2. Bajaj Finance

From being a NBFC which predominantly catered to the infrastructure sector, Bajaj Finance pivoted towards retail lending in 2011. This turned it into the one of the fastest growing NBFCs and a major wealth creator. The company’s USP has been its strong presence in the consumer financing business, which accounts for 39% of AUM. This lending helps the company to maintain high margins and is less risky because of its small ticket size. The company has been leveraging technology to examine the credit history of a customer and lend loans at a fast pace. However, analysts state that it would be difficult for Bajaj Finance to justify its expensive valuation of 5.4x estimated FY21 book value as consumption is showing signs of slowing down.

31. Indraprastha Gas

Among India’s leading natural gas distribution companies, Indraprastha Gas operates primarily in the National Capital Region and adjoining areas. The government’s effort to substitute the use of diesel and coal with natural gas to curb pollution works in favour of the company. That apart, the company operates in UP and Maharashtra through its subsidiaries CUGL and MNGL and is also expanding its footprint in the hinterland and industrial areas to increase gas volume. A debt-free balance sheet, improving Ebitda, rising environmental concern and expansion in highly populated areas make a strong case for consistent improvement in volume and consequently, the company’s financial performance. While the threat of electric vehicles looms for Indraprastha, investors remain bullish on the firm with the stock trading at 24.1x estimated FY21 earnings.

33. Relaxo Footwears

In a segment that is over 80% unorganised, Relaxo Footwears has held its ground and maintained its leadership position, after Bata. To boost its topline, the company is expanding its reach in southern and western India. Streamlining distribution network, especially in underpenetrated markets and increasing exports is in focus. While analysts expect an improvement in Ebitda margin on the back of softening raw material prices, the stock currently trades at 34.8x FY21 estimated earnings.

37. TVS Motor

TVS Motor has zoomed past its competitors, with the company’s stock growing at an impressive CAGR of 38%. Even last year, when two-wheeler manufacturers faced a slowdown, its consolidated revenue from operations for FY19 was up 20%. Its success can be attributed to the right product mix and brand affinity among customers. Recent launches like NTORQ125 and Radeon are doing well in the market. The company also has a strategic partnership with BMW Motorrad to develop and manufacture sub-500cc bikes both for domestic and global markets. TVS trades at 25x estimated FY21 earnings.

54. Abbott India

While there are over 40 multinational companies in the Indian market, it is only Abbott that has been able to register double-digit growth over a four year period. Constant launch of new products in existing and newer categories, strategic partnerships and timely tapping of newer markets have helped the company register consistent improvement in sales and margins. At 25x estimated FY21 earnings, the stock is currently trading at a discount to its MNC peers.

58. Voltas

The company has about 23% market share in the segment and has consistently grown faster than the market driven by strong distribution especially in Tier-II cities, after-sales service and competitive pricing. Besides Unitary Cooling Segment that makes up 48% of Voltas’ total revenue, the other two verticals are Engineering Products and Services and Electro-Mechanical Projects and Services. The stock currently trades at 26.5x estimated FY21 earnings.

59. Berger Paints India

The second largest decorative paints company in India has clocked compounded stock return of 32% over five years. During the same period, the company doubled its sales from Rs 38 billion to Rs 60 billion at CAGR of 9%. Its domestic performance has been strong across both rural and urban markets. Analysts say that benign real estate demand could be a headwind but government programmes such as Housing For All and Swachh Bharat Abhiyan will continue to act as a tailwind for domestic decorative demand. Sustained product development and distribution aggression have been hallmarks of Berger’s growth narrative. The stock currently trades at 40.2x estimated FY21 earnings, factoring in strong growth momentum.

71. Trent

On the back of measured expansion and focus on developing private labels across categories, Trent has clocked impressive growth numbers. The retailer has consistently garnered gross margin of around 60% over the past five years. Its strong performance has reflected in its stock price as well which has compounded at 28.75% over FY15-19. The company has now transitioned to a more aggressive growth strategy for Westside as well as newer business verticals like Zudio. The JV with Spanish retail firm Inditex to run Zara and Massimo Dutti stores in the country allows Trent to cater to the premium segment. On the basis of its unique business model, the stock currently trades at a pricey 49.7x estimated FY21 earnings.

77. Ramco Cement

Its strength lies in the fact that it has maintained highly efficient operations despite stiff competition in the south and east regions, where it operates. The company has halved its debt-to-equity ratio from 1.04 in FY15 to 0.28 in FY18. At a time when the cement industry in India is facing a problem of plenty, Ramco Cement seems to be on a solid footing to tackle the challenges. The company’s stock has delivered stellar return over the past five years and hence trades at an EV/ Ebidta of 13x estimated FY21 earnings.

83. Kajaria Tiles

Among the leading players in the organised tiles segment, Kajaria has relied on its strong product portfolio and distribution might to consistently increase market share, which is currently at 9%. It operates in ceramic and vitrified tiles segment and has made inroads in the faucet and sanitary ware market. In a challenging real estate environment, the company has posted consistent growth in sales and profit. Kajaria has successfully transformed itself from a commoditised player to a well-known brand and currently trades at 24.7x FY21 estimated earnings.

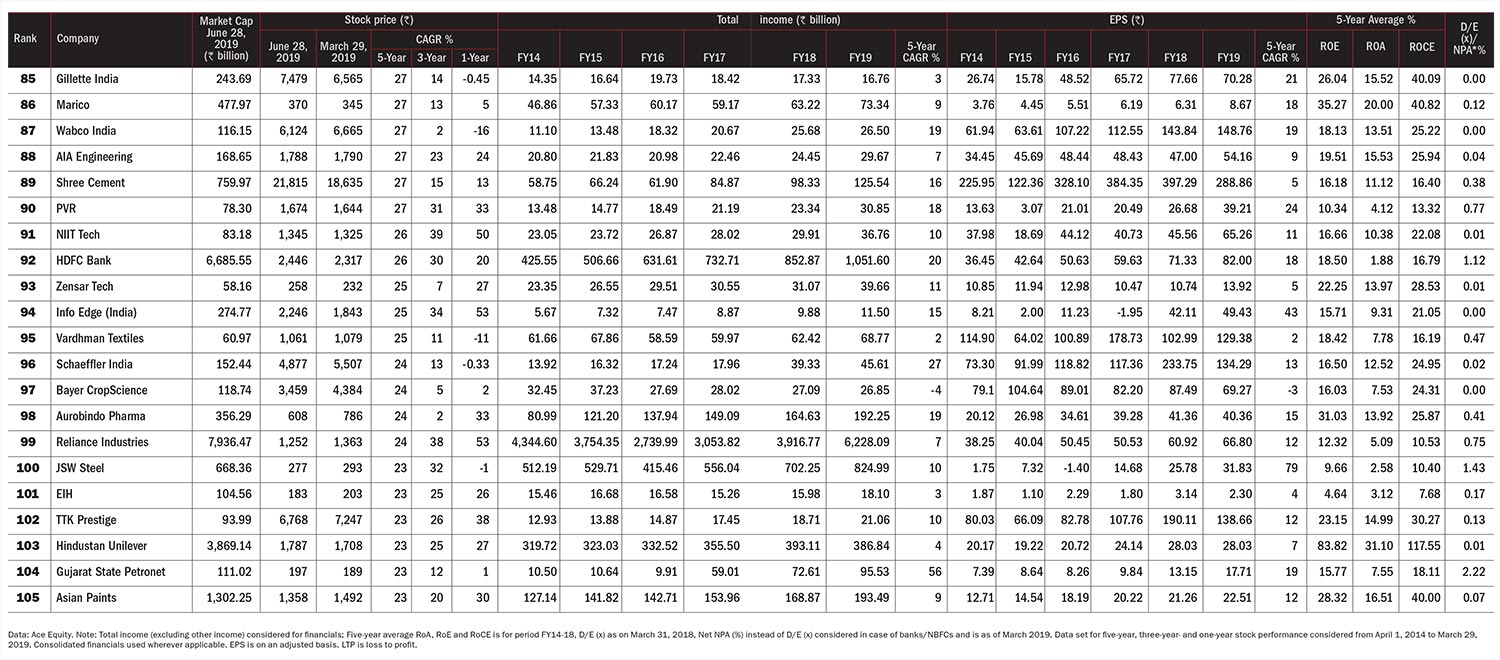

90. PVR

The multiplex chain operates 748 screens. Besides building premium variants like PVR Icon, which translate to higher ticket prices, it also generates significant revenue through in-cinema advertising and food & beverage sales. The influx of streaming services could threaten PVR’s growth, but it is navigating these challenges by using technology to reduce costs and increasing penetration in Tier-II towns. Analysts are upbeat despite the stock trading at 30x estimated FY21 earnings.

96. Schaeffler India

Its diversified portfolio insulates it from adverse macro conditions. So while the automotive segment constitutes 51% of revenue, 39% comes from the industrial segment and the rest from exports. As a result, even amidst concerns like rise in crude prices, credit crunch and rise in insurance cost, Schaeffler India registered consolidated sales growth of 11.27% to Rs 45.6 billion in 2018. With a strong clientele and focus on innovation, the stock trades at 23.4x estimated CY20 earnings.

103. Hindustan Unilever

A strong focus on research and development, robust distribution and consistent marketing are the hallmarks of HUL, which is India’s FMCG bellwether. Its brands, such as Lux, Lakme, Dove, Sunsilk and Surf Excel, enjoy a strong brand recall and trust among consumers. In addition to perfecting its product mix, HUL is gradually increasing the contribution of premium products to its overall revenue. The company has also acquired Indulekha, Adityaa Ice Cream and GSK Consumer to increase market share and deepen penetration in newer categories. While the company faced the ripple effect of slowdown in consumption, analysts expect strong volume growth driven by premiumisation, strong distribution and leveraging data analytics. The stock currently trades at 48x estimated FY21 earnings, making it steeply valued.

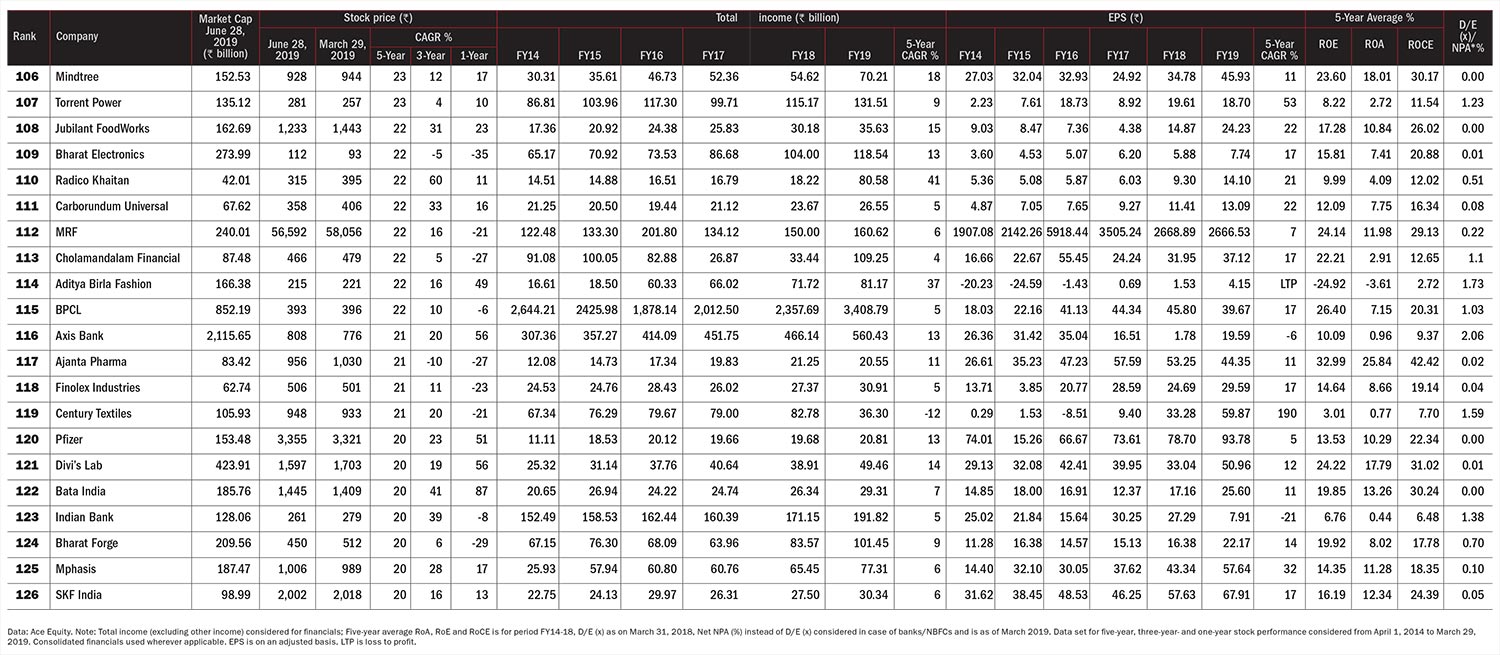

106. Mindtree

Its focus on select verticals (BFSI, Retail, Travel, Hi-Tech) and services (Digital, IMS, ADM) coupled with strong execution has helped Mindtree grow faster than the industry. The contribution of Digital to revenue is 49.5%, highest amongst its peers. Earlier this year, Café Coffee Day founder VG Siddhartha sold his stake to L&T. Even though the management vociferously resisted the buyout, L&T recently became the largest shareholder after acquiring more stock through an open offer. While the effect of this takeover remains to be seen, the stock trades at 17x FY21 estimated earnings.

110. Radico Khaitan

It is one of the largest players in the Indian spirits industry and is home to brands like 8PM whisky and Magic Moments vodka. It is a market leader in premium vodka category and has four brands with annual sales of 1 million cases. With strong distribution – 55,000 outlets pan India – and focus on expanding share of premium range, analysts believe the company will continue its growth momentum and keep investors in high spirits. The stock currently trades at 18.1x FY21 consensus estimates.

116. Axis Bank

After bearing the brunt of slowdown in power and infrastructure sector, Axis Bank is increasing its retail lending portfolio. Due to its strong focus on wholesale corporate lending, the bank’s net NPA rose from 0.44% in FY14 to 3.40% in FY18. However, the bank is now in recovery mode and has chalked out a plan to reduce the share of wholesale loans. The bank continues to focus on high-yield lending like personal loans, which have been driven through its digital platform. On the liability side, the bank commands a strong CASA ratio of 44%, which should help it to lend more. FY19 net NPA reduced to 2.06% because of rising provisioning and moderation in slippages. With the new management taking steps to make the bank more efficient, the stock currently trades at estimated FY21 price-to-book of 2.7x.

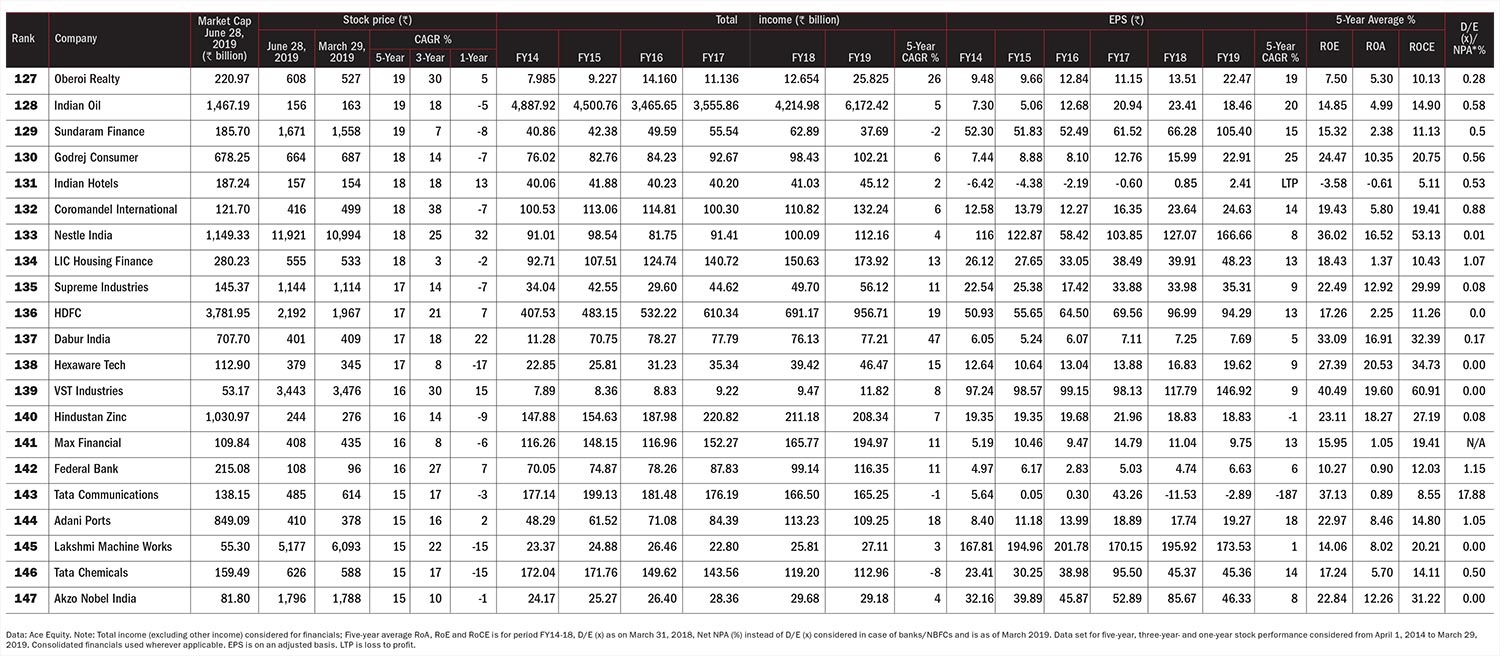

131. Indian Hotels

The hospitality major, which runs the Taj group of hotels, has adopted an asset-light strategy and is focused on reducing costs on power, food & beverages through strategic tie-ups. It has also entered into a JV with Singapore’s GIC for investing Rs 40 billion to acquire fully operational hotels in India over a period of three years. Analysts expect the company to report revenue and Ebitda CAGR of 9% and 25% between FY19-21. Its EV/Ebitda of 14.9x FY21 estimates makes it a compelling bet for long-term investors.

141. Max Financial Services

With a strong focus on high margin protection insurance products, Max Life is on a steady growth path. The share of protection sales as a percentage of total annual premium equivalent (sales) has gone from 7% in FY17 to 10% in FY19. At the same time, the insurer has been able to increase its new business margin, from 18.8% to 21.7% because of the increase in share of protection products. With the company pumping money to build its proprietary channel, it should be able to maintain high growth in the lucrative protection segment. However, the uncertainty caused by high amount of promoter’s pledged shares and ambiguity of tie-up with Axis Bank, its biggest channel partner, looms over the stock, which trades at price-to-embedded value of 14x FY21 estimates.

146. Tata Chemicals

After de-merging its consumer business, Tata Chemicals is now a basic and specialty chemical focused company. Over the past five years, its growth has been driven by soda ash and sodium bicarbonate, which falls under the category of basic chemicals. It is the third largest soda ash producer in the world. However, going forward, the management wants to increase the share of specialty chemical business from 20% currently to 50% as it expects this segment to drive growth. The stock currently trades at EV/Ebitda of 7.6x FY21 estimates.

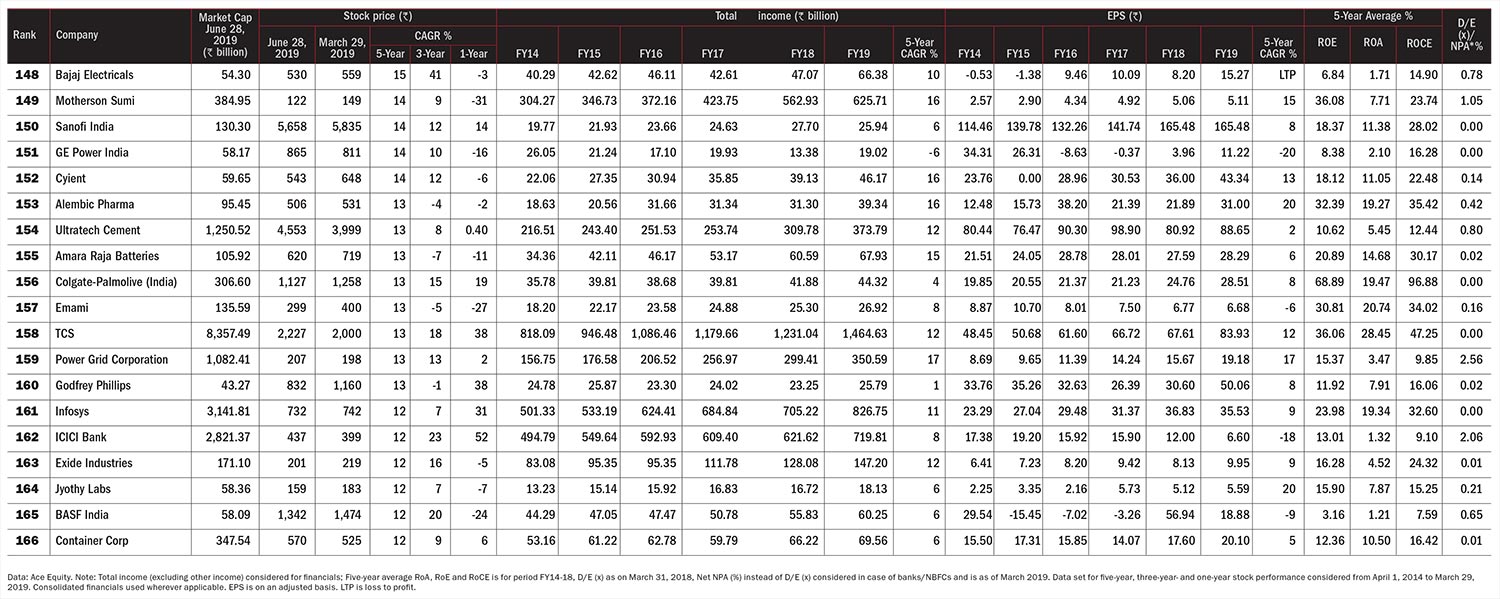

149. Motherson Sumi

Starting off as a supplier to Maruti Suzuki, it is today one of the world’s leading automotive component manufacturers. It has a presence in 36 countries across six continents and a prestigious clientele of top OEMs including Ford, Toyota, Nissan and Honda. The journey of the auto ancillary behemoth is replete with acquisitions, which helped in expanding both markets and market share. Though a difficult demand situation globally has translated into subdued sales in recent quarters for Motherson Sumi, the company is confident of meeting its five-year vision, ending FY20. This is on the back of its strong order book of €18.2 billion, stabilisation of greenfield plants and India business benefitting from content increase in BS VI. Consolidated revenue is expected to grow at CAGR of 8% over FY19-21. Meanwhile, the stock trades at 16.4x FY21 consensus estimates.

156. Colgate-Palmolive (India)

It has created a strong niche in India in the oral care and personal care business. The company’s eponymous toothpaste brand enjoys a 52% market share while it has a 48% market share in the toothbrush market. Its success can be attributed to constant innovation, strong distribution and aggressive marketing initiatives. The company is targeting market share gain through growth of kids and Palmolive portfolio, as well as distribution expansion. Analysts expect revenue and net profit to grow at CAGR of 8.9% & 8.8%, respectively between FY19-21. The valuation, at 34.9x FY21 estimates, though seems rich.

166. Concor

The rail logistics major remains focused on gaining market share and developing diverse business verticals. In January, for instance, it commenced its asset light coastal shipping business from Kandla port to Tuticorin and expects to cover India’s east coast and Bangladesh in FY20. Further, it has set up its sole distribution logistics centre at Ennore with plans to add three to four centres this year. With an annual capex outlay of Rs 10 billion, Concor has set itself an ambitious revenue target of Rs 250 billion in the next five years. The stock currently trades at 17.9x estimated FY21 earnings.