Readers are fickle creatures. Ask the publishers. They will tell you how a book that was all the rage yesterday has become as uninteresting as dust today. Therefore, publishers have to manage a promising business on a rickety supply chain. They are never sure what will be rejected, what will be read and what will be returned. Therefore, Repro comes as a godsend.

Readers are fickle creatures. Ask the publishers. They will tell you how a book that was all the rage yesterday has become as uninteresting as dust today. Therefore, publishers have to manage a promising business on a rickety supply chain. They are never sure what will be rejected, what will be read and what will be returned. Therefore, Repro comes as a godsend.

Repro India has created a print-on-demand solution where it prints a book after the customer has bought it, hence disrupting the decades-old existing supply chain. Its solution fulfills the demand through various channels — by aggregating, digitising, listing titles on online storefronts, producing on demand, delivering anywhere in the world. Repro has done this through tie-ups with the world’s largest e-retailers — including Amazon, Flipkart, Paytm, Infibeam, Rediff and Snapdeal.

Currently, India is the sixth-largest book market in the world and, with the total number of internet users in India expected to grow rapidly, the number of people expected to buy books online is increasing every day. Today, around 100,000 books are sold per day through online marketplaces.

Books have emerged as an instrumental category for e-commerce business, accounting for 15% of the overall e-commerce trade, just trailing behind electronics at 34%, and apparel and accessories at 30%. The Indian e-commerce market is expected to grow to $200 billion by 2026, and the online book market in India is expected to grow to Rs.80-100 billion in the next three to five years.

But the Indian book industry has its challenges. It receives no direct investment from the government, which is “a serious roadblock for publishers”. Other key challenges include fragmented nature of publishing and bookselling, a tortuous distribution system, and long credit cycles.

Publishing disrupted

Currently, the publishers face challenges in the traditional way of doing business. Books are produced and then sold — leading to high levels of inventory. The solution, therefore, is keeping zero inventory. By the time a book reaches the market or is actually sold, it might be out of date or no longer relevant. The solution, therefore, is zero obsolescence. All books are bought on consignment in various different geographies and so publishers may feel they have sold higher numbers than they actually have. The solution, therefore, is to entertain zero returns. Books are produced at one place and sent over to one part of the country, while the actual book may be required in another corner of the country.

The Repro solution is a tech platform that aggregates content from publishers all over the world and reaches more books to more readers, anytime, anywhere!

Just like aggregation platforms such as Uber and Airbnb, it connects products and services to users. Repro’s aggregation platform offers books to readers all over the world from publishers all over the world. It lists the publishers’ titles online through e-retail giants such as Amazon and Flipkart, and readers order the online books from Repro. The platform then produces the book (after it has been bought) and delivers it in 24-48 hours. Repro then pays the publishers their royalty immediately on sale of the book.

Hence, the publishers can focus their energies on creating a book, making no other investment. The industry need no longer be bogged down by worries about inventory, obsolescence, returns and wastage. Also, the cash flow is positive.

Repro India tied up with US-based Ingram content group, which is one of the world’s largest content aggregators and distributors for books. They have the industry’s largest active book inventory with access to 14 million titles from 45,000 publishers. The company has an agreement with Ingram in which the US company will provide international titles to Repro India to sell on Indian platforms, and Repro will also share domestic titles it has aggregated over the years from Indian publishers with Ingram to list those titles on international platforms.

Booked for growth

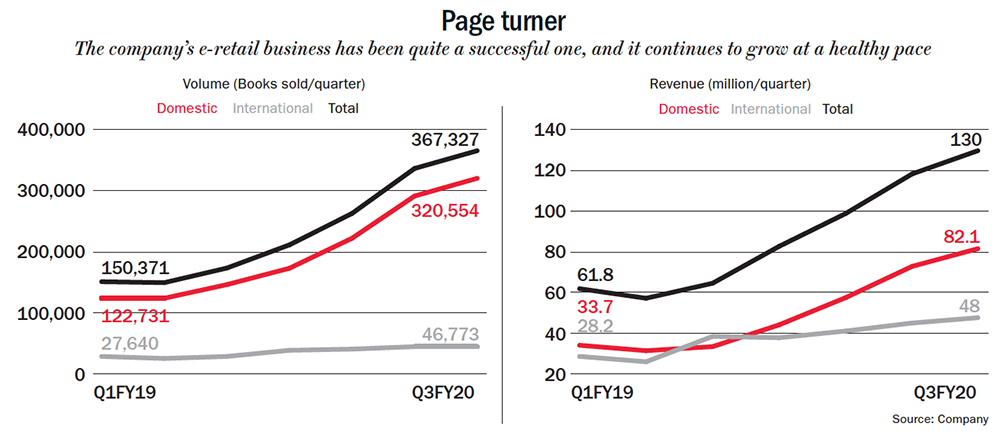

Repro started the print-on-demand operation in 2016-2017 with ~90,000 titles, with one facility in Bhiwandi with a capacity of 4,000 books per day and average sales of Rs.250,000 a week. It saw 114% increase in volume of books from Q1FY19 to Q3FY20.

Similarly, its revenue also increased proportionally by 111% over the same period (See: Page turner).

By the end of 9MFY20, it listed over more than five million titles, two operational facilities, one in Bhiwandi and other in Delhi and third facility is expected soon in Bengaluru and cumulative capacity will be 22,000 books per day and revenues are now touching Rs.130 million per quarter. It has a negative working capital cycle.

By the end of 9MFY20, it listed over more than five million titles, two operational facilities, one in Bhiwandi and other in Delhi and third facility is expected soon in Bengaluru and cumulative capacity will be 22,000 books per day and revenues are now touching Rs.130 million per quarter. It has a negative working capital cycle.

Repro seems to be entering an exciting phase of growth with its capex almost over and commercialisation of the new capacity set to start in FY21. The balance sheet has become healthy with debt/equity ratio falling to 0.35 in December 31, 2019, as against 0.52 in March 31, 2019. Operating cash flows have been improving and the company may start generating healthy free cash flows from FY21. The debtor days, too, have reduced from 105 to 68, over the same period.

One thing to note is the old printing business could continue to be a cash cow for the company, in-spite of the topline being range bound. Thus, Repro would have a healthy working capital cycle and would become debt-free sooner than expected.

Being the first-mover in this space, we expect Repro India to have minimum one-third market share in three to four years, and we are confident that it will disrupt the industry in a meaningful way.