In 2021, India minted 42 unicorns. The total funding crossed $41 billion—an amount that was more than what the ecosystem had raised in the two preceding years. In 2022, however, a different story is being written. In fact, erstwhile cheerleaders of the sector have started writing its obituary, as investors who were willing to hand out term sheets on the basis of Zoom calls just a year ago have chosen to withdraw their cheques at the eleventh hour.

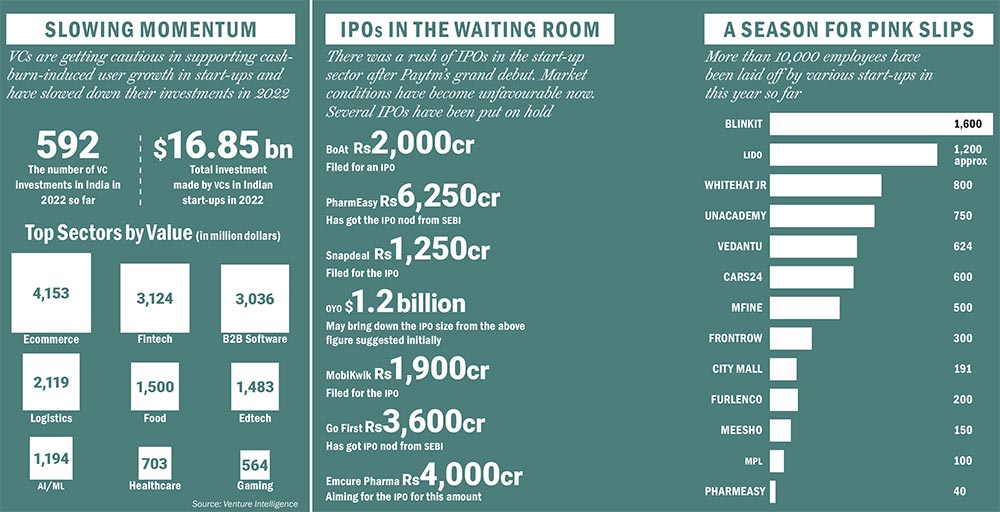

In April and May 2022, Indian start-ups raised $2.92 billion as against $4.07 billion in the same period last year. The number of deals has seen a month-on-month decline since January 2022—from 124 deals in the beginning of the year to 87 in May. In comparison, the total number of funding deals stood at 1,128 in 2021. As funding dries up, several start-ups are struggling to stay afloat.

Does it mean that the Indian start-up party is over? Experts say that what is happening currently is normal. What was not normal was the way things overheated last year. Interestingly, the correction in markets was predicted by Sandeep Aggarwal, the CEO and founder of car retail platform Droom, in Outlook Business’ September cover story “Rising Unicorns: A Boom Or A Bubble.” “I do not think it is a bubble ready to burst, but I will say that the market is rich and frothy and will correct in the next one or two years,” Aggarwal, a former Wall Street analyst, had said.

Aggarwal’s argument is validated by data that shows several global venture capitalists have raised much higher India-focused funds than last year. But, the question is which Indian start-ups will be chosen by these VCs for further endorsement?

This year, the start-up sector is smartening up as a matured space, where the focus is shifting from cash burn and user growth to profitability, from scale to stability.

But before we get to our survival guide, let us look at what caused the cheerleaders of the sector to turn obituary writers.

Shifting Sands of Start-up Funding Regime

The last two years saw investors riding on the easy liquidity introduced by central banks across the world in the form of Covid-19 stimulus packages. The US Federal Reserve, for instance, had expanded its balance sheet from $4.7 trillion in March 2020 to over $7.6 trillion by March 2021. Back home, the Reserve Bank of India (RBI) had introduced excess liquidity of Rs 9.96 trillion in the system by keeping policy rates at record low levels. A large amount of this money found a place either in listed firms or unlisted start-ups.

While easy money pours in fast, it evaporates faster. With the Russia-Ukraine war dragging on, inflation touching a four-decade high in the US, the Federal Reserve has been increasing interest rates frantically, the latest hike being of 75 basis points (bsp). In India as well, the central bank is battling inflation with a 90 bsp hike in interest rates in two months.

“This [funding] winter [for start-ups] is purely a result of overly accommodative central bank policies during the first Covid-19 wave in 2020, which resulted in trillions of dollars of liquidity being pushed into the system. This eventually led to an increase in real asset prices. With inflation now running out of control, the ‘easy money’ tap has been firmly turned off ... and interest rates are rising rapidly, but more importantly, the overall market sentiment has soured,” says Kunal Chowdhry, CEO, Apollo Singapore Investments, a Singapore-based investment firm.

In India, international events, global growth projections and weakening domestic fundamentals have wrecked the confidence of family offices and ultra-high-net-worth individuals (UHNIs) who had emerged to become the backbone of the country’s start-up ecosystem. A survey of 100 family offices and UHNIs, published by consultancy firm EY and law firm AZB & Partners last year, showed that over 40% had doubled their allocation to private markets in the last five years. The size of the investor market for unlisted shares, the most potent source of funding for early- and pre-IPO-stage start-ups, is pegged at Rs 2 lakh crore.

“People want to go slow with their investments. The FOMO factor that played [out] in the last two years is missing,” says Somnath Mukherjee, managing partner at wealth management firm ASK Wealth Advisors.

However, all is not gray in the ecosystem. While we panic about a funding slowdown, its impact is largely limited to late-stage start-ups so far.

Typically, global fund houses depend on exits to redeploy funds in the ecosystem. With equity markets in a tizzy, going public at this time looks suicidal for start-ups. Capital markets have been unforgiving to already listed companies. More than 60% of all software, internet and fintech companies in the US have been trading below pre-pandemic prices, states a Sequoia Capital report. In India, the current fate of Zomato, Policybazaar, Nykaa and the tragic tale of Paytm have forced other start-ups to put their listing plans on hold. OYO, boAt and PharmEasy are some of the key names whose IPO plans do not have a fixed date of launch.

“The overall worldwide macro-economic shift and its effect on public markets has its impact on valuation of later stage portfolio companies and has made exits hard to come by for investors, leaving them with a fund flow problem. This is typically true for all investments made Series B onwards. Investors are now being cautious and, in some cases, may not lead rounds but could explore it along with other investors to de-risk investment,” explains Sri Purisai, founder and general partner, RiSo Capital, a VC firm based out of Silicon Valley that invests in Indian start-ups. However, the gloom is yet to extend to early-stage start-ups. “It’s not doom for an early-stage investor since, at this stage, the investments are based on founder and market viability, rather than scale.”

A Survival Toolkit

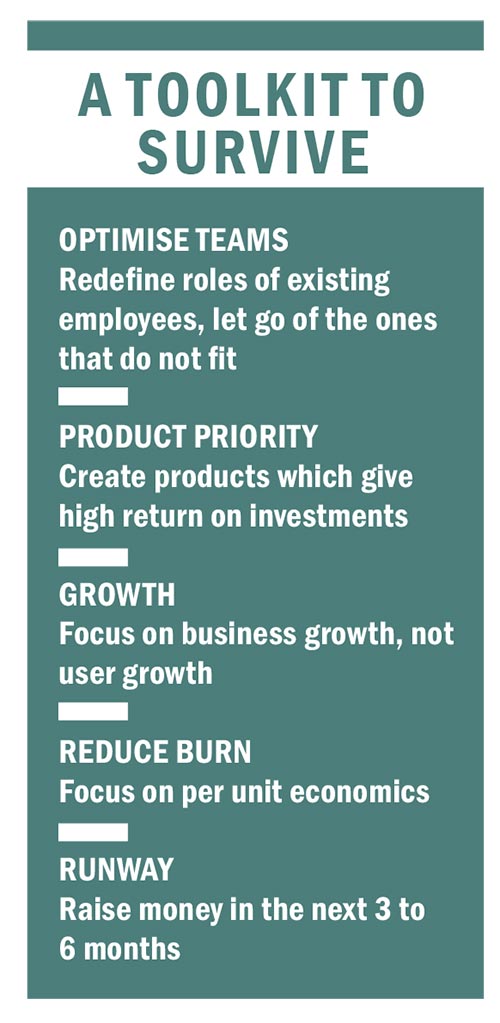

As investors get choosy and hoods of start-ups get opened for retrospection, VC firms, including Sequoia Capital and Y Combinator, have circulated survival toolkits to their portfolio companies.

For early-stage start-ups, the instructions are: focus on customer acquisition, execute product commitments, conserve cash and avoid overspend on growth. The bottom line is to explore the path to profitability over user growth. For late-stage start-ups, the VCs’ advice is: cut marketing budgets for growth and concentrate on existing customers; make fund raise a mix of equity and debt; separate debt fund for capital expenditure and cash flow; and, use equity fund for growth. The last bit is a smart way of avoiding a haircut valuation, a grave concern as many of the global recessionary trends could continue beyond the oft-quoted “18 months” to over two years, warn experts.

And above all, the VCs suggest: raise money in the next quarter or two to ensure a smooth runway for the next 18 to 24 months.

Late-stage investors Outlook Business spoke to said that valuation discounts, or the deficiency in value estimated by an investor for a start-up when compared to the valuation of its peers, has already touched a figure of 20% to 30%.

Investors claim that they are reserving cash or, as they call it, keeping “dry powder”. A large part of it is being kept aside for supporting late-stage start-ups.

“VCs are first doing an internal portfolio review to see which of their portfolio companies need their support in the next 12 months, because even they do not want to go for a down round,” says Amit Nawka, partner, deals and start-ups leader, PwC India.

The focus of this survival toolkit is to cut cash burn and focus on profitability; a strong point made by Sequoia Capital on its website: “The focus on near-term momentum is often shifting towards companies who can demonstrate current profitability. With the cost of capital (both debt and equity) rising, the market is signaling a strong preference for companies who can generate cash today. Over the medium and long-term, disciplined, durable growth is always rewarded and translates into meaningful value appreciation.”

The valuation game now seems to be a thing of the past, at least for the time being, with the health of the company becoming far more significant in the ecosystem. Investors in big names such as Paytm, OYO, Nykaa, BYJU’s and others are nudging companies to focus on the road to profitability. BYJU’s, for example, despite being the world’s most valuable edtech, is deep in losses. While its primary business was profitable in 2018–19, earning a little more than $2.7 million in profit, but as a group, its losses widened to $35.9 million in 2019–20. The story is similar in the case of India’s top start-ups.

Industry experts are recognising the sharp turn towards profitability when they warn about the continued high cost of customer acquisition. “Consumers cannot be using a product because they are being offered a discount. The businesses that will survive the current test of time will have to have some kind of a moat which allows them to charge a customer for a service,” says Nithin Kamath, CEO of fintech firm Zerodha. “Businesses will have to tone down their growth expectations and start doing the math around how to generate more revenue than spends on customer acquisition,” he adds.

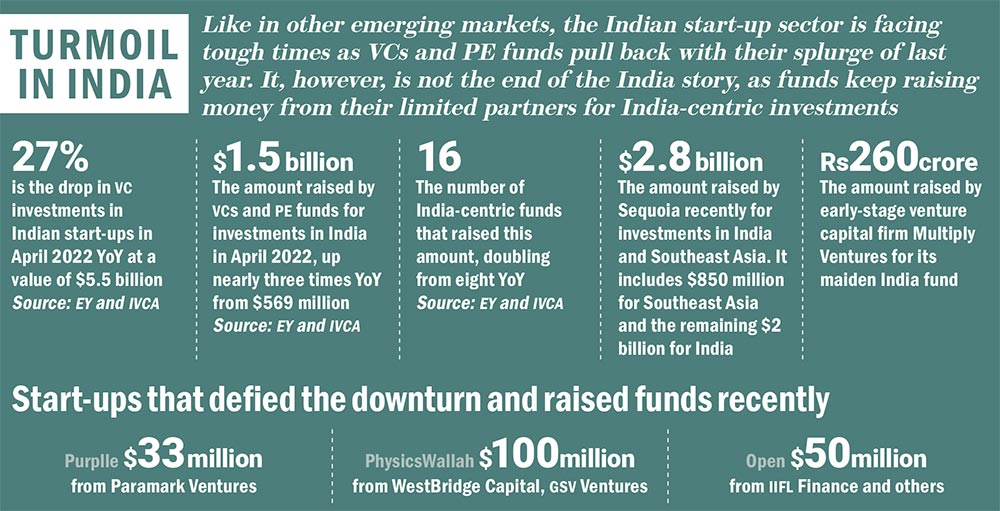

The India Story

Start-ups may be at the receiving end of a glut in investments in 2022, but funds seem to be using this time sell the India story to their investors successfully. Sequoia Capital recently closed its $2.8 billion India and Southeast Asia-focused fund after a delay of a few months. The fundraising is Sequoia Capital’s largest so far for these markets. It includes $850 million in its first fund dedicated to Southeast Asia, the remaining $2 billion going in Indian venture and growth funds. Also, early-stage venture capital firm Multiply Ventures has raised Rs 260 crore for its maiden fund. Most of the investors in the fund are Indian family offices and digital-first entrepreneurs.

A report by EY and the IVCA claims that private equity and venture capital investments in April dropped by 27% from a year-ago period at around $5.5 billion, but funds raised nearly three times the amount at $1.5 billion from the year-ago amount of $569 million. The number of funds that raised this amount also doubled from eight to 16 in this period.

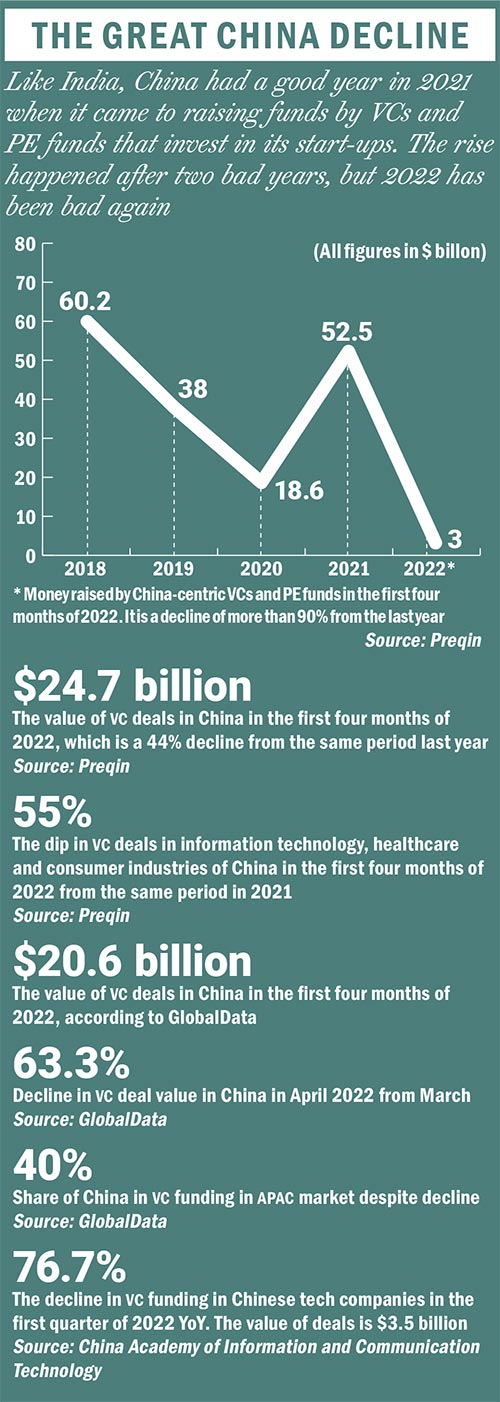

And here, China’s loss could be India’s gain. Xi’s crackdown on its tech industry saw a flight of VC money from the country with a portion of it finding anchor in India, reported American magazine Foreign Policy in October last year. The article showed how investments in Chinese start-ups reduced by a fourth while that pouring into India at the same time during summer last year increased eight times. A year on, investors are still waiting for the Chinese regulatory skies to clear and this could be advantage India.

“While global variables will impact India, but its fundamental growth story exists with vectors such as GDP, favourable demographics and exponential digital adoption among others,” says RiSo Capital’s Purisai.

Experts suggest that VCs will continue to be active, but with caution, despite the downturn, as focus shifts to valuation correction and profitability. “The business model will have to be significantly better than the peers in the sector, focus on unit economic with low cash burn, [be executed by] founders with 10 to 12 years of work experience and [be backed by] the technology stack,” says Aparajit Bhandarkar of Varanium Capital while elaborating on top qualities that his choice of start-up should have, to receive funds from him.

The recent rounds of funding raised by Purplle, PhysicsWallah and Open prove that investors are still placing their bets on a select few. Purplle’s recent Series E round of $33 million was financed by South Korean VC firm Paramark Ventures, Premji Invest, Blume Ventures and Kedaara Capital. The company, which raised funds twice this year—in January and June—seems unaffected by the winter. PhysicsWallah, an online education start-up, raised $100 million in Series A funding from WestBridge Capital and GSV Ventures. Open, a neo-banking platform for SMEs, became India’s 100th unicorn after raising $50 million in May.

Data shows that ecommerce, fintech and SaaS-based start-ups are ruling the roost in getting funded in the last six months, Purplle and Open being the case studies to validate this data. “SaaS is the biggest success story, attracting more capital than it did last year. That is because it has a predictable revenue stream, high growth outcomes and recurring nature of business. Fintech has reached just 1% of its potential. A lot of latent demand has been created, which is attracting interest from investors. Plus, fintech is getting deeply imbedded in all commerce today and has immense growth potential,” says Ankur Pahwa, EY India ecommerce and consumer internet leader.

Given India’s demographics, internet penetration and the digital leap the country has taken since the pandemic hit its shores, ecommerce and its D2C themes are a constant success story. “We have always balanced profits and growth and operated with strong unit economics. The way to build businesses in India, or in any geography, is that you do not look at a quarter view. People should take a 10-year view of things, because that is the only way one can sustain and utilise resources efficiently,” says Manish Taneja, co-founder and CEO, Purplle.

Desperate Times, Long-Term Measures

Founders have understood the harsh reality of a long winter and are finding their own ways to survive till the sun shows up again. Y Combinator recently told companies in its portfolio, “No one can predict how bad the economy will get, but things don’t look good.” Gaurav Munjal, CEO of Unacademy, in a letter to his employees, said that the tough weather was likely to last for 18 months. “We must learn to work under constraints and focus on profitability at all costs. Winter is here. We must change our ways. We will focus on organic growth channels instead,” he wrote. The edtech company was one of the first to lay off employees as a measure to cut costs, reducing its workforce by about 925 people this year.

Overvalued start-ups and high cash-burn companies with no defined road to profitability have been impacted the most in this weather. While some are shutting shop, the others are trying to extend their runway through cost-cutting measures such as layoffs. Either way, it is bad news for the sector that saw exponential growth last year.

So far, close to 10,000 employees from several start-ups, including unicorns such as Unacademy, Vedantu, MPL, Cars24, Ola and Meesho, have been given the pink slip. Smaller start-ups, such as Rupeek, FarEye, Furlenco, Trell and OkCredit, have also made their workforce leaner. “The excessive funds raised by a few edtechs led to them overstaffing and spending excessively on marketing. The layoffs, primarily, are a result of that,” says Ronnie Screwvala, chairman of leading edtech firm upGrad.

Start-ups are back to the drawing boards. Team optimisation, reining in costs, driving products with high returns and focus on business growth and revenue over user growth are some of the go-to strategies that founders are adopting.

While layoffs are an inevitable fallout of a slowdown, Akhil Gupta, founder and CTO of NoBroker, says that product prioritisation is a key area for start-ups to focus on. “Cut costs and let go of products that do not have immediate returns. With this, net burn will also be reduced. Adopt innovative growth hacking to reach out to customers and in the process reduce marketing costs,” he says, citing the example of the “click & earn” feature on the NoBroker app where people can earn money by clicking photos of properties available to be let out and uploading them on the app. “Through this, we are able to get thousands of people working for us indirectly, and we pay them Rs 100 for a photo,” he adds.

But Ananth Narayanan, founder of Mensa Brands, the brands aggregator that broke records by becoming a unicorn within six months of operations, has a different take on product strategy. “You have to invest in some products for the long term that might not give you immediate returns,” he says, quickly adding that it is easier when your company is already on the path to profitability. He mentions how Mensa is investing heavily in R&D, content and brand building, given his company is profitable from the first year of its operations.

HungerBox’s business got severely impacted during the pandemic and the company had to restrategise to stay afloat. “The last two years have been extremely tough. While all business sectors were affected, institutional food tech was probably one of the first segments to be hit almost immediately by the pandemic. Since 90% of our clients previously were from the tech/BPO sector, customer demand evaporated overnight,” says Sandipan Mitra, CEO and co-founder, HungerBox, a B2B F&B technology company.

The company has been lucky that existing investors have supported it with internal bridge rounds. “We have managed to keep a very tight rein on costs while slowly scaling the company. In fact, we turned EBITDA positive in April,” Mitra says. With the looming slowdown, HungerBox has used its experience of the crisis hurled upon it by the pandemic to ensure business longevity. The start-up has recalibrated its business model to change the way it prepares food. From off-campus, it has become an on-campus process now. “We have integrated 20 features into our platform, including congestion management, café slot booking, pre-ordering and video analytics. These features are critical in the post-pandemic era. We have permanently fixed our unit economics to ensure that this time the scaling happens profitably,” beams Mitra.

Unit economics is the topic of the season as founders and investors emphasised on the need to ensure that every transaction is making money at a time when focus is shifting from user growth to profitability.

“The way to build any sustainable intergenerational business is to focus on both growth and profitability. Some businesses require network effect, then you need to focus on positive unit economics so even if you spend on growth you will eventually make money and your burn keeps coming down,” says Narayanan.

Regardless of economic cycles, it is the cash runway that founders really need to concentrate on. “One of the tasks for every CEO is to make sure that there is sufficient gas in the tank to pass through a desert if he needs to,” says Alok Goyal, partner, Stellaris Venture Partners. “In fact, this may be a great time for some of the larger companies which have cash and solid economics to make growth-oriented investments as well as look for smart M&A opportunities,” he adds.

Amid the funding winter, the first signs of consolidation are already visible, with dozens of unicorns making a beeline to acquire smaller firms. According to data from industry tracker Tracxn, 123 merger and acquisitions (M&A) happened in the first quarter of 2022, as compared to 70 such deals during the same period last year.

With the funding glut setting in globally, smaller players struggling to raise cash are becoming easy acquisition targets for well-established start-ups planning to fuel their future growth ambitions. Such decisions are mostly aimed at gaining market share, adding revenue streams and getting access to technology, geography or talent.

“It is good that consolidation is increasing. It will pick up pace in the next 12 months. Many VCs are introspecting about their portfolio companies and understanding which of them need support. If they believe that there is some company that is not going to survive the next 12 months, they may encourage the company to look for an M&A [deal],” explains Nawka of PwC India.

Treading with Caution

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change”: Charles Darwin’s words on evolution summarise what experts are today suggesting about businesses—they must be ready to adapt even when the world seems to be conspiring against them, even when investors suddenly seem to be going back on their words and even when the world’s biggest markets are bleeding.

It is understandable that it is the need of the hour to be cautious, because things will change for the start-up ecosystem in future. However, all is not lost. In an industry survey carried out by Outlook Business, in which its editors spoke with founders, funders and analysts, a near consensus emerged on how start-up founders need to navigate this period. They argued that start-ups must have their strategies around people, product and profit: start-ups should optimise their teams without adding more people and instead redefine roles of existing employees and let go of the ones that do not fit in the organisation values; create only market friendly products which have a high probability of acceptance and can offer a great return on investments; and focus on business growth, rather than user growth, and evaluate their revenue on per user or partner basis while accommodating user and revenue churn.

As several companies stare at closure and many stand to lose their jobs, what may possibly emerge from all this is the realisation that the road to building a strong company cannot be dependent on capital alone. Instead, it will take a strong business model, grit on the part of the founder and a clear roadmap to earn profits to survive.