Metaverse, a concept that emerged out of science fiction and gaming, is turning into a (virtual) reality faster than most people imagined. Partly aided by the increased online activity and social distancing forced upon people by Covid-19 and partly by advancements in high-speed internet technology, better hardware and creativity suites, the timing for the arrival of metaverse could not have been better.

When Facebook CEO Mark Zuckerberg announced the repositioning of his company as Meta Platforms, observers felt that the concept, which was taking significant steps in the form of hugely popular cryptocurrencies, non-fungible tokens (NFTs), virtual reality (VR) games, etc., had evolved enough to be taken as a serious economic activity on the global scale.

While policymakers and corporates rush to make sense of this rapidly developing idea, its large contours have emerged, which throw opportunities and challenges in equal measures. Web3-based cryptocurrencies are already playing a key role in the development of a digital economy, which has made the Indian government edgy. But, fortunately, it has done nothing to break the momentum towards metaverse. As start-ups, Big Tech, content creators, developers and educational institutions rush to consolidate themselves in the new virtual economy and create its building blocks, early signs of rivalry between smaller players and Big Tech have already come to the fore.

Dimensions of Virtual Economy

Business intelligence firms have captured the size of the metaverse economy with a fair bit of consistency. According to a report by market research firm Emergen Research, the global metaverse market reached $47.69 billion in 2020 and is estimated to register a revenue CAGR of 43.3% to reach $828.95 billion by 2028. Bloomberg Intelligence pegs the size of the metaverse market opportunity at about $800 billion by 2024. Blockchain analytics firm Chainalysis says that NFT collectors sent over $37 billion to NFT marketplaces in 2022 as of May 1, which is close to the whole year figure of around $40 billion sent in 2021.

After Zuckerberg’s announcement, the scale and nature of metaverse have come into focus both globally as well as in India. A noticeable feature of today’s metaverse is that gaming companies, start-ups and Big Tech are working in virtual silos with communication among them only beginning to emerge.

Nilesh Jahagirdar, vice president, marketing, at [x]cube LABS, points out that building digital infrastructure for the metaverse is a humongous task, for which multiple technology companies will have to come together. “Technologies such as AR, VR, AI, ML and cloud computing will be at the core of metaverse. But, they will be unable to deliver the desired user experience without rapidly scaling [the capabilities of] cloud service providers and analytics services that can process large volumes of data, network service providers, which will make the experience accessible to consumers, and interconnection partners, which will make sure the system does not fall apart,” he says.

In India, the race to metaverse is being led in association with start-ups, where, Big Tech is largely involved in creating infrastructure, while start-ups are building apps and other use cases to increase customer engagement for traditional companies. For example, athlete Sunny Makroo’s Zippy, founded in 2021, is building “the third format” of marathons by making a metaverse for runners. LOKA, a New Delhi-based start-up, is working on a gamified version of the real world, which uses 3D maps of real-world locations, such as Connaught Place. The examples are many.

IT majors like Wipro, on the other hand, are delving into both software and hardware parts of metaverse. It is investing in hardware design, including chip design, and validation for head-mounted AR and VR devices, blockchain and NFT-based solutions.

“We see the metaverse opportunity existing at two different levels—building the new generation of hardware, software and networking technologies that will help it scale and developing and managing the content and applications to realise it,” says Subha Tatavarti, chief technology officer, Wipro Limited.

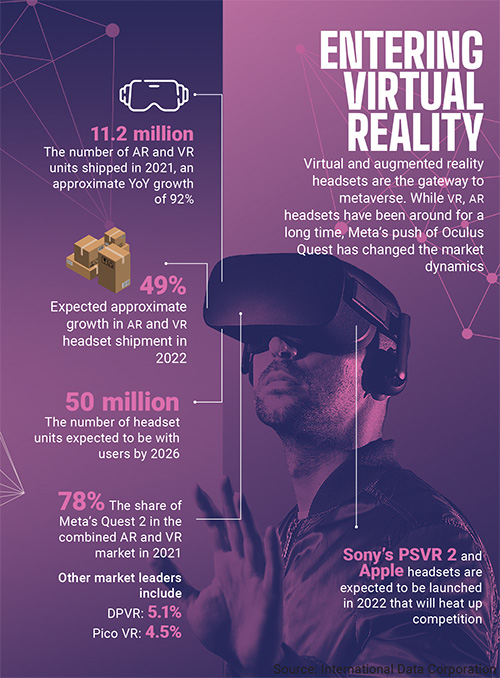

However, Ashok Maharaj, head of TCS XR Lab, is worried that non-standardisation of metaverse technology, both at the hardware end and for apps, can cause problems. He says, “Recently, the entire NFT marketplace went for a toss with one of the companies withholding all information.” The AR and VR devices, without which it is unimaginable to conceptualise advanced stages of metaverse, suffer from this issue acutely. “Consider the glass form factor of a virtual reality device like Oculus Quest, mixed reality device like HoloLens 2 or other devices. The form factor has significantly changed over the years. In the last four years, we have seen a different combination of devices, and all of them have a short shelf life. From Oculus Quest 2, which we are using for daily stand-up calls or client meetings, we are now quickly moving to the next device— Cambria from Meta. With these non-standardised ecosystems being in place, how much of full-fledged implementations can we have in metaverse?” he asks.

Incidentally, TCS is the first home-grown IT giant to take the plunge into metaverse by introducing a flurry of use cases across verticals, such as online shopping and workplace experience. Calling the set of products and services on its metaverse “themaTiCS”, it has introduced nine horizontals under three primary themes—Time and Space (TAS), Culture (CUL) and Technology (TEC).

India’s Readiness

Although it is fair to say that India’s metaverses journey has kickstarted well and a lot of new and established companies are exploring the potential of this new platform, there are some roadblocks in its full exploration. For example, its success will be based on a major overhaul of the existing IT infrastructure in the country, like high-speed internet connectivity, without which most metaverse applications cannot operate.

A consensus is emerging among industry players that metaverse will be built over the 5G mobile network, something that should worry metaverse players in India. By the end of 2021, the world was estimated to have over 600 million mobile 5G users, while Union communications minister Ashwini Vaishnaw tested the first 5G video call in the third week of May. India is the only major economy in the world without an operational 5G network.

“In terms of bandwidth requirement, a social connection, like 20 or 30 people joining a meeting, can be supported by a regular Wi-Fi network. But, for a stadium experience—for example, while watching an IPL match—a fantastic 5G network will make the experience richer,” says Maharaj.

On the user side, the real metaverse experience depends on VR and AR devices, like Meta’s Quest series, whose adoption is still at a nascent stage in India. Their high cost adds to the problem of easy adoption. Abhay Sharma, chief marketing officer of NFT marketplace MetaOneVerse, says that it will take at least a couple of years to develop digital infrastructure for metaverse in India.

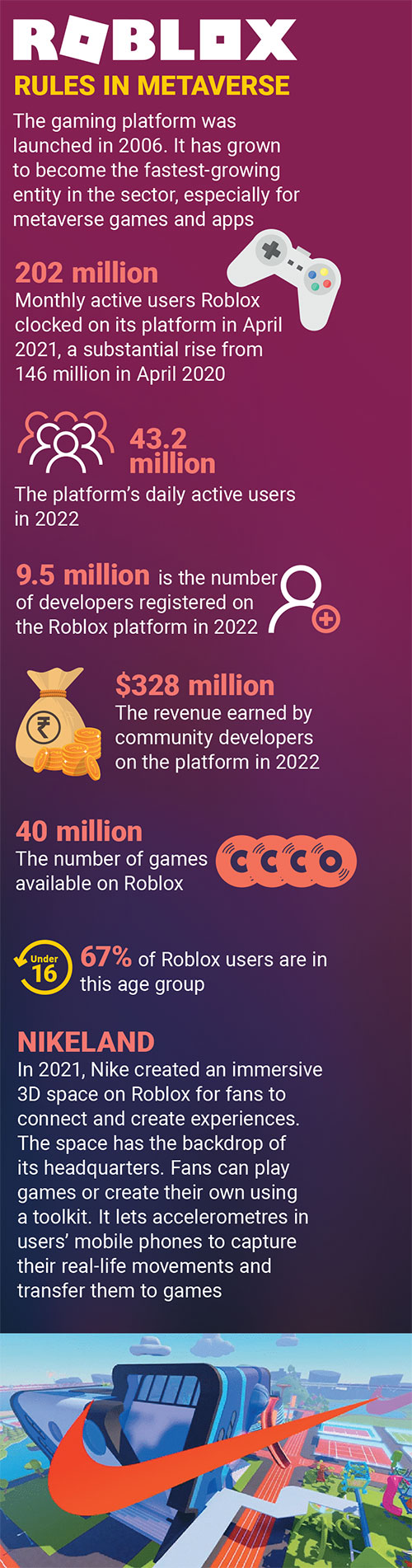

At the same time, the major reason why most of these companies are speeding up their metaverse efforts is because they want to be where the consumer is. Clearly, there is a significant shift in online behaviour of consumers, with GenZ spending a significant time on gaming and interactive media. According to Ankur Puri, partner, McKinsey & Company, there are more than 200 million monthly active users, spending over $15 per user, already on various platforms. “They are spending 3x more time in these avenues than on Instagram. Consumer companies are increasingly thinking about products and services for this audience. For these companies, metaverse is increasingly the next wave after digital media and social media,” he says.

Kazim Rizvi, founding director of The Dialogue, a public policy think tank, agrees. “The pandemic accelerated companies’ move toward metaverse, with more and more people utilising digital platforms for education, welfare delivery, etc. Besides, the anticipation of the metaverse market reaching $1 trillion acts as a financial incentive for them to enter and capture market share,” he says.

India Takes Big Tech Advantage to Metaverse

According to TCS, there is a lot of traction in the virtual store space, procedural training and the NFT marketplace. Even hotel groups are interested to see how virtual spaces can be made available to a broader public to have gatherings remotely. Banking, insurance, life sciences and healthcare are other sectors where a level of metaverse seems to be gaining traction.

India’s tech poster boy Infosys has been investing in metaverse-related technologies for some time now. Its first foray into AR and VR technologies started about eight years back, and now it claims to have matured technologies like experiential extended reality, blockchain, internet of things, applied AI, digital twin engineering and cloud infrastructure.

Its use cases are already operational. In January 2021, Infosys set up an immersive retail environment for Australian Open, where tennis fans could shop for branded merchandise and make purchases that were delivered to them in the physical world.

“Many of our clients are at various stages of the discover-create-scale journey and also exploring various dimensions of metaverse, ranging from building immersive shopping experiences to creating digital twins of complex operations set-ups and products,” says Ravi Kumar S., president of Infosys. “Presently, the metaverse is largely tapped across retail, shopping, gaming and, to some extent, for digital twins for product and complex environment engineering and maintenance. We see the metaverse being further leveraged for education and workplaces,” he adds.

Metaverse is expected to be big for engineering services organisations. What else can explain L&T Technology Services’ interest in it? “While digital engineering has transformed the conventional ways of working to a large extent, the next phase of evolution is expected to be immersive experiences. This is where metaverse comes into prominence. Complementing it further are the prevailing trends of 5G [mobile technology], digital products, AI and digital manufacturing,” says Amit Chadha, CEO and managing director, L&T Technology Services.

The company is already incubating technological innovations in areas such as AR/VR, AI and ML and 5G networks among others. It has acquired US-based Orchestra Technologies, which operates in the telecom and 5G space and also set up development centres and labs in Mysuru and Bengaluru, apart from setting up a centre in Munich in the 5G space.

Tech Mahindra announced its metaverse variant the TechMVerse recently, which will utilise its 5G capabilities to deliver immersive experiences for its customers. “The platform was launched to conceptualise and implement next-gen use cases that focuses on the convergence of physical and digital worlds by breaking down boundaries and democratising access to key goods, services and experiences. This involves collaboration with industry partners and hyperscalers in specific areas to maximise the value delivered to end customers,” says Kunal Purohit, chief digital services officer, Tech Mahindra.

Building Blocks of Metaverse

Many aspects of metaverse are being built on blockchain technology, since the concept of metaverse is informed by the Web3 philosophy of verification of data and decentralised control over it. However, just as blockchain is not the only technology that is building metaverse, metaverse is not the only sector where blockchain has use cases. It has the potential to change almost every industry, especially the finance sector, as block-level verification of the flow of money from one party to another adds an almost unbreakable layer of accountability to it.

This principle is already being applied in the gaming and NFT sectors, which is helping industry players eliminate dubious forums and marketplaces. With time, more use cases are likely to follow as the technology matures and more people adopt it, which will lead to their synchronous merger in metaverse.

In the media, there has been an immense focus on cryptocurrencies, which is built on the peer-to-peer technology of blockchain. Experts believe that as metaverse matures to develop its own economic system, cryptocurrency or a similar blockchain-based technology will lie at its core.

Om Malviya, president of crypto platform Tezos India, expects the entire financial system to shift to blockchain because of its ability to verify processes in a decentralised manner. This process has come to be called decentralised finance, or DeFi. He says, “If and when our financial institutions are able to entirely replace the traditional processes and paperwork with the help of blockchain and use share ledgers with distributed ledger technology (DLT), it could drastically reduce friction and delays as well as increase operational efficiencies involved in areas like trade finance, settlement and clearances, consumer banking, lending and credit, payments and peer-to-peer transactions, etc.”

Game on

Interestingly, youngsters and children have already experienced a bit of metaverse through games, such as Fortnite, Pokemon Go and others. Video game publisher Epic Games has been focussed on creating a metaverse for its iconic game Fortnite. It is partnering with The LEGO Group to build a metaverse application. It secured a $1 billion funding earlier this year, which, it said, it would use to work on its long-term vision for metaverse.

According to the Bank of America, the most promising company in metaverse is Roblox, a gaming platform for children, because it is the only company with “the only fully fledged metaverse product on the market”. The platform that is enormously popular with younger children, with approximately half of its users aged 13 or under, has seen an unprecedented rise in its user base since the pandemic. In the third quarter of 2021, its daily active users reached 47 million compared to 36 million in Q3 2020, registering a 31% increase.

Gaming is one of metaverse’s most significant use cases—a statement recently confirmed by Microsoft chairman and CEO Satya Nadella when he said, “Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms.” His statement came alongside Microsoft’s announcement that it would purchase game publisher Activision Blizzard for $68.7 billion.

Action-Adventure Competition

The Indian gaming sector, which saw a massive boom post pandemic, is buzzing with new start-ups entering metaverse. According to Statista, the online gaming industry across India was valued at around Rs 79 billion in 2021, marking a leap from about Rs 65 billion in the previous year. The sector is expected to be worth over Rs 150 billion by 2024, indicating a CAGR of around 15%. Lumikai, a gaming-centric fund, estimated that in 2021, India approximately had 450 million gamers, around 100 million of which actively paid in the gaming ecosystem. It pegged the Indian gaming market to acquire the size of $7 billion by 2026.

The metaverse part of the Indian gaming sector has invited some curious investments in the form of celebrity endorsements. Bollywood actress Sonam Kapoor recently invested an undisclosed amount in blockchain-based gaming platform MechaFightClub, which was launched by online gaming start-up Irreverent Labs.

So far, the virtual gaming space in the country is firmly with start-ups, while major global players are still testing the waters. Tamasha.live is one such start-up platform that is trying to build a gaming creator community in India. Founded in 2020 by Saurabh Gupta and Siddharth Swarnkar, Tamasha is building a next-generation gaming metaverse—a real-money gaming space—which disrupts gaming through live social engagement. The platform already has over 50,000 monthly active users.

But, with giants like Meta entering the gaming space in a big way, what does the future hold for small players? “Only constant innovation can help us survive. Plus, the gaming space is too vast for any one platform to enjoy a monopoly. Going forward, collaborations and acquisitions will also become part of the gaming industry,” says Gupta.

Bullieverse co-founder and COO Murali Reddy has an interesting take on the issue: “Large players like Meta come from different ethos of building the gaming community. When Meta announced that it is looking to give its creators 47.5% of the value generated by it on the platform, it confirmed its approach to this market. In Web3, we believe that creators should get the largest share of the value they create. At Bullieverse, it means that they get 95% of the value they create on the platform. While firms like Meta have the might to launch platforms and scale it, they are primarily serving their shareholders.”

One of the challenges in the gaming world is finding the right talent and companies often have to rely on overseas talent for developing games and platforms. “We have a solid team of investors and creators, but we have to hire game developers, 3D modellers, level designers and character animation experts from countries such as the UK, Peru, Ukraine and Indonesia to meet the needs of the platform,” Reddy says. Gupta of Tamasha.live agrees: “Most of our team is based out of India, but finding talent for specific roles, such as game design and game production, is a bit difficult here.”

TCS’ Maharaj has a strategy to overcome it. “One is, we are upskilling our existing employees at a massive scale, and, second, we are forging partnerships with different tool companies, such as Unity, Unreal and Adobe. Beyond this, in the campuses, we have been constantly launching game challenges,” says Maharaj.

With so much innovation and new technologies coming in, will gaming in its current form cease to exist in the coming years and shift entirely to metaverse? Ankur Pahwa, EY India’s ecommerce and consumer internet leader, thinks that old-school online gaming is here to stay. “It is true that metaverse will make gaming more immersive and create better engagement through shareability and more monetisation opportunities. Yet, in a country like India, which is still in the early adoption curve on this, online gaming will stay relevant for people not looking for an immersive experience and not dissipate with metaverse,” he says.

Getting Youth Ready for Metaverse

All stakeholders of metaverse-related activities realise that whatever be the use case of AR and VR technologies, both users and workforce needs to be trained well.

Many Indian educational institutions have already started experimenting with metaverse-related technologies. A bunch of schools in and around Delhi and other parts of the country have set up AR and VR laboratories, where they let students experience the virtual mode of learning and training. There are also simulation labs in many institutions.

Recently, the Central Board of Secondary Education (CBSE), the national-level education board, collaborated with Meta Platforms to explore the use of metaverse in education and training. Biswajit Saha, director, training and skill education, CBSE, says that metaverse presents opportunities from universalising STEM education in India, skilling students for jobs of the future to even strengthening immersive or project-based learning. “By empowering students through immersive technologies like AR and VR, skilling on metaverse can make our workforce creator and producer oriented,” he says.

Data Deluge

Jahagirdar is bang on when he says: “One can only imagine the amount of data that will be generated by billions of varied interactions in metaverse”. Security and credibility of metaverse will depend upon cutting-edge data collection and its encryption and analysis, a concern in a country that is still struggling to make sense of data analytics, localisation and privacy-related issues.

As the world transitions from Web 2.0 to Web 3.0, the issue of data localisation needs a fix. Experts believe that unlike in Web 2.0, where what one shares does not belong to them, in Web 3.0, people will have control over their data due to its decentralised nature. However, in such a scenario, the concept of data localisation is still evolving. “Presently, data localisation has multiple dimensions, with a clear policy-led framework missing in most markets. As standards for the new world of metaverse get established, there needs to be a clear framework for data localisation as well,” says L&T Technology Services’ Chadha.

While many consider metaverse as an extension of the internet, experts believe that it differs in significant ways from today’s internet, especially when it comes to data. “Data ownership is expected to become a fundamental right in the metaverse. Transparency and control over that data to disclose pieces of information selectively and electively is an extension of this right. Trustless verification and immutability are pivotal in enabling metaverse transactions and safeguarding the rights to privacy, security and data ownership. To enable these features, blockchain technology is a necessity,” says Wipro’s Tatavarti.

Just as India made large strides in the IT services sector in the 1990s and the early 2000s, the world expects it to play an important role in the next digital wave of virtual economy. Zuckerberg, while speaking at Meta’s “Fuel for India 2021” event, expressed hope in India’s developer community. He said, “India is on track to have the largest app developer base in the world by 2024 and already has one of the largest Spark AR developer communities.” The preparedness of India’s IT sector and a proactive government approach will decide how much of the success of 1990s and 2000s can be replicated in metaverse.

With input from Jeevan Prakash Sharma