufacturer, warns that a 26% duty on exports could prove fatal for his sector.

In the leather industry, “the imposition of reciprocal tariffs has sent shockwaves. Orders are being put on hold and buyers are negotiating for rate reductions or seeking compensation for the tariff impact”, says Puran Dawar, founder Agra Footwear Manufacturers and Exporters Chamber.

Then, on April 9, the US president announced that he was shelving plans to hike tariffs on all countries, except China. Exporters welcomed the 90-day reprieve, but the news was shrouded in uncertainty over the impact that changing tariff policies would have on global trade—raising the question, how can India tackle Trump’s tariffs?

Banking on BTA

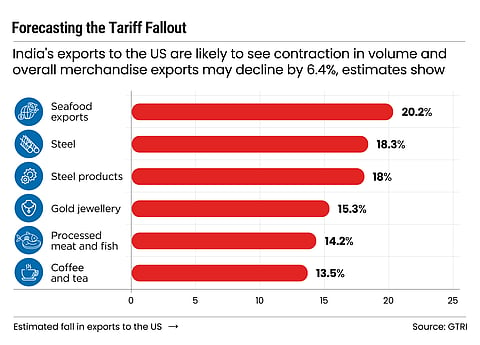

The US is the top destination for India’s exports and accounts for 18% of all goods exported from the country and 6.2% of its imports. In 2024, India exported goods worth $89.8bn to the US, which could decline by $5.8bn, or 6.4%, due to the new measures, shows an estimate by the think tank Global Trade Research Initiative (GTRI).

In February, New Delhi and Washington, DC agreed to negotiate the first stage of a Bilateral Trade Agreement (BTA) by fall of 2025. As talks progress, India is hopeful of using the BTA as a pathway to address the impact of reciprocal tariffs.

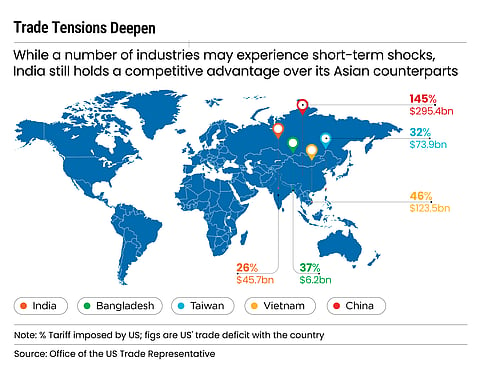

And as other countries jump on the bilateral agreement wagon, India has a first-mover advantage that it hopes will shield it from the impact of reciprocal tariffs and position it as a preferred partner of the US.

At the moment, India’s best bet is being able to negotiate lower average tariffs while protecting vulnerable sectors. An executive order put out by the White House in April states that the US is open to dialling down tariffs, provided its trading partners take “significant steps” to correct what it deems non-reciprocal trade practices.

And while Union Minister of Commerce and Industry Piyush Goyal has assured that trade talks are progressing in the spirit of “India first”, time is of the essence.

“Exporters are requesting them [government] to be a little faster in [finalising] bilateral trade agreements as early as possible. So, people can decide and take their alternative routes for reducing the export cost or changing the product categories,” says a textile exporter requesting anonymity.

The government has for now decided to steer clear of a zero-for-zero tariff policy, which means both sides cut all tariffs, as it would hurt small and medium industries. Ajay Srivastava, GTRI founder and former Indian Trade Service officer, also cautions against entering into a comprehensive free trade agreement with the US as “it would force India to make damaging concessions. It’s a deal that would cost India more than it gains”.

Diversifying Markets

Closer home, exporters are turning their attention to long-overlooked markets in Africa and Latin American countries, hoping to hedge against the uncertainty of a stalled BTA.

“We foresee procurement teams in the US either delaying decisions or shifting toward local alternatives. To counter this, we are focusing on value engineering, enhancing product certification to differentiate our offering and accelerating partnerships in other tariff-neutral regions such as West Asia, Europe, Southeast Asia and Africa,” says Sarvadnya Kulkarni, chief executive, General Instruments Consortium (GIC), an exporter of engineering goods to the US.

But concerns remain that even with reductions to the proposed tariffs, the US may no longer be an attractive destination for exports.

For instance, pharmaceutical items have been exempted from reciprocal tariffs for the time being. However, Trump has recently indicated that he expects to impose tariffs on imported phamaceuticals in the not-too-distant future.

“This poses a challenge, particularly for India’s generic pharmaceutical industry, which [also] supplies to regions like Latin America, Africa and Asean [Association of Southeast Nations] countries. These are markets where Indian products are already in demand. Rather than focusing primarily on the US, the government could adopt a strategy to expand exports to these other markets,” says Rajan Sudesh Ratna, deputy head and senior economic affairs officer at the United Nations Economic and Social Commission for Asia and the Pacific, South and Southwest Asia Office.

But there are other considerations India must take into account before it taps other markets. For instance, meeting local sustainability standards is mandatory in several countries.

Explaining that exporters need to meet environmental, social and governance (ESG) compliance criteria, Sudhir Sekhri, chairman of the Apparel Export Promotion Council (AEPC) says sustainable manufacturing can be promoted “by supporting apparel exporters in adopting eco-friendly and ethical production practices [and] encouraging investments in renewable energy, circular economy models and sustainable materials that align with global sustainability mandates”.

Here too, exporters from labour-intensive sectors and SMEs would need some sort of handholding from the government. This could take the shape of targeted support that eases access to finance, raw materials and infrastructure, promotes investment in textile parks for a robust supply chain and aids SMEs to upgrade technological infrastructure.

“We have been pushing for the revival of the Technology Upgradation Fund Scheme for micro units or a new initiative tailored to facilitate the adoption of Industry 4.0 solutions, automation and smart manufacturing,” adds Sekhri.

Other Allies

Meanwhile, fears of an escalating trade war have prompted India to accelerate free trade agreement (FTA) negotiations with other countries, including the UK, Oman and the European Union (EU). In a marathon of negotiations, trade and investment-related discussions were held with over 10 countries in March.

India intends to finalise its deal with the EU and UK by the end of the year and has also set an ambitious goal of sealing an FTA with New Zealand in 60 days. But much remains to be done.

“Policymakers will have to ensure fiscal, monetary and trade coordination and also double down on spending, initiate trade reforms and deregulate to lower the cost of doing business,” says Sachchidanand Shukla, group chief economist, Larsen & Toubro.

Trade experts agree that deepening partnerships with countries like China and Russia should be part of the strategy to offset the impact of tariffs, as well as strengthening ties with Japan, South Korea and the UAE—countries with which India has a Comprehensive Economic Partnership Agreement (CEPA).

This would allow exporters to extend their reach to countries that have active trade relations with CEPA countries. “The African market has huge potential. Indian exporters are also taking advantage of the CEPA with the UAE, from where Indian products reach other markets. New Zealand may be a small market, but it’s still a good market and so is Chile. Chile is a good market because they distribute to all the Latin American countries,” says Jalan of Arvind Footwear.

Elsewhere, trade retaliation looms from Canada, China, Mexico and the EU in response to US tariffs. In its ongoing economic conflict with the US that started in 2018, China has successfully rerouted exports through other countries, grown global exports by over $1trn and continued expanding supply chains—indicating that tariffs alone are unlikely to be a deterrent to exports.

A GTRI report suggests that India consider partnering with China in certain industries. “India can benefit economically by partnering with China in sectors like chemicals, machinery and electronics. Sharing inputs and production could boost exports and local value addition—a practical win-win,” says the report.

There is a lesson to be drawn from this. Trade deals may be some way off, but both India and China can share raw materials and parts to make products with more local value, which can help boost exports.

It is this kind of cooperation that can bring quick benefits and deserves consideration by both governments and industries.