The present government has been long on promises and short on delivery. That, though, hasn’t stopped it from making new commitments. The Finance Minister recently reiterated that Rs.100 trillion would be invested in infrastructure. How and to what extent that promise will be fulfilled is anyone’s guess, but recent developments have not been encouraging. Take, for instance, what Minister of Road Transport and Highways Nitin Gadkari said at a recent conference in the capital. “One thing is clear that the government is facing financial constraints and it is very difficult for any government to invest in all these sectors (infrastructure),” he said. Gadkari admitted that they are finding it difficult to fund these projects, while urging private companies to boost investment and help revive economic growth. Reflecting this bleak sentiment, road stocks such as Ashoka Buildcon, Dilip Buildcon and KNR Constructions have fallen by 20-30% in the past six months. So, what’s ailing our infra sector? Is it just collateral damage from an economic slowdown, or is there much more at play?

Debt dilemma

There are a number of intertwined factors. But first, let’s address the elephant in the room — the huge quagmire that National Highways Authority of India (NHAI) is in. The nodal agency, which is responsible for awarding and funding projects besides managing national highways, is neck-deep in debt. Its debt has grown 8x between FY14 and FY19, ballooning to Rs.1.8 trillion, mostly due to high land acquisition cost. “Fiscal concern is still hovering over the sector. The government has told NHAI to fend for itself. How will the NHAI fund projects?” asks Amit Khurana, head of equities and research, Dolat Capital.

According to Crisil, the average cost for acquiring land has increased to around Rs.34 million/hectare in FY19 from Rs.9 million/hectare in FY14. Land acquisition cost alone contributes to one-third of total spends at NHAI. “The compensation policy under the current land acquisition bill requires the NHAI to pay 4x the market rate for rural land and 2x for urban land,” says Hetal Gandhi, director, Crisil.

Furthermore, since FY18, smaller players have faced severe liquidity crunch. These factors have led to deceleration in HAM projects, in which the government shares 40% of the financial burden. It’s no wonder then, that the Crisil report highlights that out of the 6,670 km of awarded HAM projects in 2016, over 2,540 km are yet to commence construction. “For projects awarded in FY18, contractors have witnessed delays in receiving financial closure for their HAM projects and postponements in the receipt of the appointed dates for construction due to land availability issues,” says Alok Deora, vice president, Yes Securities.

The sorry affair of the sector has been further exacerbated by the ongoing economic slowdown. Especially since after the IL&FS crisis, banks have become wary of lending to infra projects, which mostly end up as NPAs on their books. Besides, due to a change in axle norms, trucks have been allowed to increase load capacity, hence reducing the trips they make. That has led to slower traffic growth. “With an increase in the carrying limit, a dip in the numbers of trucks on the road has been observed since January 2019,” says Gandhi. According to ICRA, traffic growth fell to -0.1% in H2FY19 YoY and -0.6% in Q1FY20. Meanwhile, it is also hurting toll collection. Toll revenue is expected to grow in the range of 4-5% in FY20 against 8-9% in FY19. It grew marginally at 4.3% in Q1FY20.

Needless to say, the government is in damage control mode. Reports suggest that the Prime Minister’s Office has urged the NHAI to sell off assets and re-examine the commercial viability of its projects. This reprioritisation, on the back of a resource crunch, means a fall in the new projects being awarded (See: Bumpy Road). “This decline is because of funding issues faced by NHAI and the fiscal situation of the country,” points Deora. Analysts believe road construction rate will slow down to 12 km/day in FY20 as compared to 15 km/day in FY19, which was also a tough year for road construction companies. This has put the brakes on expansion of the road companies’ order books.

Time to cherry-pick

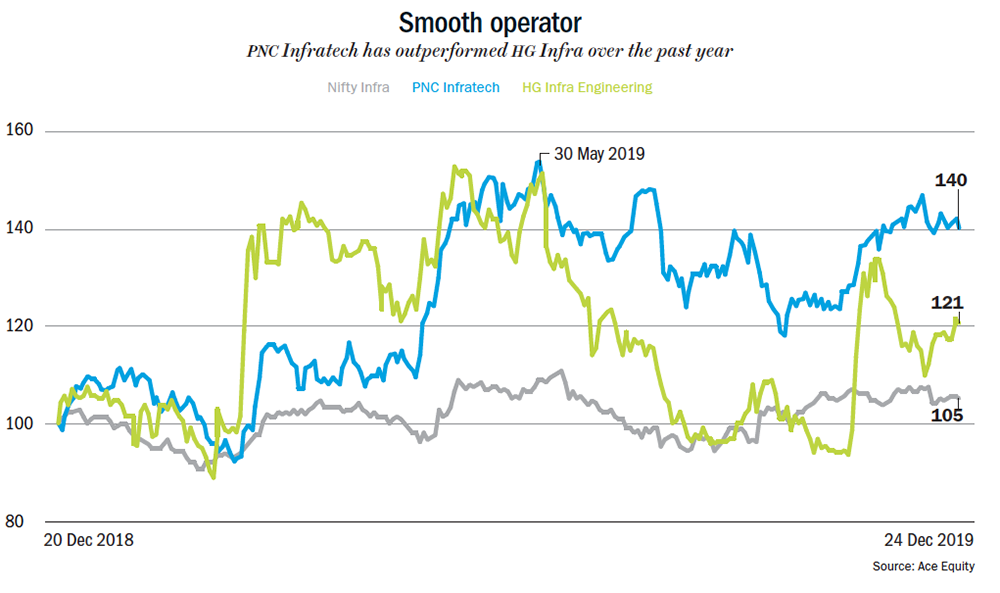

Is such a backdrop the end of the road for infra stocks? Analysts don’t think so, especially after the massive fall in valuation. They believe this is the right time to selectively play the space. “Investors have to be stock specific rather than betting on the macro,” warns Khurana. Just like there are diamonds in the PSU stocks space, there are safe stocks to hide in the infrastructure space. In fact, for developers who have a robust order book, they opine that the weakening in new orders comes as a blessing in disguise. “They have a large chunk of unexecuted orders. So, they will be able to focus on execution instead of worrying about piling up of orders,” says Deora. Among their preferred bets are PNC Infratech and HG Infra. With a strong order backlog and an excellent execution record, both companies are expected to generate double-digit revenue growth for at least the next two years.

Of PNC Infratech’s Rs.110 billion outstanding order book, some projects are either in execution mode or have achieved financial closure. Its big projects that are underway include Mumbai-Nagpur Expressway, Purvanchal Expressway Package V among others. In fact, the company has received about Rs.940 million as bonus from the UP government for early completion of sections of two expressways since FY18. They also expect to receive Rs.145 million as early completion bonus for Aligarh-Moradabad Highway Project in Q3FY20. “The regular receipt of early completion bonuses speaks about their execution capability,” says Deora.

The UP-based company focuses on its key region, playing to its strength, which analysts believe is an added advantage. “If a company such as PNC Infratech, which is based in the North, picks up a project in the South, it becomes very difficult for them to navigate local challenges like getting approval from authorities, labour and local politicians. The management team has to understand these nuances to have a good execution record. So, sticking to one’s geography has its advantages,” says Khurana.

The other safe-bet infra company that is also based in the northern region and operates across six states is HG Infra. Its key projects include Hapur-Moradabad and Delhi-Vadodara Package IV. Analysts expect its order book of Rs.62 billion to be in execution mode by next quarter of FY20. That should translate into revenue growth of 25-30% for the fiscal year. According to the company, its execution strategy is based on favourable project selection, clarity on margins, responsible bidding and competent resource deployment.

Khurana points out that PNC Infra and HG Infra have better revenue visibility as they have a stronger order book-to-revenue ratio compared to their peers (See: Smooth operator). While PNC Infratech’s FY19 order book-revenue ratio stands at 3.9x, HG Infra’s is at 3.1x. In comparison, their peers such as Sadbhav Engineering and KNR Constructions have order book-to-revenue ratio of 2.7x and 2.5x respectively. The inability of weaker road construction companies to bid also gives them the opportunity to grab market share.

Apart from the strong backlog of orders, rate cuts by the RBI will also give these players a much-needed breather from the liquidity crunch. Analysts state that the benefits of rate cuts have not yet been passed on to companies. “While the RBI has been cutting rates quite aggressively, bankers haven’t passed it on. You will see this happening very actively over the next year,” Khurana is optimistic. He estimates that banks could cut 100 basis points over the next two to three quarters, which will give significant operating leverage to the companies.

That does not mean these companies are completely shielded from macro setbacks. Analysts believe there is lack of revenue visibility post FY21, mostly due to uncertainty around NHAI’s ability to fund projects. “NHAI doesn’t have the capability to fund massive projects. If the awarding for this year is around 4,500 km, then it will give revenue visibility for FY21. But how will they place orders in FY21? For that they will have to monetise some assets,” says Khurana. He adds that NHAI had a separate allocation in the budget, which has also been merged with the general budget allocations, restricting the leeway it had.

But for now, both PNC Infratech and HG Infra offer a mix of strong fundamentals and attractive valuation. While the former currently trades at FY21 estimated P/E of 12x, the latter trades at 7x. This, despite revenue growth estimates of 37% and 23% CAGR between FY19 and FY21 respectively. Moreover, PNC Infratech’s debt-equity ratio is very low at 0.1x. HG Infra, on the other hand, has a debt to equity ratio of 0.5x.

While the road ahead for the sector is most likely to be rocky, companies with robust operating cash flow generation and low leverage will emerge as winners. For now, PNC Infratech and HG Infra with relatively low net debt, strong execution and cash generation could ensure a smooth ride for investors.