ICICI Securities (I-Sec) is one of the largest and oldest equity brokers in India and ranks number one with an overall retail client base of 4.7 million, and number two by active client base with 10% market share and number two in market volume with a 9% blended market share — its retail volume share is higher than its blended share. While the advent of discount brokers has dented margin, I-Sec is still the number two by revenue market share, with a CAGR of 14% over FY14-19.

ICICI Securities (I-Sec) is one of the largest and oldest equity brokers in India and ranks number one with an overall retail client base of 4.7 million, and number two by active client base with 10% market share and number two in market volume with a 9% blended market share — its retail volume share is higher than its blended share. While the advent of discount brokers has dented margin, I-Sec is still the number two by revenue market share, with a CAGR of 14% over FY14-19.

I-Sec is a full-scale broker and provides research, margin funding and a full bouquet of other financial products including mutual funds, life and general insurance, and third-party loan products. The leadership position extends even to the distribution piece, where I-Sec is the second-largest non-bank distributor with a market share of 4% as on FY19, as per AMFI. The capital markets business remains its crown jewel, with I-Sec being number one domestic financial advisor by revenue for FY19, as per Prime Database.

The moat

As a subsidiary of one of the largest private banks in India, the ICICI brand provides customers the trust, especially given the recent incidents surrounding client asset misappropriation, with client’s custody sitting with the bank. I-Sec has been an innovator from the start, with being the first to provide eATM facility to all clients, where up to Rs.500,000 is transferred to all clients within half an hour against industry practice of T+2 (transfer day plus two) working days. I-Sec still has a sizeable customer base above the 40-year age bracket, which is considered sticky and a segment that has been difficult to crack by discount brokers.

The biggest moat in financial services in India has always been distribution, which serves the dual purpose of client acquisition and servicing. While the broking industry has moved online with 30% of the NSE cash and derivatives trade being done via the internet, broking still remains a light touch model, and being the subsidiary of a bank with 4,874 branches, of which 50% are in semi-urban and rural areas, has its advantages.

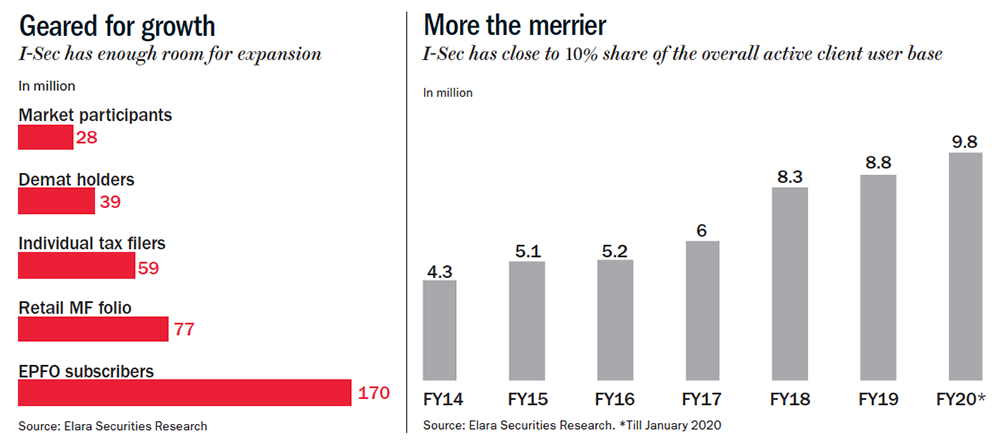

We see enough room for the industry to expand client base from a mere 28 million retail participants (See: Geared for growth), of which I-Sec has 0.96 million on board as active users on December 2019 (See: More the merrier). Beyond the natural shift to financialisation of savings, which benefits the industry at large, the firm has other advantages including the 8,600-plus sub-brokers.

We see enough room for the industry to expand client base from a mere 28 million retail participants (See: Geared for growth), of which I-Sec has 0.96 million on board as active users on December 2019 (See: More the merrier). Beyond the natural shift to financialisation of savings, which benefits the industry at large, the firm has other advantages including the 8,600-plus sub-brokers.

Beneficiary of consolidation

A growing client base (2x over FY14-20) and a revenue pie (16% CAGR over FY14-19) are testaments of I-Sec weathering the storm of discount broking, which heightened since FY17. Revenue did take a beating at 64% CAGR in average daily turnover versus revenue growth of 16% over FY14-19, though not all was because of pricing but also a shift to derivatives and intraday trading.

Recognising the needs of new-age customers and aggressive competition, the management led by Vijay Chandok has taken steps to bridge gaps in pricing and products. I-Sec launched a separate membership plan called Prime, where it has reduced the rack rates, although they are still higher than those of discount brokers. The steps have been well received with 5% of the customer base shifting to Prime, which has resulted in increased activation rates.

Of the 230,000 Prime customers, 90% are in the first category, as per the management. While volume has held up for 60% for 9MFY20, broking revenue was down 2% YoY, which we ascribe to the launch of Prime at the start of the current fiscal. We currently do not build in any material shift of customers to Prime, and expect FY20 brokerage revenue to see 2% YoY growth. Margin trade financing, too, has picked up with a quarter on quarter jump in book to Rs.11 billion in Q3FY20 from Rs.6.8 billion in Q2FY20. Management sees this is as a stable source of revenue. Given its current networth of Rs.10 billion, I-Sec has the ability to grow this 4x.

Tightening rules a positive

Despite the growing size of the broking industry, the regulator has not increased the minimum networth requirement for trading and clearing membership (TM & CM) in the capital market and futures and options segment, which currently stands at Rs.30 million. The networth for large brokers remains high and comfortable and gives them an edge. The changing regulations, while do not directly increase the requirement, are pro-large brokers given their stronger balance sheets.

We see tightening regulations working towards the benefit of large brokers and increasing networth requirement putting a floor to the price war. On one hand, a stricter implementation on margin funding will be detrimental for the industry at large. On the other, regulations to reduce settlement frequency and inability to use client assets post the Karvy episode work in favour of I-Sec. We expect a 27% CAGR in market volume over FY19-24, with I-Sec growing higher at 28% as we build in market share gains. These gains could be sharp due to the reducing competition, but we keep them conservative, given the uncertainty around margin funding. We expect 12% CAGR in broking revenue over FY20-22 on the back of 20% CAGR in market volume and a slight dip in yield to account for the impact of Prime and Option20.

Amazon Prime of broking industry

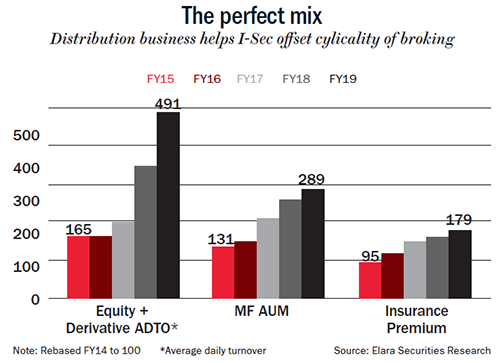

I-Sec historically has had a diversified revenue mix, with distribution being an integral part at 23-26% of revenue. This makes the company partly offset the cyclicality of the broking business. The management’s long-term objective remains to have a 50:50 broking and non-broking share, which stands at 57:43 currently.

The largest pie in the distribution piece is mutual funds. With an MF AUM CAGR at 24% over FY14-19, I-Sec has seen its client MF post an AUM CAGR of 35% over the same period, with market share in commissions going up from 2.3% in FY14 to 4.0% for FY19. The recent total expense ratio (TER) cuts have dragged MF revenue down 3.0% for FY19. We estimate MF revenue to fall by 16% YoY for FY20, with growth resuming over FY21-22.

Being a one-stop shop, insurance is also a part of the bouquet of services. But unlike MF, the tie-up is only with group companies on the life (LI) and general insurance fronts, while for health, it has tie-ups with two standalone health insurers. The management is looking to go the open architecture route here too, which could be an additional growth lever. Revenue for the LI business has been flat in 9MFY20, due to subdued performance by ICICI Life Insurance with annualised premium equivalent (APE) up just 1.2% for 9MFY20. We see it improving once ICICI Prudential Life picks up steam.

I-Sec has other distribution products, including the National Pension Scheme, Alternative Investment Fund, portfolio management services and fixed deposit, which contribute to 28% of distribution revenue. We expect distribution income to bottom out in FY20 for the combined impact of TER cuts and slower growth by ICICI Prudential Life. We estimate distribution income at a CAGR of 13% over FY20-22.

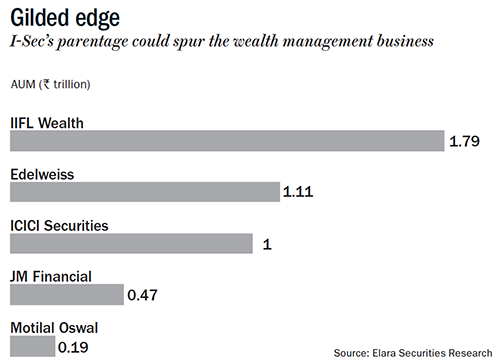

Long entrenched relationships are the backbone of wealth management, with I-Sec boasting of 65% of revenue contribution by customers who have been in association for more than five years. I-Sec classifies its wealthy clients as having asset under advice of more than Rs.10 million and currently stands at an aggregate of Rs.1 trillion spread over 30,000 strong client base (See: Gilded edge). Given limited disclosures, the potential from this pie could range from 12% to 30% of revenue. We see this piece gaining increased focus under the new management and could be a significant value driver.

As far as investment banking activity goes, FY16-18 were the best years as I-Sec reported Rs.1.4 billion in revenue for FY18, at a CAGR of 31% over FY15-18. FY19 was hurt by the IL&FS crisis, which combined with the fall in consumption reflecting in macro and GDP growth rate. With GDP growth and capex expected to bottom out, we expect capital market activity to revive in the medium term. Additionally, the government’s Rs.2 trillion divestment target will be a key driver to revive capital market activities. I-Sec remains the largest domestic financial advisor by revenue, and a high share in public issuances will enable it to capture the above opportunity.

As far as investment banking activity goes, FY16-18 were the best years as I-Sec reported Rs.1.4 billion in revenue for FY18, at a CAGR of 31% over FY15-18. FY19 was hurt by the IL&FS crisis, which combined with the fall in consumption reflecting in macro and GDP growth rate. With GDP growth and capex expected to bottom out, we expect capital market activity to revive in the medium term. Additionally, the government’s Rs.2 trillion divestment target will be a key driver to revive capital market activities. I-Sec remains the largest domestic financial advisor by revenue, and a high share in public issuances will enable it to capture the above opportunity.

We are conservative in our projections of overall revenue CAGR of 12% over FY20-22 on the back of 12% CAGR in broking revenue and 13% for non-broking. We currently project 20% CAGR in market volume over FY20-22 against 68% over FY17-19, and we expect further moderation in pricing owing to the adoption of Prime and Option20.

Call for efficiency

Profitability of the capital markets businesses is volatile, given the cyclical nature of business, which coupled with lofty employee cost, makes it a highly operating leverage play. For I-Sec, profit before tax margin has been moving from 20% for FY14 to 44% for FY19 and has maintained during 9MFY20. This is a result of the following: One, tight leash on other opex, which was up by 3% CAGR over FY14-19, owing to the strategic shift in closing down branches. As per the management, direct cost toward branches is 10% of FY19 overall cost, and, thus, has further scope for rationalisation as it closes more branches. Two, given the increasing use of digital as a platform, I-Sec has broadly maintained headcount, but wage inflation has meant employee cost rising at CAGR of 11% over FY14-19. Management is now only looking to fill vacancies which are crucial, else the headcount is expected to rationalise further. Three, the focus is also on reducing cost-income ratio to 50% by FY22.

One-stop shop

We see merit in financialisation of savings as a theme and expect financial savings to post CAGR of 11% over FY19-24. Even with intense competition in financial services and disruption from new entrants, we believe I-Sec will hold its fort as it has weathered the storm with a strong balance sheet. I-Sec’s net worth of Rs.100 billion is more than combined networth of 400 small brokers.

It ticks off all the boxes — leadership position across clients, revenue and distribution, and a strong brand that instills trust. The organisation has a lot of firsts to its credit and continues to innovate under the aegis of a new management, which we believe is of utmost importance, given the competition from fintech. Another advantage to I-Sec would be the continued consolidation into larger brokers. A diversified business model and expectation of further diversification bode well to reduce cyclicality (See: The perfect mix). We expect FY20 to be a bottom for revenue growth and expect it to pick up to 12% CAGR over FY20-22. This clubbed with an 6% CAGR in opex would result in an earnings CAGR at 21% over FY20-22.

It ticks off all the boxes — leadership position across clients, revenue and distribution, and a strong brand that instills trust. The organisation has a lot of firsts to its credit and continues to innovate under the aegis of a new management, which we believe is of utmost importance, given the competition from fintech. Another advantage to I-Sec would be the continued consolidation into larger brokers. A diversified business model and expectation of further diversification bode well to reduce cyclicality (See: The perfect mix). We expect FY20 to be a bottom for revenue growth and expect it to pick up to 12% CAGR over FY20-22. This clubbed with an 6% CAGR in opex would result in an earnings CAGR at 21% over FY20-22.

Big to bigger

We see changing regulations working in favour of large brokers as the smaller ones find it difficult to sustain incrementally. This opens up 35% of market share gains for large brokers. Risks from the entry of other big firms such as Paytm remains, but having weathered the onslaught from the largest discount broker Zerodha with continued increase in market share, I-Sec is likely to ride this one out, too. A one-stop shop for all financial products provides stickiness and is expected to provide delta to earnings and reduce cyclicality of business.

Importantly, I-Sec has been an innovator at its core. With Chandok taking over charge in May 2019, the company has further strengthened its offerings. The incumbent management undertook an extensive internal assessment to bridge product gaps, further strengthen the core and plug excesses in cost. The new launches via Prime and Option 20 is already visible in a 133,000 increase in active client share over the past 10-11 months to 988,000 in January 2020. Along with that, blended volume market share has also moved up from 8.1% to 8.9% as on December 2019. Additionally, the management looks to adopt open architecture in distribution of life and general insurance segments and acquire non-ICICI bank customers as well to broaden the customer base. We see strategies playing out well with Chandok at the helm until FY24.

We are bullish on I-Sec with a target price of Rs.610, based on an earnings growth model which implies a P/E of 26x. We see moat in the business, reflective in its wide distribution, brand name, good balance sheet, diversified revenue streams and strong execution.