The reciprocal tariffs promised by U.S. President Donald Trump are set to take effect from April 2, a day he calls "Liberation Day." One of the key nations in the firing line of Trump's tariff plan is India, which he refers to as one of the "highest tariffing nations in the world."

Trump Tariffs Risk Upending India’s Key Exports: Here Are Most Vulnerable Sectors

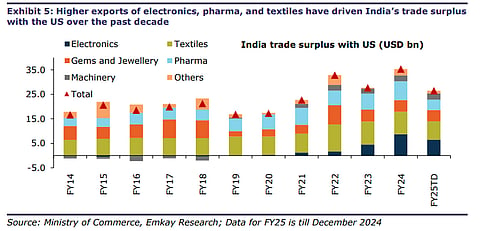

India’s trade surplus with the U.S. has surged from $17 billion in FY15 to about $35 billion in FY24, driven by exports of electronics, pharmaceuticals, and textiles. Now, experts say these sectors are likely to be hit hardest by Trump's proposed tariffs

The total trade between the two countries stood at $129.2 billion in 2024, with the U.S. having a trade deficit of $45.7 billion. While India's trade surplus ranks only 10th among its trading partners, it has doubled over the past decade.

According to a report by Emkay Global, India’s trade surplus with the U.S. has surged from $17 billion in FY15 to about $35 billion in FY24, driven by exports of electronics, pharmaceuticals, and textiles. Now, experts say these sectors are likely to be hit hardest by Trump's proposed tariffs.

Sectors Most Vulnerable to Trump’s Tariffs

As per Emkay Global, India could lose approximately $6 billion—or about 0.16% of its GDP—in exports to the U.S. if the Trump administration imposes a broad 10% tariff on Indian imports. If tariffs rise to 25%, the loss could widen to $31 billion.

"While India could be among the worst-hit nations due to broad reciprocal differentials, we find that key sectors like auto, pharma, and electronics are better positioned than feared. However, apparel and gems/jewellery remain highly exposed," stated Emkay’s report Reciprocal Tariffs: Big Bark, Small Bite published last month.

A GTRI report warns that a uniform U.S. tariff could raise duties on Indian exports from 2.8% to 4.9%, with agriculture being the hardest hit. Shrimp, dairy, and processed foods could face tariffs of up to 38.2%, while industrial goods like pharmaceuticals (10.9%), diamonds & jewellery (13.3%), and electronics (7.2%) are also at risk. Meanwhile, petroleum, minerals, and garments are expected to remain largely unaffected.

Electronics Exports

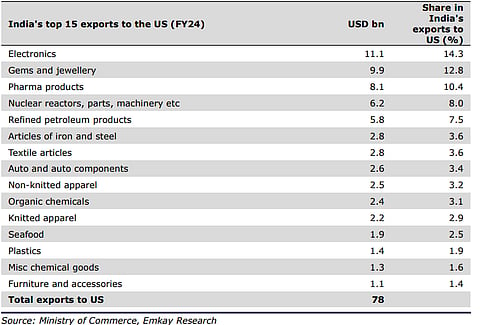

Electronics exports to the U.S. reached $11.1 billion in FY24, with mobile phones—primarily iPhones assembled in India—accounting for over half. This growth was largely driven by the Modi government’s flagship manufacturing incentive scheme, the Production-Linked Incentive (PLI).

A 9% tariff, as estimated by Emkay, could significantly impact exports. However, since India already imposes a 15% tariff on imported phones, a reciprocal U.S. tariff would primarily result in higher iPhone prices for American consumers rather than hurting Indian manufacturers.

According to GTRI, electrical, telecom, and electronics exports worth $14.39 billion could face a 7.24% tariff, impacting iPhones and other communication devices.

Gems and Jewellery Sector: 'Most Exposed'

Emkay’s report highlights that India’s gems and jewellery sector is particularly vulnerable to U.S. tariffs, as the U.S. accounted for 30% ($9.9 billion) of India’s exports in FY24.

Gold jewellery and diamond exports would be most affected, given that India’s gold jewellery import tariff (20%) is significantly higher than U.S. import tariffs (5.5-7%). Additionally, while the U.S. currently imposes no tariff on cut and polished diamonds, India levies a 5% duty.

India dominates global markets in cut and polished diamonds (45%), gold jewellery (25%), and lab-grown diamonds (92%). However, higher U.S. tariffs could push buyers towards lower-tariff countries or incentivize manufacturers to shift production to locations like Singapore, the UAE, or Oman.

Automobile and Auto Parts Exports

India’s auto exports to the U.S. stood at $2.6 billion in FY24, with auto parts contributing $2.1 billion. Since India exports very few vehicles to the U.S., high tariffs on cars and motorcycles (up to 70%) are unlikely to have a significant impact.

Auto components, however, face some risk. But as Emkay notes, if the U.S. imposes even higher tariffs on Mexico, Canada, and China, India could become a more competitive supplier.

Farm, Dairy, and Seafood Exports

GTRI warns that seafood, dairy, and processed food exports will face the highest tariff risks. Seafood exports ($2.58 billion) could see a 27.83% tariff, making shrimp less competitive. Processed food ($1.03 billion) faces a 24.99% hike, while dairy products ($181 million) will be hit hardest with a 38.23% tariff increase. Rice, spices, and other agricultural goods ($1.91 billion) face a 5.72% differential, affecting shipments.

Agricultural products have been one of the key sticking points in trade tensions between India and the US over the years. In a report published on March 31, the United States Trade Representative (USTR) noted that India applies an average tariff rate of 13.5% on non-agricultural goods and 39.0% on agricultural goods.