Representatives of Indian billionaire Gautam Adani and his companies have reportedly held talks with officials from the Trump administration, seeking to have US criminal charges against him and his nephew dropped.

Adani Wants Trump to Drop Biden-Era US Bribery Charges

In November, US authorities charged Adani, his nephew Sagar Adani, and others, accusing them of paying bribes to Indian state government officials to win a power supply contract in the state of Andhra Pradesh and of misleading US investors during fundraising efforts

According to the Bloomberg report, discussions began earlier this year and have intensified in recent weeks, potentially leading to a resolution within a month if progress continues at the current pace.

In November, US authorities charged Adani, his nephew Sagar Adani, and others, accusing them of paying bribes to Indian state government officials to win a power supply contract in the state of Andhra Pradesh and of misleading US investors during fundraising efforts.

The report said that Adani’s representatives have argued to the new administration that the case, filed during Joe Biden’s presidency, does not align with President Donald Trump’s current policy priorities.

Allegations Against Adani Group

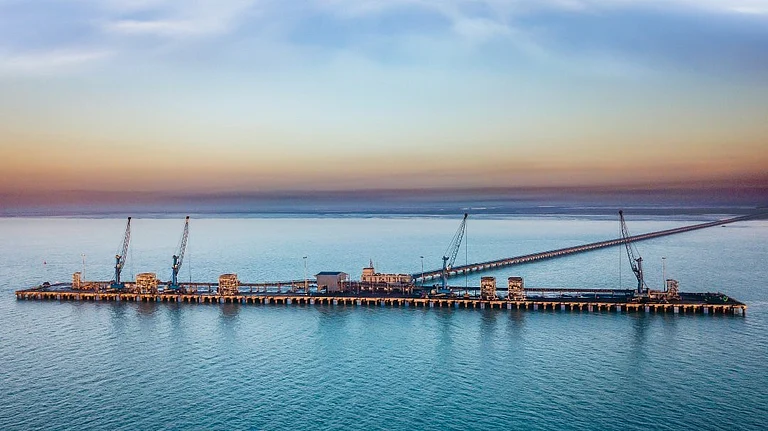

Gautam Adani, the Chairman of the multinational conglomerate Adani Group, has been indicted alongside his nephew, Sagar Adani, on charges involving large-scale bribery. US authorities allege that Gautam Adani paid $265 million in bribes to AP state officials to secure solar energy contracts.

In parallel with the criminal indictment, the US Securities and Exchange Commission (SEC) filed a civil complaint, claiming the Adanis misled American investors. According to the SEC, they failed to disclose the bribery payments during a $750 million bond offering by Adani Green Energy Ltd, the group’s renewable energy arm — conduct deemed as securities fraud.

The complaint also named Cyril Cabanes, a former board member of Azure Power Global, accusing him of helping to coordinate the bribery scheme in both domestic and international roles.

The charges against Gautam and Sagar Adani include securities fraud, wire fraud, obstruction of justice, and violations of the Foreign Corrupt Practices Act (FCPA) — a US law that bans bribes to foreign officials to gain a business advantage.

Adani's Efforts to Dismiss US Bribery Case

Gautam Adani, Asia’s second-richest man, is intensifying efforts to have US bribery charges against him dismissed. According to the Bloomberg report, his legal team has engaged top attorneys, lobbyists, and political allies, holding discussions with the Trump administration and meeting with prosecutors, including those from the US Attorney’s Office in Brooklyn.

Adani's company has reportedly enlisted firms such as BGR Group and Kirkland & Ellis to challenge the aggressive enforcement of the Foreign Corrupt Practices Act (FCPA), under which he has been charged. His legal team contends that the case, initiated during the Biden administration, undermines business relations and should be dropped.

On February 10, 2025, President Donald Trump signed an executive order directing the US Department of Justice (DOJ) to pause all enforcement of the FCPA for 180 days. This pause encompasses halting new investigations and prosecutions, as well as reviewing existing cases.

The executive order argues that stringent FCPA enforcement has adversely affected US economic and national security interests by placing American companies at a disadvantage in global markets. The DOJ has been instructed to issue updated enforcement guidelines that align with the administration’s foreign policy and economic priorities.

While the FCPA remains in effect, this pause has already impacted ongoing cases. For instance, a high-profile foreign bribery case against former Cognizant Technology Solutions executives was dismissed in April 2025, marking the first case to be closed following the executive order.

Adani's efforts to leverage this policy shift underscore the potential implications of the executive order on international business practices and legal proceedings.