It all happened in a moment. Mukesh Ambani, one of the richest businessmen in the world, with a track record of never losing a corporate war—a trait his late father Dhirubhai Ambani was known for—walked out of a two year-long battle with American businessman and second richest man in the world Jeff Bezos.

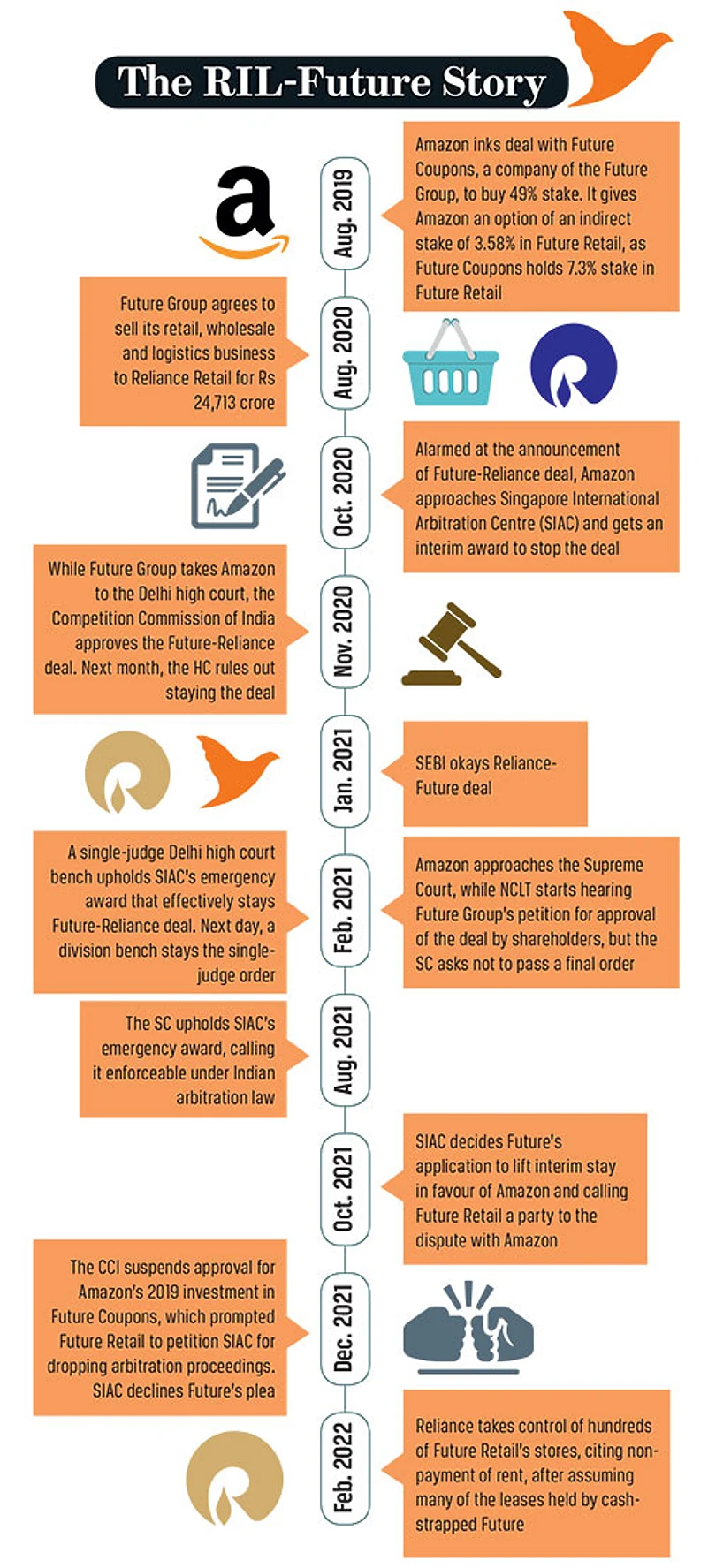

In a stock exchange filing on April 23, Reliance Retail said that it could not implement its $3.4 billion deal to acquire core parts of retail chain Future Group after the latter’s secured creditors rejected the offer earlier this week. “In view thereof, the subject scheme of arrangement cannot be implemented,” said Reliance Retail. This was an admission of the fact that Ambani’s Rs 24,713 crore takeover bid of Future Group’s retail business has come to an end.

Bezos, another businessman with a reputation of demolishing his rivals across the world, had challenged Ambani’s takeover bid of Future Retail Ltd (FRL) at several forums, including the Singapore International Arbitration Centre (SIAC) and the Supreme Court of India, citing the right to refusal to acquire Kishore Biyani’s retail business as per a deal his company signed in 2019 with Biyani’s company. But, Ambani is not known for giving up on battles so easily. So, what triggered Ambani’s withdrawal?

Ambani’s Plan B

Reliance Retail’s acquisition plan for the Future Group entailed merger of the latter’s five listed entities in one company, called the Future Enterprise Ltd (FEL). Reliance had proposed to invest Rs 1,200 crore in FEL as preferential equity (6.09% of post-merger equity of FEL) and Rs 1,600 crore in preferential warrants (option to acquire further 7.05%).

The deal would have increased the retail store footprint of Reliance Retail, from 28.7 million square feet to 52.5 million square feet, consolidating its pole position in the market.

After facing legal resistance from Amazon against the deal, Ambani devised a new strategy. In February this year, Ambani’s Reliance Industries Ltd (RIL) started the process of taking over 800 of the 1,400 brick-and-mortar stores of FRL, which accounted for 60% of the latter’s revenue. These stores included FRL’s flagship brand Big Bazaar along with FBB, Easyday and Heritage. RIL acquired lease rights with the owners of the real estate where FRL stores were located. Since FRL had not paid its rent for over a year, the owners happily transferred the deal in the name of a company owned by RIL. Later, RIL ousted FRL from those stores, for payment defaults. Experts say that a significant number of the remaining stores of FRL are non-operational and have no value even for the creditors.

In this scenario, Reliance Retail has managed to get at least prime real estate from FRL by incurring the loss on just the unpaid lease. This leaves Future Group with nothing more than a decade-old brand name in retail, while Reliance has consolidated its position as the largest organised retailer in the country.

On the other hand, Bezos, for whom FRL could have been a gateway to enter India’s brick-and-mortar retail market, has been left with a favourable ruling from SIAC and the Supreme Court of India. A retail analyst, who has tracked the RIL-Future Group deal for two years and does not want to come on record, says “After a point, it became a battle of egos between Bezos and Ambani. Knowing that things were going to get difficult legally, Ambani came up with a practical plan to get maximum out of the deal without spending anything, whereas Bezos can be happy about the fact that Reliance could not get the kind of advantage it had originally thought of.”

Devangshu Dutta, founder of retail consultancy Third Eyesight, says that a clean acquisition of Future Group’s retail business would have given a great advantage to either of the warring parties in India’s $900 billion retail market. “But Reliance already has a leading presence in modern retail and, given the network of its different retail verticals, it was not dependent on just Future Group’s acquisition for its expansion. As for Amazon, we know they have been trying to crack India’s brick-and-mortar business for some time.”

Can Reliance Takeover be Undone?

In the entire deal, the behaviour of secured creditors remains a mystery. Bank of India (BoI), one of the secured creditors, waiting for payment of dues worth Rs 20,000 crore from FRL, had moved the National Company Law Tribunal, demanding insolvency of the company. Laws required a majority of the secured creditors, along with shareholders of the company, to vote in favour of the deal.

But, as per the exchange filing by Future Group, in the secured creditors e-voting, 69.29% of the votes of 11 lenders were against the proposal to sell the assets to the RIL subsidiary. Reports suggest that secured creditors were not convinced that RIL would take over Rs 12,000 crore debt on FRL’s books.

“I am surprised that the secured creditors believed that insolvency is a better way to recover their money rather than agreeing to the deal. What are the assets of FRL that can be sold by creditors to recover an amount as big as Rs 20,000 crore. After profit making assets have gone to RIL, what will the brand of Big Bazaar do? You know what happened with the brand of Kingfisher after the company was grounded?” asked an expert, requesting anonymity.

Saurabh Kalia, advocate and partner Sasttra Legal and secretary, NCLT Bar Association, however, feels that all is not lost for the creditors. “In case FRL … [invokes insolvency and bankruptcy code], a thorough process will be undertaken for resolution of the company, where efforts for resolution will be made. The entire inventory and other assets will be considered for resolution. Brand names, such as Big Bazaar, can draw a premium for someone wanting to enter or expand their business in retail,” he said.

It is possible that the creditors try to get the prime locations back from Reliance Retail where Future Group’s outlets were operational. Earlier this month, the State Bank of India had written to Future Retail seeking accountability on the stores taken over by a company associated with Reliance Retail.

An NCLT lawyer, requesting anonymity explained, “The IBC law has the provision of ‘avoidance transaction’ that can be used if a company facing insolvency has undertaken a transaction that has led to loss of value to secured creditors. This clause can be used to claw back the assets, and even the promoters of the insolvent company can be asked to pay for the losses.”

If a scenario like this plays out, banks may be able to claim recovery of the value that has been caused to Future Group due to the takeover of the stores by Reliance. But, banks will have to bear in mind that Bezos has decided to press arbitration proceedings at SIAC and in all likelihood will ask it to consider the takeover of Future stores by Reliance as hostile to his interests. If Amazon gets a favourable order from SIAC, the claims of Future Group’s secured creditors, which are largely Indian public sector banks, on the stores in question may stand diluted.

So, who is the ultimate winner in this game of thrones? We can only guess.