here are several companies that have generated alpha in my fund but the one that stands out for me is my bet on a company that eventually emerged as the country’s third largest cement maker. But before dwelling on that, let me articulate on what I look for in a good investment. To begin with, a company has to be a good capital allocator over an entire business cycle; second, it has to be run by a passionate promoter, and third, the management should pay importance to cash flows, followed by the balance sheet and then the P&L and not the other way around. Last but not the least, the valuation should be favourable. Companies that fall in this investment framework could possibly end up as multi-baggers, and Shree Cement was one such investment.

It was FY04 when I first came across Shree Cement. It was a marginal cement player with less than 2 MT capacity. It’s been a ritual for me to read annual reports and what struck me about the company then was that despite its size, its ambition was always big. The company’s annual report even then revealed the promoter’s enthusiasm about the future of the cement industry, and the zeal to capitalise on the infrastructure growth story. I had the company in my radar but the fact that it was a micro cap and the promoter was still to prove his mettle made me circumspect, initially. But Hari Mohan Bangur kept delivering on his stated milestones. By FY06, Shree was a 3.5 MT entity, and the beauty was that the expansion was entirely funded through internal accruals. That the company was getting better and better at execution was evident when in FY11 it set up a 1 million tonne clinkerisation unit in Rajasthan in record 330 days compared with the industry average of 630 days. In doing so, Shree broke its previous world record of 367 days achieved in 2009. Today, the company has, from being a nobody, gone on to become a formidable No 3 cement player with 29 MT capacity.

Whenever one invests in a commodity business, the three things to watch out for are: first, whether a company’s capital cost is the lowest in the industry, which means the entity constructs a plant at the lowest cost possible with the best of equipment and in the lowest possible lead time. Second, the company’s capital cost should be lower than its peers. In Shree’s case, its costs are till today 30-40% lower compared with that of its peers as far as greenfield or brownfield expansion is concerned. Third, the opex, a key sustainable advantage, has to be lower than your peers. Here again, Shree continues to operate in the lowest cost quartile.

Incidentally, Shree was the first company in India to talk about petcoke as an alternative fuel. Since fuel is the largest component of cost in cement manufacturing, Shree began experimenting feeding petcoke in its plants since early 2000. Despite breakdowns initially, the management persisted with its experiment which went on to become a resounding success. By the end of FY10, a majority of the company’s capacities were dual-fuel linked. It’s not without reason that Shree did what it did as petcoke is not just a cheaper alternative (40% cheaper than coal), but enjoys higher calorific value per tonne, thus ensuring more energy output. Not surprisingly, Shree’s fuel costs have stayed lower over the years.

Shree’s other big initiative was in the area of logistics. Instead of carrying cement from the plant to the end consumer, it began the practice of transporting clinker to a grinding unit closer to the market and ship the cement from the facility in a shorter time span to the end customer. This trend of setting up split grinding units closer to the market has since became the norm in the cement industry.

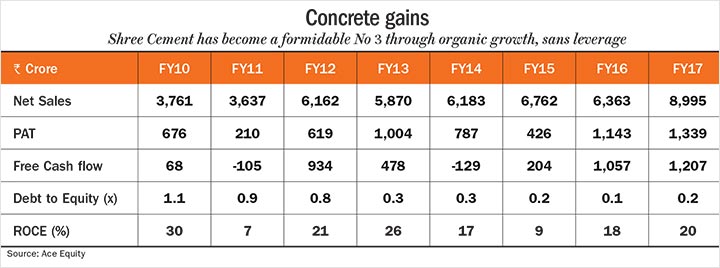

As it grew in size, Shree’s operating profit from around Rs.103 crore in FY03 is up 28-fold to Rs.2,874 crore in FY17. It has managed to achieve this feat without equity dilution and without any debt on the balance sheet. The company’s share capital has stayed at 3.4 crore shares (Rs.34 crore) since inception. The promoter were also clear the company would be low dividend paying company till such time it is able to deploy shareholders’ money in a high RoE business. Its RoE has gone up from 3% in FY03 to 18% in FY17. But for the recent special dividend in January 2017, their payouts have been very minimal. The company kept deploying capital back into the business. Its 10-year profit CAGR is 17%, while topline is 19%, much higher than the cement industry’s growth rate.

Though it’s a highly profitable company (Rs.1,340 crore in FY17), the management never focused on the P&L but on cash flows which aligned with our investment framework. The company’s depreciation policy was one of the most aggressive among its peers as it depreciated the plants in four to five years. Hence, more than PAT, the company ensured its cash flow was always robust and it ended up saving on taxes as well. The other important hallmark of Shree is that in its life cycle it has had just one buyout, and in the first year of acquisition, the goodwill created was written off. Most companies carry on with goodwill as an intangible on their books. These small attributes is what make for a good company. Even today Bangur is as engaged and passionate as he was a decade back. I remember him saying once that if a promoter is less attentive or less passionate 1% of the time, the guy below him will lag 2% and the chain will follow right down through the organisation, making it inefficient. Hence, a passionate promoter is always a critical factor for an investment to succeed.

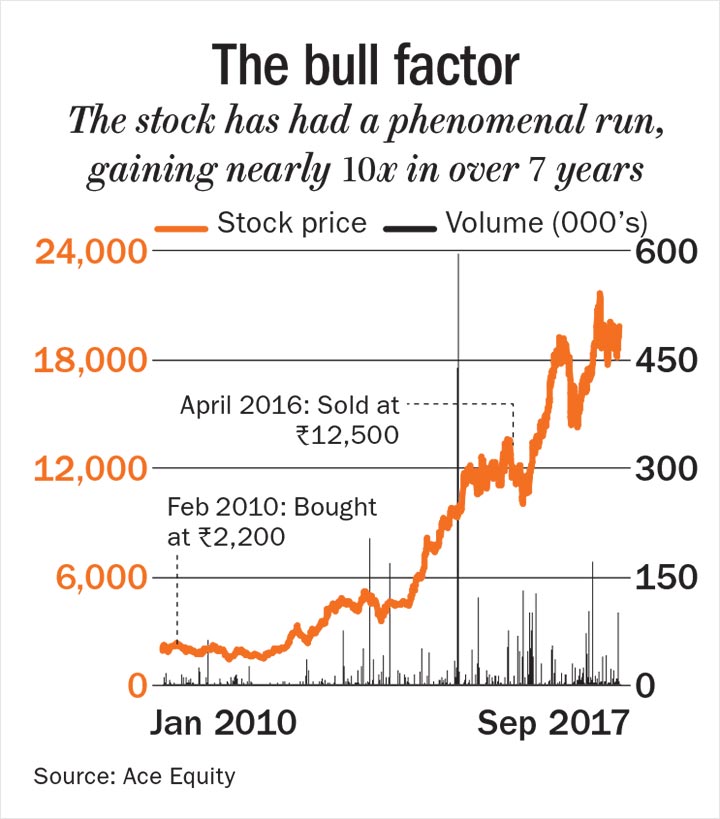

During the crisis, when I was with Principal AMC, I bought the stock after it fell to Rs.400 levels from its highs of Rs.1,100. The stock at that point in time was available at an EV/Ebitda of 5x. In 2010, I moved to Kotak Mutual Fund, where I bought it again at roughly about Rs.2,200 levels in February 2010 in the Emerging and Mid-cap funds. Though the valuation [EV/Ebitda] was around 10x, it was not completely out of whack as the company was still in the capacity ramp-up phase and the call was that, five years down the line, it would be a significant cement player. I still repent buying less — we had a weightage of only 1.5-2% in the two funds. In April 2016, we sold the stock at Rs.12,500 levels as its valuation [EV/Ebitda] was no longer cheap at 17x.

Selling Shree was a valuation call and not a comment on its fundamentals. Even today the stock is expensive but then good companies don’t come cheap.

Investing lesson

To know a company’s future, you need to know its past. Hence, reading up on annual reports gives you a sense of what the promoters’ real intentions are and whether they are living up to their statements. I invested in Shree Cement only after it kept delivering on its promises with prudent risk management. Rome was not build in a day. Great companies don’t spring up overnight, they are painstakingly built over decades.

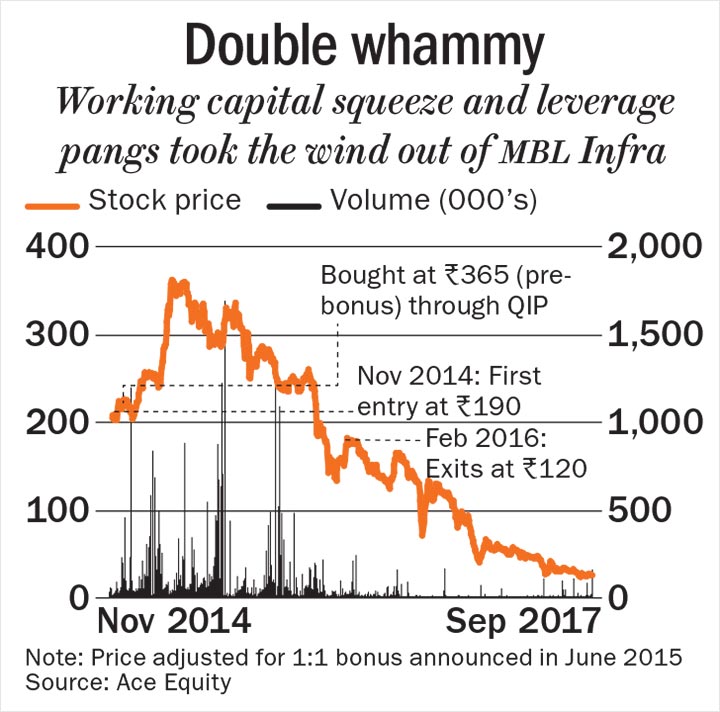

The moment you deviate from your investment framework then in all probably you are going to end up with a dud, just like I did. Unlike Shree Cement where I had kept a track of the company over a period of time, one of my worst performers turned out to be a company that was an outcome of playing a macro theme. It was in 2014, buoyed by the new government’s drive to push infrastructure, especially road projects, I took a call on MBL Infrastructures.

My call was that if the government has to achieve its ambitious road projects, it would lead to a situation where a handful of mid-cap companies such as MBL could turn out to be big beneficiaries. Though a small player, the company had done some good projects. Hence, execution was not a worry. In December 2014 (Q3FY15), the company issued a QIP, wherein we were one of the buyers, at Rs.365 a share (pre-bonus). When we took a position, we were given the impression that the working capital days, one important component of return on capital, will improve from the prevailing 120 days.

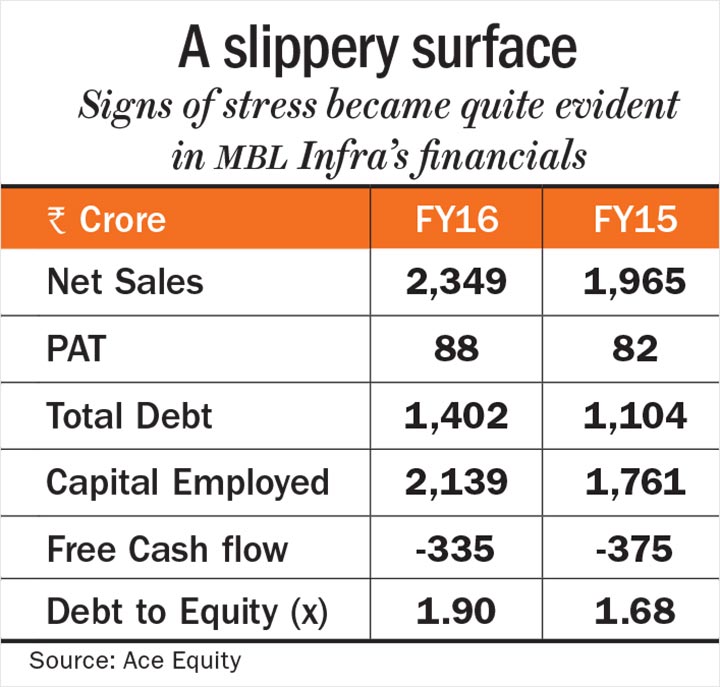

Though the stock initially went up after the QIP, over the ensuing 18 months, things did not turn out right. Every quarter the working capital kept growing. The reasons were flimsy and unconvincing. Inventory days were high and debtor days too were increasing. Inventory levels increased from Rs.490 crore as on September 2014 to Rs.740 crore by March 2016. Similarly, debtors increased from Rs.300 crore to Rs.700 crore over the same period. Working capital, instead of improving, had deteriorated and stood at over 180 days, leading to an increase in debt.

We kept evaluating it very closely and from our field trips we got to know that some of the company’s hybrid annuity model projects were not gaining financial closure. We also got a whiff that some statutory dues were not paid by the company. These were enough indications that the story was not going as per script.

If working capital keeps ballooning it means the company is unable to churn its capital faster. We eventually decided that the thesis was not working well and given that the ROC had fallen from 15.39% in FY14 to 14% by FY15, we were getting a bit uncomfortable. The management too was not able to provide convincing answers. All these red flags were enough to show that things were not going to look rosy. Given that the company needed to invest fresh equity in its BOT portfolio and additional equity in the HAM projects, there would have been more strain on the balance sheet.

We started offloading our position in the third quarter of FY16 and completely exited our position in both the Emerging and Mid-cap funds by end of FY16. Against our average acquisition price of Rs.190 [including the QIP investment], we ended up exiting at an average of Rs.120, a more than 37% erosion, in February 2016. The stock, in fact, went on to lose 87% of its value.

Investing lesson

Never deviate from your investment framework; avoid sticking to low ROCE stocks hoping for things to turn around. If you don’t get convincing answers and the management is not delivering what it states, cut your losses and move on.

The views expressed by the speaker are to be construed as portfolio action taken and not as an advice for making investment in the mentioned stocks. Portfolio management of any scheme is at the discretion of the fund manager.