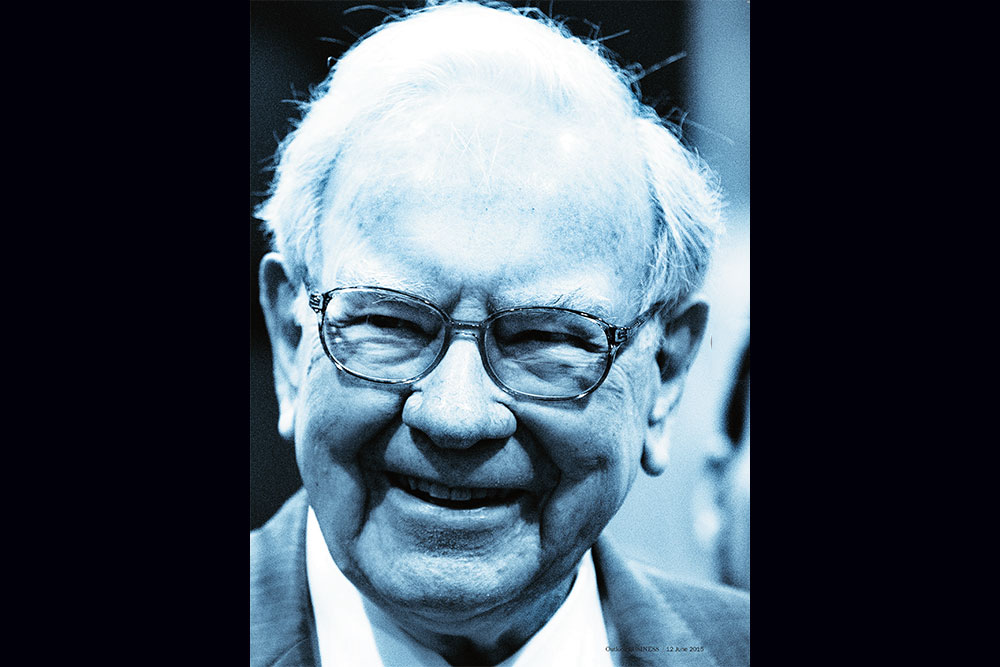

With more than 40,000 shareholders attending, the 50th annual meeting of Berkshire Hathaway under Warren Buffett was a big deal and the media frenzy was no exception. Media agencies from across the world were in attendance but Outlook Business was the only publication from India to get face time with Buffett after the annual meeting concluded. In this interview with N Mahalakshmi and Rajesh Padmashali, Buffett talks about his market outlook, why the management partnership with 3G Capital makes sense and how he handles compensation at his sprawling conglomerate.

Outside the US, which country is the best to win the ovarian lottery?

I think there are a lot of great countries. I could name 20 of them or more. But I don’t really spend a lot of time thinking about it because I am going to stay in the US.

Editor’s note: During the annual meeting, Buffett was all praise for China and this is what he said: “America’s ascent to claim a massive portion of global GDP was impressive and look at what China has done in 40 years. We found it 200 years ago and they found it 40 or 50 years ago. It’s just amazing that you can have people go nowhere, basically, in their lives, for centuries, and then it explodes. It’s the same human beings, but they found a way to unlock their potential. China and the US will be superpowers for as far as the eye can see.”

Berkshire has largely confined its investments to the US. Going forward, do you think it is imperative to look at emerging markets or will you still play that opportunity through American corporations?

We would love to find things anyplace. But we are more likely to find things in the US than any other country. We are also likely to find a few things outside the US. But we are better known in the US, there are more big businesses here and we have got to buy big things. So, it is likely that a substantial majority of our acquisitions in the next five years will be in the US. But I hope to find acquisitions throughout the world.

Editor’s note: During the annual meeting, Buffett said, “I would really be surprised if we don’t make at least one deal in Germany in the next five years. We’re eager, we have the money, and we do fit the family situation occasionally. Prices may be a little more attractive there than in the US.”

Given the prevailing interest rate scenario and the expectation about the future, where do you think equity multiples should be? What is the implication for future multiples?

Future multiples will be determined in a big way by future interest rates. In terms of return on capital, the base rate for the US investor is that of the US Treasury. If the US Treasury 10-year is yielding 6-7% five years from now, then equities will be at a different price than if the 10-year Treasury is at 2%. Everything is based on that. So, if you tell me what the interest rate will be, I will tell you what stocks will be at.

Editor’s note: A related question in the meeting was about the sustainability of corporate profit as a % of US GDP. Historically, it was 4-6.5% and currently, it is 10.5%. To which Buffett’s response was, “We live in an interest rate environment that Charlie and I would have thought was almost impossible not too many years ago. Profits are worth more when government bond yield is 1% vs. 5%. Opportunity costs come into play when you compare buying government bonds against buying stocks. We’re living in a world that has incredibly low interest rates and the question is, how long will those prevail? If we get back to normal interest rates, stocks will look like they’re priced very high, and vice versa.”

But do you think equities today are undervalued because interest rates are at very low levels and you don’t have any certainty that they are going up?

I don’t think equities are undervalued but they are in a zone of reasonableness. But that zone is very wide. In my 50 years at Berkshire or as long as I have been investing, there have only been a couple of times when I thought equities were dramatically overvalued or dramatically undervalued. Most of the time, they are in a fairly wide zone and I can’t tell you the answer. Right now, they are not dramatically overvalued, they are certainly not dramatically undervalued.

Editor’s note: During the meeting, Buffett said, “So far, I’ve been wrong. I would not have predicted you could have five to six years of close to zero rates and now we’re seeing negative rates in Europe. So far, nothing bad has happened except for the fact that people who have saved and put their money in short-term savings instruments have gotten killed. It’s still hard for me to see if you toss money from helicopters that, eventually, you won’t have inflation.”

Berkshire’s philosophy has been to buy a great business with great management at a fair price. Now, with 3G Capital as your partner, are you diluting the great-management-in-place criterion to some degree?

Well, I think they have great management. They are more willing to pay higher prices than we are. They will pay for the fact that they think they are going to improve the management. We don’t pay for that because we don’t get involved in the management. So, they’re more of a sport in terms of what they will pay. But it’s proven that their management brings enough to the party that they can afford to pay more than what we can pay.

Editor’s note: The partnership with 3G Capital came in for repeated grilling at this year’s meeting. The apprehension is that 3G’s aggression is not in step with how Berkshire has been traditionally managed. 3G brings in cost efficiency at the companies that it acquires by shedding non-required assets and people. The jobs cut at Heinz, which Berkshire co-owns with 3G, are fresh in memory and layoffs are expected at Kraft too. But Buffett defended 3G’s approach saying, “The 3G people have been successful in building marvelous businesses.” As for the jobs cut, he said, “Efficiency is required over time in capitalism, and I don’t know of any company that has a policy that says we’re going to have a lot more people than we need. We do have some businesses where we probably have more people than we need, and I don’t do anything about it but that doesn’t mean that I endorse it. I basically tolerate it.”

But Frank Gifford, a BRK shareholder for 15 years with whose question on Clayton Homes and 3G, Carol Loomis opened the Q&A, seemed unconvinced. In his blog, he later wrote, “When I became a shareholder, only the empty calories at Dairy Queen caused any ethical second thoughts (and they were easily dismissed). Today’s situation is far different — and threatens to become more so if “Berkshire beyond Buffett” involves 3G to a greater extent. Buffett’s effusive praise for 3G and his “friend” Jorge Paulo Lemann almost guarantees this. In my opinion, Berkshire has entered a new phase that involves bankrolling mercenaries.”

You believe in the power of incentives. Can you tell us more about the incentive system at Berkshire and how you approach it?

We have 70-something companies and I set the salary and the incentive system for the key executives and I try to tailor those to the nature of the industry. A capital-intensive business will have a different set of criteria than one that is not capital-intensive. There are some of our businesses that are easy businesses. There are some that are pretty tough. There is no one-size-fits-all, which is one of the reasons I act as the compensation committee and we don’t try to homogenise a compensation system throughout the company. It wouldn’t make any sense.

You can read more about 50 Master Moves That Shaped Berkshire Hathaway by clicking on the link