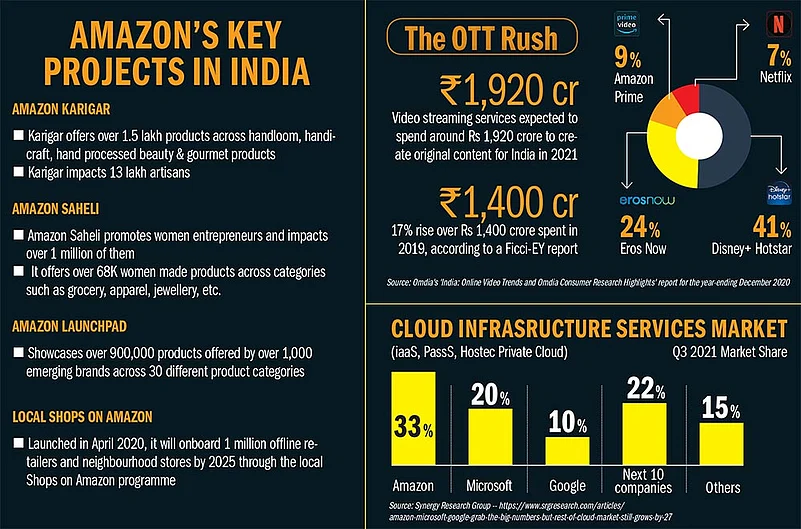

Since launching in India in 2013, Amazon has become the nation’s Apni Dukaan. In its eight-year history, the company has digitised 2.5 million SMBs, done $3 billion in exports and created 1 million jobs. While Amazon Web Services is the leader among the country’s cloud operators, Amazon Prime is driving the OTT craze in India. With its eyes firmly fixed on Bharat that comprises 85 per cent of its new customers, Amazon remains bullish on India despite narratives against its foreign origin, accusations of killing India’s kiranas and flouting FDI laws. But Amit Agarwal, senior VP and country manager, Amazon India is not swayed by these ‘vested interests’. With ‘customer obsession’ at heart, Agarwal talks about Amazon’s plans for India as it aligns its priorities with the country’s growth agenda: While Amazon Web Services is the leader among the country’s cloud operators, Amazon Prime is driving the OTT craze in India. With its eyes firmly fixed on Bharat that comprises 85 per cent of its new customers, Amazon remains bullish on India despite narratives against its foreign origin, accusations of killing India’s kiranas and flouting FDI laws. But Amit Agarwal, senior VP and country manager, Amazon India, is not swayed by these ‘vested interests’. With ‘customer obsession’ at heart, Agarwal talks about Amazon’s plans for India as it aligns its priorities with the country’s growth agenda:

You announced a $1-billion investment last year. How much of that has been spent and in which areas?

The billion-dollar investment was announced in support of the pledge to digitise 10 million small and medium businesses, reach $10 billion in exports and create 2 million jobs. And if you just think about it, all of this requires investment. In the last 18-20 months, the number of sellers on Amazon has grown from 5.5 lakh to over a million. So, the pace of enabling sellers to go digital is increasing.

When we look at exports, the first billion took three years, the next billion took 12-18 months and within last year, we had $3 billion in exports from India. So, that requires investment because we are teaching brands and manufacturers,and building pipelines so that products can move from India to across the world.

We’ve also launched new programmes. Local Shops is a recent programme that enables local stores to go digital and sell on Amazon. It has already got one lakh sellers from 450 cities. During Smbhav (Amazon’s annual MSME summit), we pledged to increase that number to one million by 2025. We also announced a Smbhav fund of $250 million for investing in startups that are focused on technology related to SMBs (small and medium business), agriculture and healthcare. We’ve launched Digital Kendras, the first one being in Surat. It’s a brick-and-mortar resource center for small businesses to learn about becoming digital entrepreneurs. Then there is Spotlight North East which brings artisans and businesses from the northeast and helps them go global and become digital. So, it’s just a wide variety of programs that are focused on small businesses and on digitising them to go global. All of this, in turn, drives employment.

What are the biggest challenges of doing business in India?

You could look at that question in two ways. First, the biggest business challenges we face. And I would say most of the challenges are actually opportunities. When you ask yourself, ‘How do you get SMBs to digitise? How do you make the mobile phone a gateway to e-commerce globally? How do you get local stores to become omnichannel and digitise their opportunities?’, you realise all these are opportunities. If you are referring to the policy environment, every country has its own unique laws and India is no different. So, rather than thinking about these as challenges, we think it is our responsibility to operate within the confines of law. Luckily, our priorities are perfectly aligned with India’s priorities. It is all about empowering SMBs to get selection, reducing cost of doing business to get more value for customers and building logistics and infrastructure. These drive jobs and so our business model is perfectly aligned with India’s future plans. We continue to push for a stable, predictable and enabling policy regime that is focused on allowing e-commerce to realise its potential because we are convinced that by doing that, the vision of Digital India, the scale of Skill India, and the mission to take Make In India global will be realised.

When we talk about Atmanirbhar Bharat, there is an entire narrative about Amazon being a foreign company that is hurting Indian SMBs. Does that narrative irritate you?

I think we are probably as Indian as you would want a company to be when we have already, in our eight-year history, digitised 2.5 million SMBs, done $3 billion in exports and created a million jobs. There are very few companies who can boast of this accomplishment. We are very clear that we are in complete compliance with all laws and regulations. And what energises us, and me, every day is that the facts out there communicate a very different reality. So, the voices that you refer to are few but they happen to be louder than millions of SMBs that are reinventing themselves and embracing technology.

Let me give you a story. There is a store called All India Handicrafts—a 40-year-old family-owned cane furniture business based in Uttar Pradesh’s Bareilly. They joined the Local Shops programme in 2020 and today, they are selling not only in their town but are also receiving orders from all across India. Their orders have grown by 200 per cent. So, we are better served by listening to and being energised with these stories than paying attention to the narratives that might be motivated by vested interests.

There is an apprehension that when you digitise supply chains, you take away profits from the unorganised supply chains established decades ago that employ lakhs of people. Your comments.

Every time there is a new technology, there will be disruption. So, you either embrace and reinvent yourself or stand on the side and have a commentary on the lines of what you are talking about. I’m giving you an example of 10 lakh sellers who have taken steps to embrace that and have seen growth. Two lakhs of these are local stores. It’s not only about embracing technology to sell to customers in India but about creating new brands and selling globally.

Another example is Chandralekha Creations, a Varanasi-based offline apparel business which is more than two decades old. This is as traditional as you can get—the ones who sell to distributors to get their products somewhat noticed by customers. They decided to go global with Amazon in 2016. Today, they are among the leading fashion brands in the US, the UK, Australia and the Middle East.

My vision is that in a country the size of India, with 30 million small businesses, all of them should be digital, physical, hybrids entrepreneurial units that are wired up to serve customers to every single channel that they can. That is going to create employment and that is going to build robust businesses.

Are you actively working on changing the narrative or do you think your actions will speak for themselves?

The number of state governments that have approached Amazon and signed pacts with us point to the fact that you are focusing on a particular narrative and generalising it. Our entire business model is based on Digital India, making India go global and creating jobs. We like that more and more small businesses and consumers are dependent on us for their lives and livelihoods and the narrative will take care of itself.

India has a history of internationally acclaimed companies being forced to leave due to constant policy flip-flop, enforcement action and all of this often backed by vested interests. Does this scare Amazon?

These things happen only when you’re successful. So I would rather be that than be in a state of irrelevance. In some ways, I’m grateful that Amazon, in its eight years, has established enough relevance that we matter. And, when you matter, you should be inspected to see that you are doing the right thing. That is how the world works, right? Every country has its own laws and we are in complete compliance with the laws of India.

E-commerce 2.0 seems to be coming from social commerce channels. Amazon dabbled in Spark a couple of years ago but competition is increasing from the likes of Meesho. What will be your strategy to compete in this segment where Flipkart has Shopsy?

I think we get very focused on labeling models. Online, offline and then omnichannel, hyperlocal and social. I don’t think customers think that way. They want selection and value. I keep saying that we are paranoid about customers finding a better experience elsewhere and that drives us every day. We are constantly innovating on their behalf. Having said that, many models will emerge as we operate in a very large segment. Our responsibility is to make sure that we innovate so that customers don’t get a better experience elsewhere.

The next 200 million online shoppers will be key. Where do they stay and what is your strategy to reach out to them?

Our stated position has been to serve every Indian. Very early on, we started thinking about ways to reach out to all customer bases and be relevant to them. So, if I look at customers, they are divided into two sets of buyers and businesses because we are a marketplace that brings them together. Customers can now shop on Amazon in nine Indian languages. In fact, 85 per cent of our customers come from small cities, as does a large part of our businesses. We are constantly innovating. We integrated Alexa that allows customers to talk to us. It reduces the friction further because if you don’t really want to type or don’t have the proficiency to go through the digital interface, maybe just talk to Alexa. We have more than 10 million stores that accept Amazon Pay and allow customers access to digital payments. We have launched ‘pay later’, a first-of-its-kind service in India because as you go deeper into India, there are issues of affordability.

We’ve launched Amazon miniTV that allows people to actually engage with us with free content. This includes content from influencers and content creators which allows customers to get familiar with the digital interface and then get into shopping, pay bills, buy movie tickets or travel. We have launched games on Amazon so customers can earn coupons that can give them a start to shopping. So, there is a wide variety of programmes and initiatives on the Amazon app that allow us to engage with customers in different life cycles of the digital journey and bring them slowly into the Amazon journey.

Data shows that India’s 2.2 per cent share in global online orders would rise to 8.9 per cent by 2030. And, because of forecasts such as this, a severe competition to capture the online shoppers is being witnessed in India. What do you think will be the deciding factor for the winner of this battle and what is in it for Amazon?

If you just take the example of the US in our over 25 years’ existence there, online is still a single-digit percentage of retail segments. So, talking about large segments, there won’t be a single winner who takes it all, there will be many winners. In a perfectly transparent and informed world, we want customers to choose us. And that only happens if they find better selection, better value and more convenience than anywhere else. That’s where our investments and innovations are squarely focused. Many companies say that they are customer-focused. We actually say we are customer-obsessed.

What would India have missed out on if Amazon hadn’t set up shop in the country?

I think the biggest contribution that we have made is to substantially change the expectations of what customers want to experience. So, the bar of what selection means, the bar of how you could digitise a small and medium business to create value in the ecosystem, the bar of what convenience really means has been set by us. The base of Prime members, who actually pay us for that convenience, is a huge statement on how customers perceive us.

Technology has the power to unify people and it is secular in nature. In times that are so divisive, what is Amazon’s role in ensuring inclusive empowerment?

I think technology is a huge lever to drive equity. It powers all the stories I have been telling you—a 40-year-old local family business becoming a national seller and a 20-year-old family business being able to create a global brand. So, the power of world-class logistics and infrastructure is not limited to the large companies but available to small businesses, catalysing them into massive global brands. I truly believe e-commerce and mobile internet in India are very important socio-economic levelers.

***

It’s All About Entertainment

“I don’t know how it happened but this whole OTT thing came as a blessing not only for me but also for so many other actors who were waiting in the wings for years,” Manoj Bajpayee was referring to the success of Family Man as he spoke to Outlook. Bajpayee went on to explain the profound impact of OTTs on storytelling and its reach; and the dismantling of the much-vaunted star-system of Bollywood. Leading this ongoing digital revolution of transforming Indian cinema and shows at various levels is Amazon Prime Video (APV). As it provides the widest possible screen to actors and makers, it is changing audience expectations and most importantly storytelling, where 50 per cent viewership of APV’s South Indian films came from outside home states. “Today, for customers, it doesn’t matter whether a film or show is in their native language because they want great content,” says Gaurav Gandhi, country head, Amazon Prime Video, India.

As APV streams to 99 per cent of the country’s PIN codes, across 4,500 different cities and towns, Indian films and shows are watched in over 180 countries, making the world truly the stage for actors and creators. “Our investment and focus is about really changing the way India creates content and views content,” says Gandhi. As the market for paid streaming grows, Amazon has prioritised 10 Indian languages and has been investing to ensure no genre or customer segment is left untapped. And the formula is simple: “The script is the hero. The creator and casting are super important. So, we will have shows, which will have big known faces and celebrities along with those that have newcomers. It is about creating characters, who live beyond the show with you,” says Gandhi.

***

‘Data localisation may hit India’s $5 trillion dream’

Nishant

AWS took 10 years to launch its first infrastructure region in India after its arrival in the country in 2006. It announced the second region in the next four years. Call it an increased interest in cloud computing for service delivery or the government’s push on data localisation, AWS, the market leader of the cloud, is hard pressed to meet its own business expectations of free flow of data across borders and address the government’s nationalist aspirations.

It was recently reported that the Joint Parliamentary Committee on Personal Data Protection wants the impending data privacy bill to restrict the usage of sensitive data and non-personal data for pre-defined purposes. Earlier, an expert committee of the Ministry of Electronics and Information Technology developed principles around which non-personal data governance could operate in India.

The restrictive nature of these and similar developments in India has alarmed the big tech companies. “Data localisation comes with overheads. Inhibiting cross-border data flow and data sharing can deny access and benefits of the cloud technology, including big data processing, machine learning, etc. to Indian companies,” says Rahul Sharma, president of AWS India and South Asia worldwide public sector.

AWS has successfully dominated the cloud space in India in SMBs and public services segments. The AWS leadership feels that SaaS companies in India will stand at a disadvantage if the government presses on data localisation aggressively. “Enabling the free flow of data across borders is crucial for India, especially if it wants to achieve its goal of becoming a five-trillion-dollar economy by 2025. … There is so much opportunity for SaaS unicorns in India. It is a bit of a blocker that comes in [with localisation],” adds Sharma.

Sharma, however, argues that AWS has and will continue to work with the government on the issue. It was the first multinational company to be empanelled by the government after it started its Mumbai data region in 2016.