Would gladiators have been considered as glorious if they had been thrown into an arena against a hapless goat? Nope. You need a worthy rival to claim glory. An institutional sell-side broker and his buy-side investment manager aren’t exactly adversaries, but one’s selling skill is pitched against the other’s critical analysis. And every sales pitch could be a learning opportunity, realised Harshad Patwardhan, CIO, Edelweiss Mutual Fund, early in his career.

He entered the capital markets as a broker in 1994. For the next 12 years, he worked with various organisations including Marlin Partners, Caspian Research India and Deutsche Equities, covering sectors such as oil, gas, auto and engineering. The clients were mostly foreign institutional investors since the domestic mutual fund industry was just taking off, and Patwardhan says, interacting with these highly experienced fund managers and observing the kind of questions they asked, gave him “invaluable perspective”.

For instance, from Edward Pulling of JP Morgan Asset Management, Patwardhan learnt the lesson of looking at the bigger picture. Analysts are trained to think from a bottom-up perspective, but Pulling taught him to appreciate linkages of a business to other sectors and the economy. “He taught me when to look at the bigger picture and when to focus on the smaller details,” Patwardhan recalls. From others, he learnt the importance of looking at parameters besides valuation and how to research a stock thoroughly even when it has minimal coverage.

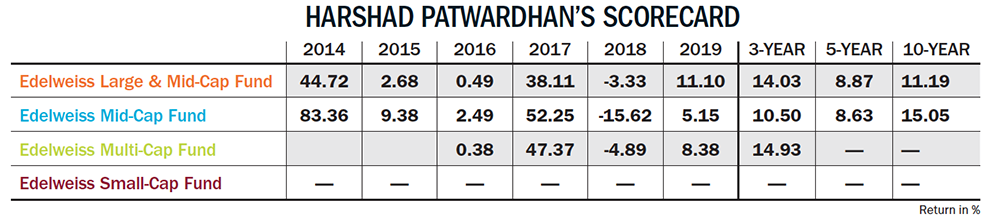

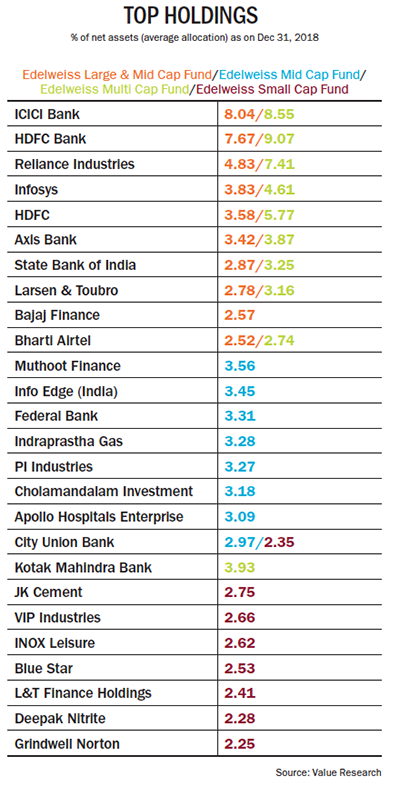

This arsenal of advice came in handy for Patwardhan when he stepped onto the buy side with JP Morgan Asset Management in 2006 as a fund manager. There, he managed the Equity Fund, Smaller Companies Fund and Economic Resurgence Fund. In 2016, after JP Morgan’s India business was acquired by Edelweiss AMC, the schemes continued to remain under Patwardhan’s purview. Currently, he looks after Edelweiss’ Large and Mid-Cap Fund, Multi-Cap Fund, Mid-Cap Fund, Long-Term Equity Fund and Small-Cap Fund. Managing schemes as diverse as these is a tall task for any fund manager. Despite these challenges, data from Value Research shows that Patwardhan’s funds, with an AUM of Rs.23.13 billion, have delivered a return of 13.25% over the past ten years.

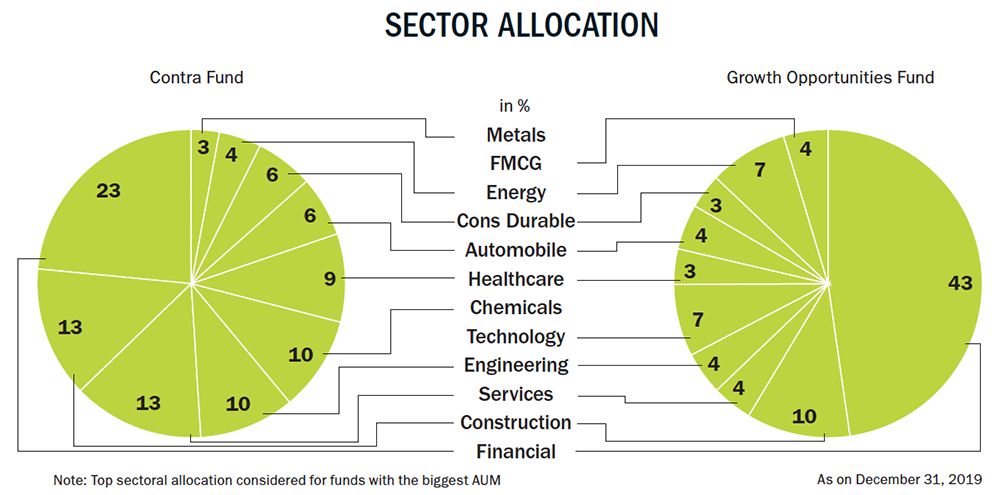

He does not care much for the large, mid or small-cap classifications and says that it is a myth that mid and small-caps are of inferior quality. He invests in them by scouting for leaders in their industry. Therefore, he prefers to go by the categories of “well-researched” stocks and the “less-researched” ones. Similarly, he does bother much about “fads and fashions” in the market. Sectoral weightages are important to mitigate risk but otherwise he follows the bottom-up approach. For this, he looks for companies that display growth and reinvestment opportunities in markets that aren’t saturated. For example, private sector banks and consumer companies that have compounded growth consistently, over a long period of time. While asserting that no one formula fits all, he looks at the quality of management, balance sheet and cash flow of a company.

Meanwhile, valuation holds minimal weightage in his checklist. He cites the example of several consumer businesses or retail private sector banks that have always appeared expensive, but there was never a reason to sell them. His bets have paid off as they have given strong 20% compounded return. Similarly, there are stocks that always look cheap, and no one makes any money buying them. So, Patwardhan relies on a company’s earnings progression, valuation and dividend yield together to evaluate its stock price return, a learning he picked up during his days as an analyst.

Meanwhile, valuation holds minimal weightage in his checklist. He cites the example of several consumer businesses or retail private sector banks that have always appeared expensive, but there was never a reason to sell them. His bets have paid off as they have given strong 20% compounded return. Similarly, there are stocks that always look cheap, and no one makes any money buying them. So, Patwardhan relies on a company’s earnings progression, valuation and dividend yield together to evaluate its stock price return, a learning he picked up during his days as an analyst.

Before the final go, Patwardhan looks at it through a risk-reward framework – assessing the potential upside and downside. His IndusInd Bank buy in 2009 is an example of this trade-off. That year, Romesh Sobti had just taken over as the CEO of the bank, which did not have any retail product barring vehicle financing, and had several regulatory and compliance issues. Sobti put forth a clear plan to tackle compliance problems, and extend the product offering in retail and then corporate lending in three-year phases each. At the time, the stock was trading close to book-value and Patwardhan decided to buy into it. As the management delivered on its promise of growth, Patwardhan kept increasing his position. Over the past ten years, the stock delivered a CAGR return of 43% and he exited the stock in 2018. The risk proved worth the reward.

A similar example is from 2013. At the time, emerging markets, including India, weren’t doing well. There was a big sell-off that followed, as a result of which small and mid-cap stocks especially in the construction space began trading at extremely cheap valuations of 0.3-0.4x P/BV. Upon some research, Patwardhan managed to find a few good companies in this space, and among them was Action Construction Equipment. The company was a leader in construction equipment in select categories, and was hardly covered by analysts. But Patwardhan drew from his experience from the ‘sell’ side to evaluate the opportunity and found it a lucrative one. The stock turned out to be a multibagger, and he exited the stock with six-year CAGR return of 34%. The trick, in small and mid-caps, is to identify winners early. “It is not easy. But if you can, you benefit from compounding of earnings and valuation rerating,” says Patwardhan.

While these are his ground rules for stock picking, Patwardhan has a plan for the overall holding as well. All his bets fall into four buckets. There are ‘strategic’ stocks, to be bought and held for a long period of time. The second is ‘tactical stocks’, which are cyclical in nature. “You don’t want to hold these over a long period of time, but you want to buy them at the right time in the cycle,” says Patwardhan.

The third category is ‘option stocks’. The outcome of such stocks can be zero or one, says Patwardhan, which means they can either be multibaggers or can go down significantly. These are typically businesses that don’t have a long track record for business or management, but from a topdown (economy-sector-stock) perspective, appears to be very attractive. “It is called ‘option’ to remind ourselves that it is that, and we don’t get carried away and own too much of it,” he says. The fourth are ‘defensive stocks’, usually from the large and mid-cap category and are a big part of the benchmark. “I may not be very positive on them. However, I am not so confident to own zero,” he says.

The allocation of stocks across these four categories varies based on circumstances. For instance, when conviction is high, allocation to strategic stocks tend to be high. But at inflection points (such as upcycle of a sector), tactical bets rise. Defensive and Option tend to remain a smaller part of his portfolios.

He is also a stickler for maintaining sufficient liquidity in his portfolio. “If you are not disciplined about maintaining liquidity, what tends to happen is that when redemption pressure comes, you will be forced to sell your higher quality liquid stocks,” he says. He also keeps in mind the number of days it will take to exit a stock because of the position he holds. Patwardhan says that this planning is done at the design stage itself, and not as an afterthought.

He is also a stickler for maintaining sufficient liquidity in his portfolio. “If you are not disciplined about maintaining liquidity, what tends to happen is that when redemption pressure comes, you will be forced to sell your higher quality liquid stocks,” he says. He also keeps in mind the number of days it will take to exit a stock because of the position he holds. Patwardhan says that this planning is done at the design stage itself, and not as an afterthought.

Leveraging Experience

He spares no effort in designing a watertight portfolio, but he takes care not to get too attached either. “I have learnt that it is very important to not fall in love with any stock. Otherwise, it is difficult to be ruthless when time comes,” he says. For instance, he had identified the growth story in Eicher Motors way back in 2009, and reaped multibagger return when the company’s two-wheeler sales picked pace. But he was also quick to exit the stock at a CAGR of 74%, when he saw the risk-reward ratio tip unfairly in 2015.

Mistakes cannot be wished away but they have to be accepted and rectified immediately, according to him. In 2014, the government had made several announcements pertaining to micro-irrigation. Buoyed by the possibility of growth in this sector, Patwardhan had picked up a stake in a leading irrigation company. However, within six months, it was clear that while ‘Per Drop More Crop’ was a good slogan, it wasn’t exactly a priority for the government, and Patwardhan made an exit. “Translating top-down announcements into bottom-up stock picking is tricky. Sometimes it can take a long while for the companies to start doing well, and sometimes, it may never happen. That is a big learning,” says Patwardhan. Besides keeping an eye on one’s portfolio, he says, it is also important to keep an eye on stocks one doesn’t own. “In 2016, there was a big commodity stock price rally, and we missed that because commodities are not compounding stories,” he recalls.

Changing Times

Patwardhan has learnt to be flexible the hard way. He has always been overweight on financial, banks and consumer durables, but from being skewed towards retail private banks, his portfolio is now overweight on corporate banks over the past two years. “Corporate banks have more room to run up as economy recovers and NPA cycle turns,” he opines.

Similarly, he entered steel and telecom sectors recently. “For long, we were away from telecom because competitive intensity was high and companies made huge losses,” he says. But few months ago, it seemed like the end game was near. In the steel sector, he believes the cycle is turning based on global developments, such as improvement in demand from emerging markets such as China and price rise in domestic market.

Through it all, Patwardhan stays steadfast to his mandate. “I have to generate alpha, that is outperformance vis-a-vis the benchmark and try to be ahead of median in terms of competition,” he says. And, in this quest, his flexible approach to picking stocks is sure to come in handy.