It’s a cut. Deepika Padukone is at work, revisiting a take she just shot. As she does that, she’s also intently snacking on a cup of yoghurt. That’s what the Bajirao Mastani star digs into during quick work breaks — she calls it her ‘happy balance’. The 10-second ad did not have a single dialogue, but the message was clear, and the ad, a hit. Epigamia’s tasty snack — humble dahi in delectable flavours — delivers nutrition to those who are short on time.

The 37-year-old co-founder and CEO of Drums Food International, parent company of Epigamia, narrates how a four-year-old yoghurt brand became a rage, big enough to win the Bollywood star’s investment and brand ambassadorship. “Entrepreneurs need to keep throwing darts, each successive one closer to the target. That is what we did,” explains Rohan Mirchandani, the man better known as the founder of once popular ice cream parlour chain, Hokey Pokey.

Founded in 2007, Drums Food — co-founded by Mirchandani, Ganesh Krishnamoorthy, Rahul Jain and Uday Thakker — has seen its share of ups and downs. The four had set out to open a dessert lounge in Mumbai with an investment of Rs.1.5 million. It was unique, fun and an indulgence. A customer could choose the scoop of ice cream and toppings that ranged from cookies and chocolates to brownies and gems — a completely customised dessert, one of the first ones in the city.

Even as the ‘ice-cream lounge’ attracted customers and more outlets were opened, the founders realised that the brand’s topline was not growing. The premium positioning was its Achilles’ heel. “It was more of a celebratory brand. So, we would see good walk-ins during weekends, but the stores would be empty during weekdays,” recalls Mirchandani. They had to get more volume.

That’s when they turned the ice cream into an FMCG product. In 2014, Mirchandani set up a 2,000 square feet warehouse, and released Hokey Pokey’s best-selling flavours in stores. Within a year the 600 outlets were contributing 70% of its revenue, while 30% came from the parlours.

The success was, however, short-lived. With the onset of monsoon, sales saw a sharp dip, and since the business was entirely dependent on one product, revenue growth came to a standstill. It was time to go back to the drawing board, this time to find a product that was not so seasonal.

Not plain vanilla

The founders already had a few insights from their interaction with customers at the parlours. One, ‘healthy’ was becoming the buzzword. Second, their ice cream was working because it was fresh and had no preservatives. That helped them pin down a few options, one that also included frozen pizzas. But pizza and ‘healthy’ didn’t seem the best combo. Yoghurt felt like the perfect proposition.

Like with their ice creams, the founders decided to contemporise traditional yoghurt and its consumption pattern. First, they brought in flavours such as mango, strawberry and blueberry to make the boring dahi more fun. Then, to make it healthier, they settled on Greek yoghurt, packed with probiotics and eight grams of protein per serving. Third, they wanted to make the product a lifestyle brand. Hence, Epigamia — derived from the agreement signed during a war between the Mauryan and Greek empires in 300 BC.

Having established the positioning, they then created an entirely new category for yoghurt in the country. “Here, most people have dahi as part of their meals. But Epigamia became your healthy in-between snack, not a part of your thali. They redefined the occasion of eating yoghurt,” says Deepak Shahdadpuri, founder and managing director, DSG Consumer Partners, one of Epigamia’s early investors.

He adds that most people he spoke to before the launch were sceptical, especially when they revealed their pricing strategy (Rs.42 for a 90-gram pack), placing Epigamia above Nestle and Danone’s premium products. But Shahdadpuri, known for identifying winners such as Sula Wines, Veeba, Oyo and more, wasn’t deterred. “We back founders who want to become category creators,” he says.

His belief in the company is shared by other investors, including Verlinvest, French dairy major Danone Manifesto Ventures, InnoVen Capital and Cipla’s Samina Vaziralli, who have together invested $49.12 million in Drums Food. “Epigamia is part of the global wave of challenger brands, which are giving ‘Big Food’ (giant FMCGs) a hard time and gaining relevance and market share,” says Arjun Anand, principal, Verlinvest. This wave that Anand mentions hit the nation a few years ago with the likes of Paper Boat, RAW Pressery and iD Fresh Food, which disrupted several categories. They might not have eliminated the biggies, but they did force them to rethink their product strategy. Similarly, analysts state that the shelf space allocated to Greek yoghurt in retail outlets has been an ‘Epigamia creation’.

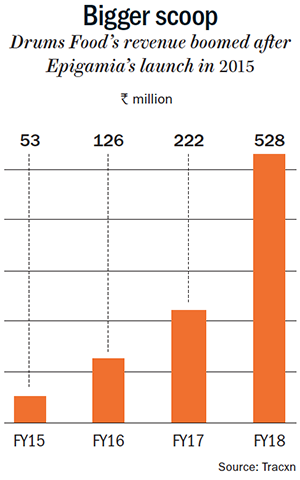

The investors’ and founders’ bet seems to be paying off. Epigamia’s premium positioning helped in improving margins, which in the dairy business are otherwise thin. Sales picked up within months after its launch in 2015, with products flying off the shelves instantly. “Epigamia started contributing 90% to Drums Food’s revenue within a year of its launch,” says Mirchandani (See: Bigger scoop).

But it was getting increasingly difficult to manage two brands. “For one, marketing expense on one brand wasn’t helping the other,” Mirchandani points out. Also, while ice cream requires a frozen supply chain, yoghurt required a chilled one, thereby doubling costs. These factors, combined with Epigamia’s early success, pushed the founders to gradually shut down their six parlours in 2016.

Sweet success

“We put all our learning from Hokey Pokey into Epigamia,” says Mirchandani, pointing to the wide array of products displayed at his office. The brand promises ‘real fruit, low fat, no preservatives and natural ingredients’, which acts as a strong pull for the urban consumer looking for healthy food choices. And its products, packed in sleek white cups with ‘Epigamia’ written on a colourful patch, are hard to miss as one walks down the dairy aisle in a supermarket.

Mirchandani says over four million cups are produced every month in Jaipur, Maharashtra and Andhra Pradesh, and the plan now is to upgrade that to 10 million cups in the next 12 months. Success of flavoured yoghurt prompted them to diversify into adjoining categories such as smoothies, curd, mishti doi and spreads in 2018, across a price range of Rs.30-350. Currently, they are available at 12,000 outlets across eight metro cities, ranging from kiranas and supermarkets to online kitchens and grocery stores. Additionally, the brand has partnerships with hotels, gyms and fitness centres. Since its inception, Epigamia’s sales have risen 20% every quarter. Its total revenue more than doubled from Rs.222 million in FY17 to Rs.528 million in FY18. The brand isn’t profitable yet, but they expect to break even in the next 18-20 months.

Epigamia competes with the likes of Nestle’s Grekyo and Mother Dairy’s Fruit Yoghurt. With deeper pockets and a much wider distribution, the reach of these companies is significantly higher. But, it’s interesting to note that even after Danone bowed out of India in 2018, it re-entered with an investment in Epigamia. Meanwhile, for Nestle, milk and nutrition products contribute about 46% of revenue. Within this, its condensed milk brand Milkmaid and dairy creamer Everyday contribute a major chunk. So, flavoured yoghurt is a very small pie and not really a focus category for Nestle, opine analysts. Similarly, for Mother Dairy, flavoured yoghurt is an insignificant category in terms of overall revenue. Meanwhile, analysts say that Epigamia has created a segment for itself, with good visibility and recall. Bigger brands have simply followed its lead. “Epigamia managed to achieve product-market fit early, which translated to a quick uptick in sales,” says Anand.

Epigamia ticks another box. For most start-ups that are niche consumer brands, growth starts to taper off at the Rs.2.5 billion revenue mark unless they look at clever category extensions. Epigamia is already doing that with its smoothies and spread offerings. The consensus is that it will continue to be a niche brand, but will see strong growth within the segment.

Tackling challenges

While Epigamia has had a great run so far, it is important to be cognisant of the challenges of scaling up. For one, it is difficult to maintain freshness when volume rises. “Since it’s a short shelf-life chilled product, a big challenge with growing distribution and scale for us is to ensure that the freshest product is available to consumers at all retail outlets,” says Mirchandani. To tackle this, the team is working on end-to-end digitisation of its supply chain. This includes using barcodes at all warehouse locations — 13 in five metros — and digitally tracking freshness at every store. “While distribution takes time and effort to build, it acts as a large entry barrier for new entrants,” he explains. For now, Mirchandani’s target is to take Epigamia to 50,000 outlets across 25 cities by the end of FY24.

Shahdadpuri believes that Epigamia is more of a consumer-goods platform, which delivers healthy, and tasty products. “For us, this is not and never has been a dairy business,” he adds. In the pipeline is India’s first flavoured ghee — chocolate, blueberry, banana caramel — made without preservatives. As they gear up for their next leg of growth, the endorsement from Padukone will come in handy in bolstering the popularity of the brand in newer markets. And just as Epigamia allows the celebrity to maintain a ‘happy balance’, it has also helped Drums Food find its own.