Did you know that Motherson Sumi Systems (MSS) is India’s largest auto ancillary company? When I put this fact before investors and friends, they were surprised since most of them believed that that achievement belonged to Bharat Forge or Mico (now Bosch India). Their reaction is not without reason. Even 10 years ago, MSS was just one-third of Bosch — its revenue was just under ₹500 crore, compared with Bosch’s ₹1,700 crore and Bharat Forge’s ₹685 crore. Today, with revenues of ₹25,225 crore (FY13), MSS is the largest domestic auto ancillary firm (Bosch reported ₹9,300 crore revenue and Bharat Forge reported ₹5,900 crore in FY13). In fact, MSS’ revenues make it bigger than Bajaj Auto and Hero MotoCorp.

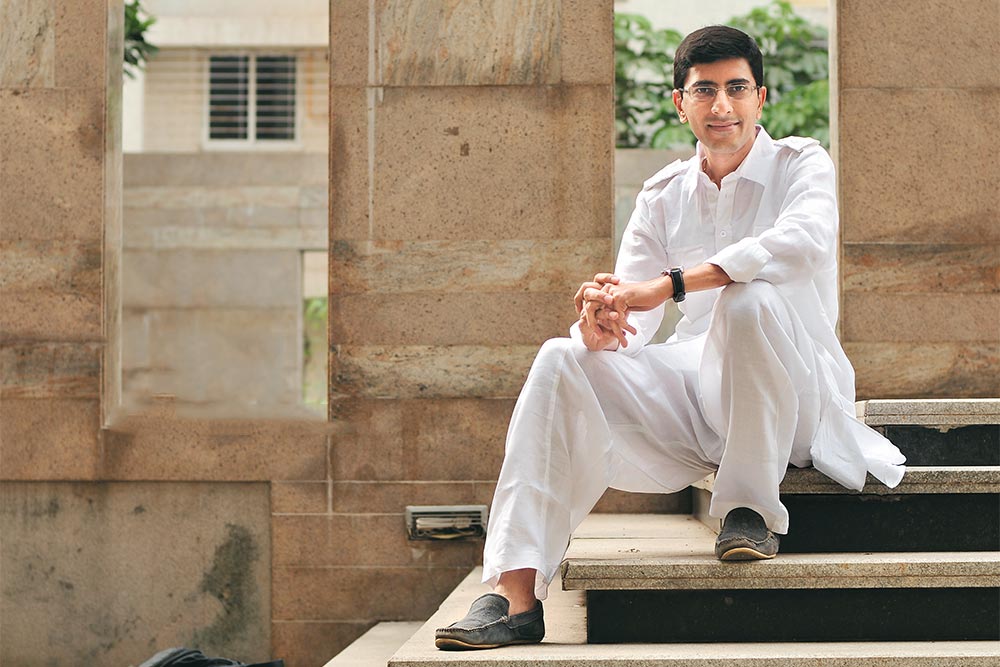

Over the past 10 years, under the leadership of Vivek Chaand Sehgal, MSS grew its revenue by 65 times and net profit by 12 times, from ₹35 crore to ₹444.5 crore. Like many Indian firms, part of this growth was through the inorganic route (MSS made nine acquisitions in 10 years). However, unlike many other firms, its acquisitions did not dilute earnings or return on equity. The reason was that the acquisitions were often driven by requests from customers. That is one of the major reasons why valuations paid by MSS while acquiring the companies were very attractive and had a low pay-back period. For instance, MSS paid just €19 million for SMR, which had revenue of €500 million. And, by acquiring SMR, it became the second-largest exterior mirror manufacturer in the world.

Thus, MSS is very selective while making acquisitions — the target has to not only complement its existing product offerings but also strategically add to its technology domain, customer base and geographic reach and help the company become the market leader in the category. This was again evident when MSS acquired Peguform (SMP) in November 2011 ($1.8 billion): it became the leading supplier of bumpers and interior components, added German OEMs such as Volkswagen, Audi and BMW to its client list and entered new geographies such as Brazil, China and Mexico. Today, Motherson Sumi has a presence in 25 countries and most of its 125 manufacturing facilities are not only low-cost but are also located closer to its global customers.

Buyout binge

Acquisition is an integral part of MSS’ strategy. Both its global acquisitions — SMR and SMP — are expected to give significant synergies to the company. It got access to new customers such as Hyundai, Volkswagen and GM to supply components globally, for which SMR has added new manufacturing facilities in China, Hungary and Brazil. At the same time, the expertise of SMR and SMP will help it cross-sell mirrors, bumpers and cockpits to Indian customers. Acquisitions have helped MSS to add $1 billion in additional revenue and gain the ability to make high-end products. Also, as the Indian market matures, it will demand advanced technological products. Absorption of acquired technology will help MSS to further improve its market share in India. SMR and SMP are also expected to witness significant improvement over the next three years, if new order win is any indicator. Both firms have received huge orders in H1FY14 — while SMR won new orders worth €842 million, SMP won orders for €1.76 billion. New order wins also reflects customers’ trust in MSS’ capabilities.

Another important strategy it follows is a focus on productivity. When the company acquired Visiocorp (SMR), it became Ebitda positive within the first quarter of the acquisition. Similarly, Peguform reported 3% Ebitda in 4QFY13 compared with barely breaking even earlier. Higher capacity utilisation, turnaround in loss-making units and operational efficiencies will further improve operating margins. We expect both SMR and SMP to witness significant improvement in margins of close to 10% from 6.4% and 3.8%, respectively, in FY14. With rising revenue and operating margins, the combined operating profit of SMR and SMP is expected to jump from about ₹1,000 crore in FY13 to ₹3,000 crore in FY16.

In India, MSS is the leader with over 65% market share in wiring harness and 53% market share in exterior mirrors. In H1FY14, despite the sluggish growth of the domestic car industry, standalone revenue grew by 16%, driven by increasing content per car and improvement in market share.

In good hands

MSS is perhaps the only company in India that clearly articulates its five-year vision plan in the annual report. The management spells out not only its revenue target but also its return on capital employed (RoCE) target, set at 40%. With two acquisitions and significant investment in new capacities, its present consolidated RoCE is over 17%.

However, we believe that as operating profit margin improves and asset turnover increases from present levels, RoCE will improve significantly. We expect MSS to witness a 3X jump in profit and expect the stock, trading an attractive valuation of 12 times estimated FY15 earnings, to fetch a handsome return for investors with a 12-24 months’ horizon.

The writer does not hold the stock in his personal capacity, but AAA holds the stock in its client accounts