May the odds be ever in your favour. Sounds hopeful and harmless, right? Except that it’s the most famous quote from The Hunger Games, said right before contestants are sent into the wild to fight each other till death. Although not as life threatening, the stock market is also a jungle of possibilities where investors have to spot the winners and fend off dangerous bets. And Howard Marks, one of the most successful American investors, believes one can do that by ‘mastering the market cycle’.

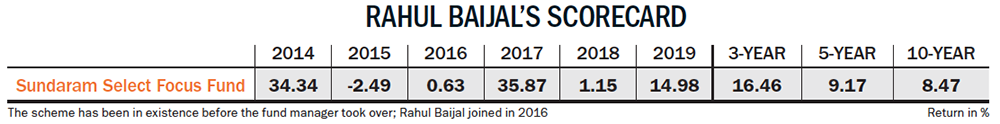

He wrote a book by that title, which gives insights on how to work the odds in your favour. His philosophy has many admirers. Rahul Baijal of Sundaram Mutual Fund is one of them — who has delivered stellar return with some support from Marks’ philosophy. “I admire Howard Marks… He has shown investors how important it is to monitor business, earnings, valuations and market cycles,” he says.

This trait has become more important than ever as we have seen pockets in the market create wealth, while others destroyed a lot. Baijal adds that, earlier, he used to follow the bottom-up approach of stock-picking. But over the years, his style has evolved and he has learnt to pay close attention to trends. “I realised that even good companies go through cycles. One needs to be conscious of these cycles and rebalance the portfolio accordingly,” explains Baijal.

This strategy has helped Baijal stay away from sectors or stocks facing a downturn. Since 2015, the US generic market has turned extremely competitive for Indian pharma players. While the number of manufacturers increased, buyers consolidated, leading to price erosion. At the same time, the USFDA cracked the whip. That’s how US-focused pharma companies turned into wealth destroyers. Baijal recognised early signs that the cycle was about to turn and made allocations to portfolio accordingly. Baijal had made a lot of money for his investors in this sector between 2005 and 2015 when he was working for Voyager Capital and Bharti Axa Life Insurance as a fund manager. But he decided to steer clear of this space at Sundaram Mutual Fund, which he joined in 2016. “I created a lot of portfolio wealth by investing in the US generic space in my earlier roles. But I have broadly stayed away from the sector here over the last three years. That’s one reason, it has helped the portfolio,” says Baijal.

Similarly, Baijal’s ability to understand cycles again came in handy last year. It was not a great year for the auto sector and even a market leader such as Maruti Suzuki was not left unscathed. Baijal had first invested in the stock in 2009, as the passenger vehicle maker had built a competitive advantage through a strong distribution network. Alongside, it had a competent management, a clean balance sheet and was generating high RoCE. Things changed in 2019 as the company witnessed its steepest fall of 12.3% in annual sales in a decade. Weak demand and an adverse economic environment were ailing the entire industry. Baijal spotted the downturn early and exited the stock before the stock price crashed. After hitting levels of Rs.7,460 in April 2019, Maruti Suzuki fell to Rs.5,450 within two months. Although it regained some of its momentum, it has been a volatile 12 months for the company.

Quality + Valuation

The global and domestic macro sentiment has made ripples not just in the auto space, but the stock market overall. And as the market rally narrows further, Baijal remains true to his strategy of examining business, sector and valuation cycles before investing. “Business cycle involves looking at the fundamentals of a stock, in terms of the company and sector, and examining how they are evolving,” he explains. He looks at three things — the quality of management, business model and financials. This gives him a clear picture about the company’s competitive advantage, culture of innovation and its agility.

Thus, he does not compromise on quality. “The portfolio revolves around strong franchises, which should be run by well-managed teams. They should not be dependent on a few individuals. Along with this, corporate governance is also very important,” says Baijal. Hence, he looks for companies with attractive RoCE and those that have a trend of generating free cash flow.

Once he has vetted the stocks with the help of this checklist, he moves on to valuation, comparing this cycle to historical levels and the sector. “When the valuations get too rich or euphoric, I have to resize the allocation of a stock in the portfolio. Sometimes, it could also mean exiting a stock,” says Baijal. Elaborating his point, Baijal asserts that while he has a growth bias, valuation plays an equally important role. “It’s more like growth at a reasonable price rather than growth at any price,” he explains.

Once he has vetted the stocks with the help of this checklist, he moves on to valuation, comparing this cycle to historical levels and the sector. “When the valuations get too rich or euphoric, I have to resize the allocation of a stock in the portfolio. Sometimes, it could also mean exiting a stock,” says Baijal. Elaborating his point, Baijal asserts that while he has a growth bias, valuation plays an equally important role. “It’s more like growth at a reasonable price rather than growth at any price,” he explains.

He is also not averse to investing stocks with cheap valuation. For instance, Bharti Airtel had been facing aggressive pricing from Jio for three years. Its earnings were under pressure, but over the past year, the stock has gained nearly 90% as tariff rates increase. Baijal entered the stock a year ago and since then it has given a return of whopping 87%.

Similarly, he identified a multibagger opportunity in 2007. Berger Paints was in a strategy shift mode and about to emerge as a challenger to Asian Paints. It was a well-entrenched player in the eastern states and had decided to expand its footprint in the South and West. The company then set up local manufacturing units and distribution network in these regions, which helped it gain market share. It registered strong sales CAGR of 16.99% between FY08 and FY15 by eating into market share from other players. By identifying the turning point, Baijal raked in multifold return as the stock rallied from Rs.13 in FY08 to Rs.149 in FY15.

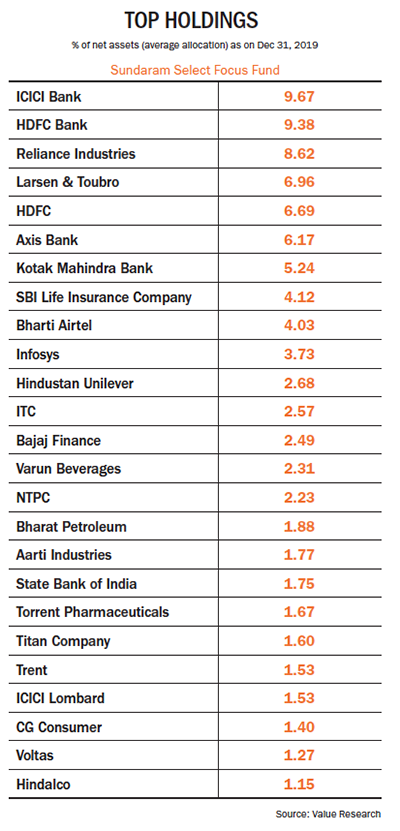

Another stock that Baijal hit bullseye with is Kotak Mahindra Bank, which he has held across various portfolios over the past ten years. With a focus on asset quality and credible management in place, the lender has beaten all down-cycles. Since FY17, its NPA fell from 1.09% of the total loan book to 0.70% in FY19. In the same period, net earnings grew from Rs.49.49 billion to Rs.71.19 billion. On the back of strong performance, the market has rewarded Kotak Mahindra Bank by attributing a valuation of 4.65x P/B for FY21. The stock has given a three-year CAGR return of 28%.

ICICI Bank, which has recovered impressively since the new management took over, is also a bank that has delivered outstanding return for Baijal’s portfolio. Besides increasing share of retail loan book, the bank decided to focus on attaining high credit growth and RoE last year. As provisioning falls and credit growth picks up pace, the bank expects RoE of 15% by the end of FY20, which will be a stark improvement from 5.20% in FY19. Baijal, who picked up the stock in 2018 has been handsomely rewarded. The stock has gained at 23% CAGR over the past two years.

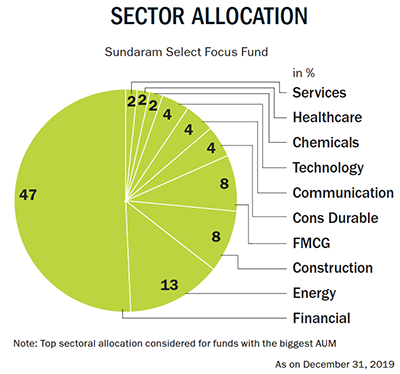

Baijal’s love for the financial sector is evident, and he continues to be bullish on this space. The weightage given to financials stands at 47%, 37.9% and 28.6% in Select Focus, Services and Equity Hybrid, respectively. “Large corporate banks will do well over the next two or three years. They have pricing power and cost of funds is also low,” he says. Within financials, he is also very excited about general and life insurance. “We will see more listings in life and general insurance space. You will see a new set of compounders in the insurance space in the next seven years, just like private banks. Also, wealth management firms will hit the bourse. So, there will be a lot of opportunity even in the non-lending financial space,” estimates Baijal.

Besides financial stocks, he also has an eye on Indian specialty chemical companies, which could emerge as winners of the trade war between US and China. “They have the opportunity to scale just like pharma companies did in the 2000s. Because of the trade war, American companies are looking to diversify and source material from domestic players. A lot of Indian companies have established good credibility and a track record of growth,” he states.

Rich return

His knack for understanding cycles and picking growth stocks has boded well for his Select Focus Fund. Since it is a concentrated large-cap fund with 30 stocks, the margin for error is minimal. But Baijal has geared up for this challenge, with the scheme delivering 16.46% CAGR return over the past three years compared to Nifty’s 15.7% return. “You will find high-conviction calls in my portfolio because I do additional diligence after receiving valuable inputs from the internal buy-side and external sell-side. I interact with the management and also have my network in sectors,” says Baijal.

For instance, in Select Focus Fund, Axis Bank and ICICI Bank have an allocation of 6.2% and 9.7% compared to the index weightage of 3.2% and 6.8% in Nifty 50, respectively. He is also overweight on stocks such as SBI Life Insurance, Larsen & Toubro and Bharti Airtel. “The top 10 stocks of Select Focus Scheme make up around 60% of the portfolio. So, having a high degree of accuracy and making as few mistakes as possible are critical factors,” states Baijal. Similarly, even in his other scheme, Hybrid Equity, he is overweight on SBI Life Insurance and Bharti Airtel.

A portfolio with high concentration in select stocks might be considered risky, but it has generated alpha for Baijal. According to Value Research, Select Focus Fund has an alpha of 3.59%, which means the fund has outperformed its benchmark index by a good margin, after taking risk into account.

Baijal’s Sundaram Service Fund has also outperformed since its inception in September 2018, registering a return of 19.6% against S&P BSE 200’s 6.2%. The fund, which has 43 stocks, focuses on investing in service sectors such as finance, healthcare, tourism and hospitality, transportation, staffing, media and retail. “We have a diversified set of 15 sub-sectors, which are growth-oriented and not cyclical. When there is a downturn, some parts of the service sector will slow down, but there are enough options to play within these 15 sub-sectors where growth is visible and funds can be reallocated accordingly,” he says.

This confidence comes from his ability to identify up and down cycles, which has yielded positive results over the past three years. It is this mastery of cycles that will help Baijal sustain his benchmark-beating performance in a highly polarised market.