If demonetisation was at the front and centre of all our discussions during our State Of The Economy survey in 2017, GST rightfully took its place this year. It is only natural that the biggest tax reform the country has seen and its impact on business formed the meat of our conversations with large corporates, SMEs, small entrepreneurs and industry associations. While the transition to a unified tax regime was far smoother for larger players, smaller players struggled with the move from dealing only in cash to filing returns and paying taxes. According to the latest Economic Survey, GST implementation has increased the indirect taxpayer base by more than 50% with 3.4 million businesses coming into the tax net.

This year, as it has since 2009, the Outlook Business team visited 12 prominent industrial clusters across the country to gauge the state of the economy and file an on-the- ground report of how businesses fared and the impact GST had on their business. More importantly, we also weighed in on what their expectations were for the coming fiscal. Over the past one-and-a-half month, reporters travelled to 12 industrial clusters in east (Howrah-Salt Lake), west (Rajkot,Pimpri-Chinchwad, Morbi, Naroda, Aurangabad-Nashik), north (Noida-Ghaziabad, Pantnagar, Faridabad, Bhiwadi) and south India (Peenya). Rajkot and Peenya are two new clusters that have made their debut since the special edition was launched in 2009.

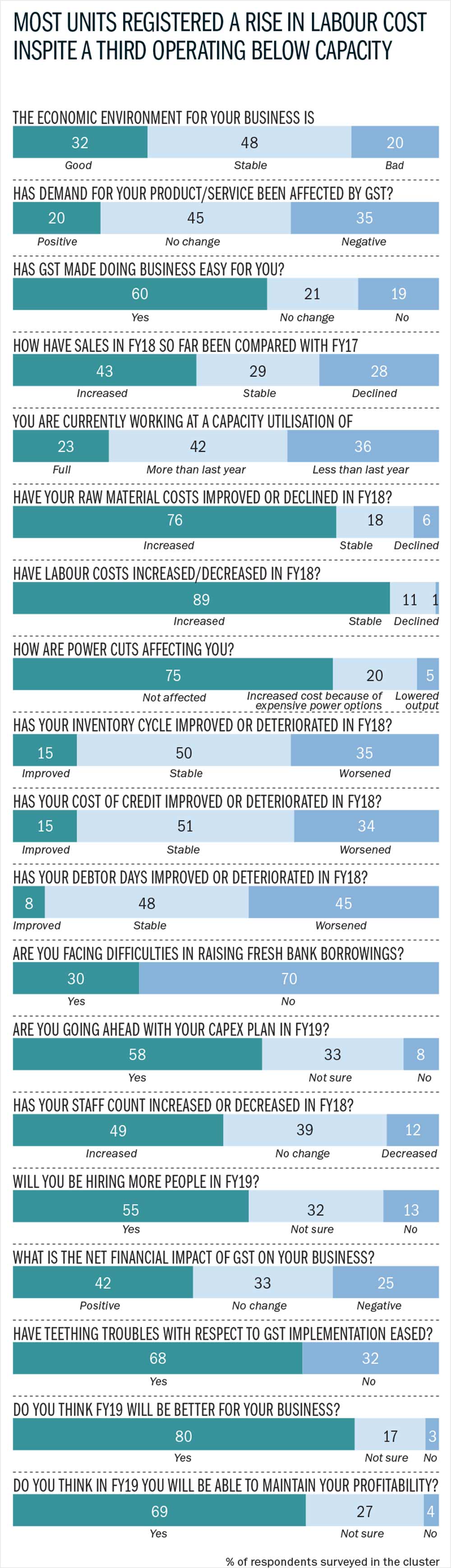

Despite initial hiccups that came with the implementation, 60% businessmen surveyed say GST has made doing business easier as it has replaced myriad of existing taxes, ensured disintegration of state borders and with it a whole lot of middlemen who were eating into their profit. Though the implementation of GST was initially marred by multiple rate changes and procedural hitches, 68% businessmen say most of the teething problems are behind them. However, they would be a lot happier if the refunds, thanks to the multiple rate changes, made their way back to them sooner.

Of the 132 respondents from the 12 clusters, 80% said the overall economic environment was stable or positive. Even as GST hampered sales in the first three-four months, not much damage was done; with over 43% respondents saying that their overall sales in the current fiscal would be better than FY17 while 29% claimed that revenue remained stable for them. Thanks to the robust growth in automobile sales, component manufacturers in Faridabad, Pantnagar and Aurangabad are a happy lot. And also with pharma and food processing doing well in these clusters, more than two-third of the businesses surveyed have recorded higher revenue growth thus far in the current fiscal. While competition from China is always a bone of contention for Indian manufacturers, shutting down of chemicals units and foundries due to stringent pollution norms meant more business came the way of chemical manufacturers in Naroda and foundry owners in Rajkot.

Rising commodity prices meant 76% of the respondents had to pay more for their raw materials. Labour didn’t come cheap either, with 89% of the respondents complaining about higher wage bills. But the bigger irritant for businessmen in clusters such as Naroda, Peenya and Howrah was that even after doling out higher wages, skilled labour was a scarce commodity. This meant they had to make do with migrant labour and spend precious time training them for at least six months.

The silver lining is the fact that the availability of power has improved over the past couple of years with over 75% of respondents saying they were no longer affected by power cuts. While stretched working capital conditions meant a longer debtor cycle for nearly half of the respondents, it is heartening to note that 70% entrepreneurs said they faced no problems raising fresh loans from banks. Over 51% of the respondents were happy with the stable cost of credit in FY18. In a world of rising input costs and price hikes not always an easy option, reduction in interest costs is definitely a welcome relief.

The demand for better infrastructure has been a constant fixture in all our surveys thus far and this year it is no different. Businesses in Pantnagar have been tackling connectivity issues for sometime now and unless the government provides better infrastructure, future investments in the industrial cluster will be hard to come by. SMEs in Ghaziabad and Nashik have also chimed in about lack of proper road connectivity. Just like skilled labour, finding affordable land for new manufacturing facilities is increasingly hard in industrial clusters such as Pantnagar, Pimpri-Chinchwad and Naroda. And where there is land available in clusters such as Noida, small businesses have to battle corruption.

However, concerns aside, SMEs across clusters are optimistic about how their business would fare in FY19. Given that India is a very competitive market, it is this optimism that keeps the engines running. A whopping 80% of the respondents have strong hopes that their business will fare better in FY19 with nearly 70% of them confident of maintaining profitability in a rising cost scenario. About 58% are looking at expanding capacity and 55% of them are likely to hire more people in FY19. Not all the optimism is wishful thinking with the Economic Survey predicting that the Indian economy would grow at 7-7.5% in FY19 compared with the estimated 6.75% in FY18. Growth is expected to be back on track as the economy emerges from the aftermath of demonetisation and the benefit of having a unified tax regime under GST. That is something businesses across the country are looking forward to. How much of that comes through will reflect in our next State Of The Economy edition.